KPMG and CB Insights are keeping their finger on the pulse of blockchain investments

A partnership was recently formed between KPMG and CB Insights. KPMG is a global network of professional firms which provide audit, tax and advisory services. CB Insights is a National Science Foundation that uses data science, machine learning and predictive analytics to help their customers invest. Together, they are working to produce a quarterly report, The Pulse of FinTech, which advises on market trends within the growing FinTech industry.

KPMG is a global network of professional firms which provide audit, tax and advisory services. CB Insights is a National Science Foundation that uses data science, machine learning and predictive analytics to help their customers invest. Together, they are working to produce a quarterly report, The Pulse of FinTech, which advises on market trends within the growing FinTech industry.

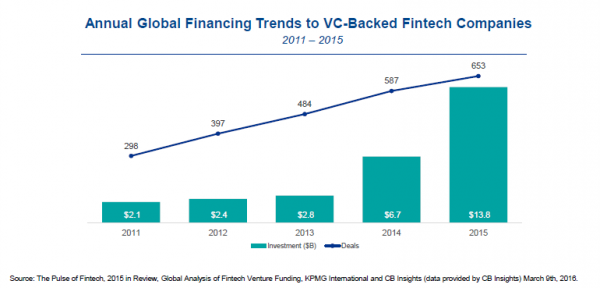

Last year, 653 deals were made by VC backed FinTech companies, which raised US $13.8b in funding.“Limiting the data to equity funding involving VC-backed fintech companies shows 2015 reached a multi-year high, topping 2014’s VC-backed total by 106%. Deal activity grew 11% compared to 2014 and a whopping 119% compared to 2011,” states the most recent report.

“The force of change is becoming impossible to ignore, with mobile-enabled consumers having more options than ever. The rising tide of millennials is demanding more personalized and convenient services.”

- The Pulse of FinTech

The report provides the top 26 deals of 2015, including Social Finance receiving US $1b, Zhong An Insurance raking in US $931m, and One97 Communications bringing in US $680m.

The representation of blockchain in the top 26 FinTech investments is thin, however, the report does carve out a section dedicated to the niche technology, described as a “deep-dive.”

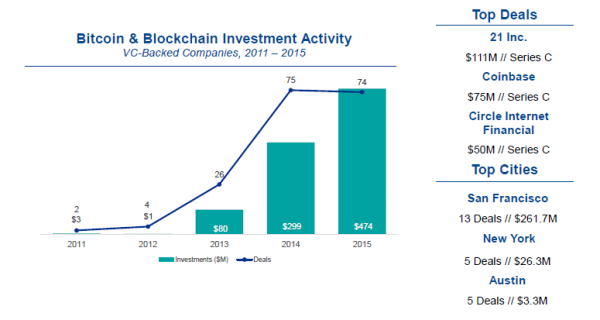

2015, saw the first Series C deals take place in the bitcoin and blockchain space. Despite witnessing large growth, with VC investment growing from $298 million in 2014 to almost $460 million this year, seed funding dropped by 53 percent.

The top three series C funding rounds for bitcoin and blockchain investment activity include; 21 Inc, which raised $111m; Coinbase, brought in $75m; and lastly, Circle Internet Financial, a bitcoin services company that secured an additional $50m in funding.

Established institutions and FinTech companies leveraging blockchain technology also formed a range of partnerships last year. Citibank, Santander, Wells Fargo, HSBC and numerous other big banks announced their involvement in the blockchain space, some with the financial innovation firm R3 CEV, that claims 42 of the world’s leading banks in it’s membership.

Earlier this month R3 CEV announced that it had successfully trialed five distinct blockchain technologies in parallel, the first test of its kind. The trial represented the trade of fixed income assets across blockchains, between 40 of the world’s largest banks, using multiple cloud technology providers within R3’s Global Collaborative Lab.

The strengths and weaknesses of technologies built by Chain, Eris Industries, Ethereum, IBM and Intel were measured by running smart contracts programmed to facilitate the issuance, secondary trading and redemption of commercial paper, a short-term fixed income security typically issued by corporations to raise funding.

“Blockchain is a notable example of an emerging technology that offers enormous potential to the financial services industry, however this needs to be balanced with the reality that substantial barriers must be overcome in order for this potential to be realized.”

— – Ian Pollari Global Co-Leader of Fintech, KPMG International, Partner, KPMG in Australia

The report indicates that careful consideration is required with the fledgling technology. Not only are there significant boundaries to the successful implementation within the banking and capital markets, changes in the market, and proposed regulation could hamper blockchain’s adoption on a global scale.

As a result, investor expectations may not be realistically fulfilled, and those that are looking for an immediate return may be sorely disappointed. KPMG and CB Insights advise that corporate investors should be wary of the blockchain hype, and need to qualify their expectations and the obstacles associated with achieving value. “The technology is not a silver bullet that can solve every problem tomorrow. To get the most value from blockchain, corporate investors need to be less hopeful and more pragmatic,” states the report.

The document also outlines that blockchain technology is not scalable, at least not to an extent that could replace high availability and large scale platforms: “Nor does it provide the speed, ubiquity, APIs, or controls environment needed by banks to conduct day-to-day activities.”

The report suggests that now is the time for experimentation, and not for wholesale implementation. “A great number of the major financial services institutions that KPMG’s network of firms work with have Proof of Concept (POC) and prototype initiatives underway related to blockchain. Larger financial institutions, such as JP Morgan Chase, are now considering how to test for scalability, validate initial hypotheses, build longer term target operating models and enhance business cases based on their POC/prototype results.”

“It seems clear that the move to test and experiment with distributed ledger technologies is well underway in financial services.”

- The Pulse of FinTech

Don’t miss out – Find out more today

“Blockchain is a notable example of an emerging technology that offers enormous potential to the financial services industry, however this needs to be balanced with the reality that substantial barriers must be overcome in order for this potential to be realized.”

“Blockchain is a notable example of an emerging technology that offers enormous potential to the financial services industry, however this needs to be balanced with the reality that substantial barriers must be overcome in order for this potential to be realized.”