We connect to 220+ exchanges, track 1,500+ assets and more than 6,500+ market pairs.

General Taxonomy for Cryptographic Assets

Today the cryptographic asset sector’s market capitalization is in the hundreds of billions, with a rapidly evolving user community. Since establishing Brave New Coin in 2014 it has been our goal to provide the data, tools and insights needed to support this market as it matures into a dominant asset class. Using our extensive holding of knowledge and data, we developed a general taxonomy for cryptographic assets. This has created greater sector transparency and a uniform classification system of cryptographic assets across more than 65 different data points and metrics. Its intended audience is:

- Asset Managers and Traders

- Regulators

- Researchers and Academics

- Developers and Product Owners

- Industry Executives

- Crypto Enthusiasts

Our Taxonomy underpins the establishment of cryptographic assets (coins/tokens/securities) as the 4th superclass of assets. This classification is a living program in which further fields, coins and metrics are being applied monthly.

- 65+ data points and metrics on each asset (coins, tokens, cryptocurrency)

- Comprehensive institutional grade level of information

We provide an API solution feed that enables you to:

Judge the strengths and weaknesses of different distributed protocols in an objective and consistent manner.

Assess the impact of distributed-ledger-based assets on global, regional and/or local industries.

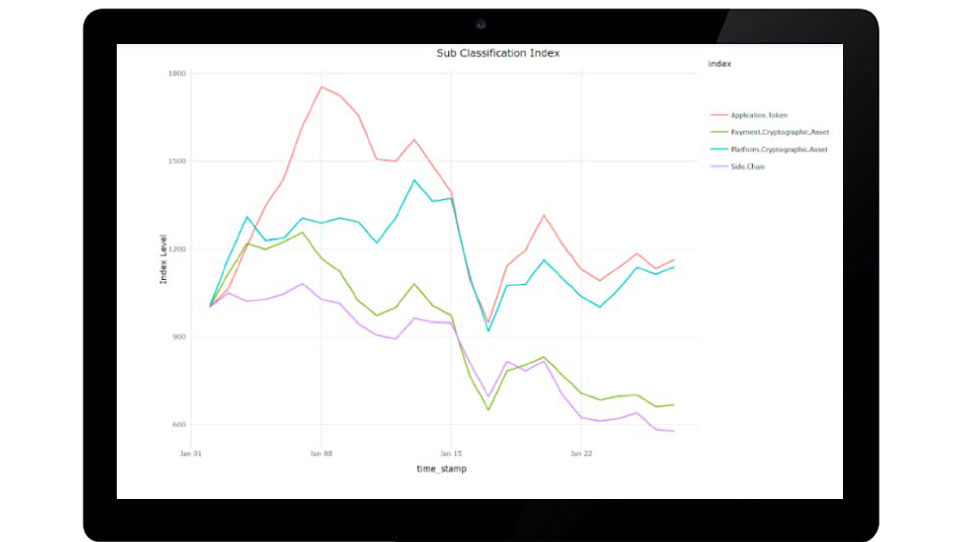

Analyze sector and industry contributions to portfolio performance and compare industry sector exposures versus pers or benchmarks.

Construct consistently defined global or industry-based and industry rotation research, development and investment strategies.

Use Cases:

Introduction to Use Cases

This is an introduction a series of use case articles that will showcase how Brave New Coin’s General Taxonomy of Cryptographic Assets can be used by industry participants to inform their investment process, research, development and/or commercial programs, as well as policy making decisions.

Investment Strategies

The first article in this use-case series, “Building Investment Strategies with the General Taxonomy for Cryptographic Assets”, will be devoted to individual and institutional investors. We will show how the GTCA can be incorporated in the decision-making process to create a wide range of investment strategies based on over 60 key qualitative and quantitative metrics for cryptographic assets.