Omisego Price Analysis: The long wait for value

The OMG token has enjoyed a recent period of upward price activity following a major testnet launch in mid-February and generally favourable market conditions. Medium and long term fundamental concerns still remain, however, with a market-ready product still appearing a long way off — and a token holding community still smarting from a series of broken roadmap promises.

OmiseGo (OMG), is an Ethereum based scalable decentralized banking and exchange solution that utilizes Plasma technology. It has gained market notoriety as one of the original ICO unicorns, achieving a $1 billion network valuation (market cap) as an ERC-20 without yet offering a real product.

The OmiseGo project exists as an expansion of the Omise company — an already established, (and successful), fintech company based in Thailand. Omise is an online payment solution for merchants aiming to optimize sales options and OmiseGo is an extension of the Omise product, adding blockchain and cryptocurrency payment services.

Endorsed and with contributions from leading Ethereum developers Vitalik Buterin and Joseph Poon, the OmiseGo project has often been touted as an Ethereum foundation backed implementation/use case of Plasma child chains — essentially a sponsored use case for building scalable token projects on the Ethereum main chain.

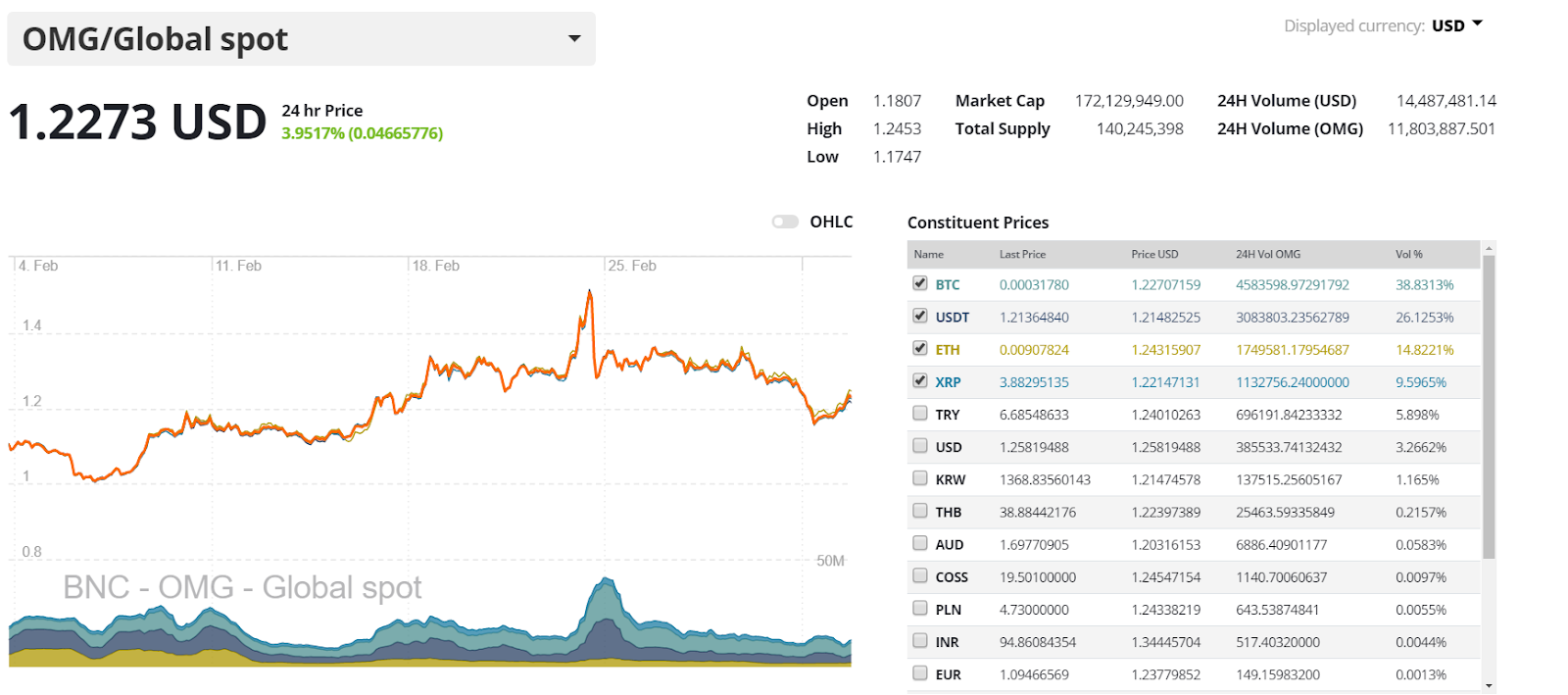

The OMG token currently trades at ~$1.22 and has fallen by 95% from an all time high of ~$25.62 achieved on 13th January 2018. It is currently listed as the 31st largest crypto asset on the BNC market cap table.

Unique tech

The OmiseGo solution revolves around an electronic wallet system built on the OmiseGo network with an integrated decentralized exchange (DEX) solution to allow for instant currency-to-currency transfers with off-chain counterparties. Though not yet live or available publicly, the OmiseGo model is intended to permit fiat values to be traded across payment platforms and between e-wallets, in real time. Initially the network will only transfer Ethereum tokens between wallets.ha

The network will act as a hub and facilitator between OmiseGo e-wallets and Electronic Payment Processors (EPPs). Meaning a clearinghouse between regions and various fiat-on ramps, with OmiseGo maintaining a ledger of the various OmiseGo e-wallet transactions providing security and permission-free transactions via its blockchain.

This is a complicated solution to provide. OmiseGo is advertising that it will be able to manage multiple fiat-to-fiat, fiat-to-crypto exchanges facilitated instantly, cheaply and between EPPs (across border financial entities). Any blockchain is likely to struggle with verifying this many moving parts at any given time.

