Bitcoin Cash vs Bitcoin: Can BCH make up ground in 2021?

Another bout of discord and disagreement within the Bitcoin Cash community has continued to affect the BCH price performance. Two years on from the Bitcoin Cash / Bitcoin SV hard fork drama, Bitcoin Cash has forked again. Where is Bitcoin Cash today in terms of its goal to ‘be a better Bitcoin’ - and where does it go from here?

In May 2018, the Bitcoin Cash (BCH) protocol quadrupled its block size from 8MB to 32MB. The move perplexed many in the crypto community because the network’s new transaction capacity far exceeded network demand at the time. Current block sizes on Bitcoin cash are still only a small fraction of the 32MB limit.

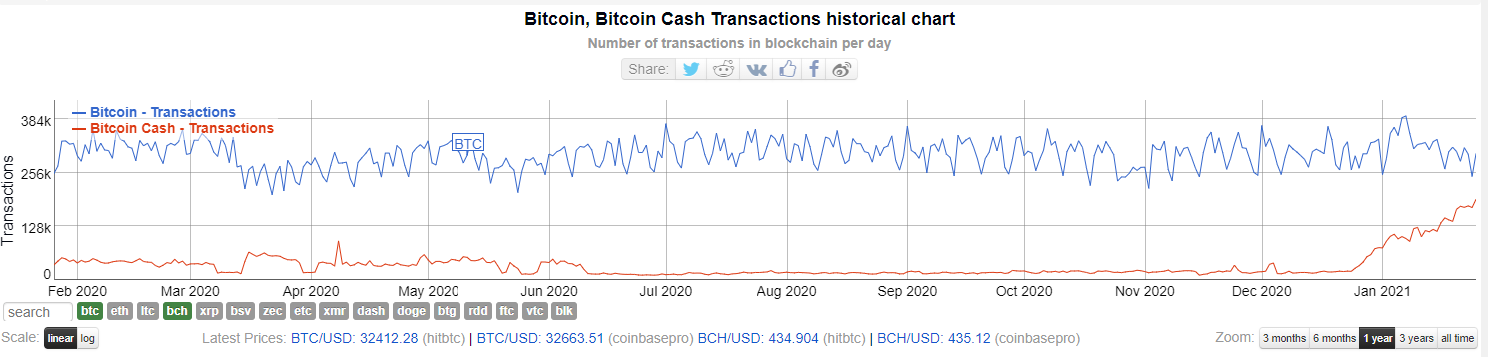

At the time of the fork, the Bitcoin Cash network was processing approximately between 1000-1,500 transactions per block. During a stress test following the block size increase in September 2018 the network showed it had the ability to handle up to 25,000 transactions per block. Recent data from the blockchain suggests that it is currently processing around 1000-1400 transactions per block. The network was processing between 100-200 transactions per block for most of 2020, however, there was a sharp pickup in demand to use the network around the time of the new year as markets took off.

