Deal Flow – July 2020

Welcome to Deal Flow, a monthly report on investment in the blockchain space. Deal Flow provides a comprehensive listing of new capital raises, mergers and acquisitions, ICOs, IEOs, and STOs. The report identifies industry trends and follows the money with expert analysis and commentary - providing essential market intelligence for professional crypto investors.

According to Brave New Coin research, we have identified 28 companies that raised traditional equity investment in July 2020, of which 20 have disclosed financial details. These 20 companies raised over US$159M, with the largest raise of US$30M being completed by B2C2.

In June 2020 the total equity capital raised was just over US$92M, split between 19 companies that disclosed financial details. In July there was only one more company than June, but collectively the companies in July raised just over US$67M more than companies in June.

**Fig 1: Investors in July 2020 **

July was a busy month for investors. Digital Currency Group and Coinbase Ventures made four investments. Both made three equity investments and one token investment. Coinshares, Three Arrows Capital, Framework and Parafi Capital made three investments. All of the Coinshares investments were in equity deals, while Three Arrows Capital made two equity investments and one token investment. While Framework and ParaFi invested in two token deals and one equity deals, most of which they were co-investors in.

Polychain, Dragonfly Capital, Pantera, and Multicoin Capital made two investments. Multicoin was the only firm that made one token investment. Other crypto specific investors that made one investment include Electric Capital, FuturePerfect Ventures, Binance, Morgan Creek Digital, BitMEX, NEM Ventures, Fenbushi Capital, Hashkey and Lemniscap

Well known general funds that also made an investment in July include Neotribe Ventures, Floodgate, Ribbit Capital, Sound Ventures and Lightspeed Ventures. As seen in the past few months institutional investors are still holding off from making investments, with Standard Chartered, Hanwha Group and SBI being the only that made investments in July.

Of the 20 companies that disclosed financial details, five raised over US$10M, raising US$108M between them. Three raised US$5M and above, with US$18.1M raised between them. The remaining 12 companies raised US$33.2M between them and had an average raise amount of US$2.8M.

Half of the 20 companies are based in the US. Six are based in Europe, and more specifically the UK, Switzerland and France. There were two companies based in South Africa and one each in China and Israel.

We have tracked four token sales in July, one more than June. All three token sales in June were private sales, while in July three of the four token sales were private sales. The largest token sale was conducted by blockchain interoperability protocol Polkadot, which received around US$43.7M in funding through their private token sale. Investors that took part in the sale received Polkadot’s native DOT tokens, which were sold at US$125 per token.

AVA Labs was the only project that conducted the public sale and managed to raise US$42M. AVA Labs had announced a private sale in June, where the project raised US$12M from VCs.

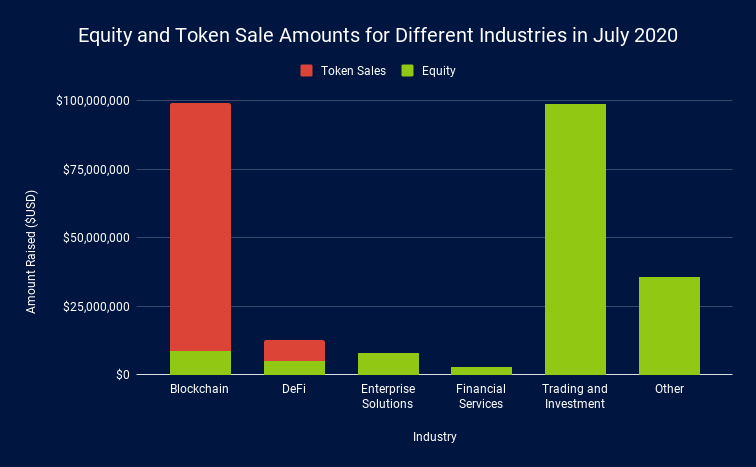

Fig 2: Equity and Token Sale Amounts for Different Industries in July 2020

Fig 2 displays the distribution of the disclosed capital raised in equity and token sales over various industries. Companies in the Blockchain sector raised US$99.4M with three token sales contributing US$90.7M, the remaining US$8.7M was raised by three companies in equity rounds.

The Trading & Investment sector was trailing close behind with just US$500K less at US$98.9M, which was raised by eight companies. The “Other” category raised just under US$36M and consisted of companies in five different sectors Compliance, Custody, Data, Gaming and Music.

July is the first month of 2020 where we recorded security token sales. There were two conducted in July. The first was by Republic, the equity crowdfunding platform, selling the NOTE security token, which offers investors profit sharing. Republic received subscriptions of over US$8M from accredited investors.

Also, NBA player Spencer Dinwiddie’s token sale, where he tokenized his contract, reached 10% of the funding goal selling US$1.35M worth of tokens.

Unlike June, where we did not record any merger and acquisition transactions, we recorded two acquisitions in July. Binance acquired Swipe, a multi-asset digital wallet and Visa debit card platform, and Mainframe, a blockchain communication platform, acquired Sablier, a protocol for real-time finance on the Ethereum blockchain.

