Verge Price Analysis: Privacy alternative makes recent progress

The price of XVG has gathered upward momentum after a recent codebase release. However, relevance remains a challenge given the number of competing privacy coins.

Verge (XVG) is a privacy-focused cryptocurrency network that provides solutions comparable to networks like Monero, Zcash and new mimblewimble-based digital currency solutions Grin and Beam. Resulting from a 2014 fork of Dogecoin, Verge was originally known as DogecoinDark, before an eventual rebrand to move away from the ‘memecoin’ image in 2016.

The Verge network has been tweaked many times, and as of January 2019 is on the 5th version of its ‘blackpaper’. The core of the Verge privacy solution is changing the way users are connected to the network, obfuscating IP addresses, geolocations and identity by using I2P, Tor technology and the Wraith protocol.

The price of XVG currently sits at ~$0.0062, down 98% from an all time high achieved in December 2017. It is the 54th largest token on the Brave New Coin market table.

Tor (the onion router) is an IP address anonymization scheme, used by the popular Tor Web browser, that has traditionally been used to browse the internet anonymously. The technology works by transmitting communication across multiple nodes in the network. Using relay computers, connections are bounced between locations, hiding the original IP address by making it challenging to determine the original sender of a request.

I2P uses end-to-end encryption by dynamically routing information/network packets that contain private user data through volunteer peer-to-peer tunnels. Tunnels are separated as incoming and outgoing, so any node only has one half of the information of any given transaction.

Wraith lets users choose whether they want transactions to be private or public, public transactions are faster and transparent, while private ones obfuscate information from other users on the network.

Because Verge relies primarily on I2P and Tor routing techniques for network privacy, and not blockchain based cryptography, XVG is often thought of as the least private amongst a select group of private transaction token networks including Monero, Zcash and Dash.

While Verge does conceal user IP addresses and geolocations during transactions, actual user and transaction addresses have historically not been hidden and this information is easily viewable on the blockchain. This means at a number of practical levels the Verge currency has often been considered a direct Bitcoin clone, lacking some of the added blockchain based transaction utility that networks like Monero and Dash offer.

One could also argue that Bitcoin is likely more private than Verge because its larger transaction load makes it more difficult to analyse individual transactions and addresses. Verge also has a rich list and cannot be considered fungible because addresses and coins can be blacklisted based on transaction history.

However, the Verge currency team has worked to add features to differentiate it from the Bitcoin network and XVG does have some unique aspects. It is a multi-algorithm Proof-of-work network, and supports 5 different mining algos: Scrypt, X17, Lyra2rev2, myr-groestl and blake2s. Some of the algorithms like X17 are also ASIC-resistant. A scrypt (hashing algo also used by Litecoin and Dogecoin) mining pool, Mining Pool Hub, contributes ~33% of the network’s hashrate at 265.37 Gh/s.

The official Verge roadmap says the integration of Ring confidential transactions (already integrated into all Monero transactions) is 45% completed. This will conceal the amount being transacted, while still allowing for the network to confirm the transactions without revealing any details publicly.

In 2018 Verge also implemented optional stealth addresses, which allow senders of XVG to generate a brand new address on Verge to send the XVG to, which can then only be claimed by the owners of the stealth addresses. Many addresses can originate from a single stealth address and these created addresses cannot be linked to the original stealth address by simply tracking the Verge blockchain, only sender and recipient can view the stealth address. Stealth addresses are useful, for example, to create addresses for donations or tips, because the ‘real’ address of the receiver is hidden.

A significant endorsement for the application of XVG as a medium for private transactions to protect user data came when it became the first cryptocurrency to be integrated for payments on adult entertainment streaming giant Pornhub in April 2018. Social momentum around this period was strong with videos like this gaining over a 100,000 views and mainstream outlets like Forbes covering the deal.

Verge is also partnered with Mindgeek, the Pornhub parent company, that operates a number of other adult entertainment platforms. Verge has also had visible, covered partnerships with Tokenpay, TenX and PLAAK.

Verge has also gained infamy for being successfully attacked for large sums of XVG twice in 2018. The attacks involved a bug in the Verge currency code which enabled attackers to spoof timestamps enabling the hacker to repeatedly use the same mining algorithm to mint blocks.

The first attack involved exploiting a bug in the implementation of the Scrypt algorithm, while the 2nd involved using both Scrypt and lyra2re algorithms. While the official statement from Verge currency didn’t give away much, many from the wider crypto community and leading developers such as Litecoin creator Charlie Lee, pointed to complications surrounding the 5 algorithm system being causes for the vulnerability.

The price of the XVG token has jumped 6% since the 3rd of March, likely benefiting from positive fundamental pressure created by the release of a new codebase that is in alpha. This is essentially a new version of the Verge blockchain, featuring improved Tor integration, smoother operations when using stealth addresses and faster overall performance.