Source: bitcoin.com

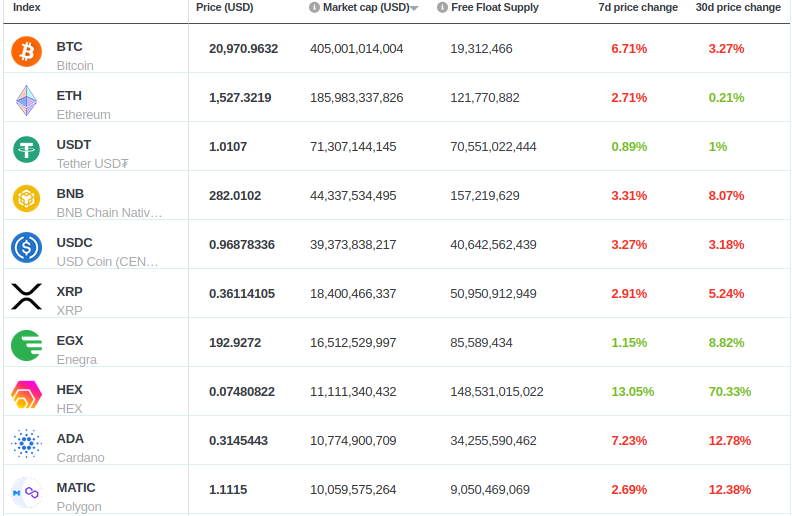

Three years on from its original hard fork from Bitcoin, Bitcoin Cash remains a top 10 cryptocurrency. While the BCH vs BTC argument has cooled, it is yet to be definitively settled. Has Bitcoin Cash achieved what it set out to do?

On August 1st 2017, Bitcoin Cash forked from Bitcoin (BTC). When it launched, its developer community promised to realize a vision for digital cash that they felt Bitcoin itself had failed to deliver: a decentralized, high-volume payment system with low enough fees for anyone to use.

In November 2018, the question of BCH or BTC became more complicated as the Bitcoin Cash itself forked – and Bitcoin SV (BSV) was created. Bitcoin SV was created following opposition to a number of scaling upgrades set to be implemented to the BCH protocol. It was led by well known community members Craig Wright and Calvin Ayre. They argued that the upgrades corrupted the original vision for Bitcoin as digital cash and so launched their own chain, “Bitcoin Satoshi’s Vision” that would roll back the changes and allow for 128MB block sizes. Today, both chains remain in the crypto top 10, but this article will only examine the performance of the Bitcoin Cash fork (BCH).

The fork forks

On November 15th, 2020, the Bitcoin fork (Bitcoin Cash) forked for a second time. The network split into two separate chains, Bitcoin Cash ABC (BCH ABC) and Bitcoin Node. This time around, the reason for the split was a major governance issue and an internal disagreement stemming from a group of developers, Bitcoin Cash ABC, suggesting a 12.5% tax should be enforced on each block as a way of funding project development. After much back and forth between the BCH community and its developers, the miner ‘tax’ was scrapped before eventually being re-implemented. The situation eventually became untenable and the Bitcoin ABC chain continued with the miner tax and the Bitcoin Cash Node chain chose to run without it.

One of Bitcoin Cash’s most famous backers and investors, Roger Ver, was highly critical of the miner tax proposal and tweeted out in September 2020 “Diverting part of the Bitcoin Cash block reward to pay a single development team is a Soviet style central planner’s dream come true. Please stop.” When the fork occurred almost all hashpower was directed towards BCHN. Most miners and the existing Bitcoin Cash community decided to back the Bitcoin Cash Node chain as its primary platform agreeing with the sentiment put forward by Ver. It has taken over the Bitcoin Cash/BCH moniker with Bitcoin Cash ABC operating as a smaller rebel chain.

Bitcoin Cash underperforms against Bitcoin

The price of Bitcoin Cash peaked on December 20th, 2017 at USD3,785. Since then its value has dropped by ~88% and it currently trades for ~USD420. However, all cryptocurrencies that were part of the 2017 bullrun have seen similar falls. What may be more concerning for holders is that the value of BCH in BTC terms currently hovers around all time lows of 0.0013 BTC per BCH. In US dollar terms, Bitcoin Cash has risen a respectable 36.5% in the last year. It’s big brother Bitcoin, however, has risen ~284% in the last year.

BCH price in BTC terms. Source: Coingecko

The narrative that Bitcoin Cash is a direct competitor to Bitcoin has waned considerably. Even so, Bitcoin Cash has a market cap of around ~USD8.04 billion and maintains a vocal community of believers. Bitcoin Cash has gained a new notable fan in the form of well known internet entrepreneur and political activist Kim Dotcom. Dotcom is currently working on a content monetization platform called K.im that blends cryptocurrency payments and file hosting. On January 4th 2021, it was announced that K.im would go to market with a Bitcoin Cash integration. Describing the BCH project, Dotcom said Bitcoin Cash is "great for payments" and for services like K.IM, and offers new financial opportunities for consumers, vendors and investors. K.im is expected to launch in Q4 2021.

