Is the Binance Smart Chain the real Ethereum killer?

At its core, the Binance Smart Chain is an Ethereum copy that is much faster and cheaper than the original - and it's onboarding millions of users at an eye-watering pace. So what is the BSC all about - and what’s to stop it from taking Ethereum’s place?

The Binance Smart Chain was launched by the Binance exchange in September 2020. It was fully programmable upon launch and arrived with full support for smart contracts. It was preceded by the Binance Chain, a blockchain built using the Tendermint consensus model with instant finality but that supported just one application, the Binance DEX.

Just six months after its launch, the Binance Smart Chain (BSC) is the flavour of the month in the crypto space. The pitch of a cheap, fast and nearly identical version of the Ethereum DeFi experience has both developers and users excited.

Ethereum protocols are beginning to deploy alternative versions of their Dapps onto the BSC. Sushiswap, 1inch, Fantom, Polygon and Sakeswap have all created BSC equivalents of their protocols – generally citing the high gas fees as a motivating factor. User numbers have shot from 35 unique addresses at the end of its first day of operations to over 60 million active users by March 21st. Transactions per day on the network have grown from 122 on day one to 2.53 million on March 21st.

What is the Binance Smart Chain?

The Binance Smart Chain was built to enable smart contracts and challenge Ethereum’s dominance of the growing Decentralized Finance (DeFi) sector. The BSC is a fork of Ethereum’s Go client-Geth. This means that the BSC has been an easily accessible alternative for existing Ethereum developers and users – a fact which has been a factor in its rapid growth.

That said, the Binance Smart Chain is not an exact replica of the Ethereum blockchain. For example, the BSC uses an alternative to Ethereum’s Proof-of-Work consensus model called the Proof-of-Staked-Authority (PoSA) model. This PoSA model optimises the network for low fees and high throughput but sacrifices decentralization and censorship resistance to do so.

Gas is the fee or pricing value required to successfully conduct a transaction or execute contracts on platform blockchains like Ethereum. The gas limit refers to the maximum amount of gas that a user is willing to spend on a particular transaction. The Binance Smart Chain allows for higher gas limits which allows for more transactions to be squeezed into each BSC transaction block.

The PoSA model allows the Binance Smart Chain to arbitrarily change the block times and gas limits of the network without worrying about congestion or fee hikes. The block time of the Binance Smart Chain is three seconds compared to 13 seconds on the Ethereum blockchain. This means that the BSC has faster throughput and transaction times but has much higher data storage requirements.

The Binance Smart Chain isn’t DeFi

So can the borrowing and lending protocols or exchange platforms built on the Binance Smart Chain really be considered strictly DeFi? Binance CEO Changpeng Zhao doesn’t think so – acknowledging the BSC’s semi-centralized nature and describing it as ‘CeDeFi’ or Centralized DeFi.

CeDeFi implies a form of decentralized finance, but with training wheels. CeDeFi allows users to participate in different DeFi-esque parallel protocols like lending, liquidity aggregators, and yield farming but without the higher gas fees and long wait times of Ethereum. CeDeFi misses out on true decentralization because the nodes that manage the network are permissioned. Additionally, there is centralized authority, Binance, that manages the direction and operations of the chain.

Familiar tools and interfaces

Since the Binance Smart Chain is a fork of Ethereum it uses popular tools like MetaMask that any user who has experimented with Ethereum DeFi in the past is likely to be familiar with. In addition, the BEP20 smart contract standard for issuing new tokens on BSC is similar to the ERC20 smart contract standard that was originally developed for Ethereum. As a fork of Ethereum, the BSC can also run the same smart contracts that Ethereum can.

This has helped the network bootstrap quickly by forking popular existing Ethereum DeFi protocols. For example, Uniswap becomes PancakeSwap, Compound becomes Venus and Zapper becomes Yield Watch.

