Regulation is propagating financial exclusion, and blockchain technology is a key solution

According to a recent [report](http://www.cgdev.org/sites/default/files/CGD-WG-Report-Unintended-Consequences-AML-Policies-2015.pdf) by the Center for Global Development, extreme regulatory and cost pressures caused by regulation has caused financial institutions to stop servicing areas which are deemed extremely high risk.

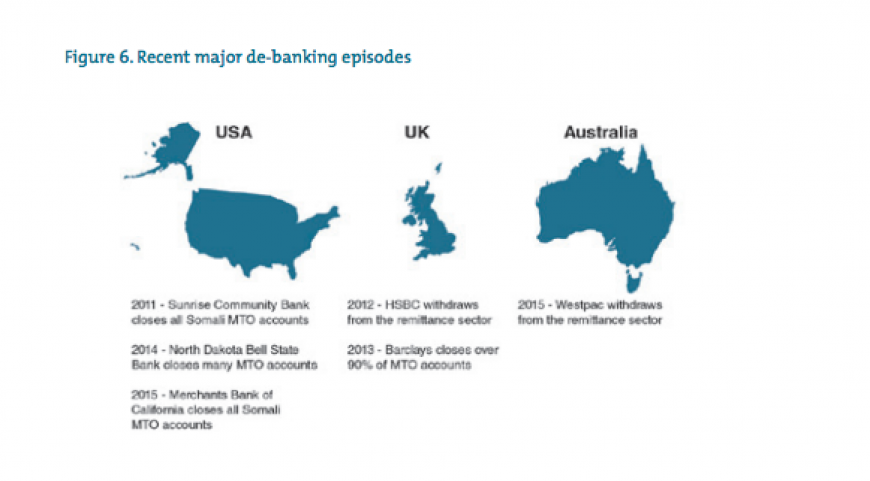

According to a recent report by the Center for Global Development (CGD) entitled, "Unintended Consequences of Anti-Money Laundering Policies for Poor Countries," extreme regulatory and cost pressures driven by Money Laundering (ML), Counter Terrorism Financing (CTF) and Know Your Customer (KYC), have caused financial institutions to stop servicing areas which are deemed extremely high risk. One of the fallouts of de-risking has been to cease activities using a wholesale approach to the problem, rather than on a case by case basis. De-risking has also led to de-banking, where banks unilaterally shut down the accounts of businesses and individuals which are in areas deemed too high risk.