There are two solutions for this problem. Firstly, liquidity pools for small transfers, where EPPs will hold a pool of liquidity for small amount transfers between their most popular destinations. Secondly, for larger transfers, an amount of ETH will be bonded via smart contract to the OmiseGo blockchain. This will allow for a large Yen-Baht transaction to happen, for example, via a Yen-to-Ether, Ether-to-Baht route, facilitated on the OmiseGo network. Ethereum does not necessarily have to be used, but the network’s size and robustness make it a natural choice.

For scalability and minimize currency exchange & transfer fees, the OmiseGo have built the network to work around Plasma. This will allow for heavy computational transactionary operations to happen off the Ethereum chain.

Plasma works by using smart contracts which act as child versions (OmiseGo network) of the root or parent chain (Ethereum in this case), to handle the bulk of transaction operations before final verification (and mining) occurs on the main chain. Plasma child chains can have their own tokens to reward/incentivize validators. Bad actors can immediately be caught by asking for transaction confirmation of child chain operations from the root chain.

Through Plasma, every EPP on OmiseGo will enter a smart-contract with ETH, which will funnel a supply of liquidity onto its own, off chain centralized network, allowing it to operate smoothly, without flooding and compromising the decentralized OmiseGo network.

OMG token use case explained

The OmiseGo business model is setup as an interoperable exchange solution, bringing together digital currencies and fiat, between platforms, using the blockchain. In the future, it will likely compete with crypto exchanges like Kraken & Coinbase, as well as crypto payment services like Bitpay and Wyre.

The OmiseGo e-wallet application isn’t just a regular e-wallet. The device it is attached to will act as a node, verifying transactions occurring on the OmiseGo blockchain (a plasma child chain attached to the Ethereum root chain). However, it is not enough just to have a wallet open and installed, there needs to be value in the wallet, and this is where OMG tokens and the PoS mining model comes in.

A Proof-of-Stake (Pos) block reward model works by giving greater rewards to nodes/validators who have larger investments in the blockchain. So, having more OMG tokens means access to more fees which positively correlate with an increase in the usage and activity on the network.

The greater reward stems from miners with more OMG taking more risk. If the network turns out poorly, and the tokens start losing value, the miners with higher stakes are worse off.

In the present market, the price of the OMG token is propped by market beliefs of the future success of the OmiseGo blockchain because the network is not yet live, and therefore OMG does not yet have any utility. Once the OmiseGo mainnet launches, even if an investor is not interested in being a node on the blockchain, having OMG gives them a chance to sell their stake in it, to someone who is.

