Best Crypto Trading Bots in 2024

Automated trading platforms powered by configurable crypto trading bots are on the rise. What are the pros and cons of these platforms, who are the market leaders - and should you use one?

In global financial markets, approximately 75% of trading is algorithmic, and the crypto markets are no different. Crypto algorithm trading is widespread and recent years have seen a rise in the number of automated crypto trading bot platforms.

What is a crypto trading bot?

Crypto bots are software applications that use an API to interact with a user’s exchange account and automatically execute trades when market conditions meet a set of predefined criteria. The best crypto trading bots can interpret and combine traditional market signals such as volume, orders, price, and time, with technical analysis signals such as moving averages, Bollinger Bands, the Ichimoku Cloud and increasingly, with other factors such as social media sentiment.

There are a variety of crypto trading bot platforms catering to the different needs of the trading community. Some are designed for experienced traders and enable them to create complex automated strategies that can be backtested against historical crypto market data.

Others are targeted at less experienced crypto investors who want to improve the return from their crypto assets without the stress of making trading decisions themselves. These robot traders offer copy trading, social trading, and automated bot trading based on cryptocurrency algorithmic trading principles.

While Bitcoin is the most popular cryptocurrency, these apps are much more than mere Bitcoin bots – with the growing interest in DeFi and the crypto interest rates earned from the yield farming phenomenon, crypto holders can put a wide range of assets to work to generate a return. Whether you’re a passive investor or an active trader, there are many choices available, all with their own risk profile. This article will look at some of the best crypto trading bot apps and algo trading platforms available today.

2024’s BEST CRYPTO TRADING BOTS

Gainium

Despite its relatively recent arrival on the scene, Gainium has rapidly gained traction thanks to its innovative approach and commitment to empowering traders of all levels. This platform isn’t just about offering trading bots; it’s about building a comprehensive ecosystem where users can access advanced tools, gain insights, and engage with a supportive community.

Gainium bots integrate with Trading View

Key FeaturesGainium offers a diverse array of trading bots and trading tools. Whether you’re drawn to the efficiency of grid bots, the precision of DCA (Dollar Cost Averaging) bots, or the innovative synergy of combo grid+DCA bots, Gainium has you covered. But it doesn’t stop there. The platform boasts an impressive suite of advanced features that can help take your trading to the next level:

- Advanced Technical Indicators: With support for indicators like Bollinger Bands, RSI, MFI, MACD, support and resistance, and moving averages, traders can set up conditions that align perfectly with their market outlook.

- Webhook Support: For the tech-savvy, this feature allows integration with external services and custom triggers, opening up endless possibilities for automated strategies.

- Backtesting and Analysis: Gainium’s powerful backtesting tools let traders simulate strategies with historical data, providing invaluable insights without risking a dime.

- Paper Trading: A step beyond backtesting, paper trading offers a real-time, risk-free environment to hone your skills.

- Smart Trading Terminal: This feature combines the flexibility of manual trading with the convenience of automated tools, offering a seamless trading experience.

- Integrated Crypto Screener: Stay ahead of the market with real-time screening tools that help pinpoint trading opportunities.

Watch: Video Tutorial

PricingGainium understands that one size doesn’t fit all. Its pricing model is designed to accommodate traders at different stages of their journey:

- Free Tier: Get started with one live bot and explore the platform’s capabilities without opening your wallet.

- Basic ($14/month): Scale up with three grid or combo bots and 10 DCA bots.

- Advanced ($28/month): For the more ambitious, this plan offers 15 grid/combo and 50 DCA bots.

- Pro Plan ($56/month): The ultimate package for unlimited access to all types of bots.

All plans come with the added benefit of unlimited backtesting, paper trading, market screening, and portfolio tracking, ensuring traders have all the resources they need to succeed.Exchange SupportCompatibility is critical, and Gainium delivers by supporting the most popular exchanges, including Binance (Spot and Futures), Kucoin Spot, Bybit (Spot and Futures), and OKX (Spot and Futures). This ensures traders can execute their strategies on their preferred platforms without hassle.

HaasOnline

HaasOnline is an all in one crypto trading bot platform that lets traders develop, backtest, paper trade, and deploy cryptobots on over two dozen exchanges like Bybit, BitMEX, and Binance. Their flagship product, HaasOnline TradeServer, lets traders use pre-existing strategies, replicate historically proven trading strategies, or develop their own proprietary strategy. Unlike other providers, traders are able to craft durable trade bots line-by-line or use a visual drag-and-drop designer without having to write a single line of code.

HaasOnline’s TradeServer Cloud comes with user configurable trading bots that use historical strategies based on signals for scalping, grid trading, dollar cost averaging, and arbitrage. Users can replicate almost any trading strategy and adapt it for crypto markets. You can even design and develop your own proprietary strategies to sell.

Web and Visual Trade Bot Designer

As a pioneer in cryptocurrency trade automation, HaasOnline developed one of the most robust drag-and-drop algo designers available. It leverages their own scripting language, HaasScript, to generate stable and performant trade bots without coding.

Traders comfortable with development can utilize their in-app IDE with IntelliSense capabilities (similar to Visual Studio). Develop trade bot logic line-by-line and know exactly how a strategy works. HaasOnline’s HaasScript is unlike black-box provided bots that have mysterious inner workings. Users can backtest, debug, paper trade, and deploy directly through the interface.

Watch: Video Tutorial

Price

HaasOnline offers several subscriptions with varying restrictions on trade bots, backtesting, dashboards, and exchanges. No hidden fees or trade volume restrictions. HaasOnline TradeServer Cloud has a free 7-day trial as well as a free subscription. TradeServer Enterprise is a locally hosted version and is intended for advanced traders.

