FunFair Price Analysis: Adoption remains a challenge

The Funfair project has built an exciting product targeted at blockchain casino operators which utilizes the unique Ethereum state channel. However, external market conditions and internal challenges, such as difficulty attracting 3rd party operators to adopt their solutions, have combined to push token value down ~98% in just over a year. While short term technicals suggest a temporary reprieve for FUN holders, long term concerns remain.

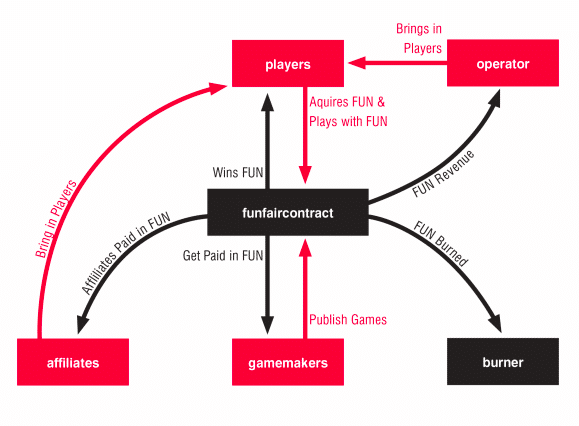

FunFair (FUN) is an Ethereum based online casino protocol. In a model that is comparable to the 0X Decentralized exchange architecture solution, FunFair isn’t actually the casino but instead has a proprietary-license style business where a technology solution is sold to casino operators and gambling platforms.

The FUN token ecosystem has a number of players and token utilities. The two core stakeholders are casino operators and players, players use FUN tokens for their play/gambles and earn back winnings in FUN, while operators earn revenue back from players and all transaction fees in FUN. Operators also pay licensing fees in FUN. Affiliates and gamemakers support this core transaction loop by bringing new players into casinos and creating games for casino partners to host.

The token has a fixed supply of 11 billion that were created when the token was launched. This creates appeal for casino operators to join the FunFair ecosystem while there is large proportion of tokens circulating but also may limit its usefulness as a payment if scarcity creates price fluctuations. A large chunk of tokens are held in reserve as a rainy day fund.

FunFair is also seeking commercial licenses in numerous jurisdictions for its own casino project, CasinoFair which will use the FunFair blockchain solution. CasinoFair currently has licenses in 14 countries; Canada, Finland, Norway, Switzerland, Russia, Ukraine, Japan, China, Brazil, South Korea, Thailand, Vietnam, Indonesia, & New Zealand.

An update released in late 2018 detailed some of the challenges the project has had over the last year, supporting these funnels into the ecosystem. It also outlines a goal to shift from a tech project, to a commercial enterprise.

The early user onboarding process (sign up, KYC, UI/UX and wallet) was described as ‘sub-optimal’ and is still being upgraded. Issues converting observers clicking on banner ads to actual players willing to stake the obscure crypto asset in online betting markets were also described.

FunFair currently only has one announced third party partner building on its platform, Spike Games. The first original 3rd party title, Ocean Blaster 2, was recently announced for FunFair and more releases will be key to establishing fundamental value within the FUN token.

An underlying challenge for the short term success of FunFair is the infrastructure of the Ethereum blockchain and Dapp browsers like Metamask, which still experience congestion & outages and remain intimidating to use for everyday consumers.

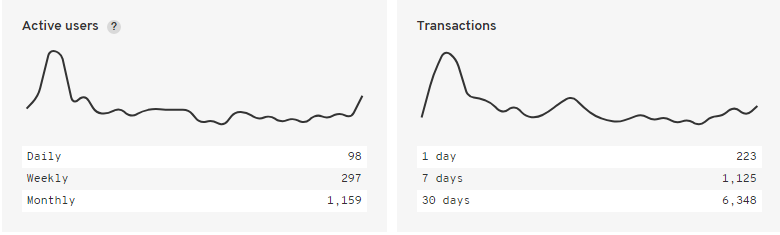

FunFair Dapp active addresses and users. Source: StateoftheDapps

FunFair currently ranks as the 316th most popular Dapp and its smart contract has fewer than a 100 users a day, with each contributing two or three transactions. A potential reason for the small number of users and transactions on FunFair is the license style business model it uses, which may be characterized by large infrequent payments by a small number of users.

