Bitcoin Price Analysis: Exchanges And NY Residents

The news is still coming in over the possible reasons for the big price fall yesterday, which resulted in a $20 drop in bitcoin’s price.

Market Thoughts

The news is still coming in over the possible reasons for the big price fall yesterday, which resulted in a $20 drop in bitcoin’s price. The most likely candidate is speculation over the effects of New Yorks BitLicense, which goes into full effect this week. In the last 24 hours we have learned that one of the most popular exchanges, Bitfinex, is going to shut down the accounts of New York residents, and competitor Kraken will be following suite.

In trading positions are usually accumulated in the anticipation of an event. The run up during the Greek crisis can most likely be attributed to traders expecting Europeans to diversify some of their assets. When the news broke that there will be another loan to put Greece further into debt, and push this problem further out in time, many looked to take their profits and the price subsided. The trading community appears to be having a similar reaction to the BitLicense.

Logic might say that all of these exchange announcements would cause people to fill up their accounts with bitcoins before shutting them down, since it’s much easier to move than the Dollar, but perhaps enough people are seeing this as a detriment to the ecosystem and positioning their trades accordingly. It is also difficult to say how much impact New York residents have on the trading price of bitcoins. The statements from currently non-compliant exchanges seem to indicate that it’s not much, hence their reluctance to assume the extra costs of compliance.

We will judge the situation when things calm down, as they appear to be doing at time of writing with the price in the $265 area. The Bitcoin trading market is much more mature then even 6 months ago and the ability to trade bitcoins long and short should be a very good thing. When it comes to putting in a low shorts need to take their profits, buying back bitcoin.

Market Outlook

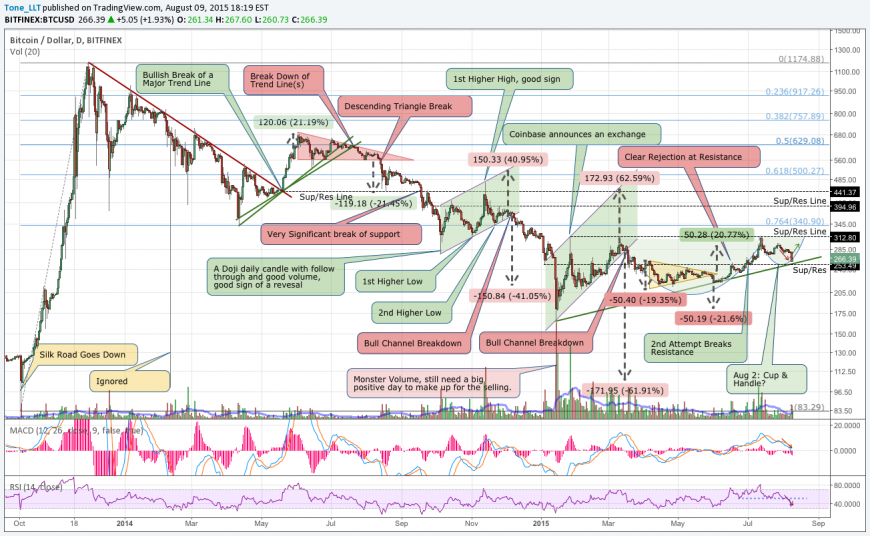

Perhaps surprisingly the overall daily picture remains generally Bullish.

Although not displayed on the chart above, we have closed below the 50-day Simple Moving Average (SMA), but we are still above even stronger levels of support around $255. If we add an additional trend line, which other traders are now doing, we have another level of support in our $255 range that many will be watching. All the Arrows have been left on this chart since it was last displayed, and we are just on the edge of that Cup and Handle pattern. The Momentum indicators are in much better positions for a reversal now, in comparison to the last few weeks, with the MACD around 0 and the RSI just under 40. The spike in volume on a big down day is not great, but it should be expected considering the size of the move.

The more detailed Daily Chart is now reserved for subscribers to BraveNewCoin Traders Report, which outlines short-term, intermediate-term and long-term viewpoints. It also breaks down all the relevant weekly news and its influence on Bitcoin’s price. The reports are free for a limited time.

Final Thoughts

In addition to the BitLicense affects, the community is fixated on a ruling in Japanese court that stated:

“The judge said it is evident bitcoins do not possess the properties of tangible entities and acknowledged that they also do not offer exclusive control because transactions between users are structured in such a way that calls for the involvement of a third party.”

This seems to imply that bitcoin owners will not have property rights, but there seems to be a clear misunderstanding by the court as to what Bitcoin really is, although there is a chance that there were issues in translation. The community should not assume that this might get Mark Karpeles off the hook, there are still 650,000 bitcoins missing. If any speculation is warranted it should be for future situations where the authorities would have the right to simply confiscate what they consider a non-asset, specifically from third parties that are holding it on your behalf.

Always know where your private keys are, and if they are not in your possession, then the risks of losing them extends significantly beyond hackers.

This article was completed on Sunday Aug 9 7:00 pm ET, when BraveNewCoins Index showed Bitcoin price at $264 USD. Tone Vays will be a speaker at the upcoming Inside Bitcoins San Diego Conference Dec 11-14.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today