- Lite ($0)

- Standard ($49/mo)

- Pro (Free 7-day trial, then $99/mo)

- Enterprise ($149/mo)

Subscriptions can be paid monthly or yearly with credit card or Bitcoin. All yearly subscriptions get 2 free months. For a 5% discount, use the promo code ‘BNC5’ when signing up.

Supported exchanges

HaasOnline is integrated with most major exchanges. Their list of supported exchanges include: Phemex, Binance, OKX, Bybit, Kucoin, Bitget, Deribit, BitMEX, WOO X and more.

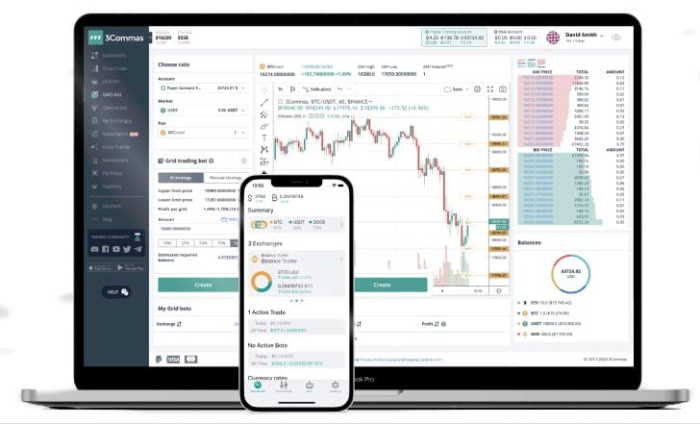

3Commas

The 3Commas trading terminal and crypto trading bot platform offer a wide range of automated trading bots with the ability to configure them for round-the-clock execution of a preferred strategy. Using the trading platform simplifies the process of trading and expands the opportunities available to traders.

Features and benefits of the platform

3Commas provides professional tools to deliver optimized and automated trading, available both on the web and through the mobile crypto trading app. With its accessible and intuitive functionality, the platform is friendly towards users with no technical or financial background.

A Smart Trading Terminal presents the trading platform with trading indicators, adjustable trading bots with additional functions allowing users to develop their own strategies suitable both for experienced traders and beginners.

The terminal also offers TradingView indicators that can be used in conjunction with market analysis tools and a range of functions for opening/closing trades and Stop Loss and Take Profit settings.

In addition to the manual settings, the platform also offers ready-made trading strategies and an option to reproduce experienced traders’ strategies, which can also be adjusted and executed without any programming skills. Options bots are also available for experienced traders, while beginners can trade using signals from professional traders available in the Signal Marketplace.

Apart from trading bots and instruments, 3Commas offers an educational blog and a responsive support team.

Features of 3Commas crypto trading bots

3Commas Trading bots give users the opportunity to make profits with minimal effort – choosing the desired functionality based on their skills, goals, and abilities.

For example, one of the bots available on the platform is the algorithmic DCA bot, which allows you to automatically enter trades over a certain period of time, thereby averaging the entry price. All you need to do is choose an asset and set a time range for the bot to function.

The 3Commas trading bots have a wide range of different settings, adding flexibility to fit any trader’s needs. There is a choice of ready-to-trade bots for beginners, while experienced traders can benefit from creating customized strategies.

The trading platform connects to the user’s exchange account using API keys, which permit the bot to trade on behalf of the user. 3Commas provides users with detailed statistics for each of the bots and allows them to track the effectiveness of other people’s portfolios.

Functionality available to users is constantly expanding and the number of exchanges compatible with the platform is growing. The user-friendly interface, the ability to reproduce other people’s trades and a broad functionality to create your own strategies make 3Commas an excellent cryptocurrency trading platform solution both for experienced traders and beginners alike.

Price

Choose a service plan to access the platform. There is a limited functionality Free plan. Depending on the tools provided and the list of features, the tariffs are divided into “Starter”, “Advanced” and “Pro,” costing $29, $49 and $99 per month, respectively. There are discounts available for annual buys.

The “Pro” subscription provides an unlimited number of exchange accounts, access to the SmartTrade trading terminal and its features, as well as the ability to connect to Binance Futures, Bitmex, Bybit trading bots and access their setup.

Supported Exchanges

The trading tools provided by the 3Commas platform are supported by 23 major cryptocurrency exchanges, including Binance, Bitmex, Okex, Kraken, Coinbase Pro and many more.

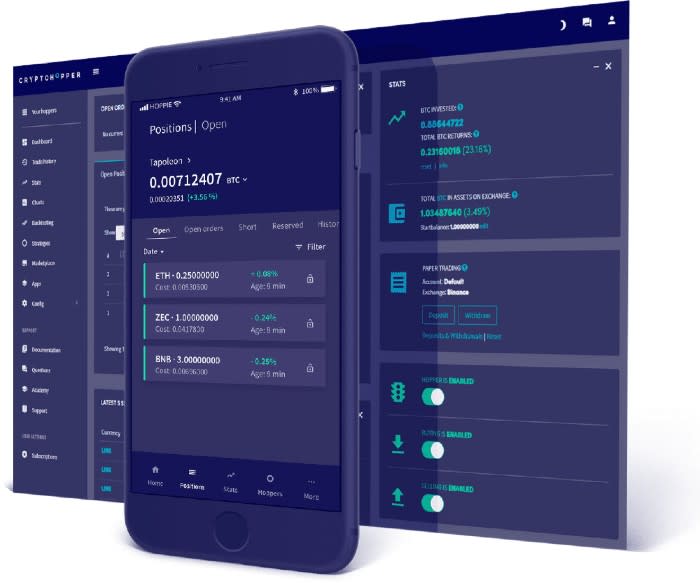

Cryptohopper

Cryptohopper is a cloud-based crypto trading bot and algo trading platform. Users can use the platform’s Strategy Designer to create strategies, follow ‘experts’ or purchase a strategy template from the marketplace. Using the Strategy Designer, users can select up to 30 technical indicators and 90 candlestick patterns to create a strategy. Cryptohopper comes with an automatic backtester that tests, rates, and deploys trading strategies.