Price performance and financial evaluations

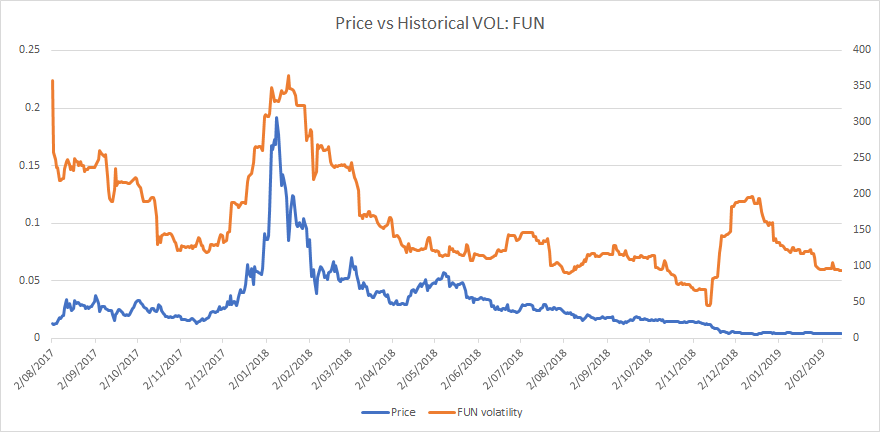

Following an all time price high hit on the 9th of January 2018 of ~$0.19, the price of FUN has been on a steep and significant downtrend that has continued for over a year. It currently trades at ~$0.004 down close to 99% since the ATH was reached.

FUN volatility: Calculated as standard deviation of daily percentage change annualized

Annualized daily price volatility of FUN has trended downwards since the bull market peak but in general has remained high (the annualized volatility of the S&P 500 currently sits at around 20 points). This pattern of high daily volatility is typical of altcoins and potentially means that a number of holders may have been lured by short term gains (frequent daily gains of higher than 10%) before being burned by swift corrections and the immediate long term down trend.

A yearly report post by the FunFair team made on December 20th 2017, indicated that the team held onto 85,000 ETH and 4.45 billion FUN following the ICO sale concluded in June 2017 and also held enough fiat to maintain operations for a year. At the time these reserves were worth ~$61 million (ETH) and ~$243 million (FUN), in today’s prices these reserves would be worth ~$12.5 million and ~$17.8 Million.

FunFair’s 2018 year report did not reveal the FunFair project’s current fiat or crypto holdings. However whether the crypto was sold at some point during the bear market or is still locked away, it is likely that the businesses financial prospects have been severely affected by the bear market and near term outlook and projections have had to be scaled back or corrected. While the company still likely holds on to assets of enough value to maintain operations for some time, re-investment goals are likely to have shrunk considerably a year on.

This does affect medium to long term valuations of the project, even if a major factor in these valuation corrections have been driven by external markets and not direct considerations of the quality and future prospects of the FunFair project.

Exchanges and trading pairs

7 day-FUN price and volume chart. Orange line represents an index price comprising of the 5 most popular FUN constituent markets, which are listed on the table to the right.

Trading of FUN is limited to just six pairs, and only two fiat onramp options. Somewhat surprisingly, even though FunFair is a London-based operation, there is no GBP trading pair for FUN. FUN/ETH and FUN/BTC trading pairs handle just over 97% of total daily FUN trading. Total daily trading in the FUN/ETH markets is worth just over ~$400,000

Despite the low daily trading volumes, FUN is available on a number of large exchanges namely Binance and OKEX. The most traded market pair by exchange is the FUN/ETH pair on multi-solution platform LAToken. Turkish exchange Vebitcoin, as well as offering a FUN/BTC pair also offers a FUN/TRY (Turkish Lira) pair.

Unique technology

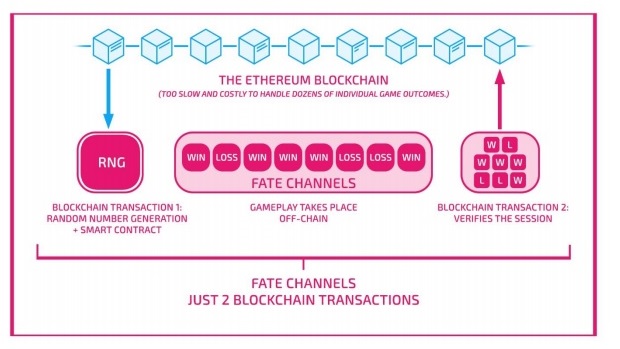

In the FunFair teams own words, the "heart of the FunFair protocol and a core feature of the platform" is a uniquely engineered version of the State channel system known as Fate channel system.

