Binance Coin Price Analysis: Establishing a position as a top 10 cryptographic asset

The value of Binance coin has grown significantly in recent months, both because of new utility as an onramp to ICOs as part of the Binance Launchpad platform and because of new long term appeal built by a series of significant announcements and product releases. While some long term risks and a possibility of short term price corrections do remain, BNB looks set to maintain relevance as a crypto investment option.

Binance coin (BNB) is the native ERC-20 token of crypto mega exchange Binance. BNB’s investment profile is driven by multiple unique factors and it has established a prominent position in the short term crypto public consciousness, rising by ~60% in the last month and firmly establishing a position as the 7th largest crypto asset on the Brave New Coin market cap table.

Historically, BNB’s primary value has been derived from the trading discounts it offers. Using BNB to pay for trading fees on Binance currently offers a 25% discount (this will change to 12.5% in July 2019). The Binance exchange is currently listed as the 2nd most voluminous exchange by daily volume on the Brave New Coin exchange volume table, this suggests that BNB is highly used even if it is only used to pay trading fees on a small proportion of trades carried out on Binance.

BNB also functions similarly to equity, with profits earned by Binance through trading fees being redistributed to BNB holders in the form of a token burn, functioning in a similarly manner to a dividend.

The below table shows the size of recent BNB coin burns, and evidences the capability of the Binance exchange to accrue significant revenues through trading fees. The largest Binance quarter by coin burn was Q4 2017, when over USD ~35 million worth of tokens were burned.

Interest in crypto spot trading has diminished during the crypto bear market, with a corresponding decline in profits for Binance, but even so the exchange’s profit through trading fees is still estimated as being over USD 50 million in Q4 2018.

Source: Multicoin Capital Binance report

Since launching its exchange just over 18 months ago with 18 pairs, Binance has grown to amass over 441 pairs and is the leader in a number of individual trading markets by exchange. As a facilitator for on-ramping into other crypto, BNB’s value increases the more tokens it is paired with.

The exchange currently offers 0.1% maker and taker fees at a highest level and 0.015% maker and 0.03% taker at a lowest.

Binance’s share of the crypto spot trading market has grown rapidly since the exchange launched in Q2 2017. While factors like a proliferation of wash trading/fake volumes on crypto spot exchanges, and the unavailability of clear user data make it difficult to properly rank crypto exchanges, Binance is considered by many analysts to be the crypto ecosystem’s leading spot exchange. Other factors driving Binance’s rapid capture of market share have been an ability to keep user funds safe (‘safu‘), accessibility globally, the wide variety of assets available to trade with, and smooth trade execution.

Binance’s position as an enthusiastic token lister and role as a ‘trusted’ platform to access obscure altcoin opportunities, is being emulated by exchanges like Coinbase and Bitfinex who are now experimenting with expanding their tradeable asset portfolios. Coinbase Pro has added tokens like CVC, LOOM, MANA and GNT in the last four months, while Bitfinex has added CLO, BTT, VSYS and PASS.

What were once Binance’s unique value propositions are now being co opted as more exchanges follow suit with ‘open’ listing policies – and existing altcoin-centric exchanges like Huobi and HitBTC are optimizing their platforms and adopting industry best practices for performance. For BNB holders the re-emergence of incumbent exchanges and new players in the space, is a consideration that may affect the value of the BNB token.

Binance users with more than 500 BNB also receive double bonuses on referrals (users get rewards based on if friends sign-up and trades via unique referral links and QR codes, commission can rise up to 40%) while BNB holders have voting rights in the Binance Community Coin voting scheme meaning they can influence decisions around which new coins get added to the exchange.

A recent driver of value into the BNB token has been the success of the Binance Launchpad ICO platform. Beginning with the Bittorrent token sale on January 28th, followed by the Fetch.ai February 25th, Binance has run two successful internal token sales open only to Binance users and accessible to BNB holders. The Bittorrent token sale sold out in under 15 minutes and raised ~USD 7.2 Million (40% in BNB, the rest in TRX), while the Fetch.ai sale hit a ~USD 6 million target (all in BNB) in under a minute.

The next launchpad ICO or IEO (Initial Exchange offering) will be for the CELER network scaling solution’s native token CELR. It is set to occur on the 19th of March. Like Fetch.ai, CELR will also conduct its full ~USD 4 million sale in BNB tokens and a similar pattern of high demand and a quick sell out is expected for this upcoming sale.

The price of Binance coin has risen ~130% since January 24th and in the lead up the first Launchpad sale of the year. BNB has displayed gains reminiscent of historical crypto bull runs and has outperformed the rest of the digital asset market, rising up 6 spots in Brave New Coin Market Cap table, currently sitting in the 7th position.

