Word on the Street: Square wins crypto patent

The month of August ended on a muted note for news, although sentiment remained steady for bitcoin as it hovered around the $7,000 mark on Friday. Global trading volume in BTC has dipped from the start of the month. September could be a different story for price action as most of the trading world will be back at the desk after the summer holidays.

Square wins patent for multi-crypto payment solution (medium impact)

US-listed payment app Square has been on a tear this year, its stock price having surged 130% this year alone and this week had a patent for a new crypto payment solution accepted by the US Patent and Trademark Office. CCN published the pages of the patent that was filed last year but only approved during the week. Square is one of the leading mobile payment apps and is forging its way into merchants point of sale.

Square has been lauded by Wall St analysts for its innovation, which links its own debt and cash cards to its Cash App. Quite apart from hosting cryptocurrencies on the platform (since this year its customers can buy BTC), Square has also been touted as a platform to bank the unbanked due to borderless payments. An analyst for Guggenheim, one of the largest US wealth and fund managers, said of the company “we think Cash App’s future revenue potential is underappreciated, we see it providing a key services role for the underbanked.”

Ripple limits number of court cases (low impact)

At the start of the year Ripple Labs was fighting legal cases on all different fronts, many of them premised on the same theme: that the XRP token is a security. While two weeks ago it had a class-action lawsuit against it dismissed, this week it succeeded in combining two outstanding cases into one, which will be added to other class action suits of the same kind. The company has been seeking to limit the number of cases it must fight concurrently and on Wednesday the California Superior Court designated the suits filed by investors David Oconer and Vladi Zakinov compatible with the remaining lawsuits filed in the court.