Sticking with developer activity, Verge has 47 repos on GitHub with the highest activity occurring on repos focused on the XVG cryptocurrency, the vergecurrency.com website and Bitcore building (Bitcore is a tool which lets projects build blockchain based apps).

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Commits on the main XVG ‘repo’, ‘VERGE’ appear to have picked up considerably recently, following a long quiet period beginning in September 2018 to mid-January 2019.

https://github.com/vergecurrency/VERGE/graphs/commit-activity

There has also been a pickup in commits from Verge’s lead developer, Justin Vendetta beginning in January. Commits from lead developers/projects has historically been a strong bull flag for some crypto assets.

Source: https://github.com/justinvforvendetta

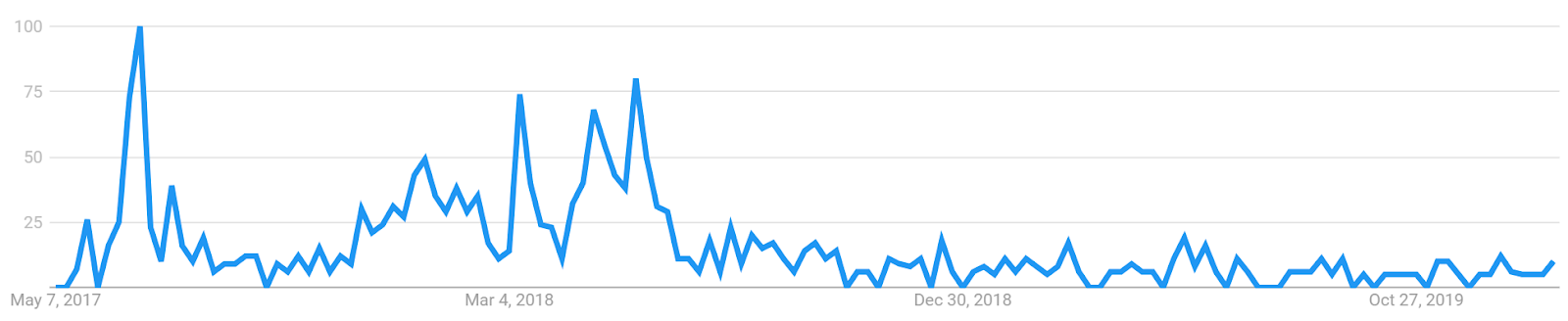

In terms of social activity, the @vergecurrency twitter account currently has ~305,000 followers, however, growth rate has stagnated since around April 2018, and the account has actually begun to loose followers since January 2019. A bearish flag that XVG holders may be inactive or selling. Growth in the number of monthly tweets has also begun to fall since the start of 2018.

https://socialblade.com/twitter/user/vergecurrency

In terms of Reddit activity, the core subreddit /r/vergecurrency has stagnated at ~53,000 followers since around December 2018, and has fallen gradually from a peak of around ~56,000. Like indications from Twitter follower activity, Reddit subscribers for Verge suggests a stagnating community.

https://subredditstats.com/r/vergecurrency

Most activity on the r/Vergecurrency subreddit in the last year appeared to happen around the time of the Pornhub partnership (10 months ago) and since then, both number of posts and comments has fallen away on the subreddit. Presently the number of comments is well under 10 on many days.

‘Lambos’ is a top-3 keyword in the verge currency suggesting that some users may be eager to realize large returns on their XVG investments, however, both ‘coders’ and ‘wraith’ are top 5 keywords suggesting a number in the community are seeking to ask questions surrounding the tech behind XVG. ‘Mcafee’ is also a popular term – likely because of a series of bullish social media posts made by crypto maverick and promoter endorsing the XVG currency solution.

Network activity

NVT signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

XVG has experienced numerous periods of a wildly fluctuating NVT signal in the three years following the launch of the Verge blockchain in 2014. Since then the NVT signall of XVG has hovered at a more stable range range between 5 and 200 points since July 2007. The approach towards 200 points appears to be a clear signal that the token is overbought and a sign that the price of XVG is about to fall. Vice versa for an NVT signal approaching 5, which indicates an oversold inflection trigger, and an arrival of forward price momentum.

The NVT signal for XVG currently hovers between 7-10 points and has dropped sharply since December. This fall has coincided with the arrival of the new Verge codebase and may be a bullish flag that fundamental support will back recent price gains.

Metcalfe’s Law

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume.

However, there may be a question of the granularity of the data, and who controls these addresses. Because of the stealth address system integrated into Verge these is a chance a single users may be controlling multiple active addresses, however a rise in active addresses vs token value may be a bullish fundamental implication that users are actually using XVG for its privacy functionality.

