Bitcoins Price: Weekly Analysis – April 22nd 2015

The weekly BNC technical analysis. A look into the market activity of the Bitcoin marketplace for the week ending April 22nd 2015.

Market Thoughts

This week, the big news that stole the show was the attempt to solve the ongoing mystery of Mt. Gox missing bitcoins. According to analysis compiled by Wizsec, it appears that Mt. Gox began to lose a hold on the bitcoins they claimed were in cold storage back in 2011, and going into 2012, they were already running a fractional reserve.

At the time, this should have had a significant affects on the market and if you look back at the charts of 2011, it clearly did, especially in light of the alleged hack that took place during that time. The price crashed from $32 down to $2 and then hung around under $5 most of 2012. That was a 94% loss in value and to put that into perspective it’s the equivalent of the price dropping from the December 2013 high of $1,242 down to about $75. As you can see, bitcoins’ value has definitely been here before with real wealth on the line, so the current fall in prices is not unusual for neither the Bitcoin veterans nor seasoned traders and investors that have seen these moves in other markets.

The one thing to keep in mind is the environment; it is significantly different than in 2011. Yes, the stakes are much higher now that Venture Capital funds have invested hundreds of Millions of Dollars in Blockchain Start-ups. But also the trading tools have greatly evolved. Instead of a single exchange we now have many and while more work is needed for greater efficiency, the ability to go short and profit from the fall in bitcoin prices is critical for a healthy stable market.

Because Bitcoin is still young, and mostly trades like a combination of currency and commodity, it will be the short sellers that will be buying back the bitcoins the next time there is a panic thus stabilizing the prices. And while it is highly unlikely that we will see prices go down all the way to $75 matching the fall in 2011, it is something a savvy investor should be ready for.

So if you are holding a substation amount of bitcoins purchased at a price over $100, right now is the time to think about what you would do if it dropped below your purchase price? Will you be able to hold through it or sell in a panic along with others?

Market Outlook

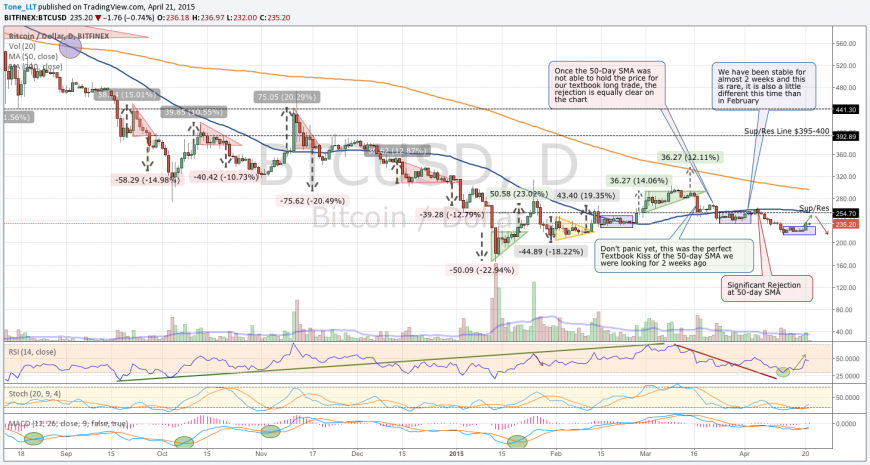

Looking at the technical picture one year out, it appears we are still looking for that illusive bottom to the 16-month decline.

At the moment those support levels are the recent low of $216, the round number of $200 and the yearly low of $166. There is absolutely no reason to panic as long as the price is staying above these points.

Looking at the same chart with some additional indicators paints a more in depth picture. As much as we love to draw triangles to help us identify price targets, surprisingly none have formed in over a month.

Instead we have head several periods of stability before the big moves. These periods of stability have also been able to hint at what direction the next move will come. Those that follow on twitter @Tone_LLT would recall that the reason for expecting the box in March to break to the upside was that we were stabilizing on the way up with momentum indicators like RSI and MACD having room on the up side.We were also breaking over the 50-day Simple Moving Average.

The second box at the very end of March going into April was expected to break to the downside due to the completely opposite technical picture just described for box 1. We are now looking at box 3 and this one is trickier. It actually has a combination of the first two. It is happening as price is coming down, but because it has already fallen so much, it is taking place as some of the momentum indicators are saying, “oversold”. We have also fallen far enough below the 50-Day Simple Moving Average that it might be time to come back to the mean before the dominant trend once again takes over.

Final Thoughts

If you are invested in Bitcoin, you should know exactly why and what your real expectations are. There is plenty of room for everyone from traders and speculators to those that think it will revolutionize Wall Street, to those that think it’s a political game changer. Being in attendance and seeing how the Rand Paul fundraiser organized by the Blockchain Technologies Corp was really able to bring together all these different beliefs for the future of Bitcoin in one place. The most important thing to remember is that pushing your view of what you expect Bitcoin to achieve onto others is not ideal at this point in time and with time it is possible everyone to be right.

This article was completed on Tuesday April 21 10:45 pm ET, when BraveNewCoins Index showed Bitcoin price at $235 USD.

Tone Vays will be a speaker at the upcoming NYC Inside Bitcoins Conference April 27-29 and also at the Inside Bitcoins Hong Kong Conference May 14-15

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today