Bitcoin Price Analysis: Bitcoin XT Waves Continue

It's unfortunate that with such large volatility in the stock markets, Bitcoin was not stable enough to benefit from a positive PR spin showing it is an alternative to panic investors in the traditional markets.

Market Thoughts

The debate over the block size limit continues unabated. The details were covered in this week’sfree 8-page Bitcoin Markets Report. We are also looking forward to seeing what you think when we publish the results from the industry wide Blockchain Scalability Survey currently being conducted. This is your opportunity to express your thoughts vote. For now we will cover two of the more important aspects here.

What has happened over the past two weeks is unfortunate and most of it stems from the political issues surrounding BitcoinXT, where people are forced to chose sides. There are also a lot of people in the middle, and even though many of them have been convinced to swing one way or another, the one good take away is that everyone will be paying more attention to core development in the future.

One of the concepts we should mention is the hierarchy of importance within the Bitcoin ecosystem. This can certainly be debated as well, but in the most likely order they are:

1. Consensus – the confidence backbone which makes sure major changes in Bitcoin’s Code are hard to change, and hence the possibility of Bitcoin splitting in a hard fork are low.

2. Decentralized, Open Source, Ledger – This layer could be split into sub-parts, but the critical take away is that Bitcoin’s code needs to remain open source, mining needs to stay decentralized and the ledger of transactions needs to be trusted to stay historically unchangeable.

3. Medium of Exchange – This is the part where bitcoins come into play and act as a global currency with a potential store of value, due to the production hard cap of only 21 Million coins.

4. Payment System – This is the Bitcoin’s network’s ability to move those bitcoins quickly, efficiently and without third party involvement.

Now that the hierarchy is established, developers making changes to the Bitcoin code need to understand that if something down the line is prioritized, it can have major effects on the rest. For example, an attempt to help the currency by adding a monetary policy like inflation, track coins used in criminal activity or prevent double spending.

Any of these changes would have to take into account that Consensus and Decentralization/Open Source are not threatened, as it could lead to a loss of faith in the system even if the changes could potentially improve the uses of Bitcoin as a currency.

Likewise if the changes are made to improve Bitcoin as a Payment System, they have to be done in a way that they do not infringe on the elements that are considered more critical in the hierarchy.

This brings us to the release of BitcoinXT. By focusing on increasing the number of transactions per second, we have a situation where confidence is being reduced in the 3 other important layers. The architects of BitcoinXT are being accused of changing the definition of consensus, before a change is to be adopted, from 90%+ to just 75%. This change threatens the most important part, and some in the community are fearing the outside chance of a Hard Fork splitting Bitcoin in two.

There are also criticisms that the additional code inside the release may centralize the mining structure, and some miners will not be able to efficiently compete with bigger blocks. The Open source aspect is also being threatened as many are accusing the two developers of attempting to hijack development of the project.

In light of all this, the currency had a significant fall in price. It may be unfair to strictly blame the fall on the Block Scalability debate, but controversy over any financial asset will cause the users and traders to be impervious, which generally leads to lower prices.

On a final note, we should briefly mention why some miners would or would not look to approve the larger block sizes. Some miners would clearly benefit from larger blocks while others would not, due to bandwidth issues and technology limitations. Then there are questions over whether miners would benefit more with micro transaction fees or making sure that Bitcoin remains the primary tool for large settlement, and if microtransactions move to Sidechains or Lightning Networks in the future, the loss of revenue would justify the efficiency of the network.

As it stands currently, it appears that several large mining pools are not in support of BitcoinXT, so it will be really difficult to get the 75% support it needs. Either way the sentiment damage has been done as it might be hard to get the sentiment back to full confidence for an immediate recovery in price.

Market Outlook

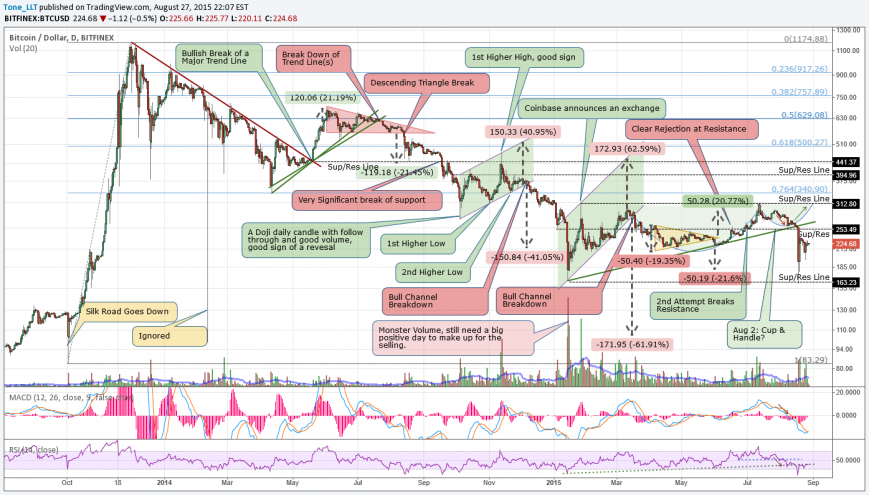

The technical picture is very tricky at the moment. The graph below is from the exchange Bitfinex, but as you all know, that was the exchange that had a mini Flash Crash which other exchanges did not experience. It was caused by a combination of over leveraged longs, a significant size seller and a significant size short entry. In addition there was a slight technological glitch that prevented traders from properly reacting to the events and when some margins were called, the fall accelerated.

This might have also been fueled by some would be buyers removing their bids in light of all the controversy in the ecosystem, which tends to fuel additional losses as the order book thins out. Other exchanges did not experience this type of fall last week, and while in the chart below it will look like a higher low was established, most other exchanges saw a lower low with increased volume. That is not an optimistic structure for the price in near term.

As you can see the price remains around the point of prior stability in the $220-230 range. The big fall took us down to exactly the same price as the low in January, and bouncing right of off that horizontal support level appears to be a double bottom. As mentioned earlier however, this is only limited to one exchange. We have a clear resistance level at $255, which was our strong support now turned resistance, and the level at which things fall apart. Until we have a clear resolution in the blocksize debate the pressure will weigh on the price, but the picture will not be clear until one of these two horizontal levels is overtaken.

The more detailed Daily Chart is now reserved for subscribers to BraveNewCoin Traders Report, which outlines short-term, intermediate-term and long-term viewpoints. It also breaks down all the relevant weekly news and their influence on Bitcoin’s price and general standing within the financial ecosystem. The reports are free for a limited time.

Final Thoughts

It’s unfortunate that with such large volatility in the stock markets, Bitcoin was not stable enough to benefit from a positive PR spin showing it is an alternative to panic investors in the traditional markets. This was a great benefit to price appreciations in mid June to mid July, as the Main Stream Media ran with the concept that Bitcoin might just be the solution Greece needs. A similar thing could have occurred and whether true or not, it would have been a much needed positive aspect to the still experimental and fragile 6 year old Blockchain experiment.

This article was completed on Thursday Aug 27 11:30 pm ET, when BraveNewCoins Index showed Bitcoin price at $223 USD. Tone Vays will be a speaker at the upcoming Inside Bitcoins San Diego Conference Dec 11-14.

Disclaimer: The price projections & opinions above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today