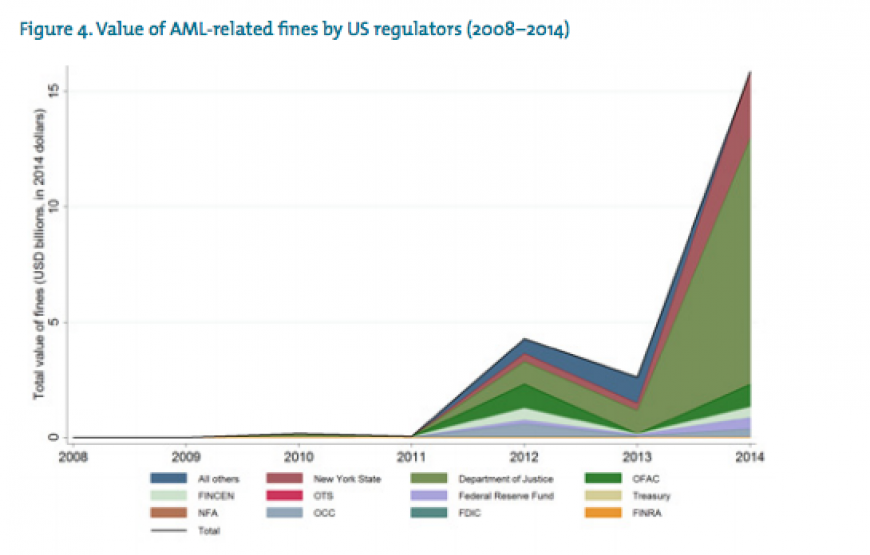

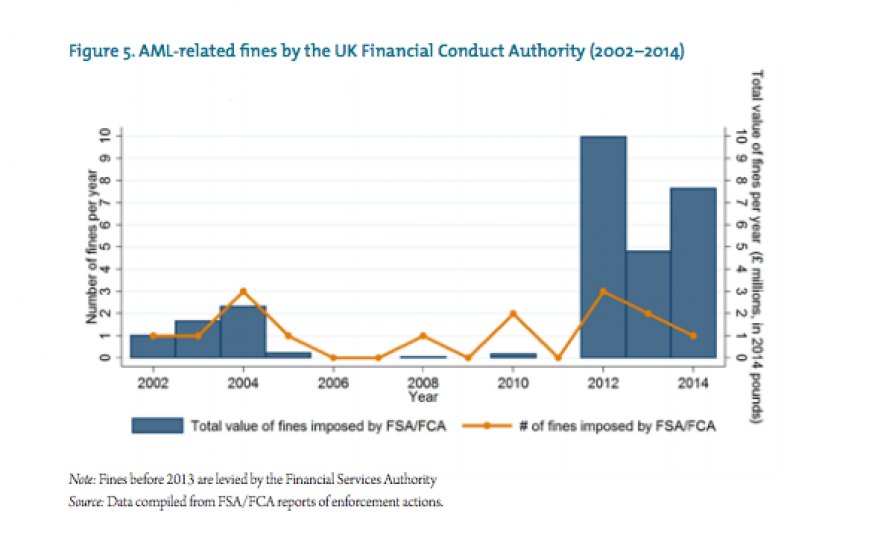

The costs and fines associated with AML/CTF/KYC have grown dramatically in recent years as the charts below show.

Compliance has become a major cost for banks and financial institutions, so de-risking and de-banking has been an easy approach to avoid issues with regulatory authorities. While the Financial Action Task Force (FATF) makes policy recommendations that are generally accepted globally, enforcement becomes even more complex in jurisdictions like the United States – although Europe is not much better – where there are multiple governmental organizations involved in the regulatory process, and each can define the rules differently. Bureaucratic inconsistency in the aforementioned jurisdictions has made it more difficult for these institutions.

The wholesale de-risking approach has had unbalanced consequences for financial inclusion, the poorest countries have often been deemed the most high risk. This is the result of nations being deemed terrorist hotbeds, individuals not having a verifiable identity, no access to credit for businesses and individuals, and the perception of the risk of money laundering.

SaveonSend does a great job of explaining why banks are shedding this business and all the complexities that are involved, including the high cost of AML/KYC for banks, which is problematic at best.