The renewal of the Binance Launchpad platform, which ran two ICOs in 2017 but none in 2018, has given the BNB token new utility as an on-ramp to the season’s most exciting new blockchain projects.

During the the Bitcoin bull run that coincided with a golden period for ICO funders in mid to late 2017, analysts proposed that BTC became a ‘digital lake of liquidity‘ as ICO investors began using it heavily for transactions related to ICO funding. As the ICO/cryptocurrency ecosystem grew in value, Bitcoin’s value naturally grew along with it.

Similarly BNB may currently be enjoying a micro version of this phenomenon and has seen its short term value grow as the Binance ICO platform has grown. Transaction demand for the BNB token is likely building with each successful token sale on Launchpad.

Over this same period Binance’s long term horizons have also been buoyed by a successful testnet release of the Binance chain/ Binance DEX (Decentralized Exchange), and expansion of the core Binance exchange’s fiat-to-crypto offerings (Euro and British Pound trading pairs having recently been added).

These two initiatives have evidenced the aggressive growth model that Binance is employing and its focus on maintaining its position as leader in the crypto infrastructure. These future projects may be creating short term FOMO appeal from retail buyers who see the BNB token as an avenue to invest in one of the crypto spaces most exciting projects.

The Binance DEX will likely offer a number of advantages over existing Ethereum based solutions which presently dominate the space. For example, it should be easier to bootstrap liquidity as Binance can incentivize existing market makers on the centralized exchange to switch to the DEX and immediately offer a sizeable pool of liquidity.

Binance chain will be launched using the Tendermint protocol, which allows a blockchain to be built with a scalable and customizable consensus model. The Binance DEX which will function on top of the Binance chain and will likely offer fast throughput and low fees, traditional challenges for Ethereum based PoW DEX’s. However, as critics have pointed out, the Binance DEX will not be ‘decentralized’ in the traditional sense of the word. The Binance DEX testnet will have 11 large nodes enabling the high trading speeds, but they will all controlled by Binance.

The Tendermint architecture will also likely minimize some of the classic DEX issues like front-running by being more deterministic (less random) than Ethereum, and therefore having a more difficult to manipulate GAS (smart contract fee payment) system.

The strategy of Binance disrupting itself with a full DEX alongside its centralized platform, does not come without some risk. The Tendermint architecture is untested and the first Tendermint blockchain, Cosmos, was only launched last week. It remains to be seen whether its on-paper benefits materialize in practice, or if some users/nodes are savvy enough to find ways to manipulate the reward model of Binance chain.

All that considered, the DEX will impact the utility and value of BNB, likely expanding potential token value and price. BNB will shift away from being an ERC-20 token to its own mainnet once Binance chain is launched (date of launch not yet revealed). This means validators on Binance chain will earn fees in BNB, and becoming a validator node on Binance chain will likely involve staking a large BNB.

Binance CEO Changpeng Zhao has stated that part of the rationale behind the shift is to try and increase community involvement within Binance. A successful Binance chain launch and transition increases the fundamental value of the BNB token and is an exciting, but risky, step for the token holding community.

"From an earnings standpoint, Binance DEX will not directly increase profitability for Binance, but it will certainly increase the utility of BNB in a big way. That should be good for BNB holders. Binance is also a larger holder of BNB, so we benefit the same way as all BNB holders. The more people using Binance chain, the more value is created, or the more successful we all become". Changpeng Zhao, Binance CEO

Network Activity

BNB exchange volume vs token value

Even though BNB functions as a ERC-20 smart contract token built on the Ethereum blockchain, most transactions of the token happen off-chain. This is by design, as much of the token’s transaction functionality is derived from primarily off-chain operations such as utility as a base pair to onramp on to a variety of crypto tokens, and transaction fee payments.

This means that onchain transaction volume patterns are generally erratic for the network, making a traditional NVT signal difficult to use as an indicator for future BNB price movements.

For this reason 24 hour BNB exchange volume is a better option than onchain transaction volume for a traditional NVT signal.

The network value-exchange transactions (BNB) NVET signal, represents the utility/consumer product like value proposition of BNB. The rationale for using exchange volume as a utilization indicator being that the more BNB that is transacted across exchanges, the more it is utilized for inherent functions such as being an onramp onto other crypto pairs and is being collected by traders to be used to access cheaper trading fees.

Mismatches between price and the NVET create oversold and undersold indications.

Data Sources: Brave New Coin, Coinmetrics.io

The BNB TVET provides bullish signals and suggest emerging growth in the fundamental value of the token.