Thanks for reading, we hope that you’ll find Deal Flow valuable. If we have missed a deal that you know of, let us know. You can access more data and insights from Brave New Coin. Remember to check back next month for the latest edition of Deal Flow.

Equity Capital Raising

US$129.3M was raised in traditional equity offerings in July 2020

30/06/2020 | B2C2 | US$30,000,000 | Trading & Investment | UK

SBI Financial Services, a subsidiary of Japanese financial giant SBI Holdings, has bought a US$30M stake B2C2, a crypto exchange.

01/07/2020 | Curv | US$23,000,000 | Custody | USA

Curv, a startup that provides crypto custody services to institutions, recently closed a US$23M Series A funding round. Investors include Digital Currency Group, Coinbase Ventures and CommerzVentures.

01/07/2020 | Paradigm | Undisclosed | OTC | USA

Paradigm has raised strategic financing round led by Dragonfly Capital with participation from Digital Currency Group, OKCoin Ventures, Bybit Fintech, Alameda Research, New York Digital Investment Group (NYDIG), CoinShares, and Yleana Venture Partners.

01/07/2020 | Vendia | US$5,100,000 | Blockchain | USA

Vendia has raised a US$5.1M funding round led by Neotribe Ventures with support from Correlation Ventures, WestWave Capital, Hummer Winblad Venture Partners, Firebolt Ventures, Floodgate and FuturePerfect Ventures.

03/07/2020 | DerivaDEX | US$2,700,000 | Trading & Investment | USA

DerivaDEX, a decentralised exchange for derivative contracts built on top of Ethereum, has raised US$2.7M through two rounds of financing. Investors include Polychain Capital, Dragonfly Capital Partners, Electric Capital, Coinbase Ventures, CMS Holdings, Three Arrows Capital, Calvin Liu (strategy lead at Compound), and Phil Daian (cryptocurrency researcher).

07/07/2020|Chainalysis|US$13,000,000|Trading & Investment|USA

Chainalysis recently raised an additional US$13M to expand its Series B round to US$49M, with an investment from Ribbit Capital and Sound Ventures.

07/07/2020 | Wintermute Trading | US$2,800,000 | Trading & Investment | USA

Wintermute Trading, and algorithmic liquidity provider for digital assets, have closed a US$2.8M Series A round led by Lightspeed Venture Partners.

09/07/2020 | Radix DLT | US$4,100,000 | DeFi | UK

Radix DLT, a decentralised finance protocol company, raised US$4.1m in funding. Investors include LocalGlobe, TransferWise’s Taavet Hinrikus and others.

10/07/2020 | HOPR | US$1,000,000 | Blockchain | Switzerland

HOPR, a company building a data privacy-protecting protocol, has raised US$1M in a strategic investment round. The round was led by Binance Labs with participation from Focus Labs, Spark Digital Capital, Caballeros Capital, AU21 Capital, and Synaitken.

14/07/2020 | Valid Network | US$8,000,000 | Enterprise Solutions | Israel

Valid Network, an enterprise security solution, has raised US$8M seed round. The round was led by Ten Eleven Ventures, and Jerusalem Venture Partners also participated.

14/07/2020 | Digital Asset | Undisclosed | Enterprise Solutions | USA

Digital Asset, Creators of DAML, add VMware as an investor in Series C Round.

14/07/2020 | METACO | US$17,000,000 | Trading & Investment | Switzerland

METACO, a provider of security-critical digital asset infrastructure for financial institutions, has raised US$17M in a Series A round, led by Giesecke+Devrient, the German-based security technology company and one of the main central bank infrastructure partners globally. Other investors include Standard Chartered Bank, Swisscom, SICPA, Avaloq, and Swiss Post.

15/07/2020 | Evertas | US$2,800,000 | Financial Services | USA

Evertas, an insurance provider focused on the cryptocurrency space, has raised US$2.8M in a seed round led by Morgan Creek. Other participants include Plug and Play, Kailash Ventures, RenGen, Vy Capital and Wavemaker Genesis.

16/07/2020 | Sorare | US$4,000,000 | Gaming | France

Sorare, and Ethereum-based fantasy football gaming startup, has raised US$4M in a seed funding round. The round was led by E.ventures, with participation from German professional footballer Andre Schurrle, Ledger co-founder Thomas France, and venture firms Partech, Fabric Venture, and Semantic Ventures.

16/07/2020 | Teller | US$1,000,000 | DeFi | USA

Teller, a blockchain project for decentralized lending has announced a US$1M seed round led by Framework Ventures, with participation from Parafi Capital and Maven11 Capital.

16/07/2020 | Xangle | US$3,300,000 | Data | South Korea

Xangle, a crypto asset disclosure platform, has completed a Series A2 investment round of US$3.3M (4 billion won) by Hanwha Investment & Securities, a licensed securities brokerage subsidiary of South Korea’s Hanwha Group.