There will initially just be 200 transaction validators on the OmiseGo child chain, however, token holders can stake their tokens to pools who validate on their behalf and allow any holder to earn confirmation rewards passively.

Current state of the OmiseGo blockchain

Around 20 months on from hitting the $1 billion market cap figure, the OmiseGo product is yet to release a consumer ready solution and its market cap has fallen to ~$173 million. It is often referenced as the archetypal ‘over promise, under deliver’ blockchain project, characterized by a history of pushing back roadmap goals and providing vague excuses as to why.

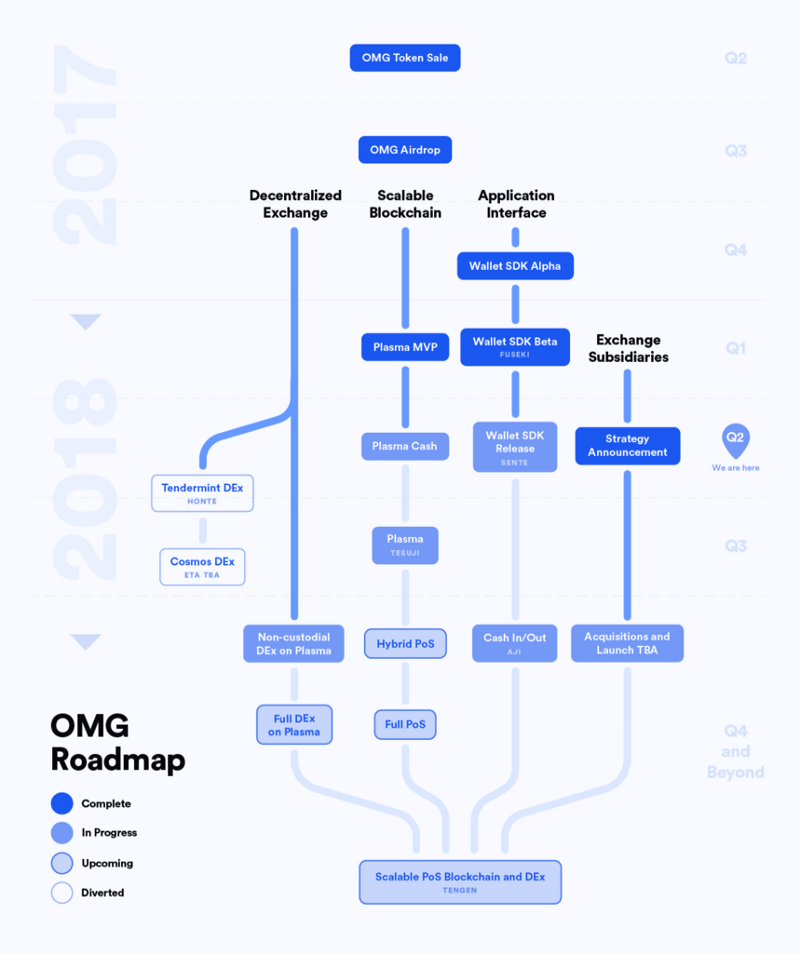

OmiseGo: Roadmap release May 2018

OmiseGo Roadmap release October 2018

Released five months apart, these two OmiseGo roadmaps/community updates are significantly different both in structure and content. The later roadmap has no mention of ‘AJI’, for instance, referenced in the May update and proposed for release in Q4 2018.

No such network update was released for OmiseGo in Q4 2018. There is a ‘cash in/cash out’ stage in the later roadmap which is likely tied to the original ‘AJI’ update, but this appears to now be much further along the OmiseGo product pipeline.

There also appears to be very little progress made on the ‘Tetsuji’ stage of the OmiseGo platform between May and October. The April 2018 update describes the project being in the final stages of launching an internal testnet, six months later the project had still not moved passed this stage and the external testnet solution was only released four months after this in February 2019.

As of February 16th 2019, OmiseGo has released ‘ARI’ as an alpha for the network, this update was referred to as ‘Tetsuji Plasma external testnet’ in previous roadmaps. The alpha opened access for select community testers and developers to use a trial version of the OmiseGo blockchain which is capable of ‘Minimum Viable Plasma’ or basic operations as an Ethereum child chain.