While the price of Binance coin has risen sharply since December 2018, TVET has conversely fallen. This indicates that a similarly sharp rise in the amount BNB being used for exchange transactions and implies that it is being used more and more for utility such as being a liquidity tool to access other crypto assets.

This emerging pattern does suggest that there are fundamentals backing the recent BNB bull run and that there has been a growth in its usage (against token value) over the last four months.

Overall Binance volume vs price

Another useful way to assess the token value of BNB, is to connect its price to the performance of the underlying Binance exchange, because BNB derives some of its fundamental value from the overall performance of the platform given the dividend buyback scheme.

Not only does the amount of the quarterly buyback depend on Binance’s profits, which are directly affected by volumes on the exchange, but there are also other speculative considerations. For example, if the market observes the Binance exchange sitting at the top of crypto exchange rankings, this may nudge traders to gamble on the token because of FOMO speculation, viewing BNB as a security, and rightly or wrongly equating its prospects to those of Binance, in a similar way as has occurred with XRP and Ripple.

There is currently a gap forming between the TVEV line and the Price line of BNB, this suggests the ongoing price push is being backed strong, growing overall volumes on the Binance exchange.

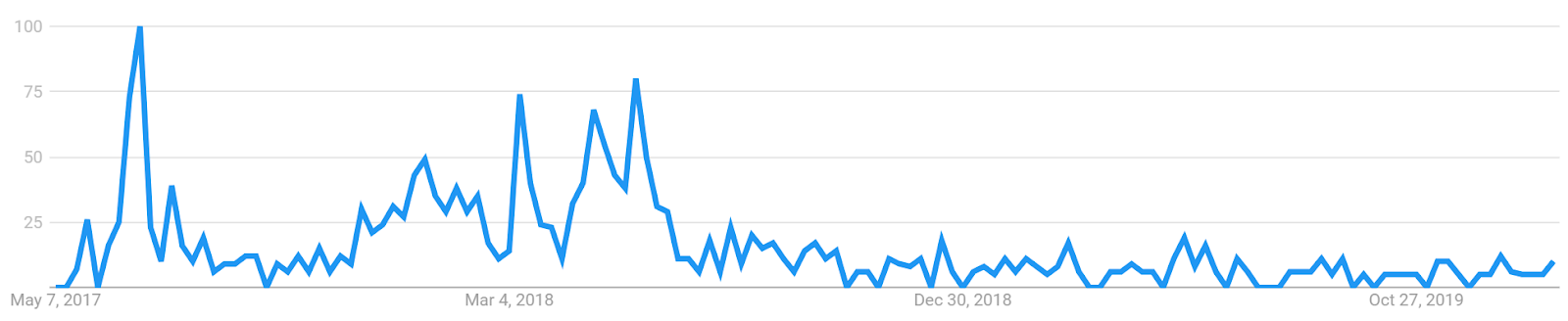

Social metrics

The main BNB Reddit community is /r/Binance, which currently has ~48,150 subscribers and is ranked as the 3146th most popular subreddit. The most popular posts include an a random spotting of Binance referral advertisement on a street poster and a BNB token 101. Popular keywords include ‘airdrops’, ‘registrations’ and ‘decimals’.

After a period of sharp growth in subscribers around late 2017, growth on the r/Binance subreddit has since tapered off but continued to increase nonetheless. Interestingly, while Q2 2018 was Binance’s most successful quarter in terms of profits, growth in subscribers was only tepid.

Comments per day appear to be trending slightly downwards since the start of 2019, on most days ranging between 10-60 comments.

Turning to Twitter, the @Binance Twitter account currently has ~933,000 followers and is ranked as the 8,158th largest account on Twitter.

Follower growth remains steady, continuing to increase by around 10,000 every month, a bullish sign of Binance’s capacity to attract new crypto users.

There has been an increase in tweets per month for the Binance accounts through, reflecting the raft of new announcements for the Binance ecosystem including the Binance chain/DEX updates, the new fiat pairing announcements and Launchpad related tweets.