BTC’s price has ripped upwards in 2020 under the shadow of unprecedented fiscal stimulus from central banks to combat the crippling effects of the Coronavirus pandemic. Under these conditions BTC’s value as a store-of-value safe-haven asset, which has been backed as a reserve asset by corporations and macro hedge funds, has outshone BCH’s cash alternative proposition.

From a macro perspective, yet another contentious hard fork raised flags about the stability of the project’s governance. As a result of the Bitcoin Cash ABC hard fork, Bitcoin Cash lost one of its most notable development teams and developers in the form of Amaury Sauchet. There are lingering concerns about whether the project can continue moving towards its goal of building a decentralized digital cash network due to its fractured community and history of infighting.

In April 2020, Bitcoin Cash executed its first-ever block reward halving. The halving is a pre-scheduled event that reduces the number of new BCH that is created via the block reward by half every four years. The halving is generally expected to have a bullish impact on the price. The halving constricts the amount of new BCH created each block, tightening supply and creating upward price pressure. While Bitcoin has surged in the months following its own block reward halving, the price of BCH has remained static and has not seen a boost from the scarcity argument in the same way Bitcoin has.

In a note released following the Bitcoin Cash halving cryptocurrency mining firm Blockware solutions said that price is “not just supply side economics,” but demand. “Bitcoin has the most robust ecosystem in the blockchain industry, and the fundamentals continuously improve due to global macro improving sentiment and accelerating demand.” Blockware argues that despite Bitcoin and Bitcoin Cash going through identical supply side shocks demand side factors meant that one asset far outperformed the other last year.

What is the difference between Bitcoin and Bitcoin Cash?

To understand what these numbers say about how BCH has grown and how it hasn’t, we need to compare BTC and BCH across three dimensions:

- Block size. How have BCH and BTC found their own solutions to the problem of scaling?

- Transaction volume. What can current transaction volumes teach us about whether people are adopting BCH vs BTC?

- Mining. How does the shared community of BTC/BCH miners influence the relationship between BTC and BCH?

BCH’s bigger blocks haven’t mattered yet

Since May 2018 Bitcoin Cash’s block size has been 32 times larger than Bitcoin’s (non-SegWit) 1MB blocks. It has always been the BCH position that block size matters. From the hard fork onward, the drastic difference in size between BTC’s 1MB blocks and BCH’s 8MB blocks has been a key differentiator between these networks.

BCH’s bigger block size means that it currently supports far more transactions than Bitcoin can in the same amount of time. While transaction volume now on BCH isn’t close to what it can support, the block size debate shows how differently the networks think about scaling.

Where Bitcoin Cash supporters like to identify bigger block sizes with cheaper, faster transactions, the Bitcoin camp views Layer-2 solutions like the Lightning Network as a better method for scaling. Bitcoin Cash supporters believe that bigger block sizes will ultimately lead to a network that anyone can transact on—one that can serve as a ‘PayPal 2.0.’

The average transaction size for Bitcoin Cash is about 350 bytes, which means that each of the network’s 10-minute, 32 MB blocks could support (on average) 91,425 transactions, for a total of 13,165,200 per day. In contrast, BTC’s 1 MB (non-SegWit) blocks can each only support 5,000 transactions of the same size, for a total of 600,000 per day.

But even though BCH is built to handle huge numbers of transactions, it is only averaging around 192,800 per day in the last couple of weeks—just 0.014% of the daily volume it could support with its 32MB block size.

Source: bitinfocharts

So why did the network double down on block size from 8mb to 32mb when there is such a mismatch between capabilities and transaction demand? The Bitcoin network has averaged around 300,000 transactions per day over the last few weeks and this has led to block sizes that are better aligned with the network’s 1MB block size limit.