ARI had a chance to be trialed robustly at Ethereum Devcon 4 in Denver and undergo testing from Ethereum community developers. Transactions for these sessions and testing since are publicly available to view. At this stage, ARI provides developers with information on processing capacity and the ability of the network to handle large transaction loads .

In the near term, the next steps for OmiseGo are to have a version of ARI that is viable for Ethereum public testnet Rinkeby, the optimization of the current GAS fee mechanism, and an eventual public beta which will let anyone trial a version of the OmiseGo blockchain.

Since the ARI announcements, the price of the OMG has risen ~8.58%, with the update and favourable market conditions creating positive price pressure.

While the progress the network has made over the last few months is likely encouraging to some community members and OMG token holders, the fact that there is no set date for the release of a publicly usable, real-world payment capable version of OmiseGo blockchain remains a frustration.

OmiseGo has historically had challenges satiating its token holding community. A number a posts on blogs and on the official OmiseGo subreddit express frustration at the project being overhyped by project operators in the lead up to the price run – which drove the push of the token’s price towards $20, and subsequent efforts to try ensure the token was not sold heavily in the bear market

Specific strategies that have been perceived by the community as being empty marketing tactics include; OmiseGo CEO Jun Hasegawa’s overly bullish tweeting, vague pictures from official OmiseGo social accounts inside Google Headquarters (hinting a possible partnership that did not come) and consistent announcements about minor events such as the creation of Github repos.

