Bitcoin Price Analysis: Week of June 24

By now everyone is attempting to explain the reason for the big Bitcoin price move last week. Many in the space are convinced Bitcoin’s price is about to go exponential once again, and are happy that they called it right.

Market Thoughts

Market Thoughts

By now everyone is attempting to explain the reason for the big Bitcoin price move last week. Many in the space are convinced Bitcoin’s price is about to go exponential once again, and are happy that they called it right. On the other side many technical analysts, that were sticking with the trend, were expecting a retest of yearly lows and will now have to put those thoughts on hold. It is really difficult to find the catelist for the move because the volume was nothing special, compared to similar size moves in the recent past.

Taking a look at macro economics there has not been anything of note. The potential that the people of Greece, or other nations on the verge of a Sovereign Debt Default, have been moving their cash into Bitcoin is probably a bit of a stretch just yet. However, there were a few other interesting things in the headlines this week.

A UK Company Elliptic introduced their Bitcoin Big Bang project. Basically it’s a tool to remove all thoughts of pseudo anonymity in Bitcoin transactions. The goal of the project is to show banks and other large financial institutions the history of the bitcoins, which they are considering to accept for business, so that they would know if the bitcoins have been used in illegal activity. Almost instantly news also hit the wires that other companies are looking to go in the completely opposite direction and provide more anonymity for the users and their bitcoins, which is what Blockstream is working on with their “Confidential Transactions”.

What we now have to figure out is how will either, or both, of these initiatives would affect Bitcoin’s Price. At the moment, Bitcoin still has a serious identity crisis. It can’t possibly exist in a world where money and especially cash is being criminalized. So either bitcoins will embrace the anonymity side of the Blockchain, and accept the consequences of all Bitcoin transactions deemed criminal in countries where Government seeks full control over the population, or is it worth giving up the features that have gotten Bitcoin this far – taking a gamble that this is what is needed for mass adoption.

It is hard to say which is the better path, but as long this uncertainty remains, mass adoptions is a long way away. Billions in Free Market wealth and Billions in Government approved wealth will remain on the sidelines. Bitcoin did just fine back when the main use case was Silk Road, and donations to Wikileaks, and the one thing no one wants to acknowledge is the fact that just because a technology is optimal for activities Governments disapprove off, this does not in any way imply that it is not optimal for everything.

From a purely economic perspective, what Elliptic is bringing to the world is a detriment to global economics. The world economy is slowing down and money velocity is plummeting. One of the main reasons is the constant increase in regulations and the criminalization of financial transactions. Those without Government connections are pretty much guilty till proven innocent when it comes to AML standards. In order for most of the indebted Governments to remain solvent they now need to hunt down every penny of tax revenue, hence initiatives like FATCA will only accelerate the global slowdown.

Bitcoin will suffer the same fate as the US Dollar, as regulations on financial transactions are increased, and people are scared to use it because they do not know if they are criminals. This is something Elliptic should consider as they release their initiative into the world. We have also seen the steep rise in the US Dollar, and if you combine the rise in the purchasing power of the dollar, the velocity of that same dollar is plummeting as seen in the FRED chart. The only logical conclusion to be made is that people across the world are running to the dollar and saving/hoarding it away for a rainy day.

Market Outlook

Clearly Bitcoin is a long way from figuring out its true purpose, so we once again go back to the charts and try to make sense of what the consensus of traders think.

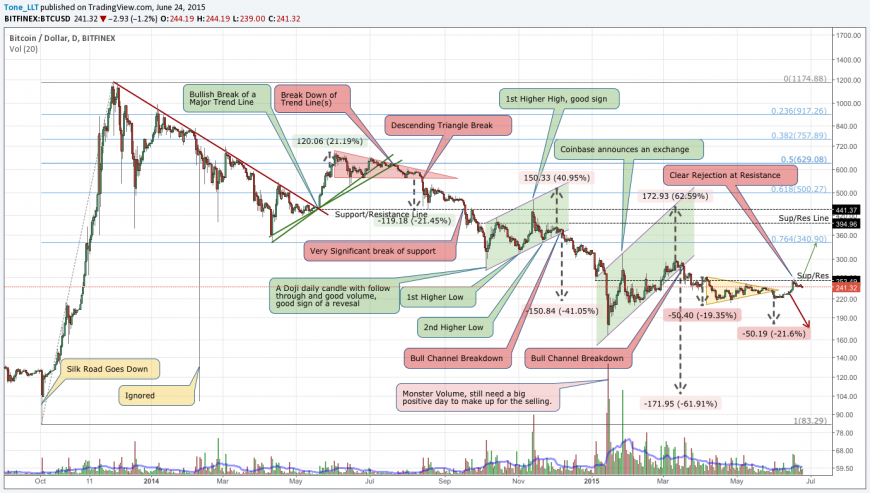

The arrows were left as they were the last few weeks indicating that, on a longer-term basis, we are still in a downtrend. There are definitely some positive signs, but even at the high mark it was just a touch of major resistance, and as the green arrow indicates long trades should not be in consideration until this resistance is clearly broken.

The zoomed in view with additional indicators is giving us something to really keep an eye on. It is pretty clear right now that Simple Moving Averages matter as the 3 month high last week touched the 200-day SMA perfectly before retreating almost $20 dollars to $240, twice. The good news is that we have cleared the 50-day SMA and as long as we remain above it, it is possible we are looking at a trend change.

Also notice that this was the outcome that was expected back in March on the break of the Ascending Triangle, which broke down in the less probabilistic directions. Ideally you want to see these moving averages cross to indicate some real strength in the rally. For now, it is probably best to consider this area between the averages as a watch zone while a move back under the 50-day being bearish and a move over the 200-day being bullish. The RSI was also hitting the overbought levels on this move for the first time in 3 months so it might need some time to cool off a bit.

This chart is getting really busy at this point, where both bulls and bears have good reasons for their positions. To add to the bear camp, another descending triangle has been added to the chart, even though the last few triangle patterns have not worked out, and the 50-day SMA support is only a few points away.

Final Thoughts

The big question one has to consider is if we are finally on the verge of a trend change. If the answer is yes, then there is no rush to get into long trades now, there will be plenty of time for that. Here is a typical image of what a trend change looks like. As you can see, it usually involves breaking out to a new high, labeled point 1, then dropping to test the area of the breakout which should now serve as support , point 2. Then break out one more time to new highs, point 3.

Applying this to the current movement in Bitcoin, we have definitely formed point 1 but not 2 and 3. Aggressive long term bullish traders might look to pick up bitcoins when they feel point 2 has been created, which in an ideal world would be a bounce off the 50-day Simple Moving Average.

This article was completed on Wednesday June 24 5:00 pm ET, when BraveNewCoins Index showed Bitcoin price at $242 USD.

Tone Vays will be a speaker at the upcoming Inside Bitcoins Chicago Conference July 10-11.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

EDIT: 6th July – Added Missing Fred & Ciovaccocapital charts.

Don’t miss out – Find out more today