Price

Cryptohopper’s pricing is a monthly membership fee model. Four packages are available. Pioneer is free, the Explorer package costs $19 per month, the Adventurer is $49, and the Hero package is $99 a month. The difference between the packages is the number of coins, positions and triggers that can be set up with each. For example, the Explorer package (which has a free 3-day trial) will allow 80 positions across a max of 15 coins and 2 triggers, while the Hero package allows 500 positions across 75 coins and 10 triggers.

Supported Exchanges

Binance, BinanceUS, Bitfinex,Bitrex, Bitvavo, Coinbase Pro, HitBTC, Huobi, Kraken, KuCoin, OKEx, Poloniex, and BitPanda Pro.

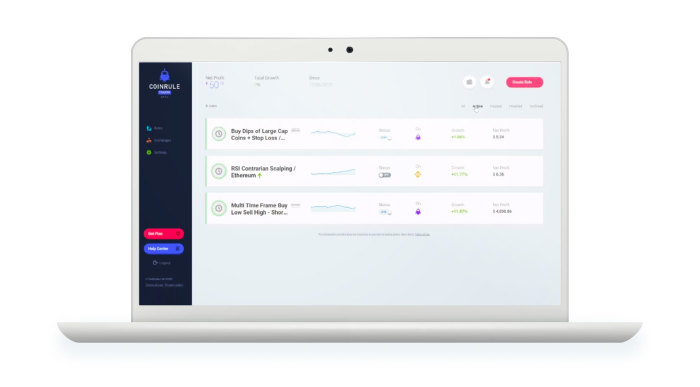

Coinrule

Coinrule is a cloud-based crypto trading bot platform empowering traders to compete with professional algorithmic traders and hedge funds. It was founded in London by Gabriele Musella and Oleg Giberstein who discovered that trading cryptocurrencies was unnecessarily complicated. Coinrule is backed by the Y Combinator accelerator.

Thanks to its ease of use and If-This-Then-That logic, Coinrule users can create fully customized automated trading strategies so that they never miss a rally or get caught in a dip. Thanks to Coinrule’s user-friendly interface, no coding is required to set up strategies. Users can choose to set up basic strategies or take advantage of the breadth of technical indicators that Coinrule offers to users. These include:

- Moving Averages

- Exponential Moving Averages

- The MACD

- Bollinger Bands

- RSI

- MFI

- And more…

Watch: Coinrule Intro

Coinrule has over 250 pre-designed template strategies available. If none of these work for you, you’ve got nearly unlimited options when creating new ones. You can test them on Coinrule’s demo exchange (a paper trading mode), and once you’re ready to connect your real exchange, no withdrawal rights are required. That means that your funds are safe and cannot be accessed maliciously through Coinrule. Regardless, Coinrule uses military-grade encryption for all API keys and has two-factor authentication is available for increased peace of mind.

Thanks to these powerful capabilities, features, and security, alongside regular traders, professional traders and investment groups have taken to using Coinrule as their go-to algorithmic trading platform. These more demanding traders will find features tailored to their needs such as dedicated ultra-low latency servers and leverage trading. Additionally, Coinrule offers TradingView integration meaning that users can send signals from TradingView to execute trades on Coinrule.

Watch: Coinrule Walkthrough

Finally, Coinrule has a friendly and active trading community on Discord as well as an extensive tutorial section with educational videos. Also, one-on-one trading sessions are available to help users make the most of the trading platform.

Price

Coinrule offers a free account and three tiers of paid plan. The free account includes up to $3K/month trading volume and contains 2 Live and Demo rules and 7 template strategies – perfect for beginners and those who want to test the platform.

The Hobbyist ($29.99/mo) plan pushes the monthly trading volume limits to up to $300k and allows users to trade on leveraged exchanges. This plan also includes increased live and demo rules as well as a myriad of template strategies and features like advanced indicators and operators.

The Trader ($59.99/mo) plan will push the monthly trading volume limits to $3M, and allow users to run a greater number of live and demo rules simultaneously. This tier also allows users to take advantage of Coinrule’s TradingView integration feature.

The Pro ($449.99/mo) tier will remove the monthly trading volume limits and offer features for professional traders and investment groups like dedicated servers with ultra-fast execution.

Supported exchanges

Binance, BinanceUS, Binance Futures, Kucoin, Kucoin Futures, Coinbase Pro, OKEX, Bitstamp. Poloniex, Kraken, BitPanda Pro, HitBTC, Liquid and Bitmex. Trading on DeFi exchanges such as Uniswap is coming soon.

Bitsgap

Bitsgap is a cloud-based all-in-one crypto trading platform that allows users to manage multiple trading accounts via one unified interface. Launched in February 2018, the platform integrates with 15 crypto exchanges via API. This means users can monitor their complete holdings across all connected exchanges – and trade more than 10,000 cryptocurrency pairs from a single dashboard – instead of having to log in to each exchange individually.

Bitsgap features many easy-to-understand trading tools including automated bots to set up buying and selling strategies to generate profit from any price movement, an arbitrage service, and total portfolio management – monitoring holdings and order statuses; tracking open positions on connected exchanges; smart trades to place take profit and stop-loss trades simultaneously; on-chart order management to make quick changes to orders, and alerts to track market anomalies.

