Weekly Bitcoin Anlaysis: May 11

In the last few days the market has been dominated by regulatory news. In what seemed at bit surprising [FinCEN decided to fine Ripple Labs an unreasonable sum of $700,000](news/fincen-confirms-larger-interest-in-bitcoin-companies-after-fining-ripple-labs/), for not complying with the Bank Secrecy Act as far back as 2013.

Market Thoughts

In the last few days the market has been dominated by regulatory news. In what seemed at bit surprising FinCEN decided to fine Ripple Labs an unreasonable sum of $700,000, for not complying with the Bank Secrecy Act as far back as 2013. This is actually a serious problem for the crypto space because Ripple Labs is considered by many in the community as one of the most regulation friendly projects in the space.

Not to continue the usual trend in these Market Thoughts write ups of talking bad about law enforcers, but certain things really need to be said, like “this is why it will be impossible to deal with regulators in the future”. They really do not care about new technology and the more a company deals with them the higher the chances of getting into trouble. The future does not lie in compliance, it will reside with those that go around it with sufficient technology to protect the merchant and consumer.

In light of this news and the possibility of the SEC feeling left out and needing to shape up their year-end financing as well; those that have been involved in something that even smells like security sales better have some real good financial lawyers on retainer. From Ethereum to Factom to MaidSafe, no one other than Satoshi will be safe from the hammer that will be coming down, and all in the name of crime that does not even exist most of the time. This will be a combination of scarring the market and driving people from some of these side projects into the original and still most trusted crypto currency on the market.

The other piece of news worth mentioning is the additional funding received itBit. The news coincided with them filling out enough forms to be compliant across the board, with not only the upcoming BitLicense but also a general banking license. This seems to have given a bit of a confidence boost to the price of bitcoin, but the jury is still out as to the long term effects of this development.

Market Outlook

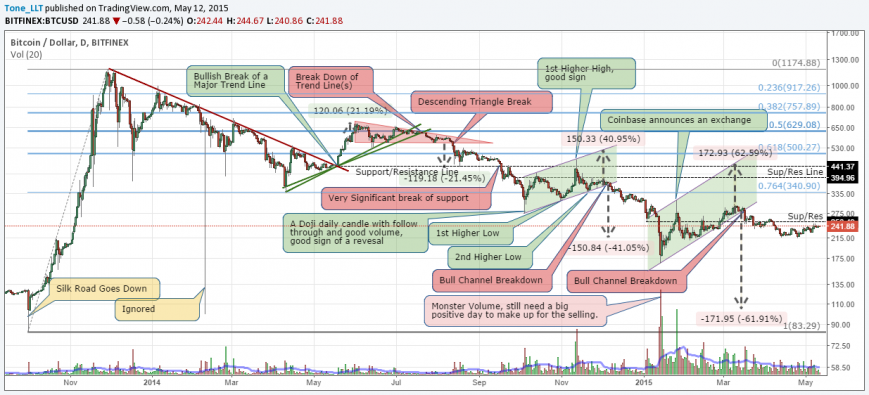

The technical picture says a lot about the health of any market, so once again we take a look at the last 16-month trend.

The news from itBit had a small effect and we are now consolidating at a slightly higher range of $238-246. Looking at this scale presents a very stable picture, but the big question is whether it will stay that way. It appears we are slowly moving up, but without a violent rise on large volume, and no immediate fall, this continues to look like another counter-trend rally. Serious resistance stands at $255 so if we get there slowly, it will be interesting.

Looking at a more detailed version of the daily chart, we can see that the rejection at the 50 day simple moving average last week was textbook perfect for about 3 days. It gave every indication that $200 was imminent. As indicated above good news gave the market a $20 jump, and now that everything is settled down we are once again stabilizing as everyone digests the information. This stabilization is taking place right on top of the moving average. All the other recent periods of stability have lasted at least 7 days before a substantial move one way or the other. At the time of writing we have had 5 days of stability, so we should see this resolve very soon. Unlike the other times, where there was some indication of which way it might jump, this time it really is almost 50/50.

On the one hand the longer term momentum is still bearish, so everything points to this latest up move as a counter-trend rally. But on the other hand this stabilization is happening above the previous stabilization, so short term bullish momentum is still positive. The best thing to do is probably nothing; until we are making a new high, and the break of $250 is imminent; or we are making new weekly lows, and price is dropping below $238 with some larger than average volume.

Final Thoughts

In two days’ time I will be speaking at the Inside Bitcoins Conference in Hong Kong which happens to be a 1yr anniversary of my very first speaking appearance in this space. While the bitcoin scene in Hong Kong is very lively among the community members, merchants have not embraced the movement as much. Even one of the main bars that has always been advertised as Bitcoin friendly is, at the moment, not taking bitcoin payments. Bitcoin still has a long way to go before it can be considered main stream, and that’s ok. It allows for more time to sort out some of the technical issues that have recently been big discussion points, like the increase in block size.

This article was completed on Tuesday May 11 at 6:00 am ET, when BraveNewCoins Index showed Bitcoin price at $243 USD. Tone Vays will be a speaker at the upcoming Inside Bitcoins Hong Kong Conference May 14-15.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today