Before the hard fork on November 15th 2020 that increased block size on the Bitcoin Cash network to 32mb, the team behind the upgrade said it was designed to keep improving BCH as a form of money. “We want to make it more reliable, more scalable, with low fees and be ready for rapid growth. It should ‘just work’, without complications or hassles. It should be ready for global adoption by mainstream users, and provide a solid foundation that businesses can rely on.”

Bitcoin supporters, on the other hand, endorse Layer-2 scaling solutions over BCH’s larger-blocks solution because they worry bigger isn’t better when it comes to block size, as exceptionally large blocks could put mining beyond the reach of ordinary people’s storage and bandwidth capacities.

Large blocks could have meant that only the largest, most organized mining pools would be able to mine new blocks—something which is antithetical to Bitcoin’s core value of decentralization.

Layer-2 protocols like Lightning Network promises to solve this problem by enabling ”millions to billions of transactions per second” on a separate layer to the base blockchain.

But the difference in block-size approach between BTC and BCH is now setting the stage for two kinds of blockchain that will be very different in the future: one that supports huge numbers of instant, low-fee transactions on its own (Bitcoin Cash), and another that is investing in an ecosystem of off-chain scaling solutions (Bitcoin).

If you build it, they might come…

Mempool size, all else being equal, is directly related to transaction fee size: a smaller pool of pending transactions means you don’t have to pay as much to get your transaction confirmed by miners. It makes sense, therefore, that BCH’s relatively small mempool size has led to very low average transaction fees—typically in the order of $USD0.002.

Bitcoin, on the other hand, usually has a mempool of around 45,000 transactions—far more than BCH. This number touched as high as 116,000 on December 18th 2020. Bitcoin’s transaction fees, correspondingly, are much higher than BCH’s, with average transaction fees now sitting around USD10.05 and yet it has maintained a transaction volume that exceeds BCH’s by an order of magnitude.

Bitcoin Cash has yet to prove itself as the new, decentralized PayPal, and has not convinced the wider market that it’s better suited for this task than Bitcoin is. That is not to say that there hasn’t been any movement in that direction, though.

Back at the time of the original fork, BCH had a mere 0.11 transactions per second to BTC’s 2.42 tps. Three years later BTC’s transaction volume has consistently grown—it is currently 3.98 tps—while BCH’s volume has grown to ~1.36 tps. During network stress tests conducted in September 2018, TPS on the Bitcoin Cash network hit as high as 24 during the tests indicating that the network is indeed capable of extremely high network transaction load

In this case, the growth in BCH transactions could be due to a growing interest in crypto-based commerce, or just be the result of more widespread speculation in the crypto space overall.

Nonetheless, BCH’s small transaction volume despite its mempool size (it usually doesn’t have more than 6000 pending transactions at any given time) and low transaction fees—shows the public remains unmoved by its ‘cash alternative’ proposition.

It does seem that during the first years of its existence the market had recognized some distinct value in BCH, the market cap has decreased by ~37% from the hard fork to now, compared to the over 1200% growth for the Bitcoin network. In the last 12 months, the Bitcoin Cash market cap has risen by 20% while Bitcoin’s market cap is up an impressive 265%.

Mining – BCH vs BTC

Both Bitcoin and Bitcoin Cash use the same hashing algorithm: SHA-256. Because of this, miners can mine both cryptocurrencies. Especially in the first few months of BCH’s existence, there was huge variation in the profitability of mining BTC vs the profitability of mining BCH. This led miners to oscillate back and forth between the two networks, which resulted in commensurate variation in BTC and BCH’s hashrate. For some time now we have seen the profitability of mining BTC and BCH are much closer to each other than they used to be.

