ICAP’s test shows blockchains could significantly transform the post trade landscape

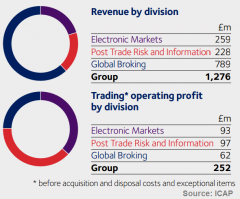

[ICAP plc](http://www.icap.com), announced today that its Post Trade Risk and Information (PTRI) division has “successfully completed a proof of technology test case using blockchain technology.” A UK-based post trade risk services provider,, ICAP operates in all the world’s major financial centers, with more than 70 locations in 32 countries. In the year ending March 31, 2015, the company reported total revenue of £1.27 billion from its three divisions; Global Broking, Electronic Markets, and PTRI.

ICAP plc, announced today that its Post Trade Risk and Information (PTRI) division has “successfully completed a proof of technology test case using blockchain technology.”

As a leading interdealer broker, the company claims to have a market share of 26 percent, with daily transaction volumes of $1.3 trillion.

ICAP came top of the table in Risk Interdealer Rankings 2015, as it had done for the previous two years. The company ranked number one for Interdealer Broker in Interest Rates too, for the 10th year running.

While the Global Broking division contributes the most revenue, almost 62 percent, PTRI division contributes the most to trade operating profits, almost 39 percent. PTRI revenue also rose ten percent in the 2014 financial year, offsetting a one percent decline in Electronic Markets, and an 11 percent decrease in Global Broking.

“PTRI division operates market infrastructure for post trade processing and risk management across asset classes and enables users of financial products to reduce operational, second order financial and system-wide risks.”

— – ICAP

Post-trade processes generally include clearing, settlement, custody and asset servicing, as well as related activities such as collateralization. PTRI enables its customers to increase the efficiency of trading, clearing, and settlement, while facilitating the effective management of capital and risk-weighted assets and associated costs. The company reported that more than 1,000 institutions were using their post trade risk services, as of the end of March 2015.

Their blockchain proof of technology, successfully completed on February 26, “has the potential to significantly transform post trade operations, while complying with new market practices within the post-crisis regulatory environment,” PTRI stated.

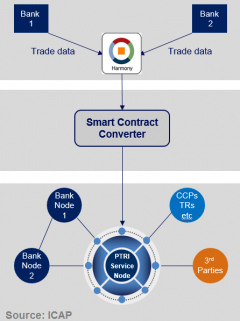

Leveraging multi-asset messaging, PTRI matched the Traiana Harmony network to blockchain infrastructure, creating a private, peer-to-peer, distributed ledger network using smart contracts.

The Harmony network delivers global market connectivity to the FX, equities, equity derivatives and exchange-traded derivatives markets, and is used by more than 500 of the world’s leading financial companies.

The system is tested using bilaterally-executed spot/forward foreign exchange block trades. After importing matched messages from Harmony and converting them in real-time to blockchain-based smart contracts, they were distributed to nine participant nodes on the blockchain network, where trades were permissioned for additional services such as valuation, compression, and reporting.

“In successfully completing a proof of technology test, ICAP has demonstrated one of the first real world applications of distributed ledger technology that has the ability to significantly transform the post trade landscape.”

— – Jenny Knott, ICAP PTRI Division CEO

This blockchain proof of technology focuses on “the distribution of data and not the agreement and settlement of bilateral transactions,” according to the press release. Moreover, the system builds on existing PTRI solutions and is “not challenging the fundamental role of participants.” No immediate switchover is required, and their blockchain is “operating safely in parallel with existing architecture.” With this technology proven, PTRI has taken a big step forward in their practical use of blockchain technologies.

Axoni, a New York-based capital market technology startup that specializes in distributed ledger infrastructure, provided the blockchain infrastructure for the test. Axoni is a brand new company, also publicly launched today, even though they have been working to bring blockchain technology to global capital markets with some of the world’s largest financial institutions, ICAP among them, for as long as eighteen months.

“Axoni’s increasing market reach has been driven by a unique combination of expertise spanning blockchain technology and capital markets. In particular, advanced solutions for scaling, throughput, privacy, life cycle management, and external connectivity have made Axoni’s technological implementations stand out in an otherwise crowded market.”

— – Axoni

While the company is brand new, the team behind Axoni is already well known for founding, building, and operating one of the leading providers of institutional tools for transacting in assets on public blockchains, TradeBlock. The founders of TradeBlock created Axoni to focus exclusively on the permissioned ledger space, and TradeBlock will continue to exist as a separate entity.

Specializing in distributed ledger infrastructure, Axoni’s products include blockchain deployments, large-scale data management, made to order smart contract development, analytics services, and connectivity tools.

“Partnering with ICAP was an easy choice. There’s no shortage of demand for distributed ledger projects. ICAP’s thoughtful consideration of where this technology can be most valuable, its ambitious deployment objectives, and market-leading client reach offer a high probability of success when combined with Axoni’s advanced blockchain infrastructure.”