The system is designed to limit only essential operations onchain and thus limit congestion on the Ethereum network while minimizing the amount Gas fees that an Ethereum casino or gambling Dapp has to incur.

Source: FunFair commercial whitepaper V2

Unique Fate channels are open for the duration of a user session, not for each hand being played, and only interact with the blockchain at the beginning and end of each session. This way the pool of off chain transactions (actual gambles) are only being verified as a single transaction at the end of a session. Number generation can occur onchain because of the offchain verifications that can occur on the fate channel system.

This system is designed to allow users to play as many hands of poker or rolls on a roulette table within a single gaming session, while still having gameplay transactions secured on the blockchain, and only paying gas fees twice.

In the Fate channel system two untrusted parties, the casino and the player, agree to have the funds involved in a single gaming session held in escrow (smart contract automated) by a third party for the duration of the session, with final settlement and payments only occurring after the player closes the session.

Both the user and the casino have to sign and approve each transaction (user gamble), contributing part of the seed for number randomness before the channel can progress.

At any stage either party can object to the outcome of single transaction, and enter a dispute resolution mode where the session is sent immediately to the blockchain to be verified and settled. In theory, this makes the fate channel model cheat proof and disincentivizes any bad actors who would consider manipulating the system.

As well as being cheat proof, FunFair proposes to be scalable because of the streamlined number of blockchain interactions, faster than traditional gambling markets because of the automatic/permissionless nature of blockchain transactions, and fair, because escrow requirements force casinos to put max liability into a smart contract i.e if a slot machine pays 100x then the maximum possible pay-out needs to be allocated to the smart contract.

FunFair’s value is banked on delivering a solution in between legacy gambling models and current blockchain gambling Dapps. A recent report from the gambling commission in the UK suggested that just 33% of the general public perceive current mainstream gambling operations to be fair and 41% believe that gambling is associated with crime. FunFair hopes to restore some of this lost faith between users and casino operators by adding transparency to number generation and automating payouts to users.

Blockchain based gambling Dapps are growing in popularity because of how easy they are to access (minimal KYC/AML requirements, transactions don’t appear on bank statements) and how cheap and fast it is to hit numerous bets in a short period of time.

That said, most blockchain gambling platforms have very crude/basic UI & UX which can often make them appear as seedy or black market.

Additionally, some of the most popular blockchains to host gambling apps are closed permissioned networks that run with a low, set number of transaction verifiers (EOS, TRON), who individually have significant power over confirming transactions. Users playing gambling Dapps on these semi-centralized networks have to trust that transaction verifiers will not abuse the power they have to publish blocks, and potentially rig games in favour gambling Dapp operators.

Network fundamentals

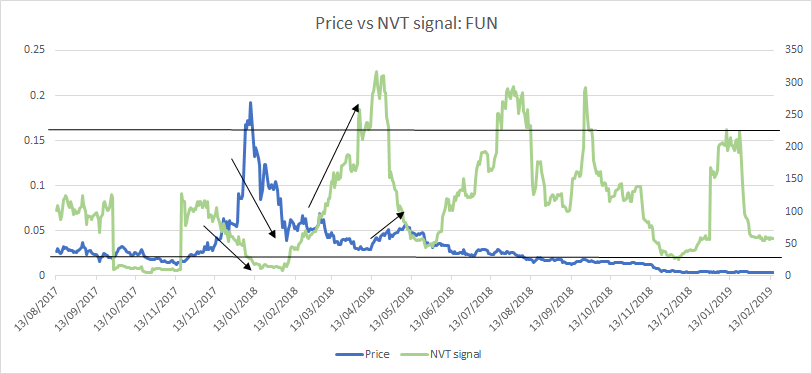

NVT signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity. The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

Onchain transaction volume collected from Coinmetrics.io

Historically, the NVT signal has provided useful indications for whether the value of the FUN token may be approaching an oversold or undersold inflection point. Over the three quarters, however, network transaction volume appears to have detached from price fully, and no longer has an effect on token value.

Sentiment may be so poor surrounding the project, that even when positive fundamental value is emerging within the fair ecosystem, it does little to create buying pressure. Presently it appears as though NVT is trending downwards and may approach something resembling an short term oversold assessment as network volume grows quickly against token value, but even so the likelihood of a price reversal appears slim.