The number of connected exchanges is a key advantage of the Bitsgap platform because it enables account holders to easily find arbitrage opportunities. For example, the arbitrage page provides a list of potential arbitrage possibilities in one easy-to-view format where you can see the purchase price, selling price, and the net profit you could generate after filling a transaction. Bitsgap says users can exploit these price differences as long as they have accounts connected via API to those exchanges and have trading balances available.

Most Bitsgap tools can be automated and the platform is accessible on both desktop and mobile devices. Bitsgap features a demo mode so beginners can learn how trading works without risking their funds – and more experienced users can test advanced trading strategies. From a security perspective, users can opt for 2FA and email confirmation of unknown device logins. Users define API key permissions and Bitsgap only requires access to trading history, balance view, and trading permission so user funds always stay on their exchange account.

Price

Bitsgap offers three pricing tiers differentiated by the number of tools, trading bots and volume of trades. The Basic package, for example, comes with 12 bots and unlimited smart orders for $23 a month on a 12 month plan. The Advanced plan includes 55 bots and other tools for $55 a month, and the Pro pack has 275 bots and every feature for $119 a month. New accounts come with a 7 day free trial (no credit card required) during which several features can be used free of charge.

Supported Exchanges

Binance, Kraken, Livecoin, Poloniex, Exmo, Yobit, The rocktrading, Wex, Bitfinex, Bitstamp.com, Bittrex.com, OKEX, Huobi, HitBTC, Kucoin, CEX.10, Poloniex, Coinbene, ZB.com, CoinEx, Gemini, Gate.10, Liquid, LBANK, Bibox, Bit-Z, DDEX BIGone, Bithumb.

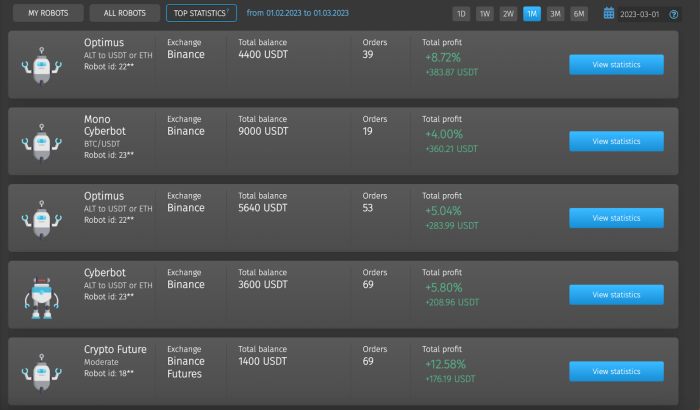

Cryptorobotics

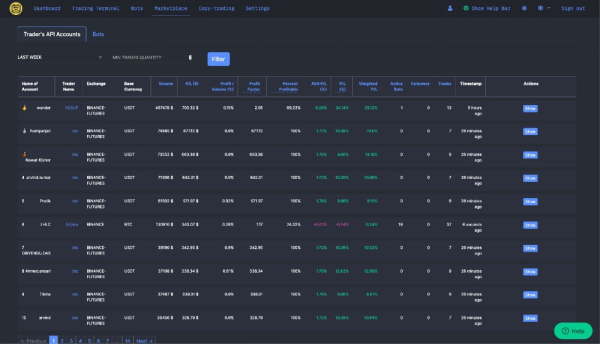

Cryptorobotics trading bots

Cryptorobotics is a cutting-edge algo trading platform that offers a wide range of crypto trading bots to cater to traders’ diverse trading needs. With 8 different bots – Optimus, CyberBot, Crypto Future, Trade Holder, Noah, AI Alpha, and AI Alpha Futures – the platform allows traders to trade across various market trends.

All the bots offered by Cryptorobotics operate independently and are fully automated. They can be used to trade any cryptocurrency, and users have the flexibility to set their own trading parameters, such as stop-loss and take-profit levels.

Cryptorobotics’ trading bots allow traders to enter trades around the clock without the need to constantly monitor the trading process. This means that traders can earn passive income without having to dedicate all their time and attention to trading. Furthermore, the bots’ advanced algorithms are capable of analyzing market trends and making informed trading decisions, thus reducing the risk of losses.

Key Features

Cryptorobotics offers traders automated trading bots that analyze market trends and make informed trading decisions without the need for human intervention.

Traders can choose from five different bots, each designed to trade using various crypto-trading strategies. For instance, Optimus and Cyberbot use the mid-term trading strategy and are designed for traders who prefer to hold positions for a few days to several weeks. The Trade Holder uses a buy and hold strategy intended for long-term investors who want to accumulate and hold cryptocurrencies. AI Alpha opens long-term positions – useful for traders looking for long-term capital appreciation.

Watch: Video Tutorial

Customization is a key feature of Cryptorobotics’ bots. Traders can set their own trading parameters, including stop-loss, take-profit, and trailing stop levels, to match their individual needs and preferences. The bots are also capable of trading 24/7 in flat, growing, and falling markets.

Security is also a top priority. The bots use advanced encryption methods to secure personal and trading data.

Traders can earn passive income with 24/7 bots, which operate around the clock. These bots use advanced algorithms that are updated regularly to ensure their effectiveness in any market condition.

Price

To use the Cryptorobotics trading bots such as Optimus, Cyberbot, and Crypto Future, you will need to purchase a subscription to one of the PRO packages.

- Basic PRO — $19 per month

- Profit PRO — $49 per month

- Expert PRO — $79 per month

On the other hand, bots like AI Alpha, AI Alpha Futures, Noah, and Trade Holder can be used with the Profit Sharing system, which allows you to pay a percentage only of profitable trades.