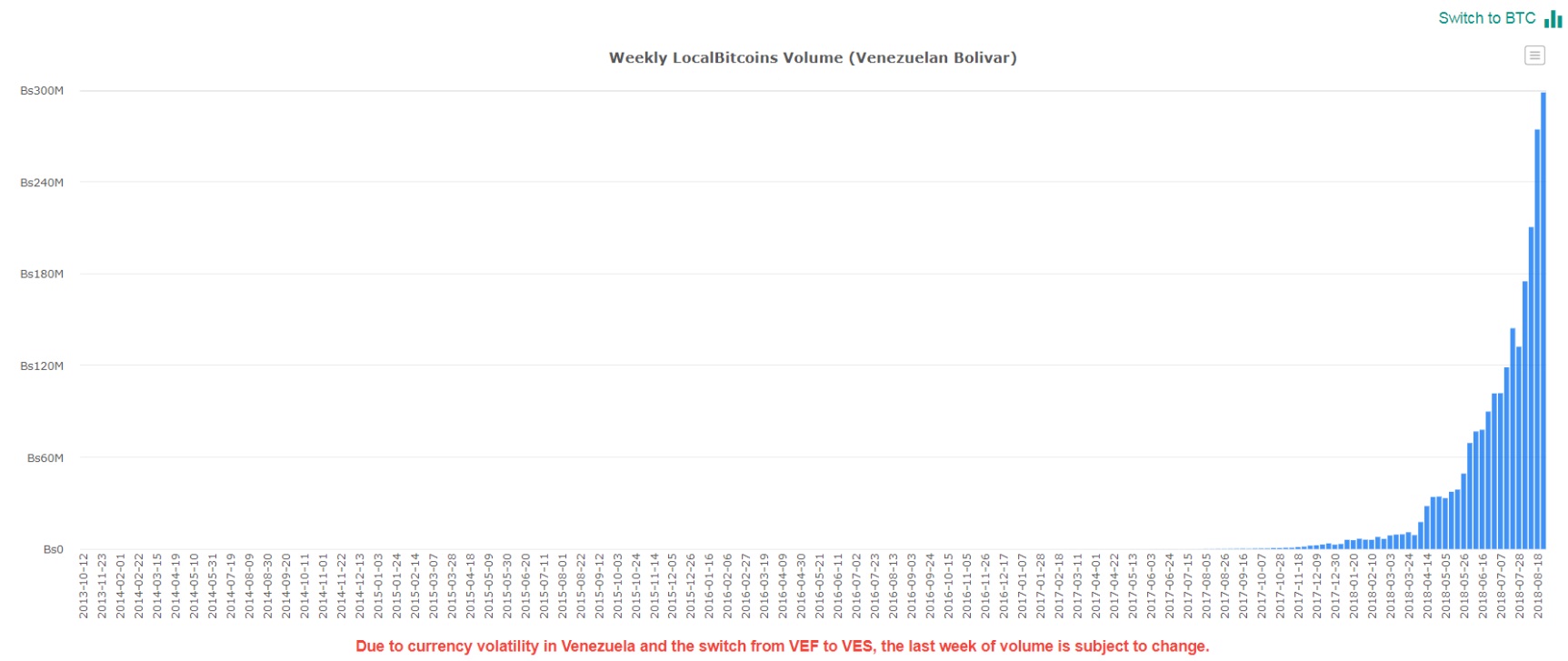

Local Bitcoin volumes go parabolic in Venezuela (low impact)

Half a billion Bolivars has gone into Local Bitcoins volumes in the past seven days in Venezuela as citizens of the Latin American country have been forbidden by their government to remove money from the economy and the government essentially introduced a new currency, the Sovereign Venezuelan Bolivars.

The volume of BTC/VEC ending the week August 25 was 1143BTC, or 506.3 in VES (Sovereign Venezuelan Bolivars). At the time of writing, one bitcoin equalled 17 billion VES.

BTC trading in the new Venezuelan Bolivar (VES) went almost off the charts this week.

Dash also saw a 30% surge in its price on news of Venezuelan adoption, as it partnered with Kripto Mobile Corporation to roll out so-called KRIP phones with preloaded Dash wallets. According to Dash CEO Ryan Taylor, 10,000 units of the phone will be rolled out to consumers every month, which will complement the 1,000 merchants already accepting Dash in the country.

Venezuela is suffering from hyperinflation and prices have been doubling almost every month for the past nine months; while its annual inflation rate has now hit 80,000% by some measures.

The government has announced drastic measures, this week it knocked 5 zeroes off the currency – so the newly issued 500 Bolivar note is really worth 50 million in old Bolivars, which is about $8 USD.

The new Bolivar will be pegged to the Petro – a cryptocurrency backed by its oil reserves – at 3,600 Bolivars to the Petro, and the Petro is worth $60 USD, which at face value is a devaluation from the old Bolivar of around 95%. This rout coincides with the plummeting value of the Argentine Peso despite interest rates in the country being raised to a world-record 60% this week.

BTC and BCH available to buy through Yahoo Finance (low impact)

US visitors to Yahoo Finance, arguably Yahoo’s only relevant remaining platform, will be able to purchase Bitcoin, Bitcoin Cash, Litecoin and Ethereum through a 3rd party – currently the buyer/seller must have an account with Coinbase or RobinHood. Yahoo Finance has 165 million monthly users and provides investors free tools, charting and many fundamental stats on all asset types.

Hedge fund to launch crypto index fund (low impact)

Hedge fund Morgan Creek Capital, which has doubled down on its crypto bet in recent months, has teamed up with crypto fund provider Bitwise and this week launched the Digital Asset Index Fund aimed at institutional investors.

With a minimum investment of $50,000, investors can gain access to the major crypto assets, with an almost 70% weighting to Bitcoin and precludes ‘premined’ coins like Ripple’s XRP and Stellar Lumens. There is a 2% management fee and assets are held in custody by Kingdom Trust.

In related news, Kingdom Trust, a digital asset institutional custodial service with $12b under management, this week announced that it will be insured by Lloyd’s of London.

Bitcoin bulls differ on price direction (low impact)

Tom Lee, of Fundstrat Global Advisors, is still holding to his prediction of BTC going to $20,000 by year-end, while Anthony Pompliano, partner at Morgan Creek Digital Assets, and long-term crypto bull believes it could head as far south as $3k.

Talking on CNBC, Lee’s thesis is premised on some sort of correlation between emerging market returns and BTC, saying their purge this year has had a knock-on wealth effect on would-be investors in bitcoin. Pompliano on the other hand, cites the duration of previous bear markets over the years and believes this one could stretch out as far as Q3 2019.

Don’t miss out – Find out more today