BNC Indices for Bitcoin and Ethereum derived from the world’s 6 most trusted and liquid trading platforms; Since 2010; IOSCO compliant

Indices Program

Cryptocurrency assets are being widely recognised as the 4th class of super assets. Underpinning this is the development of complex financial products. BNC has created indices products since 2014 (with historical data to 2010).

- Minimum standards – Consistent with key IOSCO principles with clear mechanisms for market communications

- Highly accurate and available – both technical and algorithmically

- Transparent – to provide assurance regarding the underlying constituents and algorithms

- Supported – institutional grade service levels and technical support

- Independent – there should be no interests underlying the source of the data, its weightings and how it is informed

We provide API Solutions that enable you to have:

A trader’s advantage. Technical Analysis (TA) becomes much more accurate when using the BNCBLX as opposed to a typical single-exchange data feed.

An independent source of reference. Managing risk and regulatory compliance when trading becomes much easier with an independant third party.

Easily referenced information. Reporting, settlement, performance and change management is much quicker with easy to reference, quality information.

Assured mechanisms. Investment strategy development and pan business referencing is much more robust with mechanisms assured by a trusted supplier.

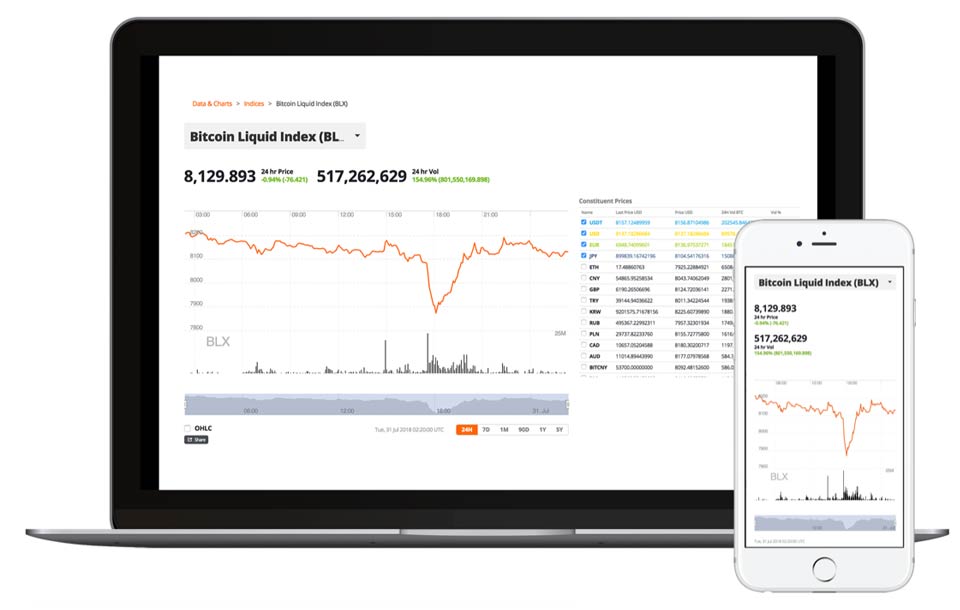

Bitcoin Liquid Index

The flagship index for the global crypto market. The BLX represents a spot rate for the most liquid end of the Bitcoin market. The BLX has been calculated since 2010 with 0 downtime. The BLX is highly referenced by a significant amount of traders and institutions. The BLX is consistent with IOSCO Principles for Financial Benchmarks, the BLX offers a robust reference rate and settlement price for any derivatives or complex products.

Ethereum Liquid Index

The ELX represents a spot rate for the most liquid end of the Ethereum market. The ELX has been calculated since Ethereum launched, in 2015, with 0 downtime. Consistent with IOSCO Principles for Financial Benchmarks, the ELX offers a robust reference rate and settlement price for any derivatives or complex products.

XRP Liquid Index

The XRPLX captures a comprehensive global sample of liquidity on the highest volume and quality exchanges and represents a spot rate for XRP (Ripple). Ideal for settlements and accurate spot pricing, the XRPLX API includes 30 second Intra-Day pricing, End-of-Day OHLCV and Time & Volume-Weighted-Averages.

BNC Custom Indices

We have developed criteria for a variety of market indices, such as a basket, or regional-based indices (e.g., BTC-USD ex USA). We build these bespoke indices for institutional organisations, leveraging our standards-based index methodology. All of our indices are consistent with IOSCO Principles for Financial Benchmarks, and the BNC LX program offers a robust reference rate and settlement price for any derivatives or complex products.

BNC Blue-Chip DeFi Index – BBDX

BNC-BTSE Composite Index Family

The BNC-BTSE Composite Index Family tracks the real-time market performance of a basket of large cap cryptocurrencies by free float market capitalization. BBCX was launched in October 2019, the institutional-grade index product is amongst the first in the world to track multiple crypto assets across multiple pricing sources at sub second frequency. BBAX was subsequently launched in February 2020.

The index family is created and administered by Brave New Coin.