Crypto Market Forecast: The week ahead, 11th March

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

While the price of Bitcoin (BTC) was unable to move past the $4000 psychological barrier this week, a number of major altcoin markets surged and drove the overall market momentum. The price of Bitcoin rose 2%, while the overall crypto market cap rose ~3.5% with top 10 assets Binance coin, Litecoin and Stellar rising ~30%, ~19% and ~15% respectively.

Litecoin trading experienced significant price volatility since that it would be exploring options to integrate the mimblewimble privacy solution in early February. Following the announcement of an upcoming partnership with Tokenpay and details surrounding it releasing early this week, speculative momentum may continue.

The BNB token has soared on the back of the Binance launchpad platform which has revitalized the ICO markets with the successful launches of the Bittorrent token and Fetch.io token projects. With another project set to launch on March 19th (the low cost Dapp hosting solution the Celer network), short term buying pressure for BNB looks set to extend.

A number of mid-cap alts have also jumped on the back of positive fundamental assessments. The price of Enjin has risen over 100% this week following the apparent confirmation that the Singapore-based wallet solution has signed a major deal with Korean electronics giant Samsung. With the Kyber Network facilitating the Enjin wallet payment system, native token KNC also jumped over 65% last week.

Switching to institutional perspectives there was some excitement surrounding the launch of the Fidelity digital assets solution to select customers, and the announcement by crypto lending and wealth management firm Blockfi that it would be offering Bitcoin and Ethereum deposit accounts with 6.2% interest – a move that some have lauded as one way to manage crypto risk in the bear market.

Upcoming crypto events

11th March – Monthly BTT token airdrop for TRX holders

Beginning from February 2019, on the 11th of every month TRX token holders on Binance are airdropped Bittorrent token (BTT) directly into their exchange accounts. The amount airdropped increases year-on-year and is designed to promote the Bittorrent token ecosystem by utilizing the support of an already active token community. The upcoming drop has failed to create much buying support for TRX, however, potentially because the price of BTT has slide over 35% since the 6th of February.

13th-14th March- Token 2049 Hong Kong

On Wednesday and Thursday one of Asia’s premier crypto events take place, featuring an impressive list of speakers discussing some of the industry’s most important topics. The schedule include Gabor Gubacs, director of digital asset strategy at VanEck discussing crypto’s regulatory landscape and Jun Li, founder of the Ontology platform discussing the future of blockchain interoperability and scalability.

13th March- CBOE XBT expiration date

This Wednesday the latest round of CBOE XBT (XBTH19) futures ends. The nature of futures contracts means they need to be settled on a set, predefined date, based on a contract. All CBOE contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around expiration dates, that coincides with a rise in volatility and potential short/long squeezing.

They were strong gains for a number of large cap assets, with EOS, LTC and BNB all continuing a period of above market average market performance. BNB has now firmly established its position in the top 10 and now appears close to taking over the Bitcoin Cash ABC coin’s top-6 spot in the chart. As highlighted by Cryptocurrency Newsfeed, outside of the top 10 the market appears undeterred by news that the DASH foundation is cutting back its workforce in the midst of the crypto winter, with the DASH token rising ~2% last week.

As other tokens enjoyed strong double digits, Bitcoin traders continued to fight resistance at the perceived key $4000 level.

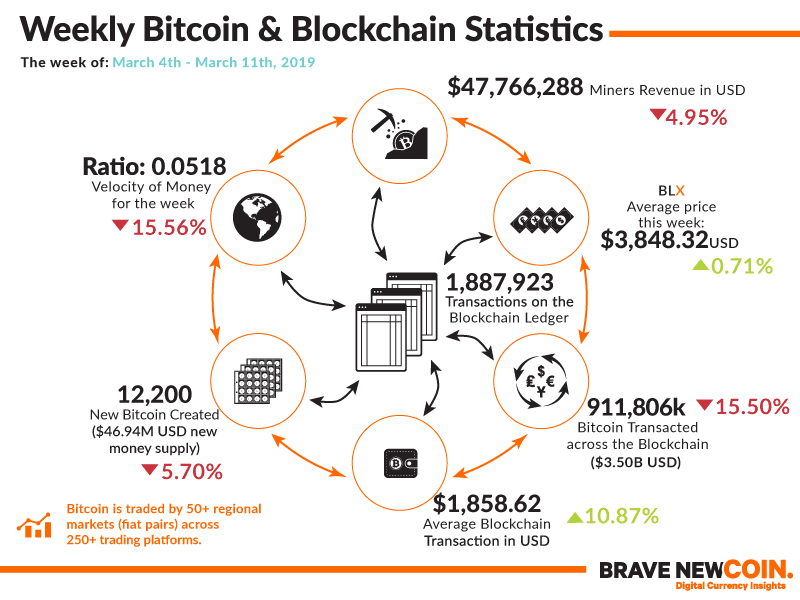

Despite positive fundamentals, such as reports that coffee giant Starbucks will accept Bitcoin payments from US customers following an equity deal with BAKKT, BTC continued to languish in the $3600 – $3900 zone for the week. Bitcoin hashrate has remained steady and on a slight uptrend over the last 2 months, indicating difficulty adjustments are working as they should. The most recent adjustment occurred on the 10th of March and was -0.05%.

Don’t miss out – Find out more today