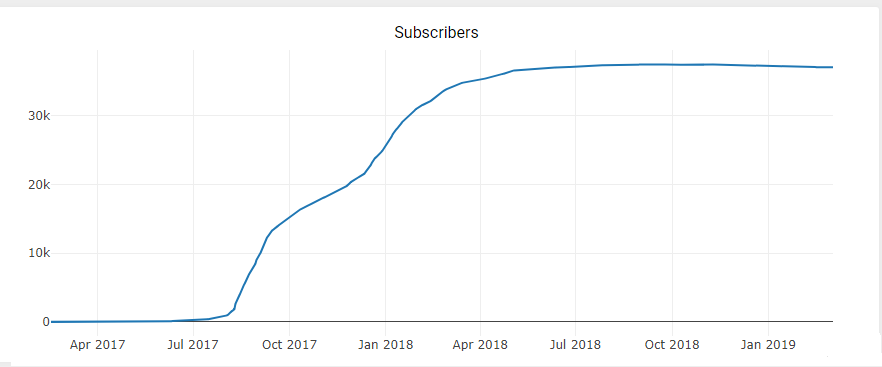

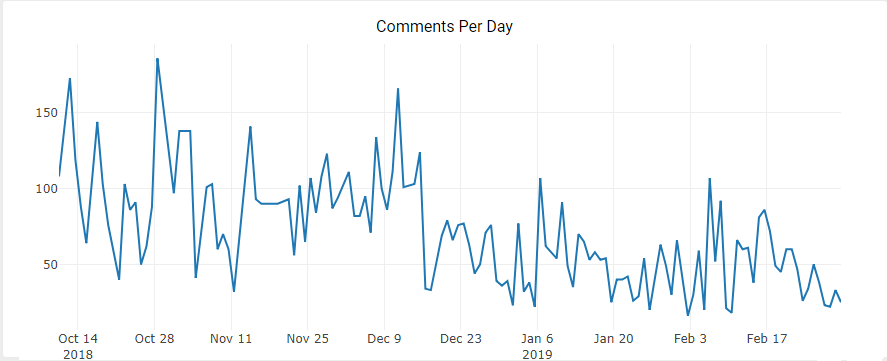

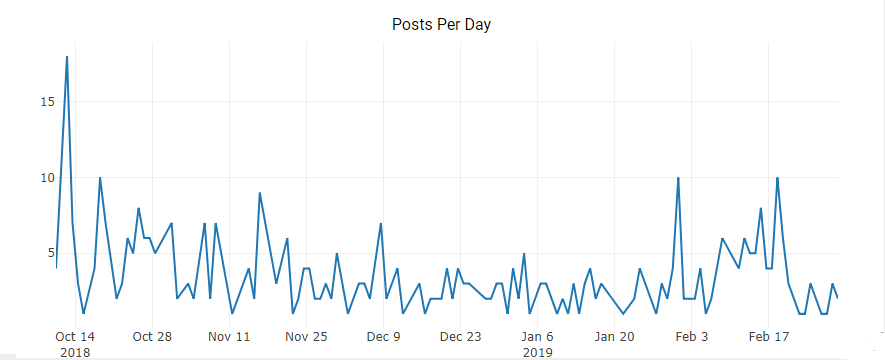

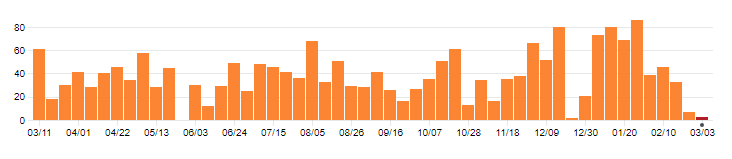

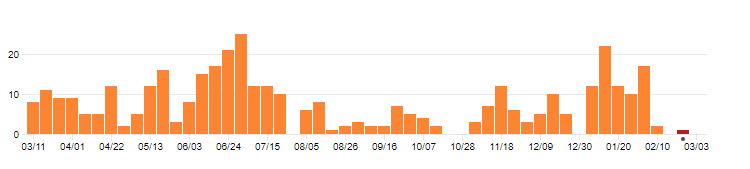

Figures below indicate activity from the official r/omise_go subreddit, source: subredditstats.com

The subscriber count has stagnated around the 37,000 subscriber level since June 2018, with very minor community growth over the last year.

Comments per day on the subreddit have more than halved since October 2018, and on many days were less than 50.

Posts per day on the subreddit are also down since October and on a number of days are as low as 0.

Turning to developer activity, OmiseGo has 46 repos on GitHub with the highest activity occurring on repos focused on the backend of the e-wallet solution and Plasma integration.

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Commits on the main OmiseGo’s 2 most popular ‘repos’, ‘ewallet’ and ‘elixir-OMG’ appear to be relatively consistent through the last year, with recent activity in January and February 2019

https://github.com/OmiseGo/elixir-omg/graphs/commit-activity

https://github.com/OmiseGo/ewallet/graphs/commit-activity

Onchain activity

NVT

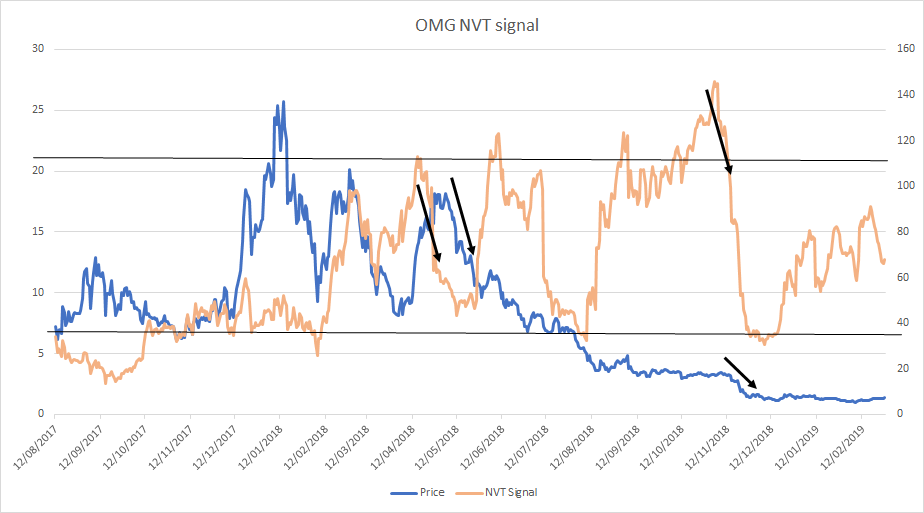

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

While the OMG token cannot yet be used to for its proof-of-stake functionality and OmiseGo network is not yet publicly available, Onchain transaction volume is likely an indicator for how the market values future proof-of-stake opportunities, and current demand to purchase stake in the network.