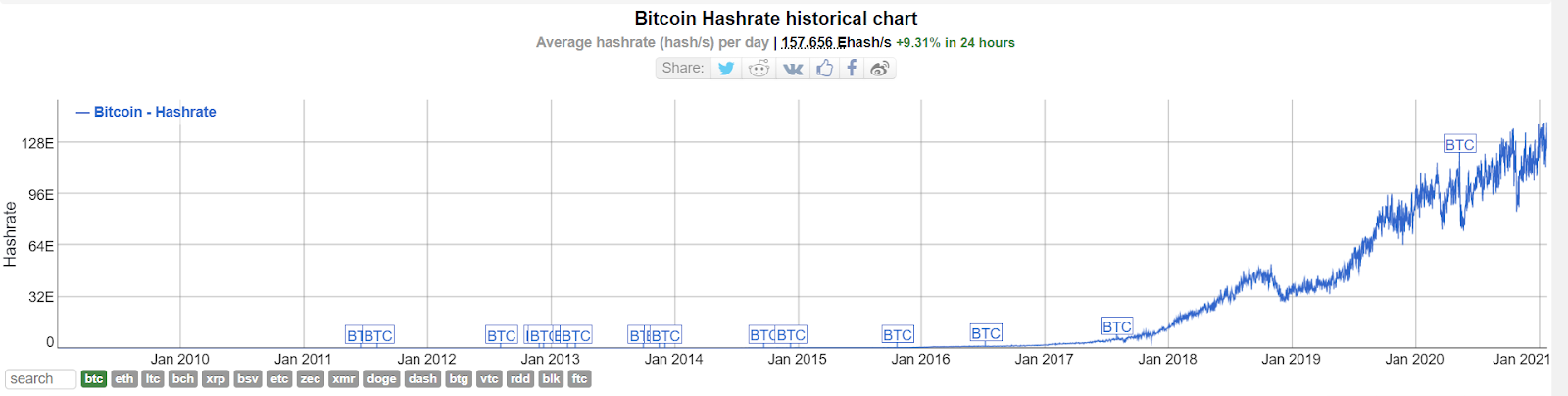

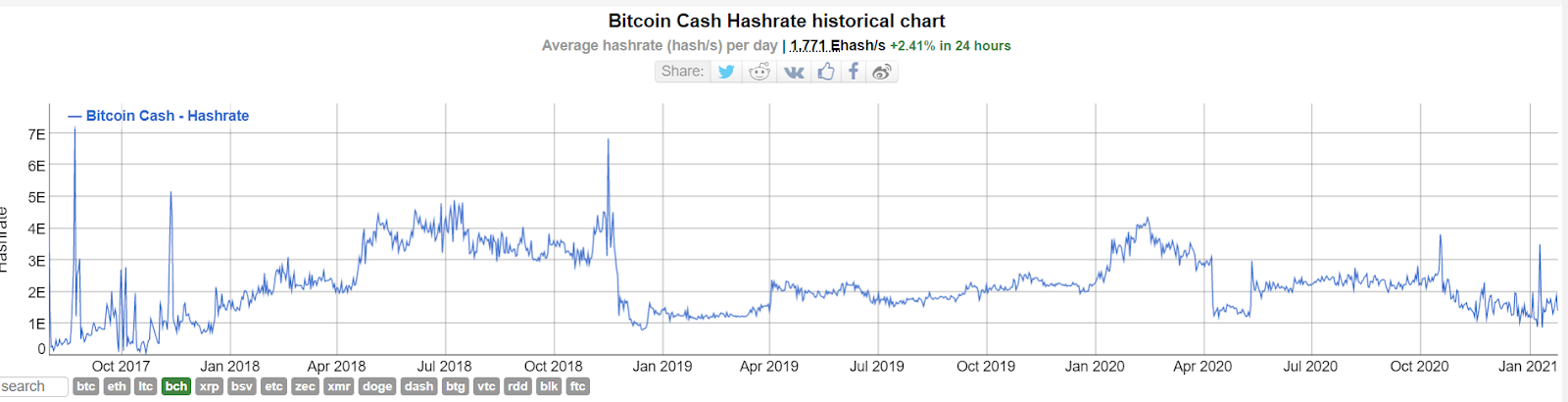

Bitcoin’s hashrate is surging while Bitcoin Cash’s falls. Source: bitinfocharts.com

Hashrate paints a different picture to mining profitability. Bitcoin’s hashrate has consistently grown since the second half of 2019 and touched all-time-highs in January 2021. Contrasting this, the Bitcoin Cash hashrate has been steadily dropping since the beginning of 2020 and the network’s current hashrate is well below its all time highs touched in September 2017.

