Crypto market forecast: 29th July

A challenging trading week for crypto trading ended with Bitcoin prices below $10,000 and down by almost 9% in the last 7 days. Regulators clamping down on the Bitmex platform and Tron figurehead Justin Sun send negative fundamental signals, however a bullish weekly close for BTC/USD and signs that Bitcoin saving has maxed out, potentially raises near term bullish flags.

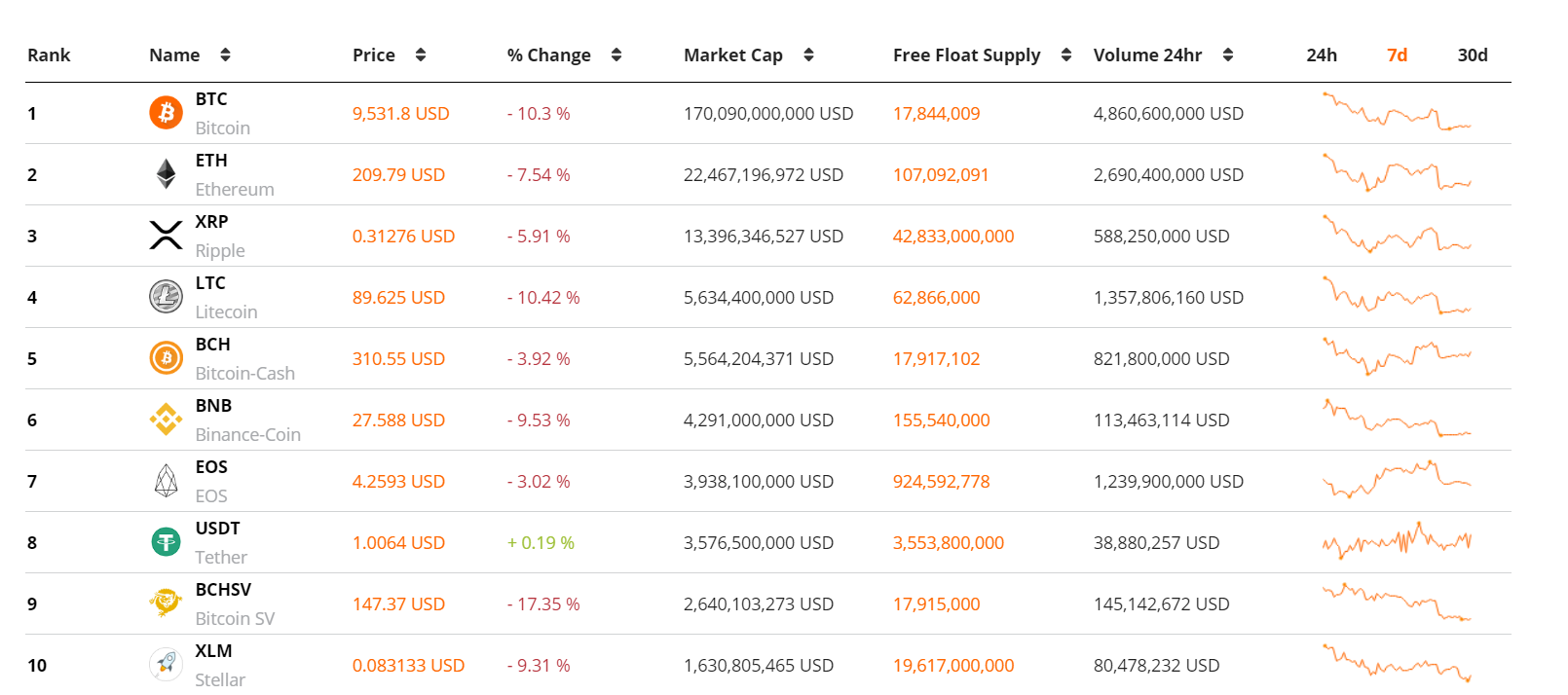

The crypto markets faced choppy waters last week. Market benchmark Bitcoin lost its 5 figure US dollar value. It fell 9% and is currently trading at ~$9500. The second and third digital assets on Brave New Coin’s market cap table, ETH and XRP, fell 7% and 6% respectively. The total crypto market fell ~8%, with BTC’s significant losses dragging the markets down, resulting in heavy double-digit losses for large-cap altcoins like TRX, ATOM, and DCR.

Bitcoin’s difficult week followed reports beginning around the 19th of July that the market’s most popular Bitcoin derivatives platform, Bitmex, was being probed by the United States Commodity and Futures Trading Commission (CFTC) for allowing citizens of the United States to access their crypto derivatives products. For US traders to legally use Bitmex, the platform would have to register with the CFTC first.

In a January interview, CEO Arthur Hayes said that Bitmex, which is registered in Seychelles but operates a main office in Hong Kong, was removing any users who were ignoring its terms & services, which ban US-based traders from using the exchange. However, Hayes also stated that it was not beyond the realms of possibility that some US-based traders were using VPNs to access the platform.

Bitmex appears to be reducing its BTC holdings as the investigation develops. Since July 11, net outflows on Bitmex have far exceeded net inflows and as of July 21st, BitMEX’s BTC supply had dropped to ~174,900k, down from a peak of ~246,000 on 3/4/19. The outflows suggest Bitmex may be stepping up its efforts to remove funds previously held by US traders. Bitmex derivatives products are Bitcoin settled, and trading profit opportunities on the platform remain one of the largest drivers of cryptocurrency trading demand. The heavy outflows on Bitmex have correlated with the falling BTC prices in the last week.

Turning to network activity, last week ‘the amount of Bitcoin not touched in 5 years’ hit an all-time high. This suggests that more Bitcoin holders now view the asset as a store of value that is designed to be ‘bought and held’ as opposed to a medium-of-exchange that is designed to be transacted frequently. The ‘untouched Bitcoin’ metric often follows or precedes price movements, with the measure tending to peak in-line with cyclical price bottoms. This implies that the current peak of ‘the amount of Bitcoin not touched in 5 years’ measure may be a bullish flag and Bitcoin whales are ready to begin accumulating new BTC at current prices.

Upcoming events in the crypto week

29th July- Cardano Byron testnet launch

This Monday, a new Cardano Byron testnet will launch with a fresh genesis block. The testnet will run alongside the current Cardano ecosystem Shelley testnets and the mainnet clusters. A fresh chain was launched to help keep the blockchain size manageable and keep track of the large group of users interested in the new testnet. The price of native token ADA fell ~2% in the last 7 days.

August 2nd to 4th- ETHIndia hackathon

Over 500 top Asian Ethereum developers will converge in Bangalore this weekend to collaborate on, and exhibit, Ethereum based Dapp solutions. Speakers for the event include Ethereum creator Vitalik Buterin, and Sowmay Jain, founder of leading De-Fi UX solution InstantDapp. The price of ETH has fallen ~7% in the last 7 days.

It was another bearish week for the large-cap altcoin markets with the weekend price drop pushing many assets to double-digit weekly losses. TRX was one of the week’s big losers. TRX fell by ~24% in price and down to 13th position on Brave New Coin’s market cap table, on damaging news that maverick founder Justin Sun is being investigated by Chinese authorities creating further negative sentiment that was compounded by the short term bear market.

The price of Bitcoin fell by nearly a thousand dollars in the last week with sharp sell-offs on the 24th and 27th of July. Bulls may have some fuel left given that BTC markets closed the week above the key USD 9,500 support level. For some analysts, this was enough of a signal to flip neutral-to-bullish.

Don’t miss out – Find out more today