Bitcoins Price: Weekly Analysis – June 18th 2015

Market Thoughts: The Bitcoin Ecosystem may be at a highly anticipated turning point. This week we analyze the European Crisis and explore a prediction from 10 months ago utilizing the Fibonacci Indicators.

Market Thoughts

The last 24 hours have been interesting to say the least when it comes to Bitcoin’s price. We all new that this trend of low volatility was due for a violent end but the direction of the move was a bit unexpected. More details on that will come in the Market Outlook section as we re-evaluate the price and what it means for the future.

Let’s take a quick look at the headlines and see if this was the result of anything fundamental. Looking at the macro economic space, we still have the Greek tragedy playing out. There is much speculation and opinions are plenty but one strongly recommended reading on the subject is from Mish’s Global Economic Trend Analysis:

Here we are, two major bailouts accompanied with haircuts later. Along the way, eurozone nannycrats and the ECB turned a minor problem into a €330 billion problem. The arrogance of central bankers who believe they can control markets with talk is stunning. Neither the ECB nor the eurozone nannycrats is in control of this situation. They don’t have a loaded gun, and are not in any position to make demands. I am curious how much longer it will take them to figure this out. I will accept as evidence they finally understand reality the moment the ECB shuts off the ELA.

— – Mike "Mish" Shedlock

The Article concludes with the following, which is an interesting perspective on the situation at hand.

Note the irony of it all. Germany wanted to issue a "Take it or leave it proposal to Greece". Instead we see Greece issuing a "Restructure or we leave proposal to Germany". It’s likely this was Syriza’s plan all along. If so, they managed to play Germany like a finely tuned violin, allowing Greek citizens to pull out cash out of banks every day for six months.

— – Mike "Mish" Shedlock

Is it possible that the Europeans are moving the money into bitcoins to hide what they have saved over the years in something that can’t be confiscated? Yes, it is definitely possible but speculation aside, this is probably not the main driver. Volume has picked up but it looks like there was one major buy that took place and everyone else followed. Also any smart Southern European that is focused on moving their money into bitcoins should be smart enough to use the cash market over exchanges and that volume is not as easily reflected.

Another interesting news of note is that more banks are starting to look at Bitcoin and the Blockchain more seriously. In a FinTech paper by Santander Bank titled Rebooting Financial Services, several good points are explored:

In contrast to today’s transaction networks, distributed ledgers eliminate the need for central authorities to certify ownership and clear transactions. Distributed ledgers can be open, verifying anonymous actors in the network, or they can be closed and require actors in the network to be already identified. The best known existing use for the distributed ledger is the cryptocurrency Bitcoin.The first major application is being seen in payments, especially across borders. International payments remain slow and expensive and significant savings can be made by banks and end-users bypassing existing international payment networks. Cutting operational costs is not the only benefit in securities trading. Distributed ledgers can increase investor confidence in products whose underlying assets are now opaque (such as securitisations) or where property rights are made uncertain by the role of central authorities.

— – The Fintech 2.0 Paper

Reading all of it really gives the feeling that for the first time a traditional banking institution is finally starting to understand what this movement is all about and what the future implications might be. This was very different then the Bank of England’s paper from about 9 months ago where throughout the 20 page document bitcoins were referred to as a “scheme”.

By the looks of it, there does not appear to be any critical fundamental reason for the sudden rise in price and so we will turn to technicals to see how things are looking for the future.