Three Sectors Most Affected

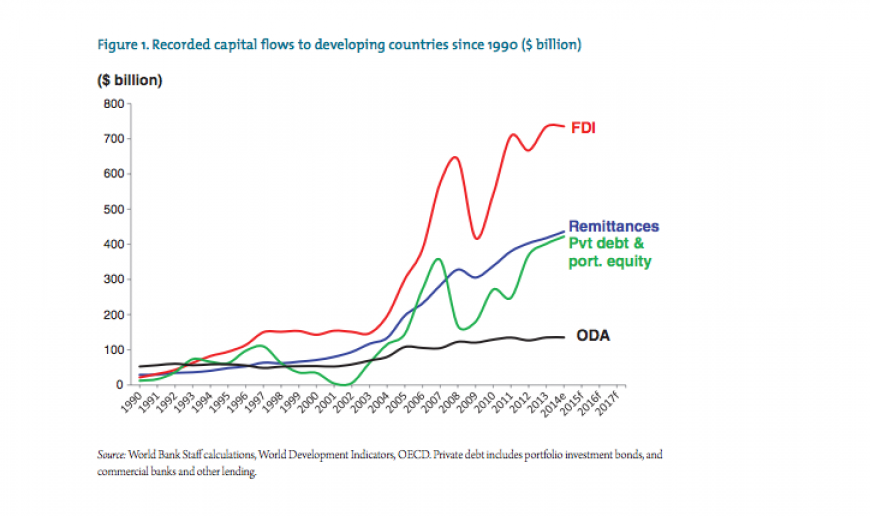

The three sectors of the global financial system most affected by regulation are: Money Transfer Organizations (MTOs), Non Profit Organizations (NPOs), and correspondent banking relationships which affect trade finance and letters of credit. The chart below shows the capital flows associated with each of these areas.

MTOs (remittances) have historically been labeled as risky by regulatory authorities, particularly in today’s world where costs outweigh benefits. The CGD report states that many MTO’s have allegedly been outright de-banked, but that hard figures are hard to get as banks do not share terminated account information publicly.

Some remittance corridors have been flagged more than others, and these corridors have been shunned outright by financial institutions.

"A significant share of world remittances now flows to countries that are deemed to be high risk by regulators. Nearly one in every three dollars remitted in 2013 was sent to a country currently listed as a high risk or non-cooperative jurisdiction by FATF. 13% went to countries in the top 25% riskiest countries as measured by the Basel Institute’s index of money laundering risk, and 6% went to countries actively covered by an OFAC sanctions program."

— – CGD report

This has made it an easy choice for financial institutions to use a wholesale regulatory policy when assessing MTOs. As the saveonsend blog states, remittance is just a tiny fraction of all banking revenues. Another worry in the report is that while remittance costs are low now, de-banking many of the smaller players reduces competition, which in the long run could lead to higher prices once again. Higher remittance costs lead to less flow, which also doesn’t help financial inclusion or generate economic activity.

Non Profit Organizations (NPOs) have also suffered greatly. While donations and aid come in all forms, including anonymous forms like cash, regulators have deemed that internal AML/KYC within NPO’s falls short, and its not hard to see why. To NPOs a donation is a donation. On the other side of the equation, making sure that money gets into "good" hands in countries that are flagged is difficult. This presents a lot of headaches for financial institutions that bank NPO’s, when releasing that money to aid, charity and assistance organizations in the targeted countries. These countries tend to be poor, disaster stricken regions.

The final area affected is correspondent banking and trade finance. Moving money across borders is something banks do all the time and in high volumes. This includes FX, remittances, letters of credit etc. Banks are not omnipresent, even though they seem to be, so when they don’t have a branch in a country where they need to trade in local currency, they form partnerships and open accounts with local banks to conduct their activities. Not only do you need to know the correspondent bank you’re dealing with (KYC) but you have know your customers’ customers (KYCC). In many of these high risk regions, that is hard to do, and in many cases the local banks are dealing with people or institutions that have been flagged, hence the risk runs high. Correspondent banking is central to economic activity in many of these countries, where trade finance/letters of credit and cross border transactions are essential. Many of these relationships are built on trust, and this is eroding due to super aggressive regulation, making basic economic activity difficult.

The real unintended consequence of what’s happening to all three sectors is less transparency. If one can’t use a traditional financial institution or small business for remittances, donations and aid, and correspondent banking, one uses whatever sources are necessary. These sources don’t discriminate in who can access money, and sometimes they are involved in illicit activity. This spillover is being caused by overarching regulation and the wholesale approach to compliance.

CGD Proposals

The solutions proposed by CGD report are:

- The World Bank should make publicly available both the results and, if possible, the underlying anonymized data from its de-risking survey of banks, MTOs and governments as soon as possible.

2) Government agencies that keep detailed registries of regulated MTOs and NPOs should make available headline statistics about the numbers and nature of such organizations.

3) On behalf of central banks and private financial institutions, SWIFT, CHIPS, CHAPS, BIS and other entities tasked with managing and collecting data on cross-border transactions and relationships should make available data on bilateral payment flows and the number of correspondent banking relationships between countries.