- AI Alpha – 30% of profit

- AI Alpha Futures – 30% of profit

- Noah – 35% of profit

- Trade Holder -15% of profit

Supported Exchanges

| Crypto Trading Bots | Exchanges |

|---|---|

| Optimus and CyberBot | Binance, Binance.US, Bittrex, Bitfinex, EXMO, Huobi, Kraken, OKX, Gate.io |

| Crypto Future | Binance Futures |

| AI Alpha | Binance, Binance.US, Bybit, Gate.io, Huobi |

| AI Alpha Futures | Binance Futures |

| Noah | Binance Futures |

| Trade Holder | Binance, Bittrex, Bitfinex, Huobi, Kraken, KuCoin, OKX, Gate.io |

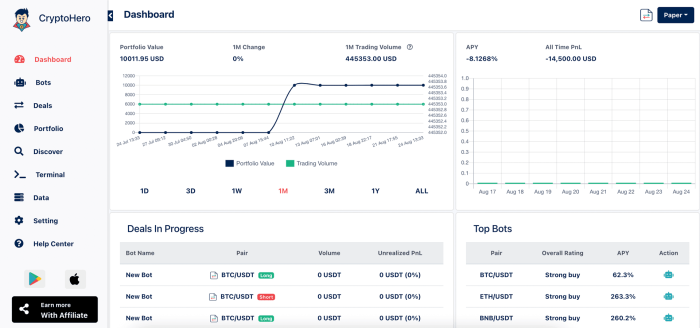

CryptoHero

CryptoHero is a multi-platform crypto trading bot. Powered by AI technology and proprietary algorithms, this service allows you to connect to a wide range of crypto trading exchanges, automating your investments and increasing profits.

CryptoHero is founded by a team of experienced fund managers who have been trading crypto and the securities market for more than 20 years.

CryptoHero bots can be configured with technical indicators. Enter a trade with one, exit with another, all without writing a line of code. CryptoHero offers presets for popular technical indicators, and allows multiple rules and triggers to work together.

Backtest bots with historical data before deploying. Get an indicative performance of your bot based on actual data with different trading frequency, against different time periods of up to a year.

Video tutorial: How to create your first crypto trading bot on CryptoHero

Price

Basic plan: Free.

- 1 Active Bot

- AI Optimized Bot

- Long & Short Strategies

- All Technical Indicators

Premium plan: $13.99 a month

- 15 Active Bots

- AI Optimized Bots

- Long & Short Strategies

- All Technical Indicators

Professional plan: $29.99 a month

- 30 Active Bots

- AI Optimized Bots

- Long & Short Strategies

- All Technical Indicators

Supported exchanges

Binance, Huobi, OKEx, Bittrex, Kraken, Bitfinex, Coinbase Pro, Bitget, Gate IO, Kucoin, IndoDax and many more.

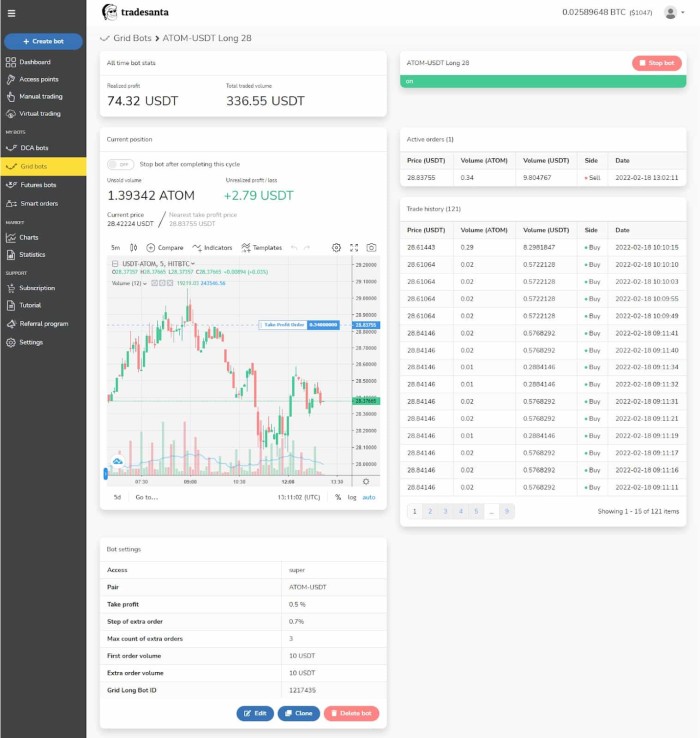

TradeSanta

TradeSanta is a crypto trading bot platform that intends to make cryptocurrency algorithmic trading more accessible to all traders. TradeSanta has been in business since 2018 and it has already helped thousands of investors to improve their day-to-day trading: there are now over 127,000 registered users and over 4 million transactions completed. The trading software is designed to provide automated algorithmic trading strategies, allowing users to execute deals at the ideal time and without the need for ongoing supervision.

Key Features

Risk management tools, grid and DCA bots, demo trading for testing strategies, real time tracking and Telegram notifications to know what your bots are doing and more are currently available on TradeSanta to help both novice and skilled traders with their trading routines.

TradeSanta is also a good product for experienced traders, thanks to a variety of features that can be used for setting a trading bot: flexibility to set the bot as you want, trade spot and futures market, connect any TradingView signal that you set yourself or get from the TradingView user base, and more.

You can also manage your robot traders on the go with the TradeSanta crypto trading app for iOS and Android. The app has all of the same features as the desktop version, such as profit tracking and analytics, managing and developing new bots with advanced features, and more.

TradeSanta’s customer service is also extremely supportive, and there are many self-help tutorials and videos available for you to get onboard with TradeSanta.