Onchain data source: Coinmetrics.io

Since May 2018, the Kalichkin NVT signal of OMG has fluctuated between 40 and 120 points and at times risen rapidly during periods of falling or stagnating price, suggesting a period of a fall in demand for OmiseGo stake even larger than what was reflected in the fall in external price of the OMG token, a bearish flag that price may need to fall lower to reflect true fundamental value.

Recent NVT signals (rising upwards slightly) against a medium term falling/stagnating price are a bearish indicator that the ecosystem is currently lacking transaction momentum.

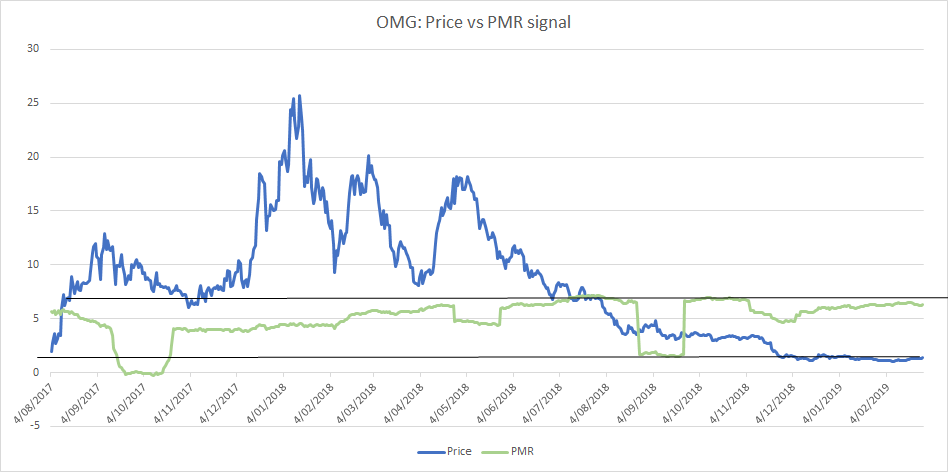

Price-to-Metcalfe ratio

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume.

However, there may be a question of the granularity of the data, and who controls these addresses.

Onchain data source: Coinmetrics.io

Historically, the PMR of OMG has ranged between 0-5 points and hit a low point just before a sharp uptrend in the price of the OMG token, during which the all time high daily price was eventually hit.

This considered, a downward push of PMR, triggered by an increase in active addresses in the network, towards a number closer to 0-1 can be considered a bullish fundamental flag. The PMR number for OMG, however, has hovered at ~5 since October 2018 suggesting that this fundamental relief is unlikely to arrive anytime soon.