In the last year the average daily hashrate of the Bitcoin Cash network has fallen by ~58%, while comparatively the hashrate of the Bitcoin network has risen 43%. On April 8th the Bitcoin Cash blockchain was the first of the major SHA-256 networks to halve its block rewards. Following its halving event the miner block reward dropped from 12.5 to 6.25 coins per block. The Bitcoin network halving took place a month later on May 11th.

Since their respective halvings the hashrate of the Bitcoin network has recovered much more strongly than its fork counterpart. It has been suggested that some SHA-256 miners would jump from the Bitcoin Cash network to the Bitcoin network, with the larger 12.5 coin block rewards available on the larger network. Other factors contributing to this hashrate differential may be the BCH networks ongoing governance challenges and comparatively poor price performance.

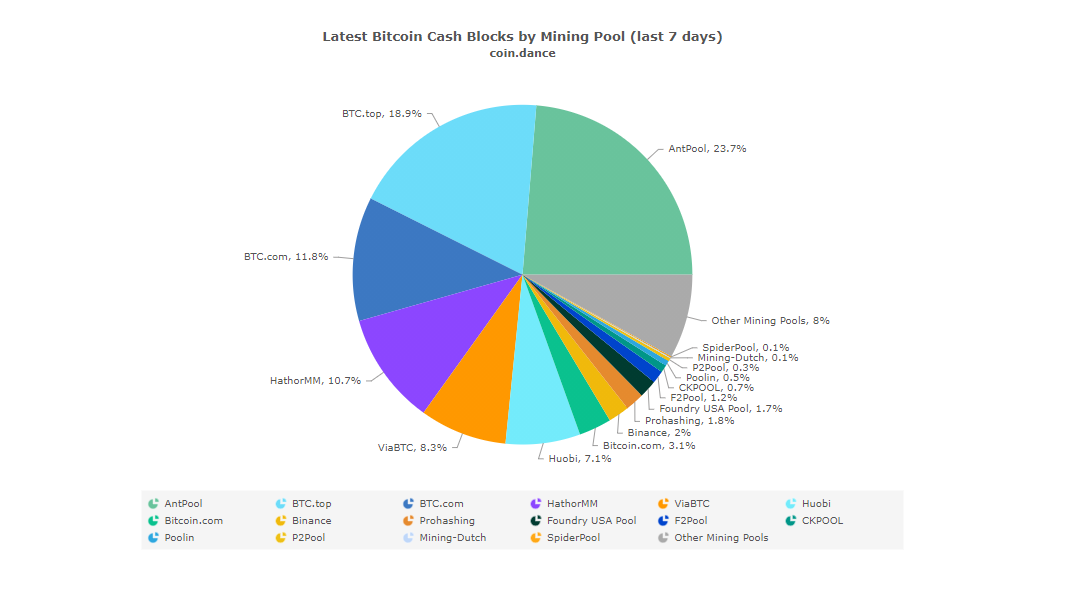

BCH mining is dominated by a few pools Source: Coin.Dance

On the Bitcoin Cash blockchain over half of the new blocks created were by the same three mining pools: AntPool, BTC.top, and BTC.com. This creates concerns around decentralization and the level of control these pools have over the network.

The future: can Bitcoin Cash coexist with Bitcoin?

Bitcoin and Bitcoin Cash have distinct long-term aims, and the differences in how they’re already handling transaction volume and block size reflect those aims.

Eventually, BTC and BCH may be able to peacefully coexist with different goals, with BTC acting like digital gold (store of value) and BCH acting like PayPal (fast payments) — but BCH will have to grow significantly before that possibility can be realized – a scenario that is not helped by repeated hardforks.

Don’t miss out – Find out more today