Ethereum gas fees hit new all time highs

As the Ethereum price hits a two year high, demand to transact on the network has surged leading to all-time high transaction fees, gas consumption and miner revenues.

Demand to transact on the Ethereum network has recently ballooned and for the second time in the last month both average daily and median transaction fees for the Ethereum (ETH) platform blockchain are hitting all-time highs according to an on-chain data provider Blockchair. Daily gas used by the network has surged in Q3 and is now up 112% since the start of the year.

What is Ethereum gas?

Ethereum is a platform for decentralized and truthful applications that run on a global, peer-to-peer network without any administrators or a single point of failure. Ethereum gas refers to the fee, or pricing value, required to successfully conduct a transaction or execute a contract on the Ethereum blockchain. Gas is the metering unit for use of the Ethereum World Computer.

As an analogy, electricity is metered by kilowatt-hours – turning on more lights and appliances in your house will result in a more kilowatt hours used and a higher electricity bill. Similarly,using more computation and storage in Ethereum means that more gas is used and the fees payable will be higher. While every operation in the Ethereum Virtual Machine (EVM) consumes a predefined amount of gas (for example, a MUL operation always consumes 5 gas), a user can specify a gas price in every transaction. The amount specified for the transaction on the Ethereum network must provide enough fuel, or gas, to cover its entire use of the computation and storage facilities. If the gas price the user specifies is adequate, the transaction will complete and any excess gas will be refunded to the transaction’s originator: the user who initiated the transaction. However, if not enough gas is allocated, a transaction will run ‘Out of Gas’ and be reverted, but it is still included in a block and the associated Ethereum fees are paid to the miner.

While gas prices can act as a general indicator of the average price of transactions on the Ethereum network, it does not directly reflect the cost of individual transactions on the network, as different types of transfers consume varying amounts of gas. For example, there are significant differences in the transaction fees between simple ETH transfers as opposed to interacting with a Decentralized Finance DeFi smart contract.

Driving ETH news in 2020 has been a booming decentralized finance (DeFi) sector and its impact on the demand to transact on Ethereum. The DeFi space utilizes smart contracts instead of third-party intermediaries to power financial products. They offer users KYC-less access to borrowing and lending services, protocols with transparent community-driven governance models, and lucrative reward schemes for users willing to provide services like liquidity provision. The total value locked in DeFi currently sits at US$8.99 billion and grew by close to 900 million dollars between September 1st and 2nd.

ETH price hitting two year high

This surge in transactions has seen the ETH price briefly touching ~USD480 this week, a price level it has not reached since July 2018. Data also indicates that Ethereum users have paid over $110m in transaction fees in the last month. That is more than double the fees paid on the Bitcoin (BTC) blockchain in the same period, and more than the last 18 months of Ethereum fees combined.

Miner revenues have also been a key topic of conversation amongst the Ethereum stakeholder community following a recent proposal to slash block rewards by 75% from 2ETH down to 0.5ETH. The rationale behind the proposal was to bring Ethereum’s inflation rate closer into line with Bitcoin’s and to preserve ETH’s future purchasing power. The Ethereum network’s hashrate continues to rise and today hit levels it has not reached since November 2018. According to Onchain data provider Glassnode, Miner revenue on the network reached a 2-year high of $1,034,419.68 (1-day moving average) on September 2nd.

A downside to the spike in network usage has been long wait times and expensive transactions for Ethereum users. While this may be turning away some potential new users from the network it does indicate a growing demand for block space and miner services. Data from ETH gas station indicates that the two biggest gas burners on Ethereum are Tether (USDT) stablecoin transfers and transactions from the decentralized exchange protocol Uniswap. Tethers were originally issued on the OMNI chain in 2015 but have been swapping to the ERC-20 token standard over the past year. In total, nearly 60% of all circulating USDT is now on the ETH chain. ERC-20 transfers are both cheaper and faster than OMNI transfers, and many exchanges have opted for ERC-20 USDT transfers in recent months. The Uniswap protocol is built as a decentralized marketplace of various Ethereum token trading pairs, with automatic liquidity provision.

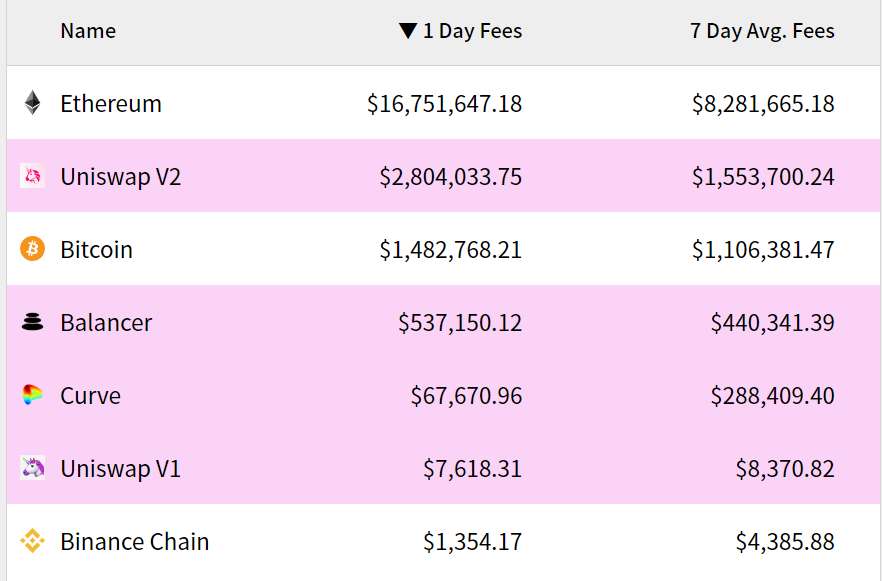

Source: cryptofees.info

How to scale Ethereum

The recent rise in transaction fees has led to concerns around the scalability of the Ethereum platform. Scaling transaction efficiency on blockchains can be difficult because transactions need to be verified by every node participating in consensus by design. More demand for transactions means more computational pressure for nodes, leading to inevitably higher fees and longer wait times.

Layer-2 scaling techniques have emerged as a viable alternative to direct base layer solutions for scaling – such as transitioning from a proof-of-work to a proof-of-stake consensus model. Layer-2 scaling techniques move transactions ‘off-chain’ but can still leverage many of the benefits of blockchains like security, immutability, and decentralization with some minor trade-offs and assumptions. Examples of emerging Layer-2 solutions being developed include ZK-rollups, Optimistic roll-ups, and various solutions built around Vitalik Buterin and Joseph Poon’s plasma whitepaper. The LEVERJ decentralized cryptocurrency derivatives exchange uses its own unique version of the Ethereum Layer-2 Plasma solution called Plasma Gluon. The framework is based around the concept of child blockchains that communicate with the parent Ethereum mainchain periodically. The Plasma Gluon whitepaper explains “one way to dramatically reduce on-chain cost and improve latencies is to use a specialized sidechain to execute trades and perform settlements." It is anticipated that as Layer-2 Ethereum scaling solutions like these become more widely adopted, the trend towards high Ethereum gas fees and long transaction times will be reversed.

Don’t miss out – Find out more today