Watch: DCA vs Grid Strategy Explained On TradeSanta

Price

Tradesanta doesn’t charge any trading fee: all you have to do is to purchase a subscription plan and that’s it, you can trade as much as you want. And in case you are not sure whether you should buy yourself a plan, you have an option to use a free 3-day trial of a Basic Package to see the benefits of the automated trading for yourself.

The plans can be purchased either with cryptocurrency or with card payments. Card payments are executed via TradeSanta’s payment provider, Paddle.

TradeSanta offers 3 plans differing in the number of bots and some functionality:

- Basic Plan: 49 bots, Unlimited Number of pairs, technical indicators. Starts at $25/month

- Advanced Plan: 99 bots, benefits of Basic plan, Trailing Take Profit, TradingView signals. Starts at $45/month

- Maximum Plan: Unlimited number of bots, benefits of Advanced Plan, Futures Trading, TradingView signals and Custom TradingView signals. Starts at $90/month

There are discounts available for annual buys, and TradeSanta also offers a 7-day free trial.

Supported Exchanges

TradeSanta operates on major platforms and supports the most popular exchanges. Its list of supported exchanges includes Binance, Binance US, Huobi, Okex, Bybit, Upbit, HitBTC,Coinbase Pro and Kraken.

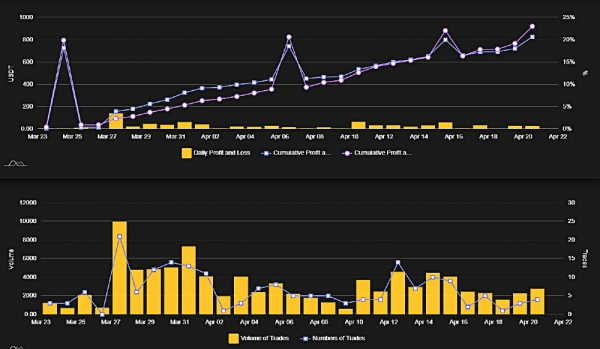

WunderTrading

WunderTrading is a cloud-based platform that allows you to start trading and investing in cryptocurrency seamlessly. Users can copy trade the best crypto traders with transparent track records, trade themselves using WunderTrading’s advanced trading terminal – or create fully automated bots using TradingView.

Visit WunderTrading’s Marketplace and copy trade crypto’s most successful traders.

It is possible to manage portfolios of multiple crypto exchange accounts at the same time using WunderTrading – without needing to execute separate trades on each account – and use the full spectrum of trading features like simultaneous take-profit and stop-loss targets, swing trade, trailing stop, multiple entries for bots and many more.

Two unique features that distinguish WunderTrading from similar services are an easy integration with TradingView and its Spread-trading terminal. WunderTrading helps users to automate any TradingView scripts into a fully functioning crypto trading bot. With easy to use automated trading software you can construct and adjust any crypto bot in a matter of seconds.

The Spread-trading terminal allows users to select which assets they would like to use for creating a spread and will execute the buy and sell orders for the chosen pairs simultaneously. Applying spread trading to crypto futures will automatically reduce the overall volatility and at the same time limits a trader’s risk in the event of an unexpected market crash.

Price

WunderTrading’s free account allows you to start with manual trading, trading bots and copy-trading. Its paid plans are competitively priced and allow users to have more open positions, active bots and a range of more advanced features. The Basic plan is $19.95 a month, Pro is $39.95 and Premium retails for $89.95. A 30% discount is available for annual purchases.

Supported Exchanges

Binance, Binance Futures, Bitfinex, Bybit, Bitget, HitBTC, Kraken, OKX, Kucoin, Woox, MEXCGlobal and Gate.io.

Gunbot

Launched in December 2016, Gunbot is one of the oldest and most popular crypto trading bots. Gunbot’s active trading community has over 7000 members and continues to see exponential growth. The bot is suitable for both novice traders and more experienced ones. For those who are new to trading, Gunbot comes with up to 14 powerful precoded trading strategies – allowing beginners to easily pick the pairs they want to trade with and then simply let the bot do the hard work.

For more experienced traders, Gunbot offers impressive customization – with users easily able to modify its precoded strategies to suit their trading preferences – or even create their own fully customized and personalized strategies from scratch. From an ease-of-use perspective, Gunbot has an upgraded interface that allows traders to easily check their portfolio values, charting of all pairs, trading indicators, recent trades and more.

Gunbot’s user friendly interface makes trading decisions easier

Also included with Gunbot are several powerful add ons including BitRage, which is an arbitrage bot that in addition to direct arbitrage is able to execute triangular arbitrage on one exchange. Other add ons include TradingView and Backtesting.

Choose between hundreds of professional trade strategies with Gunbot’s TradingView add on.

Price

Gunbot offers lifetime licenses with three pricing packages – Standard, Pro and Ultimate – for 0.014 BTC, 0.025 BTC and 0.04 BTC respectively. The packages are differentiated by the number of exchanges they can trade on simultaneously (one exchange with Standard, three with Pro and Unlimited with Ultimate, for example), and the number of built-in add-ons. Additional add-on packages can also be purchased separately. Lifetime updates are free with all packages. Gunbot offers support via Telegram, email, Whatsapp and Skype.

Supported Exchanges

Gunbot is supported on over 100 exchanges, including Binance, Binance US, Bitmex, Bittrex, Bitfinex, Coinbase Pro, Kukoin, HitBTC, Cex.io, Poloniex, Kraken and Huobi.

Trality

Trality, the European FinTech experts in automation, provides investors with access to high-quality crypto trading bots in just a few clicks. Founded in 2019 by Dr. Moritz Putzhammer and Christopher Helf in response to the volatile and mostly unpredictable crypto market, Trality exists to bring fully automated investment portfolios to all who need them.

