Weekly Bitcoin Analysis: May 4

The news of the week came from a surprising source a few days ago. The investment bank [Goldman Sachs has made a substantial investment in the Bitcoin company Circle](http://www.cnbc.com/id/102634242), which seems to have everyone cheering that this might kick off a new trend leading to mass adoption.

The news of the week came from a surprising source a few days ago. The investment bank Goldman Sachs has made a substantial investment in the Bitcoin company Circle, which seems to have everyone cheering that this might kick off a new trend leading to mass adoption. The exact sum has not been disclosed, but the amount of approximately $40 Million is definitely not a lot for Goldman to hedge the future of the FinTech space. The question that those in the bitcoin community need to ponder is whether this is really a good thing for the industry?

There are always several points of view, and every investment will come with its own agenda. Circle is definitely one of the companies built for Wall Street. It would basically be a traditional bank, but instead of using an archaic system to transfer wealth between institutions they would speed up the process, and lower costs, by simply transferring bitcoins. This of course is not revolutionary at all, and even if it does lead to mass adoption it would not be the type of adoption needed to change the system for the better.

Everyone is saying that Bitcoin needs a killer app, but in reality bitcoins themselves are the killer app. In order to function and thrive, Bitcoin only need 3 things; a distributed mining structure, secure and honest exchanges for price discovery, and secure, private and easy to use wallets for peer-to-peer transfers. Anything outside of those 3 things is in the ‘nice to have’ category, and in many cases does more harm than good. People have still not realized how powerful Bitcoin really is, and if they accept intermediaries built around the old banking system, it’s possible they might never understand.

More people need to stand up for their freedom and demand privacy and security from the system. Any company built to keep track of users and report financial activities to the authorities is not the future, it’s the past. Socialism is starting to collapse, and as it does more wealth will be squeezed from those that have it – driving the economy even lower. Holding on to your own bitcoins will become essential for wealth preservation in the near future. In the mean time all we get is this great news, that was only able to muster a measly $25 price rally. This should fade shortly and the dominant trend will pick up once again, until more people start to realize what bitcoins really are. Here is a hint – Bitcoin is not for banks to have faster transactions.

Market Outlook

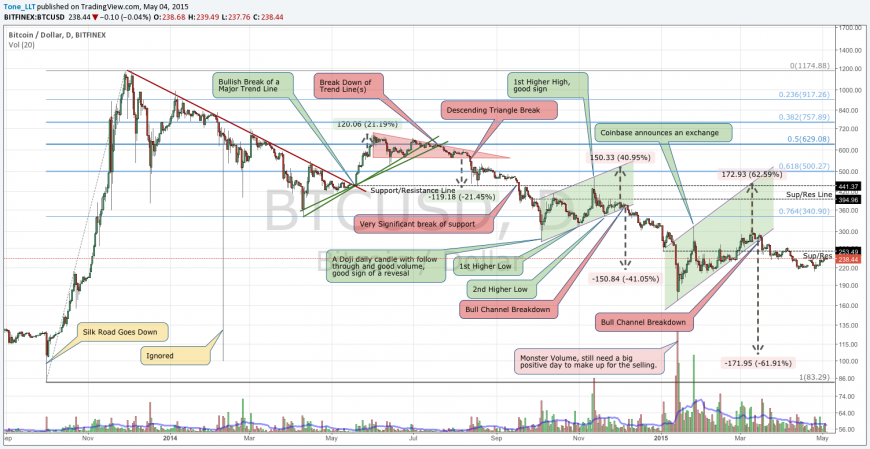

The technical picture says a lot about the health of any market, so once again we take a look at the last 16-month trend.

Not much at all has changed. We have been pretty stable over the last month with the price moving back and forth in the $220-240 range. The target from the bullish channel breakdown remains just above $100, and it will stay that way unless we see some strong demand driving the price back above $300. There is also plenty of resistance in the way, so we would need much bigger news than an investment bank investing in a company to speed up transactions.

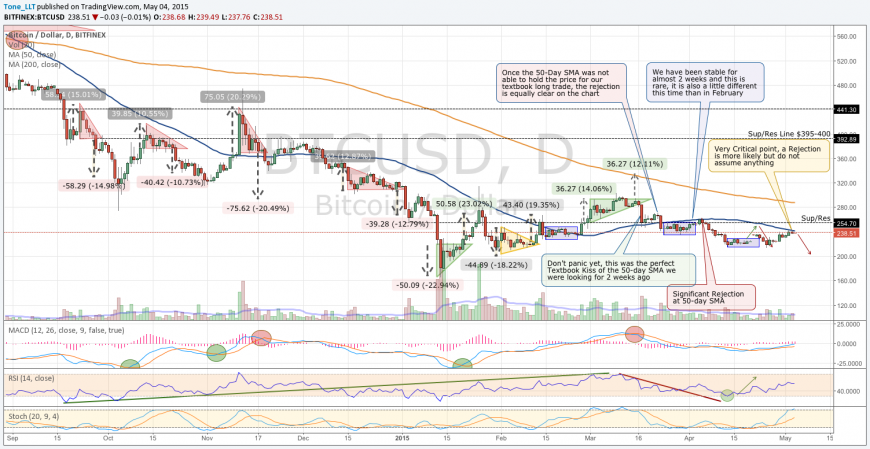

The zoomed in picture is a lot more informative. While there has not been a triangle for quite some time, the Moving averages have been pretty useful in the pattern. Bitcoin might be one of the trickiest assets to trade, but if you look at this chart and the recent arrows the expectation was for the price to bounce up. If the price were to have made it out of the consolidation zone, and make it all the way to $254, it would have meet both the 50-day SMA and the horizontal resistance line.

The rally back in April was very short lived and when the price turned to make new lows it gave the impression that sub $200 was imminent, but as is often the case many technical analysts were caught of guard in this latest up move. It’s always difficult to trade situations where the price begins to break the lows and then turns to barely make a new high. This is why we should let the technical, and not momentum, guide us in certain situations and this is one of those times. Unless over the next 2 days there is a strong violent breakout leaving the 50-day SMA in the dust, we have to look for a rejection right here at these levels and look for the next down leg. At the moment all eyes are on that round $200 support and it should arrive some time before the end of the month.

Final Thoughts

The size and energy at this year’s Inside Bitcoin NYC conference was noticeably smaller than one year ago. This is of course understandable as these events are confidence based and seeing the price move perpetually down over the last year has definitely influenced the environment. The price will find a bottom soon and when it does things will once again be well, so that next year’s event should definitely be the one to remember.

This article was completed on Monday May 4 10:00 pm ET, when BraveNewCoins Index showed Bitcoin price at $239 USD.

Tone Vays will be a speaker at the upcoming Inside Bitcoins Hong Kong Conference May 14-15.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today