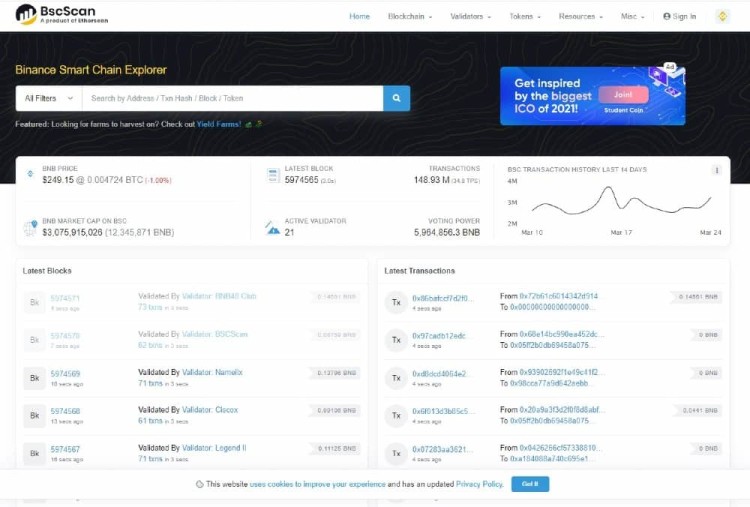

Monitoring the blockchain is also familiar as BSCscan.com, a website where users can look up their transactions, monitor wallets, and observe macro network analytics, is almost an exact replica of Etherscan.com, a website that performs the same functions for Ethereum.

Binance Smart Chain’s semi-centralized consensus

Transactions in the PoSA model are verified by a set of nodes called validators. At any given time, there are only 21 active validators on the network eligible to certify transactions. They become a part of the validator group based on the amount of Binance coins (BNB) they hold. The top 21 validators with the highest BNB holdings become activated and take turns validating transactions. This contrasts starkly with Ethereum, as there are currently 6684 active nodes on the Ethereum blockchain according to Etherscan.

This set of 21 is determined daily and recorded separately on the Binance Chain. BNB holders also have an option to delegate their BNB tokens to a validator and earn a share of the validator’s transaction fee rewards. This allows the assigned validator to have a better chance to make it into the active validator set and gives the delegator a chance to earn a passive income without much work. For many, this small number of elite validators confirms that the BSC is not a decentralized blockchain in the traditional sense, as everyday users and transactors cannot validate the state of the blockchain themselves the same way they would be able to on the Bitcoin or Ethereum blockchains.

Critiques of the Binance Smart Chain

The inherent centralization of the BSC is an issue for many. The Binance exchange is the single point of failure for the Binance Smart Chain. If Binance is targeted by regulators or runs into financial trouble, then unlike a network with a wide decentralized network of nodes such as Ethereum, the BSC is likely to go down with it. The recent locked withdrawals drama at OKEX is evidence aplenty that many one-time Chinese exchanges operate at the pleasure of the Chinese state, and registering a company in Malta or Panama won’t change that.

Another issue is censorship resistance, which is the idea that no nation-state, corporation, or third party has the power to control who can transact or store their wealth on the network. Bitcoin and Ethereum aren’t owned by a single entity and the nature of their proof-of-work consensus models means it is very difficult for any single entity to censor transactions. This is not the case with the Binance Smart Chain where Binance technically has the power to censor or modify transactions.

The censorship resistance of the Binance Smart Chain was tested recently when anonymous developers launched two controversial Dapps essentially daring Binance to censor their blockchain. One Dapp called ‘Slavery’ uses token yield farming mechanism as an analogy for slavery. Another Dapp ‘Tanks of Tiananmen’ hits home hard by referencing the controversial 1989 Tiananmen Square protests in China. The smart contract for the Dapp asks users to mint tokens called ‘TANKS’ and explains that it is a game for people who feel like “mauling pro-democracy protestors and innocent bystanders”.

Discussion of the Tiananmen Square incident is forbidden by the Communist Party of China. Binance was founded in China but moved away because of the country’s increasing regulation of digital assets and cryptocurrencies. The anonymous devs who built the Tanks of Tiananmen Dapp appear to be targeting a perceived vulnerability of a Chinese CEO like Changpeng Zhao, who despite moving his company out of China, likely has no wish to antagonize the Chinese government. So far, though, Binance has not stepped in and censored these Dapps and both are still live on the BSC blockchain.

So will Binance Smart Chain unthrone Ethereum? While the size and influence of the Binance exchange and the market cap of the BNB coin make it a strong contender, its centralized nature runs counter to the central ethos of the crypto economy, so it’s unlikely to replace Ethereum. Ultimately, though, the new crypto economy is not a zero sum game so a more likely scenario is that both will flourish, with the competition between them driving innovation on both networks.

Don’t miss out – Find out more today