16/07/2020 | XMEX | US$5,000,000 | Trading & Investment | China

XMEX, a crypto derivatives platform, has raised $US5M from the Canada Nuchain Foundation.

21/07/2020 | Coinfirm | US$2,380,000 | Compliance | UK

Coinfirm, a blockchain regtech platform, has received US$2.38M (EUR 2M) in investment from Middlegame Ventures.

21/07/2020 | Quant Network | Undisclosed | Blockchain

Quant Network, a company focussed on interoperability of private DLTs and public blockchains, has received investment from Alpha Sigma Capital.

21/07/2020 | VALR | US$3,400,000 | Trading & Investment | South Africa

VALR, a crypto exchange, has raised US$3.4M in a Series A funding round, led by BitMEX holding company, 100x. Bittrex also participated in the round among other investors.

22/07/2020 | SharpShark | Undisclosed | IP | Chile

NEM Ventures has invested in SharpShark, a Symbol-powered timestamping solution that protects creators’ copyrights.

28/07/2020 | Avantgarde Finance | Undisclosed | DeFi | Switzerland

Coinshares Ventures has invested in Avantgarde Finance, a company that aims to democratize and disintermediate investment fund administration.

29/07/2020 | HashQuark | Undisclosed | Blockchain | Hong Kong

HashQuark, a staking and blockchain infrastructure provider, has raised a Series A round led by Qiming Venture Partners. Other investors in the round include Fenbushi Capital, HashKey Capital, Hash Global, imToken Ventures, and SNZ.

29/07/2020 | Injective Protocol | US$2,600,000 | Blockchain | USA

Injective Protocol, a decentralized derivatives exchange protocol incubated by Binance Labs, has raised US$2.6M in a seed funding round. The round was led by Pantera Capital, with participation from Asia-based QCP Soteria, Axia8 Ventures and Boxone Ventures, Bitlink Capital and others.

29/07/2020 | MenaPay | Undisclosed | Financial Services | Turkey

Menapay, a blockchain-based, fully backed cryptocurrency and platform, has received investment from Coinshares Ventures.

31/07/2020 | Audius | US$3,100,000 | Music | USA

Audius, a streaming service that connects music fans directly with artists, has raised US$3.1M in a strategic round co-led by Multicoin Capital and Blockchange Ventures, with participation from Pantera Capital and Coinbase Ventures.

31/07/2020 | Circle | US$25,000,000 | Trading & Investment | USA

Circle has partnered with Digital Currency Group (DCG) subsidiary Genesis Global Trading to develop yield and lending products for USDC. The partnership also includes a US$25M strategic investment from DCG in Circle.

31/07/2020 | KeeperDAO | Undisclosed | DeFi

DeFi project KeeperDAO has raised over US$1M in seed funding from Polychain Capital and Three Arrows Capital.

Token Sales

US$93.2M was raised in token sales in July 2020

01/07/2020 | The Graph | US$5,000,000 | Blockchain | USA

The Graph, a company building an indexing protocol, has closed US$5M in a SAFT from strategic crypto funds including Framework, ParaFi Capital, Coinbase Ventures, Digital Currency Group, Tally Capital, CoinIX, Collider Ventures, Lemniscap, and Sustany, with continued participation from Multicoin Capital and DTC Capital.

08/07/2020 | Aave | US$7,500,000 | DeFi | USA

Aave, a DeFi lending protocol received US$4.5M in investment from ParaFi Capital. Framework Ventures and Three Arrows Capital also make US$3M investment in Aave.

23/07/2020 | AVA Labs | US$42,000,000 | Blockchain | USA

Avalanche raises US$42M in 4.5 Hours for the public sale of its token AVAX.

29/07/2020 | Polkadot | US$43,700,000 | Blockchain | USA

Blockchain interoperability protocol Polkadot has acquired around US$43.7M in funding through a private token sale. Investors that took part in the sale received Polkadot’s native DOT tokens, which were sold at US$125 per token.

Security Token Sales

Over US$9.4M was raised in security token sales in July 2020

16/07/2020 | Republic | US$8,000,000 | Trading & Investment | USA

Republic, the equity crowdfunding platform, raised over US$8M by selling the NOTE security token, which offers investors profit sharing.

22/07/2020 | Spencer Dinwiddie | US$1,350,000 | Gaming | USA

NBA Player Spencer Dinwiddie’s Token Sale Hits 10% of US$13.5M, selling US$1.35M worth.

Mergers and Acquisitions

06/07/2020 | Swipe | Undisclosed | Financial Services | USA

Binance has completed the acquisition of Swipe, a multi-asset digital wallet and Visa debit card platform that allows users to buy, sell, convert and spend cryptocurrencies, for an undisclosed amount.

28/07/2020 | Sablier | Undisclosed | DeFi | USA

Mainframe, a blockchain company that launched in 2018 as a decentralized communication platform, today announced its relaunch as Mainframe Lending Protocol, following its acquisition of Sablier, a protocol for real-time finance on the Ethereum blockchain.

Don’t miss out – Find out more today