Bitcoin Price Analysis — Houston, we have liftoff

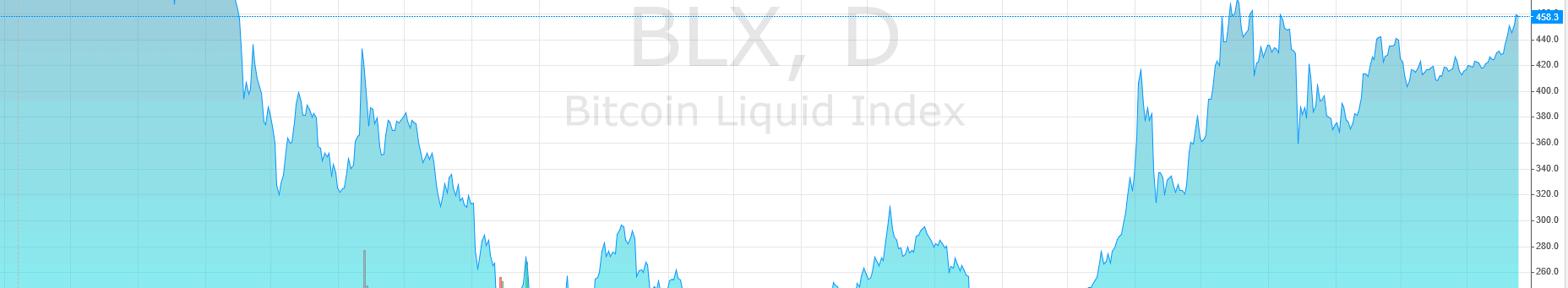

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy.

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy.

The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes.

Market Sentiment

This section is based on internal (anonymized) Whaleclub trading data and is published exclusively on BNC.

Current Active Long vs Short Volume Ratio: 3.82:1

Average Active Long vs Short Volume Ratio: 2.1:1

We have a 182% excess in active long volume relative to the average! This signals massive bullish sentiment.

The average weighted long entry price is $443.8, which means that on average, active longs are in the green.

Sentiment is highly bullish — almost exuberant. Long position volumes are very high and short positions are almost inexistent. This may be the perfect setup for a long squeeze that may result in a significant pullback as most traders, already “all-in” with their buying power, are ready to take profit.

Macro Key Points

This section is an overview of news headlines or events that may affect BTCUSD.

The week has been relatively slow for bitcoin news.

-

A European parliament member, in his talk about blockchain technology that he called “potentially revolutionary”, urged everyone to “buy some bitcoin” to get a taste for the tech.

-

We’d like to remind our readers of the bitcoin block reward halving which is estimated to occur on July 10, 2016, less than three months from now. The supply will halve – and assuming demand remains the same, the post-halving value per bitcoin is around $900. Extrapolating this based on the current market price, the present value of one bitcoin is around $225 – an attractive entry price.

Technical Analysis

4h+ Timeframe Setup

Our predicted bullish breakout has occurred. Our target area of $450-$455 has been hit and now we’re seeing resistance at current price levels.

Below we chart our new key daily support and resistance levels.

As for trend lines, our squeezers and pennant from last week are still valid. We have both supporting and resisting levels in a triangle formation converging around the $430 level, with current lows at $400 and highs at $450 which we have broken above.

This bull run may slow down, however, as price moves into hefty horizontal resistance areas and historically attractive sell points at $455 and the $460-$500 area.

In particular, the large wick from $500 from last year’s price dump will be difficult to overcome as smart money will be looking to cash in on the retail run up.

Now let’s switch to the 4h timeframe to dig a little deeper. Our daily trend lines and S/R levels are preserved.

We confirm that a clear breakout has indeed happened above our resistance trendline, with a couple of retests of that level failing to break lower, possibly confirming that our resistance has turned into support.

It’s interesting to go back and study the formation that led to this bull run as that will give us clues on how powerful it is and whether it’s likely to last.

We detect a clear arc formation, with higher highs and higher lows creating massive support levels at $420, $430, and now $440.

We are up against heavy resistance from $460 to $500, but the arc formation is one of the most reliable and powerful “resistance-breaking” patterns.

So we deem it more likely than not that price will indeed break through resistance, albeit more slowly than what most would expect. We see the $460 – $500 area as a battleground between new “smart” money buying bitcoin and old “smart” money looking to take profit on their $400 area longs.

We expect a zig-zagging of pumps and pullbacks, with a bullish bias supported by aggressive retail buying.

In any case, the downside is limited, especially with the bitcoin halving event getting closer. Barring any bearish fundamental catalysts, a dip to $430-$440 is a high probability bullish setup and should be bought.

Trade Ideas

If you are long from the $400-$420 area, exit half your position and take profit. $460 is not a resistance to take lightly – this price has repeatedly been an attractive sell area for institutional money.

However, our arc formation, breakout, and bullish macros give us confidence that this resistance level will be conquered.

The highest probability scenario right now is to be in a long position with half your usual trade size. Complete that long position on a dip to $440 or on a breakout above $460.

A dip is a likely scenario for two reasons. First, as we’ve established previously, $460 is a historically attractive sell price. Second, sentiment is exceptionally bullish. Long position volumes are almost at all-time highs, which means buying power is depleted, and a significant upmove is unlikely before some profit-taking (liberating tied-up capital by selling long positions at a profit before re-entering long positions at more attractive prices).

Alternatively, new capital may enter the market and power a break above $460.

In practice, we think both the above elements will catalyze an upmove. $430 longs will take profit, resulting in a dip, which will then be bought by fresh smart money, creating the support we need to move up above $460 and beyond.

Disclaimer: The information presented in this article is general information only. Information provided on, and available from, this website does not constitute any investment recommendation.

Petar Zivkovski has a Master’s Degree in Mathematics and Computer Science. He spent 10 years trading for BlackRock before assuming his current role as the director of operations at Whaleclub.

Don’t miss out – Find out more today