Bitcoin Price Analysis — Bears Beware

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD, and use very few indicators. All charts use BNC’s [Bitcoin Liquid Index](bitcoin) for maximum accuracy.

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD, and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy.

The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes, although I’ll briefly describe a shorter-term scalp setup.

Market Sentiment

This section is based on internal (anonymized) Whaleclub trading data and is published exclusively on BNC.

Current Active Long vs Short Volume Ratio: 3.5:1

Average Active Long vs Short Volume Ratio: 2.2:1

We have a 59% excess in active long volume relative to the average. The average weighted long entry price is $411.24, which is slightly lower than the current market price – this means that on average, current active longs are in the green.

Sentiment is bullish. The risk of a long squeeze is above-average due to the high long ratio, although not as high as last week – where we had a 90% long ratio excess, which resulted in a $15 sell-off (long squeeze) as predicted. If price breaks down below key $400 support, which has held strong for now, and long positions keep piling up, then we may see a broader long squeeze.

Macro Key Points

This section is an overview of news headlines or events that may affect BTCUSD.

It was a slow week for bitcoin in the media.

News developments that may affect BTCUSD:

- Australian banks are cutting off ties with bitcoin businesses. Although the Australian bitcoin economy is relatively small, exchanges, mining, and trading firms operating in Australia are beginning to see an increase in regulatory enforcement which could set a precedent that other countries could follow.

- 21.co launches a Ping21, a service that allows users to earn bitcoin by monitoring uptime and latency of various web services. This is similar to Pingdom, which monitors web service availability from multiple origins globally – except Ping21 is run exclusively with Bitcoin.

- Network fragility, block filling, block size debate, and core developer disagreement headlines have toned down this week.

- Reminder: The bitcoin block reward halving is estimated to occur on July 10, 2016 – that’s less than four months from now. The extrapolated post-halving bitcoin price, based on current market price and assuming demand for bitcoin remains the same, is about $200 – which is surely an attractive entry price point to many market players.

Technical Analysis

4h+ Timeframe Setup

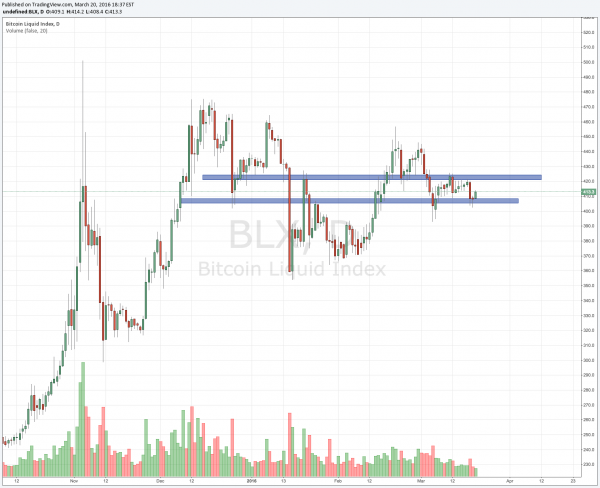

Let’s start by determining key support and resistance levels on a higher (daily) timeframe. We find that price has consolidated between daily support area around $405 and daily resistance area around $420.

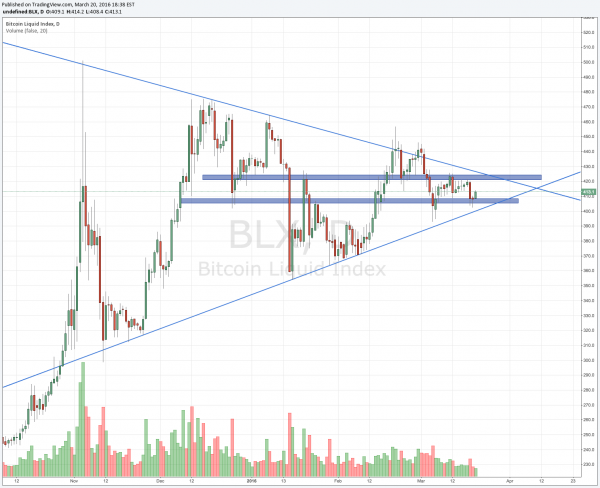

As for trend lines, our squeezers from last week are still valid. We have both supporting and resisting levels in a triangle formation converging around the $430 level, with current lows at $400 and highs at $450.

We detect a new, solid support trend line (in orange on the chart) with multiple touches on previous price highs and lows and the latest touch point at $405. That support line successfully served as a bounce point for our sell-off from $420. The large, engulfing green candles that printed on that support are another indicator of its strength (for support and resistance levels, the quicker price bounces off of them, the stronger they are).

We also detect a pretty solid resistance level at $420, with multiple attempts by the bulls to break past it in vain.

Both support and resistance levels detected are equivalent in strength. This sets us up for high-probability ping-pong and breakout trades, which we explain in the Trade Ideas section below.

Scalp Setup

Before we go on, let’s see if we can identify a good scalp setup on the sub-hourly timeframes.

$404 and $418 serve well as support and resistance levels for this timeframe. $404 represents the swing bottom while $418 is the 78.6% Fibonnaci bounce retracement level. Longing $404 and shorting $418 would be a relatively low-risk scalp strategy.

Trade Ideas

We determined from our technical analysis that price is in a consolidation region between $405 and $420 and we have two high-probability setups we can trade.

The ping-pong trade consists in shorting the $420 area and longing the $405 area. For additional confirmation, you can choose to go long only after a red or green candle has printed on the 4h timeframe on the resistance or support levels, respectively.

The breakout trade consists in entering a long trade if $420 is broken, and a short trade if $405 is broken. We are basically trading a breakout from the $405-$420 consolidation zone. For additional confirmation, you can wait for price to retouch the support or resistance level from which it broke out before entering your trade.

The gold discs in the chart below represent possible breakout areas.

For both these trade setups, since they highly depend on support and resistance level holding or breaking, place tight stops on the opposite side of the relevant support or resistance level.

A combo of the ping-pong and breakout trades can be used. For example, short $420 ping pong and long $420 breakout.

We still have a bullish bias because of the macro events on the horizon (in particular, bitcoin supply is halved this July). So we see going long at $405 support or trading the $420 breakout (long) as the higher probability trades here.

Disclaimer: This is not financial advice. The information presented in this post is an opinion and is not purported to be fact.

Petar Zivkovski has a Master’s Degree in Mathematics and Computer Science. He spent 10 years trading for BlackRock before assuming his current role as the director of operations at Whaleclub.

Don’t miss out – Find out more today