— – Greg Schvey, Axoni CEO

Axoni was discovered through an early-stage funding program majority owned by ICAP called Euclid Opportunities. ICAP launched Euclid in March 2011, as a new and unique approach to financial technology incubation. Founded by CEO Steve Gibson, Euclid offers seed funding and an acceleration program to early-stage technology companies, providing innovations in the areas of post-trade risk management, data, and other financial market applications. In October 2015, Gibson told Markets Media that Euclid is spending some time looking at blockchain technologies.

“If the market chooses to adopt central record keeping it will require significant re-engineering of business processes and that is a long term-project. There could be some early wins for blockchain in precious metals or illiquid asset classes but there needs to be absolute agreement for practices to change and everyone will have to move as a collective.”

— – Steve Gibson, Euclid CEO

ICAP’s proof of technology shows that blockchains have the potential to “provide a common golden source of user transaction and reference data cross asset,” their press release states. Using it, accuracy, timeliness, and security will be enhanced. Messages will be securely coded and viewed only by permissioned participants. And all of this will reduce operational risk as well as back office costs.

Prior to this announcement, ICAP had already invested in blockchain technology by investing in a developer of distributed ledger technology for the financial services industry, Blythe Master’s Digital Asset Holding LLC. The investment in Digital Asset Holding, which was also made through Euclid, forms part of a funding round that exceeds US$50 million, from a broad range of leading financial and market infrastructure participants. Other investors are IBM, Goldman Sachs, Accenture, the Australian Securities Exchange (ASX), Citi, CME Ventures, Deutsche Börse Group, IJP Morgan, Santander InnoVentures, The Depository Trust & Clearing Corporation (DTCC), and The PNC Financial Services Group, Inc.

While ICAP currently focuses on the data distribution aspect of post-trade operations, other financial institutions are focusing on post-trade processes themself, such as settlement.

Japan-based mega-corporations Fujitsu Limited, Fujitsu Laboratories Ltd., and Mizuho Bank Ltd. recently announced that they have completed a blockchain trial to streamline cross-border securities transaction settlements.

Nasdaq is also a proponent of using blockchain technology to shorten settlement time. The company announced that they have successfully issued private securities over a blockchain at the end of last year, on their Nasdaq Linq platform.

There are many more blockchain projects in the works to enhance post-trade operations. In January, the Australian Securities Exchange Ltd (ASX) announced it had selected Digital Asset Holdings to develop blockchain solution for their post-trade services, including clearing and settlement of the cash equities market.

Last year, UBS started prototyping their “settlement coin” to reduce settlement time from the common T+3 (trade date plus three days) to near real-time. The megabank also joined the blockchain working group formed in November 2015, by London Stock Exchange, LCH Clearnet, Euroclear, CME Group and Société Générale, to explore how blockchain technology could transform the way security trades are cleared, settled and recorded.

During the next few months, PTRI plans to discuss how participants can access this new, “golden data source” and start working towards realizing technology savings in their various systems, all the while ensuring that they remain compliant with current safety regulations.

Don’t miss out – Find out more today

“PTRI division operates market infrastructure for post trade processing and risk management across asset classes and enables users of financial products to reduce operational, second order financial and system-wide risks.”

“PTRI division operates market infrastructure for post trade processing and risk management across asset classes and enables users of financial products to reduce operational, second order financial and system-wide risks.”

“In successfully completing a proof of technology test, ICAP has demonstrated one of the first real world applications of distributed ledger technology that has the ability to significantly transform the post trade landscape.”

“In successfully completing a proof of technology test, ICAP has demonstrated one of the first real world applications of distributed ledger technology that has the ability to significantly transform the post trade landscape.” “Axoni’s increasing market reach has been driven by a unique combination of expertise spanning blockchain technology and capital markets. In particular, advanced solutions for scaling, throughput, privacy, life cycle management, and external connectivity have made Axoni’s technological implementations stand out in an otherwise crowded market.”

“Axoni’s increasing market reach has been driven by a unique combination of expertise spanning blockchain technology and capital markets. In particular, advanced solutions for scaling, throughput, privacy, life cycle management, and external connectivity have made Axoni’s technological implementations stand out in an otherwise crowded market.” “Partnering with ICAP was an easy choice. There’s no shortage of demand for distributed ledger projects. ICAP’s thoughtful consideration of where this technology can be most valuable, its ambitious deployment objectives, and market-leading client reach offer a high probability of success when combined with Axoni’s advanced blockchain infrastructure.”

“Partnering with ICAP was an easy choice. There’s no shortage of demand for distributed ledger projects. ICAP’s thoughtful consideration of where this technology can be most valuable, its ambitious deployment objectives, and market-leading client reach offer a high probability of success when combined with Axoni’s advanced blockchain infrastructure.” “If the market chooses to adopt central record keeping it will require significant re-engineering of business processes and that is a long term-project. There could be some early wins for blockchain in precious metals or illiquid asset classes but there needs to be absolute agreement for practices to change and everyone will have to move as a collective.”

“If the market chooses to adopt central record keeping it will require significant re-engineering of business processes and that is a long term-project. There could be some early wins for blockchain in precious metals or illiquid asset classes but there needs to be absolute agreement for practices to change and everyone will have to move as a collective.”