The PMR signal for the Verge currency rose steadily from the end of 2015 to late 2017/early 2018 and then fell away as the price of XVG tapered away following an sharp upward price jump in December 2017. This suggests that XVG may have been undervalued for a long period of time based on number of addresses and token activity and that the eventual price ramp up helped align fundamental value to externally traded value.

The PMR signal for XVG has hovered close to ~0 log points for most of the crypto bear market. While this number can be considered low, active address activity has not reflected in any significant buying activity or forward price momentum. This considered, the PMR signal falling to as low as -1 to -2 points is likely to be a strong medium/long term bullish fundamental flag.

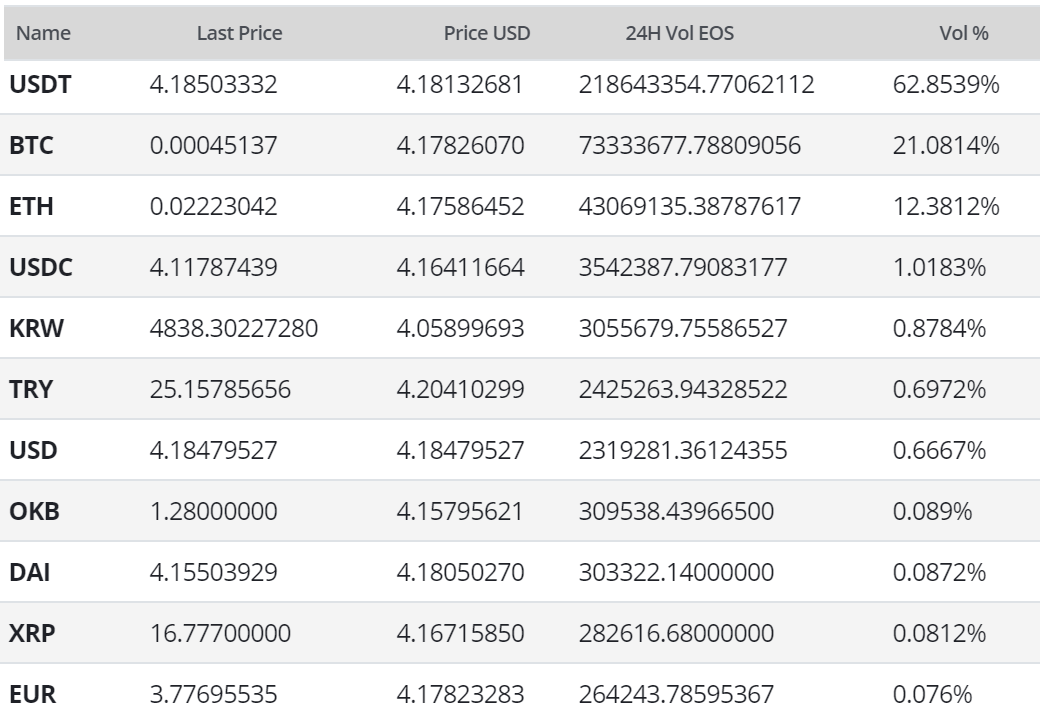

Exchange and trading pairs

Source: Bravenewcoin.com

The most popular trading option for XVG is by some distance the BTC market, handling over 90% of daily trading volume. The second most popular market is the XVG/ETH stablecoin pair with all 3 of the most popular OMG trading markets being crypto-to-crypto. Fiat transactions with XVG are offered in multiple options, with EUR, USD,TRY (Turkish Lira), JPY trading pairs available. The USD value of daily volume in the most popular XVG/BTC market is worth ~USD 5.6 million.

