Bitcoin price analysis: The year ahead

It has a been a very quiet end to the year in terms of news, even though the price had a sudden $65 drop the day after Christmas. As with previous years, there are infinite articles talking about the year that was, and predictions for 2016.

It has a been a very quiet end to the year in terms of news, even though the price had a sudden $65 drop the day after Christmas. As with previous years, there are infinite articles talking about the year that was, and predictions for 2016. The focus however, still remains on Blockchains without bitcoin, and this may be the reason there hasn’t been as many articles with price predictions. I will of course go out on a limb and talk about our price expectations for the year ahead, but prior to that, let’s look at a few recent headlines in the world of Bitcoin.

The New York Times is reporting that Blythe Masters’ Digital Asset Holding is having funding problems. This could be a big story next year as the competition for being the best bitcoin(less) blockchain heats up, and the value proposition of the technology for banks remains questionable. As mentioned on several occasions, all Blockchain related news in the mainstream media will be good for Bitcoin, which is independent of whether Permissioned Ledgers are successful.

There was also interesting regulatory news this week. There is a value proposition being offered to Russia’s Vladimir Putin on why Bitcoin could be a boon to the economy. According to the document, it’s being suggested to the Russian Authorities that there could be additional tax compliance from black market profits – if the semi-anonymous bitcoins could be sent to cover tax contributions.

It is well known that no matter how much force is used against illicit activities they will never be eradicated, and this may just be a way to benefit the country in the meantime. This would apply to fines and other court rulings as well, where instead of not receiving any payment, there could be anonymous contributions to settle the issues with no questions asked. These types of proposals are not new and are, in a way, similar to a safe haven law that allows unwanted newborn babies up to 30 days old to be dropped off at the hospital with no questions asked.

We already have countries like Britain and Italy factoring in illicit activities like prostitution and drug trafficking into their GDP, but without the tax collection that actually benefits the finances of those nations. The suggestion for Russia is to attempt to do the reverse of that initiative.

Staying with the regulatory theme, Europe is in the headlines once again. This week there was a motion for a European Parliament resolution on controlling cryptocurrencies, which was proposed by the representatives from France.

France is still considered one of the stronger economies in the Eurozone, but the Socialist policies of incumbent President, Francois Hollande, are starting to take their toll on the people. The far right wing candidate Marie Le Pen has a good chance of becoming the next President.

These political shifts from far left to far right are rarely smooth, so I expect France to be a major focal point of European instability late in 2016. This would of course be very positive for Bitcoin, but in the meantime most of the French laws are stifling free markets and competition, as illustrated by the issues the Uber are dealing with.

Look for France to be one of the most difficult countries to be a Bitcoin user in going into next year. Other countries to keep an eye on (outside of Europe) will be Australia and probably the United States, but a closer overview of them will be provided at a later time.

Market Outlook

Let’s generally talk about what I’m expecting for the year ahead from a price perspective. Regular readers know that I have been short term bearish for a few months, I took that position just before the unsustainable rise from $350 to $500 in early November. The price then fell quickly and touched $300 ever so briefly, so I doubt anyone had a chance to properly time the trade back to the upside. In my opinion the current market price of $430 remains in an overbought position, even though I am pretty Bullish on Bitcoin over the next few years. I turned long term Bullish last summer around the time of the Greek banking shutdown.

With Gregory Maxwell’s new roadmap it seems like there is now a plan to tackle scalability, and the issue of block size seems to not be as critical as once thought. What we do have to keep in mind is the halving taking place some time in July, and with the recent increases in hashing power and quick block discovery, perhaps it will be upon us sooner than expected. I’m expecting plenty of media headlines leading into this event.

There’s also a good deal of people who will be convinced that they need to buy bitcoins before it’s too late, before they will miss out on gains due to a choked off supply. Most likely, there will be a run up in price in the Second Quarter (Q2) of 2016. If this artificial run up in price occurs on schedule, there is a good possibility of a letdown right after the halving, which would lead to disappointed new speculators selling on undelivered hype. This situation would lead to drop in prices in Q3.

Now we come to the final big event of 2016 – the US Presidential Elections. It’s too early to tell who the final two candidates will be, but there will be plenty of uncertainty in the air. Economic uncertainty in traditional markets is very good for Bitcoin. There will be more important things for the US Government to focus on during this period, so Bitcoin’s antics might just get to fly under the radar. For those reasons, I expect the price of Bitcoin to do well going into the year end of 2016.