Market Outlook

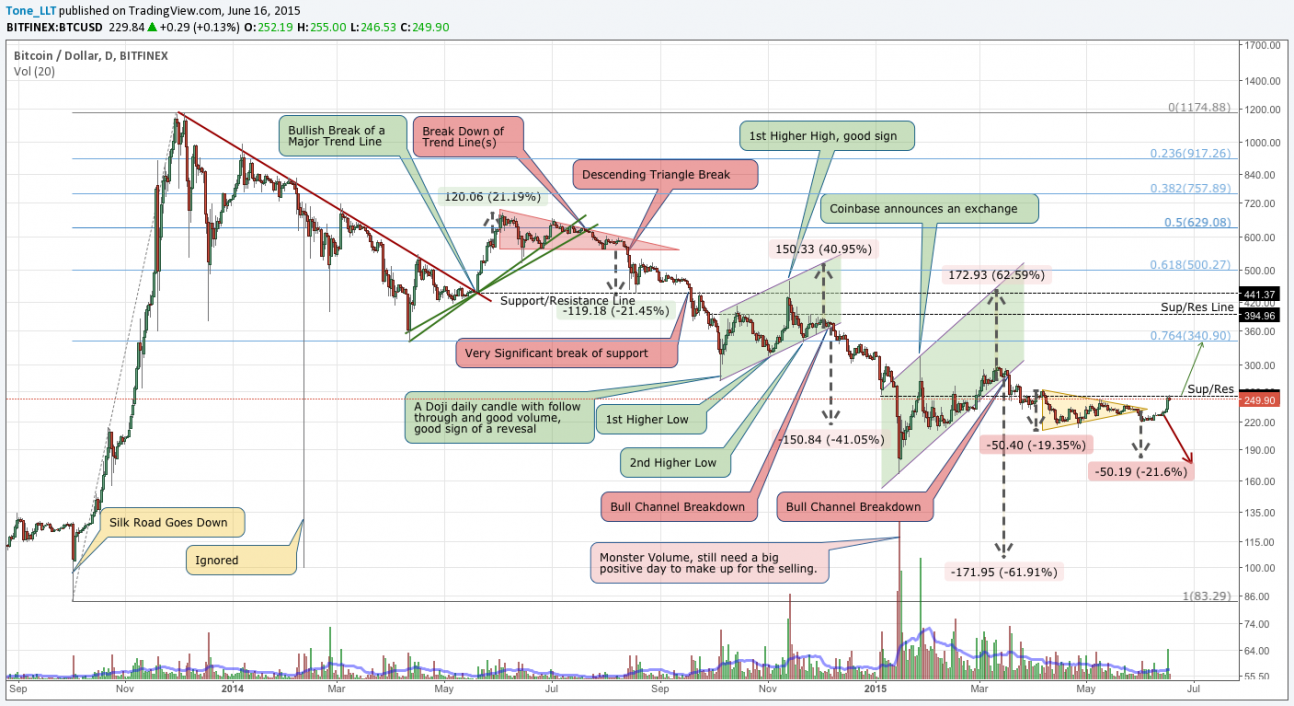

Our picture has clearly changed from last week so let’s take a look at the last year.

The Symmetric Triangle breakdown looked pretty clear but it is possible it was a head fake move. We will know very soon. The price breakout has moved right into horizontal resistance that has been on the chart since the first week of the year. This is now a very critical point. Yes it is possible that a move by traders can set off a prolonged trend like what happened in march in the wake of the Evolution marketplace running away with people’s coins, but even that was more driven by fear and fundamentals which we do not see much of here. Any time the price is at a major support or resistance point the best course of action is usually to sit back and watch the outcome. Nothing good ever happens with rash decisions.