Source: Bravenewcoin.com

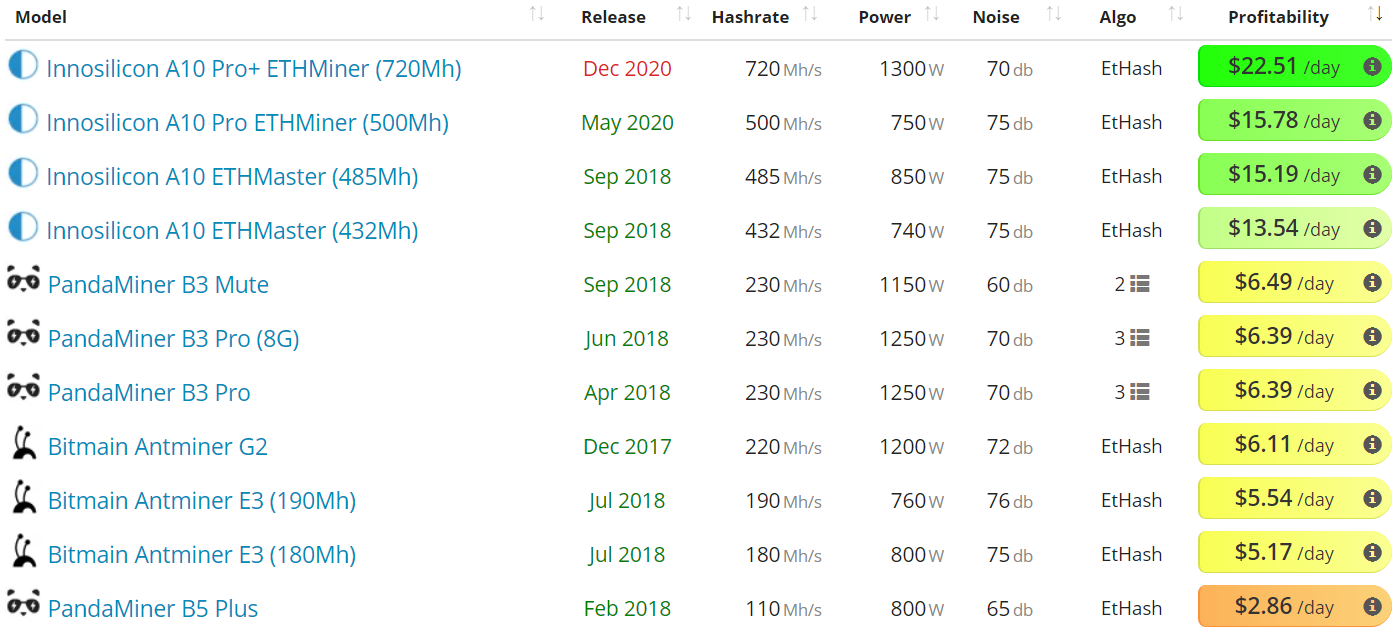

The most popular exchange by pair for trading XVG is mega exchange Binance which has a wide international reach and is known for generally offering excellent liquidity and listing a wide range of trading pair options. XVG is also listed on a number of other major exchanges including Bittrex, Huobi and HitBTC.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, the death cross, using the 50 and 200 day EMAs, has persisted since May 2018 with the 50 day EMA currently acting as resistance (black arrow). Furthermore, XVG has been contained within a negative linear price trend with a Pearson’s R Correlation between time and price of ~0.79 (not shown).

However, on the 2 hour chart, a golden cross occured on March 3, with price currently above the 50 period EMA and using it as support (black arrow) near $0.0063.

On the 1D chart, the 15 day TRIX and volume flow indicator (VFI) both show muted momentum for XVG with TRIX plateaued at 0, and VFI trending downward beneath 0.

Using the 2H chart, both indicators show slight momentum for XVG with TRIX plateauing barely beneath 0, while VFI remains beneath 0, but trending upward.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is mixed; price is below the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below the Cloud and above price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price attempted to complete a Kumo breakout, but failed to breakthrough the Cloud (arrow), which coincided with the momentum plateau seen above. Price’s current RSI metric of 51 doesn’t rule out another breakout attempt, but increased buying volume will be needed to pierce the demonstrable resistance ahead. If volume does grow and price completes a breakout above $0.0073, the price targets are $0.0079 and $0.0088, while support levels are $0.0059 and $0.0055.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and above price.

The slower settings present a far less optimistic outlook for a price breakout given the large resistance ahead. In the unlikely event of a Kumo breakout, price would need to break above $0.01 with price targets of $0.011 and $0.013.

Conclusion

The XVG token has enjoyed a period of strong short term price momentum as recent codebase updates appear to be building towards making the Verge currency network a genuine, stable privacy coin alternative. While the network’s existing TOR and I2P IP hiding capabilities has been appreciated by some, the arrival of smoother stealth address support and optimized network features extends XVG’s short term buying appeal

Medium and long term, XVG has historically relied on partnerships and endorsements to drive market relevance, and incoming features and efficiency updates may help the token compete on a more level pegging with blockchains like Monero and Zcash.

However, concerns remain surrounding the robustness and security of the Verge currency blockchain following two successful hacks on the network within the last year. The retention of a multi-algo POW model, which many analysts evaluated was the key factor in the network’s vulnerabilities, means these concerns likely remain for some market observers.

The technicals for XVG show tepid near-term momentum and longer-term bearishness. Both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above $0.0073 and $0.01, respectively, before entering a long position. Both trader’s support levels are $0.0059 and $0.0055. However, if price can hold its golden cross on the 2H chart, it may have enough momentum to reach near $0.0067 before succumbing to Cloud resistance, on the (10/30/60/30) settings, thus ~6% higher than its current price.

Don’t miss out – Find out more today