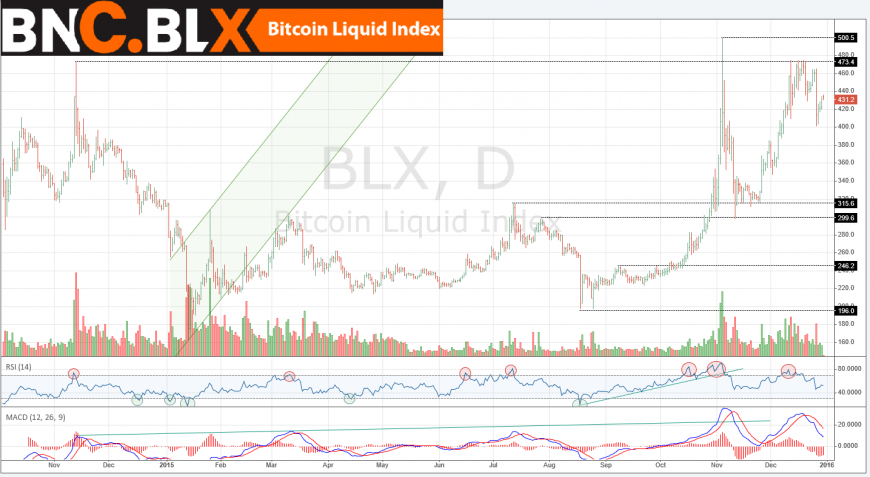

On a more intermediate term basis, looking at the chart above displaying the BNC Liquid Index (BLX), price is now slowly pulling back up to the $440-450 range. It’s forming a pattern known as the Bear Flag, which we saw last week as well, just before the $60 price drop. The price still remains in slightly overbought territory and the momentum indicators like the RSI still have not touched the 30 level. Over the last year the RSI has been consistently swinging from overbought (above 70 circled Red) to oversold (below 30 circled Green). I will continue to be either Bearish or Neutral until this momentum indicator comes back down and works off the overbought condition. This can of course happen at any price, but the ideal range for a pull back would be in the $300-350 zone.

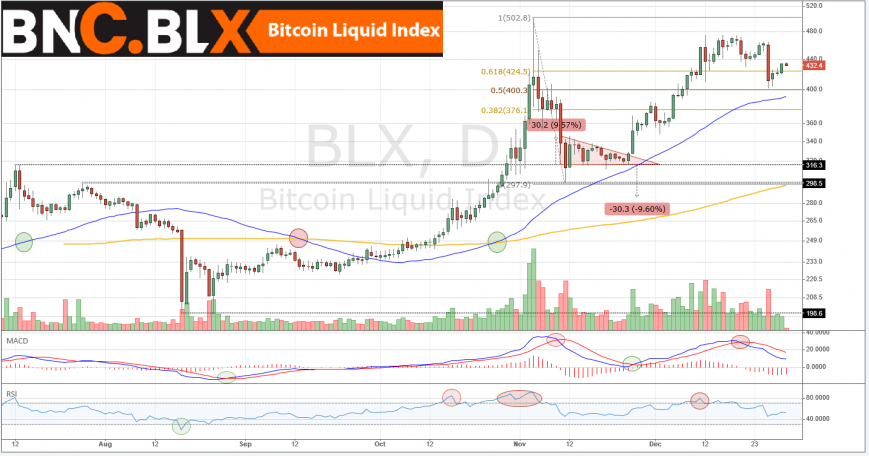

Looking at the zoomed in version of the same daily chart, there is a breakout from the Descending Triangle in the non-conventional direction. The latest price drop took us to the 50% Fibonacci line but still came up short of the 50-day Simple Moving Average (SMA). This combination is generally reasonable support, but a hit of the SMA would have been better. I am still expecting to hit that 50-day SMA, and most likely the 200-day SMA as well – which is now moving up to the $300 level.

The more detailed explanations of the Short, Medium and Long-Term outlooks of technical charts are reserved for subscribers to the BraveNewCoin Traders Report. It also breaks down all the relevant weekly news and it’s influence on Bitcoin’s price and general standing within the financial ecosystem. For traders looking to use the BNC Liquid Index for long term charting, it is available on Trading View, updated Daily.

Final Thoughts

I’ll close out my views with something to think about in regards to the recent jump in hashing power, and the unusually fast block discovery, that will be leading to increases in difficulty. Without speculating if this is BitFurry’s new chips as rumored from many chat groups, what a trader needs to think about is why the sudden need for rampant activity now.

One of the reasons might be the upcoming halving event, and a race to win every possible block while the rewards are higher. This is one of the reasons the halving may come sooner than expected. In addition, we need to consider what large mining organizations are doing with the influx of current block rewards.

As a business you need to optimize your cost of operation for the foreseeable future, and just like many in cold climates save food for the harsh winter months, we may have miners holding on to more bitcoins than usual so that they can have a smoother time running operations for the first 6 months to a year after the rewards get cut in half.

All the traders and speculators know there will be less mined bitcoins up for sale in late 2016, but they may not be anticipating the additional selling from the savings potentially going on over the current 6 month stretch. This can also create artificial short supply today causing the prices to run up higher then expected leading up to the halving this summer. This is just pure speculation but as the popular quote says: “Buy the rumor, sell the news”.

This article was completed on Tuesday December 29st 10:00 pm ET, when the BNC Liquid Index (BLX) was $431.

I will be speaking at the following upcoming events:

TNABC, Miami, FL Jan 21 – 22

Anarchapulco, Acapulco, MX Feb 18 – 21

Hoftra University, Long Island, NY Mar 3

Blockchain Conference, San Francisco, CA Mar 7

CMU Summit at Carnegie Mellon University, Pittsburgh PA, Apr 10

Inside Bitcoins, NYC Apr 11 – 12

Inside Bitcoins, HK May 24 – 25

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today