Exchange & trading pairs

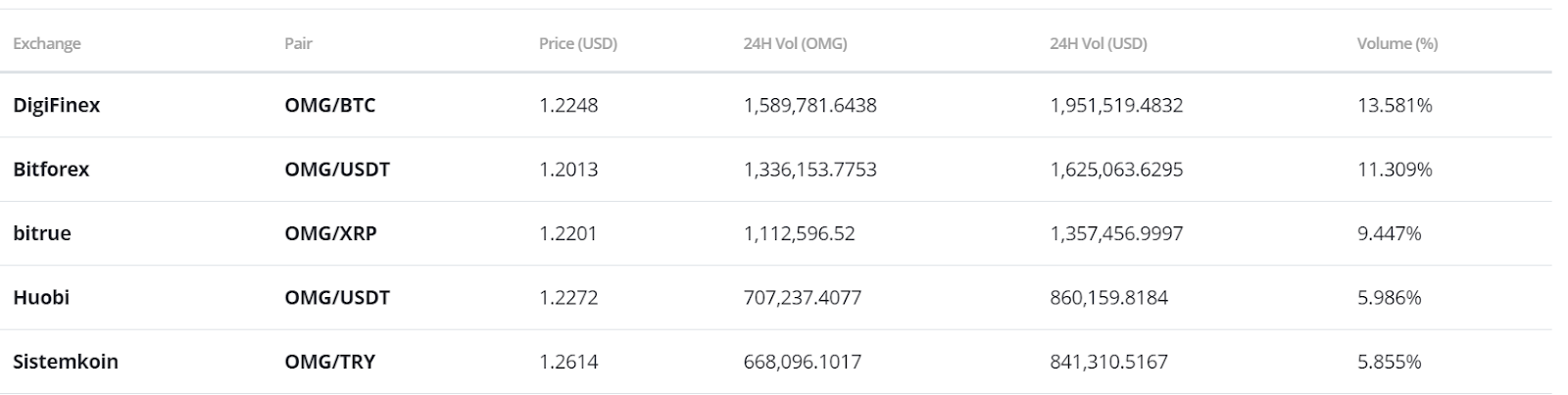

Source: Bravenewcoin.com

The most popular trading option for OMG is the BTC market. The second most popular is the OMG/USDT stablecoin pair with all four of the most popular OMG trading markets being crypto-to-crypto. Fiat transactions with OMG are offered in multiple options, with USD, KRW, AUD and EUR trading pairs available. The USD value of daily volume in the most popular OMG/BTC market is ~USD 5.6 million.

The most popular exchange by pair for trading OMG is Singapore based Digifinex which is focused on Chinese-speaking regions. OMG is also listed on a number of major, visible exchanges including Huobi, Binance,OKEX. Coinbase in a blog released in December, stating they were ‘exploring’ the possibility of listing OMG along with a number of other relevant ERC-20 token projects.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart (left), the death cross, using the 50 and 200 day EMAs, has persisted since June 2018 with the 50 day EMA currently acting as resistance (black arrow). Furthermore, OMG has been contained within a negative linear price trend with a Pearson’s R Correlation between time and price of ~0.86 (not shown). However, on the 2 hour chart (right), a death cross occured on March 4, and the 200 period EMA is currently acting as resistance (black arrow) near $1.25.

On the 1D chart (left), the 15 period TRIX and volume flow indicator (VFI) both show upward, but muted price momentum for OMG with TRIX above 0 and plateauing, while VFI remains beneath 0. Using the 2H chart (right), TRIX is beneath 0 and trending upward, while VFI is above 0, but trending downward.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is mixed; price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below the Cloud and above price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

At time of writing, price is attempting to complete a Kumo breakout, but has failed to meaningfully pierce Senkou A Cloud resistance, which coincides with the momentum plateau seen above. Additionally, these failures coincided with RSI touching overbought levels (arrow). However, the slightly positive momentum coupled with RSI falling back to near 40, doesn’t rule out a potential re-attempt of a breakout. If price can break above Senkou A resistance above $1.29 and the Cloud of $1.48, the price targets are $1.56 and $1.70, while support levels are $1.13 and $1.05.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below the Cloud and above price.

Using the slower settings, the outlook for a successful Kumo breakout is far less optimistic. Similarly to the faster settings, price attempted a breakout, but has failed to enter the Cloud at Senkou A resistance. The gap to breach above the Cloud is far larger, especially with momentum waning. All of which, makes a Kumo breakout unlikely. Price would need to break above $2.29 with price targets of $2.42 and $3.09.

Conclusions

OmiseGo, as a decentralized exchange solution with future capabilities to seamlessly and scalably connect with electronic payment vendors and fiat only merchants, remains one of the most exciting and sticky ICO project concepts in the crypto investment space.

However, with few practical milestones hit by the project in the almost 2 years since the attached OMG token began trading on secondary markets, heavy selling pressure beginning around the 2nd half of 2018 has been difficult to contain. The OMG token, which has value as stake in the OmiseGo network, is yet to have tangible utility with no public version of the network yet launched and no economic activity generated.

The launch of a testnet which is Minimal Viable Plasma (MVP) in mid-February was a major step for the network and appears to have created some positive buying pressure for OMG. Continuing dev activity and support from some of Ethereum and crypto communities leading figures is also a positive long term sign.

The technicals for OMG show plateauing momentum in the near term, and cautiousness in the longer term with strong resistance on the 1D slower Ichimoku settings. Both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above $1.48 and $2.29, respectively, before entering a long position. Both trader’s support levels are $1.13 and $1.05. However, if price manages to break above the 200 period EMAs on the 2H chart, it may have momentum to reach near $1.47 before ultimately failing to breakout of the faster Cloud, thus ~17% higher than its current price.

Don’t miss out – Find out more today