Whether you’re an advanced investor or beginner, now everyone can automate their own investment strategies or rent strategies created by experienced quantitative analysts with Trality’s flagship features—Python Code Editor and the Bot Marketplace.

Additional innovative offerings include Trality’s proprietary Bot Optimizer; margin trading functionality; Trality Wallet; Trality Rule Builder; and Trality Masterclass. Now the best crypto trading bots are at your fingertips with Trality’s mobile app (iOS & Android)

By combining the expertise of world class Python programmers with the latest developments in Artificial Intelligence (AI), Trality offers a full range of market-beating bots for all conditions, enabling each and every investor to maximize profits while minimizing risk.

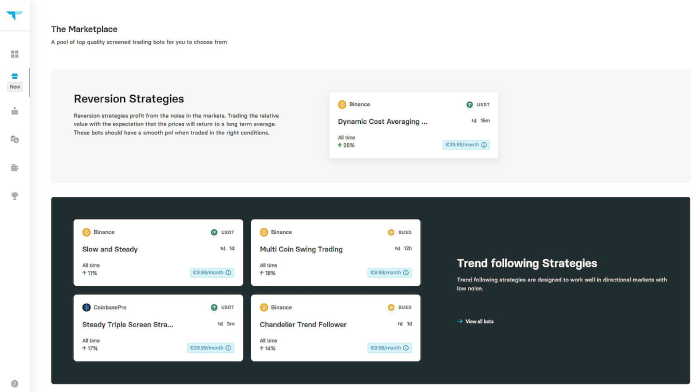

Trality’s Bot Marketplace

Trality’s Marketplace is a one-of-a-kind space that brings together crypto trading bot creators and investors for mutually beneficial purposes.

Investors can rent profitable bots tailored to specific risk tolerances (low, medium, and high) and individual investment goals. A full suite of metrics is available, allowing investors to decide on a bot based on clear, quantifiable data.

Bot Creators can now monetize their bots and earn passive income from investors around the world by having their bots listed on Trality’s Marketplace. Most importantly, bot algorithms remain completely private, meaning that each creator retains full IP rights.

Video Guide » Get to Know Trality: Bot Marketplace

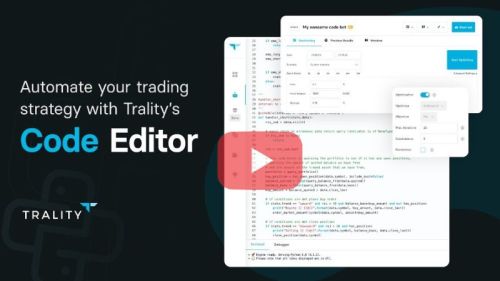

Trality Code Editor

Python programmers will feel at home using the Code Editor’s full range of powerful tools and innovative features to create and backtest their algorithms. In-browser editing with intelligent auto-complete as well as in-browser debugging provide a seamless process for the development of trading ideas and their eventual realization as profitable trading bots.

Video Guide » Get to Know Trality: Python Code Editor

Price

Trality’s plans are named after chess pieces. Pawn is a free lifetime plan, which is ideal for newer investors interested in exploring the platform and its many features.

Intermediate and advanced investors can enjoy greater flexibility, increased trading volume, and lower tick intervals by upgrading to a paid monthly or annual subscription (save approximately 20% with an annual plan). Prices start as low as 9.99€/month for the Knight plan, 39.99€/month for Rook and 59.99€/month for Queen. A 20% discount is available for annual plans. Trality also offers a number of bonus programs, including its Friend Referral Program and Trality Wallet Bonus Program, for additional savings and exclusive benefits.

Supported Exchanges

Binance, Binance.US, Kraken, Bitpanda, Coinbase Pro.

What’s the difference between a crypto trading bot and a crypto trading platform?

There are many simple, off-the-shelf automated crypto trading bots available for purchase, subscription or free download. Their value proposition is simple – offering traders the ability to automate their trades, and wait for the robot traders to make profits. This is not always the case, however. While basic bots can be connected to a user’s exchange account and can execute buy/sell orders automatically, users have limited control over the bot’s strategy making them less useful for advanced traders.

These bots are ready-to-go ‘blackbox’ solutions with few options for customization. Users have to rely on the programming skills and strategy of the original creator. The quality of these trading bots varies from good, to fair, to poor, to outright scams.

Identifying which crypto trading bots can turn a profit, and which are failed experiments, or worse, are designed to steal the user’s money is a daunting task. While a free crypto trading bot sounds like a good deal, free doesn’t mean quality, and the ‘best bot ‘ really depends on a user’s needs and experience.

Another issue is that off-the-shelf bots are limited and don’t consider all the factors that make markets move. They can be caught out by unexpected factors such as a flash crash, exchange hack, or major news event. Events of this kind make the crypto markets very volatile and without human supervision, these bots can make unprofitable trades that result in user losses.

As a result, in 2024, the trend will continue to be towards customizable trading platforms that give traders granular control of their trading strategy with automated rebalancing strategies to protect profits. These platforms offer a range of other features including social integrations, back-testing, paper trading, a community, support, copy trading, portfolio tracking, auto-portfolio rebalancing, and more.

Reasons to consider using a trading bot platform

Some of the advantages of using a crypto trading bot platform include:

Trade 24/7

Unlike traditional markets, crypto markets never sleep and it is possible to transact in today’s global crypto economy 24/7. For traders this presents a dilemma — nobody can watch the market all the time. Crypto market participants will be familiar with the thrill of waking up to a portfolio gain, and the reverse is equally true — traders with open positions risk waking up to a negative news event that has adversely affected a position leading to a loss.