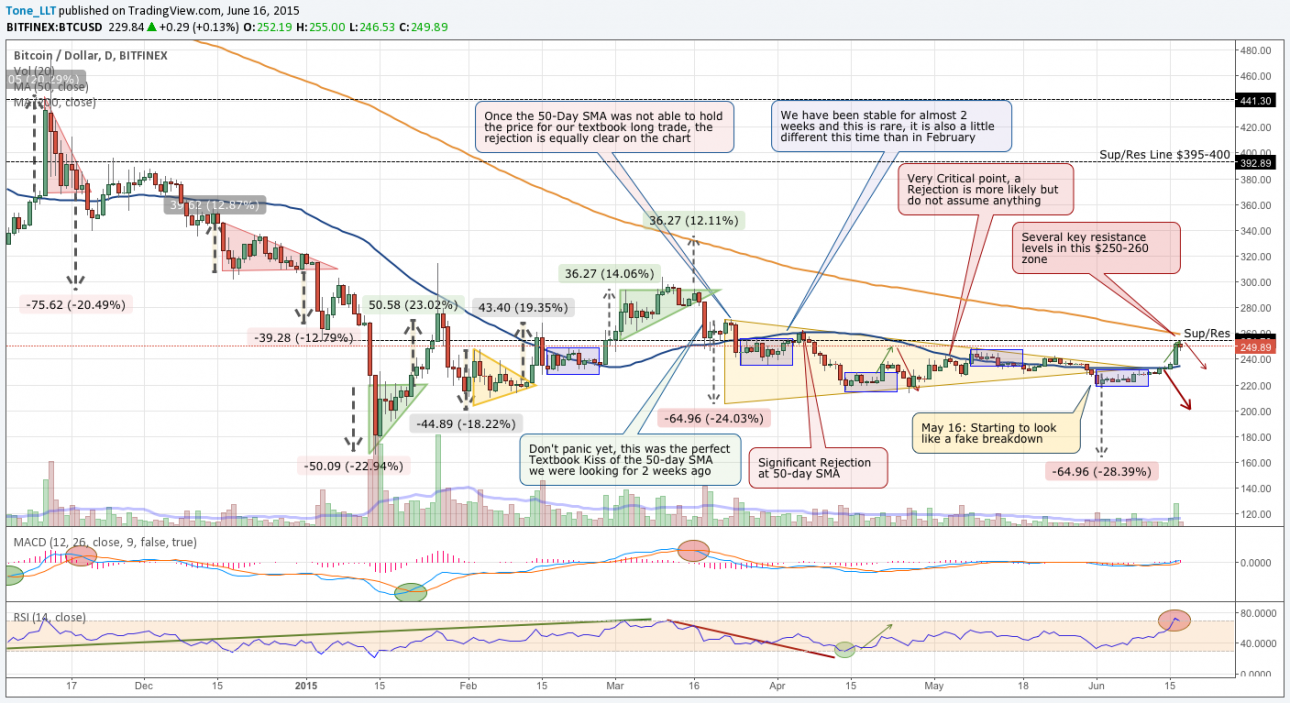

The more detailed chart shows us how the Moving Averages are in play and as mentioned last week, they are also critical:

The 200-day Simple Moving Average continues to decline and is almost on top of the $255 horizontal resistance line that has been in place since the start of the year. There are still few positives to take away from this chart. All talks of bullish momentum cannot begin until we start seeing higher highs and higher lows along with breaking through the Moving Average resistance.

So now we are sitting just a few points under this very significant moving average, which the Bitcoin price has not seen in about a year. The big question is what happens next? In the chart above there are arrows that have been there for almost a week. As you can see the expected direction was the rejection at the 50 day Moving Average, but a secondary less likely move was for a rise up to the $255 resistance zone for a rejection. Nothing is ever certain but if the price does get rejected at these levels what a trader should be looking for is what happens when it falls back down to the point of the breakout ~$235 and meets the 50-day moving average from above. Next week should be a very interesting time to observe the price movement.

Final Thoughts

As a final thought, we should always consider time in our quest for picking our critical reversal points. Almost 1 year ago I wrote a trading article titled Intro to Time. In that article I used the basic theory of Pi to calculate the cycle of when significant turning points might take place. (This idea was invented by Martin Armstrong for his Economic Confidence Model.) At the time it was too early to tell if the days determined by this analysis would represent a high or a low, but in February of this year during a presentation in Acapulco Mexico, that same analysis table was labeled as the low. Here is that slide from that presentation which was also used at events in Austin in March and Hong Kong in May.

The table is from the August 2014 article but the idea of that date being a low is from February 2015. Not fully embracing this idea, I did not do the calculation to the day but instead wrote in June 2015. However, if we do look at the days, the cycle should have turned 6.45 years after the genesis block. There is some rounding involved in keeping things to two decimal places but if we take it one additional decimal place out, the turn was expected to take place in 2015.455 which is 166.075 days into the year (multiply 365 x .455). That just happens to be 15.075 days into June. So basically for those that care to fact check, 10 months ago I wrote an article that June 15, 2015 would be a turning point.

Now to be honest, I was expecting the turning point at much lower prices and did not actually expect it to be accurate almost to the day, let alone a week or a month. Should have pointed this out to readers a week ago and trusted my own analysis from long ago even if it did look strange and random. Only time will tell if this week was really a turning point.

This article was completed on Wednesday June 17 12:30 am ET, when BraveNewCoins Index showed Bitcoin price at $252 USD.

Tone Vays will be a speaker at the upcoming Inside Bitcoins Chicago Conference July 10-11.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today