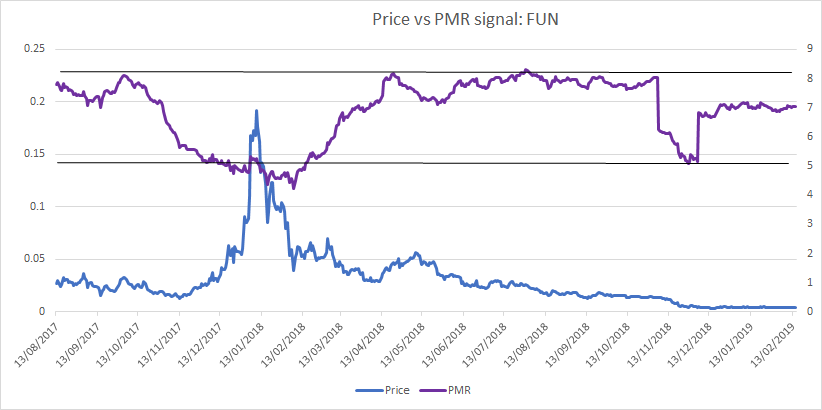

PMR signal

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume. However, there may be a question of the granularity of the data, and who controls these addresses. As suggested, FUN may be designed to have a small user base because of the licensing style business model it proposes.

Active Address collected from Coinmetrics.io

Similar to NVT signal, whatever fundamental relationship token value had with Metcalfe’s law, active address growth has diminished over time. This suggests any potential fundamental indicators become difficult to use until there is some wider sentiment recovery.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, the death cross, using the 50 and 200 day EMAs, has persisted since mid-2018 with the 50 day EMA consistently acting as resistance (x marks). Furthermore, FUN has been contained within a negative linear price trend with a Pearson’s R Correlation between time and price of ~0.82 (not shown) since the beginning of 2018. However, on the 2 hour chart, price has recently broken above the 200 day EMA, and used it as support resistantly. This positive momentum may enable FUN to retest previous resistance levels between $0.0041 to $0.0043.

On the 1D chart, the 30 period TRIX and volume flow indicator (VFI) have shown muted price momentum, both remain beneath 0, despite an increased upward trajectory in recent months. Using the 2H chart, both oscillators show a more positive picture of price momentum with TRIX climbing above 0 and VFI holding 0 as support.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

At time of writing, on the 2H chart (not shown), FUN has completed a Kumo breakout, which coincides with the short term momentum seen above. Given the current momentum and RSI (~48), price is likely to attempt a Kumo breakout on the 1D settings, but find the Senkou A resistance near $0.0045 formidable. If price can break above Senkou A resistance, the price targets are $0.0055 and $0.0065, while support levels are $0.0037 and $0.0034.

[ ]

]

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

On the 2H chart (not shown), price again, has completed a Kumo breakout, which confirms near term price momentum that could attempt a breakout on the 1D settings. Same as above, the odds of a successful breakout on the 1D chart are low with the Senkou A resistance at $0.0049 being a large obstacle.

Conclusion

The story of an ICO project struggling to maintain token value post the explosive bull market of late 2017/early 2018 is not unique to FUN, however, the token is on the most heavily affected end of the spectrum. An asset being worth ~2% of what it was worth just under 14 months ago would normally be a red flag for new investors. FUN is likely a long term distressed asset at this point with numerous token holders having already sold or looking for the right price to sell at.

While some of the price slides can be accounted for by external market factors, own factors like an inability to onboard third party casinos have also been critical issues.

However, altcoin crypto markets are different from traditional trading markets and are characterized by sentiment driven retail buyers that likely overvalued FUN initially and undervalue it now.

The FunFair on/off chain ‘fate’ channel model uses novel tech, and delivers a solution that potentially could find a sweet spot between untrusted legacy and blockchain gambling models.

To date, though, the intimidating nature of the model and numerous moving parts involved may mean that potential customers in the short run are simply not ready/willing to understand or adopt the FunFair casino model. While some dead cat bounces or oversold reversals may occur in the short term, establishing long term value of the FUN token will be more challenging.

The technicals for FUN show positive momentum in the near term, but caution is recommended in the longer term with notable resistance levels on the 1D chart being the likely cap to the short term price increases. Both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above $0.0049 and $0.0097, respectively, before entering a long position. Both trader’s support levels are $0.0037 and $0.0034, respectively.

Don’t miss out – Find out more today