Save time

This is the number one advantage that automated trading and crypto bots provide: efficient, rules-driven trading without having to watch the markets. Even active crypto traders are sometimes unable to dedicate time to the markets. Automated trading strategies provide the means to generate trading profits without being tied to a screen.

Find new opportunities

A bot is always online and can relentlessly hunt the markets for an opportunity to make a profit 24/7. The volatile crypto markets can change very quickly, and bots are always ready to exploit a change in market conditions. Depending on what parameters have been set, once the bot sees the opportunity, it will execute.

Take the emotion out of trading

Traditional day trading is one of the most stressful occupations on the planet. The volatility in the crypto markets amplifies this stress even more. Crypto trading can be a rollercoaster of emotions, characterized by extreme highs and lows. Humans are emotional creatures and prone to many biases that affect decision-making. This can lead to costly miscalculations in the high-stakes world of crypto trading. A rules-based, crypto bot trading strategy can help protect a trader from their own worst enemy – themself.

Generate income

Unlike stocks, crypto assets don’t pay dividends. From an investment perspective, crypto assets can be viewed more like a commodity. However, in a bear market there is no reason to hold on to a commodity as it doesn’t deliver a return aside from price appreciation, which is unlikely in bearish conditions.

Trading bots can provide crypto holders with a passive income, by leveraging their crypto assets via trades. This income stream is not as safe or reliable as crypto compounding interest, but it is one of the few options available to crypto investors who intend to hold their assets for the long term.

If a trader can create an automated trading strategy that performs well over a consistent period, it may generate a long-term passive income. Copy trading platforms allow investors with no trading experience to ‘copy’ the trades of professional traders, or to copy pre-set algorithmic trading strategies run by the platforms.

Advantages to trading the crypto markets vs stocks

- Crypto markets are open 24/7

- Low barrier to entry

- Anyone can join an exchange and start trading

- Volatility means you can make quick profits (or losses)

Trading is often compared to poker, and in poker, there’s a concept called ‘Table Selection’. This simply means a player can choose whom they play against. If the goal is to make a profit, given the choice, a rational poker player will choose to play at a table of weaker, less experienced players. Trading in the traditional financial markets is like sitting down at a table of professionals. It’s possible to win but you’ve got to be one of the best in the world. Cryptocurrency traders, however, are generally less experienced. There are some professionals, but the majority are retail investors.

This is another way of saying that crypto traders are less sophisticated than forex traders. This uncomfortable truth, combined with several factors unique to the crypto markets, has the potential to give savvy crypto traders an edge. Combine that edge with a backtested, algorithmic trading strategy (a crypto trading bot) and traders will give themselves the best chance to succeed.

The crypto market is often described as the ‘wild west’ because the market is largely unregulated. Every country and exchange has different requirements, and there are no global, standardized regulations. There is not yet an agreed-upon model for the reliable valuation of crypto assets. This regulatory uncertainty, the possibility of market manipulation, and ongoing price discovery create the trader’s best friend – volatility.

Crypto trading bot strategies

Automated trading bots are designed to be configurable to allow for a wide variety of trading strategies. From a simple trend-following strategy to more complex strategies that evaluate a wide range of data points, today’s bots are highly customizable. Common strategies include:

Trend following

A trend following strategy aims to identify the directional movement of an asset and gain from the momentum of this movement. The strategy will go long when the asset is trending upwards or go short when the asset is trending downwards.

Arbitrage

Arbitrage trading looks to exploit the difference in the price of an asset between different markets or exchanges. As a new and emerging market, the spread between different crypto exchanges can vary, though this has tightened as the market grows.

Market making

A market-making strategy is based on continuously buying and selling crypto assets (on both sides of the order book) to capture the spread between the buy and sell price as the price fluctuates.

Copy trading

Copy trading is a growing trend that allows users to automatically copy another trader’s trade. Copy trading often involves a social community and gamification elements such as a leaderboard. The rise of DeFi and the emergence of non-custodial platforms such as TokenSets means it is now possible to copy other traders, or take advantage of algorithmic trading strategies without giving up control of your private keys.

What are the risks of Crypto Trading Bot Platforms?

Trading bots and algorithmic trading strategies are simply a tool and there is no guarantee of profitability. There are also some risks associated with trading bots and automated platforms. It’s important to understand that trading bots are generally designed for traders, not investors, and some are not appropriate for people new to crypto or new to trading.

Are you an investor or a trader?

If you’re a casual investor intending to buy and hold crypto assets, a complex black box trading bot strategy may not be appropriate. Investors with no trading experience can opt to ‘copy’ other traders or use existing algorithmic strategies on a trading platform. While platforms vary in their complexity, users with some financial literacy, analytical skills, and trading knowledge will have an advantage over those who don’t.

Beware of scams and hidden fees

Unregulated, emerging boom markets and new technology tend to attract bad actors. Some crypto trading bots are designed to exploit unsophisticated traders by stealing personal data and funds. Do your due diligence. How? Ask yourself how credible is the team that created the bot or platform? Do they have a public profile? A support team? Can they be contacted? Do they have a community of satisfied customers? Are the fees clearly explained and easy to understand? Are there any hidden costs?

A bot is just another tool in the trading tool kit

While you can set and forget most cryptocurrency trading bots, the best solution is a combination of automated trading with ongoing human supervision. Crypto market conditions can change extremely fast so traders need to ensure they are constantly adjusting the parameters of their strategy to reflect this.

There are unknown unknowns

The volatility in the crypto markets makes crypto trading the riskiest of all. Bots can be buggy, can suffer from poor programming, and can be caught out by unusual market conditions like flash crashes or major news events. Expect the unexpected.

Don’t miss out – Find out more today