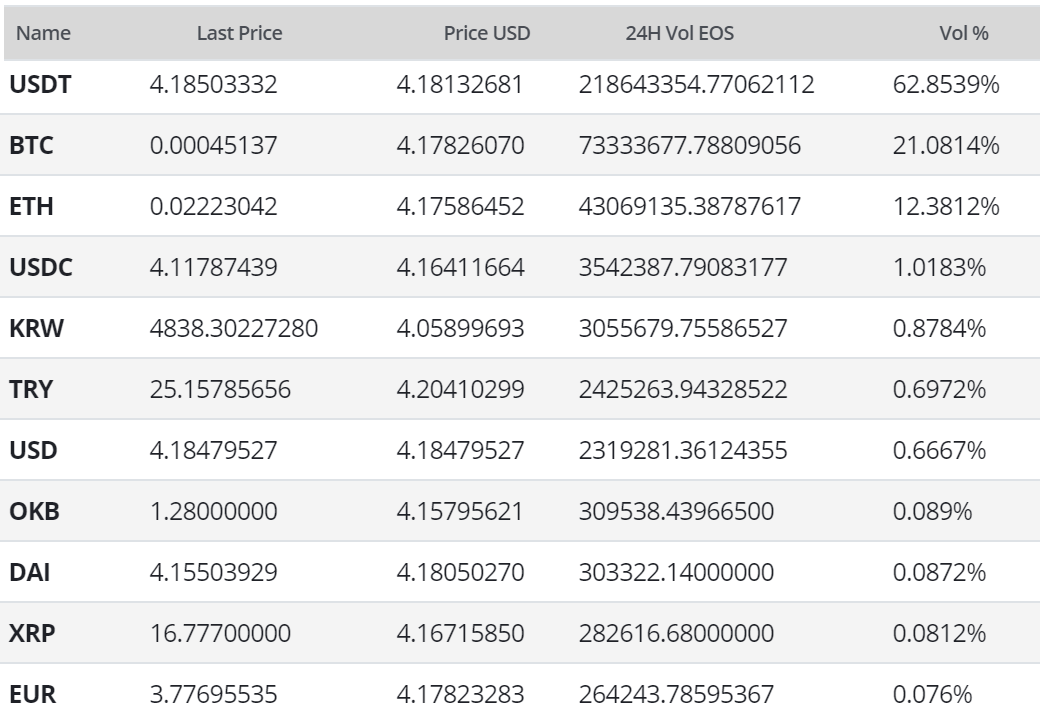

Trading pairs and exchanges

Source: Brave New Coin

The most popular trading option for BNB is USDT, handling close to 50% of daily trading volume. The second most popular market is the BNB/BTC pair and together the top two pairs make up over 82% of daily trading volume. Fiat transactions with BNB and it is only traded with the the US dollar as a fiat option. The USD value of daily volume of the entire BNB market is ~ USD 109 million.

The most active platform for trading BNB is the Binance native exchange, but is also tradable and popular on other exchanges like Lbank and p2pb2b. While the usual suspects USDT, BTC and ETH are the most popular options to trade BNB, the Enjin (ENJ) pair has also became a popular trading option, likely because of a recent surge in the token’s value.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, BNB has followed a strong, positive linear price trend with a Pearson’s R correlation between time and price of ~0.90 since mid-December 2018. This momentum resulted in a golden cross (arrow) in late February 2019, with price still looking strong at ~USD15.75, currently.

On the 1D chart, the 30 day TRIX and volume flow indicator (VFI) are well above 0 and still trending higher, respectively. Additionally, SAR confirms the current momentum, and illustrates that up-moves have lasted almost 3x as long as down-moves during this uptrend.

Last, price has shown a pattern of movement which bodes well for continued momentum in the near term. Using fibonacci retracement, price has re-tested fibonacci support levels twice prior (see circles) before moving higher. If this pattern persists, price may fall from its current level of USD15.75 to ~USD13.18, before moving higher towards USD18.59.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bullish; price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price has completed and maintained a Kumo breakout since early February, and has shown few signs of reversal despite the RSI in overbought territory. As mentioned above, price may retest lower levels in the interim with support at USD14, USD13, and USD12. If the breakout holds, likely price targets are USD17.50 and USD18.50.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bullish; price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The analysis with slower settings is almost identical to faster settings.

Conclusions

The Binance coin has exploded in value since the end of 2018, rising by over 100% in the last four months. The token has benefited from tangible utility as a medium to trade against, and buy into crypto assets and ICOs. While the growth and raft of significant announcements emerging from the Binance platform, have strengthened the equity style value proposition of the network and created FOMO appeal.

Binance’s aggressive growth policy does come with risks, namely that its competitors are both waking up and catching up – and there is the possibility of technical challenges when launching the Binance chain. Nevertheless, interested eyes are on BNB for the time being – and justifiably so.

The technicals for BNB are strongly bullish despite the likelihood of a short term price correction. If the technicals maintain their strength, the short term correction may offer a long entry point at USD13.18, which coincides with the 1.618 fibonacci level and Senkou B support (on slower settings). If the aforementioned support holds and the breakout persists, price targets are USD17.50 and USD18.50.

Don’t miss out – Find out more today