4) Banks and other financial institutions should accelerate the global adoption of the Legal Entity Identifier scheme.

Developing globalized and national standards for regulation and compliance can be achieved through generating better data and sharing that data with other jurisdictions. This would include detailed registries of MTO’s, NPO’s, and correspondent banks. This would also lead to a "chain of custody" in which tracking and marking/flagging suspicious activities of these organizations can be monitored by all those who are sharing the information in a quick and efficient manner. Once consensus is achieved on nefarious activity, this can develop a more case by case basis on which entities should be banked and which de-banked. This increases transparency for both the regulators and financial services industry. What also goes a long way is standardizing definitions for AML/CTF that both regulators and the private sector can understand. These can be determined by size and scope of the business. Along with proper identification methods, this could lower the cost, and certainly the risk, of conducting compliance and doing business.

Verifiable Identification for businesses and individuals is the biggest onramp to financial inclusion. Legal Entity Identifiers are the result of a partnership between regulators and the private sector, including financial institutions. The Legal Entity Identifier (LEI) is a 20-digit, alphanumeric code used to uniquely identify legally distinct entities that engage in financial transactions. The report suggests scaling this form of identification quickly for global adoption. The individual side is a bit trickier and harder to implement at present.

"National governments should provide citizens with the means to identify themselves in order to make reliably identifying clients possible for financial institutions and other organizations […] National governments should ensure that appropriate privacy frameworks and accountability measures support these identification efforts while ensuring the free flow of information related to identifying ML and TF."

— – CGD report

Another suggestion is for better messaging standards and KYC documentation repositories: "Banks and other financial institutions should redouble their efforts, with encouragement from the FSB and national regulators, to develop and adopt better messaging standards and implement KYC documentation repositories."

Why Blockchains?

The above solutions should make it apparent that blockchain/distributed/shared ledger is a real solution here. In the existing system information is not shared, but replicated and duplicated over multiple regulatory bodies and financial institutions. Eliminating replication and duplication over multiple databases can be accomplished. Once the information is shared, confirmation can be made in a timely fashion based on AML/KYC/CTF. If one goes from a good actor to a bad actor, instantaneous changes can be broadcast over the entire network, thereby allowing for a more case by case basis approach, and allowing regulators and institutions to act in tandem. This may well lower the cost and fees of regulation, and allow for more businesses and individuals to be accepted and be banked. This is proper de-risking in action.

Storing transactions and records in one automatically shared database eliminates the need for complicated procedures, ensuring banks and regulators have their records in sync. The above description saves time and money, while reducing the risk of error. Trust becomes distributed over a network, be it private or public, in which the participants can determine if "they are who they say they are," through self organization and standards. This will get rid of the fear of big fines and overreaction, since the network will consist of all interested parties.

An argument can be made for using a shared/distributed ledger to perform the tasks outlined above, in which a consortium of financial institutions and government regulators are included. The information is not controlled by one entity but shared amongst all, in the interest of promoting financial inclusion and economic activity for all parties who are not flagged, rather than acting indiscriminately.

When it comes to all that private information being centralized in a database, a security leak could be completely devastating, and the world is filled with identity theft and governmental surveillance. On the other hand there is a decentralized censorship resistant ledger like Bitcoin for identity. Allowing citizens to control their information and identity in an immutable database where they hold their private keys allays such fears.

Follow George on Twitter: @sammantic

Don’t miss out – Find out more today

"A significant share of world remittances now flows to countries that are deemed to be high risk by regulators. Nearly one in every three dollars remitted in 2013 was sent to a country currently listed as a high risk or non-cooperative jurisdiction by FATF. 13% went to countries in the top 25% riskiest countries as measured by the Basel Institute’s index of money laundering risk, and 6% went to countries actively covered by an OFAC sanctions program."

"A significant share of world remittances now flows to countries that are deemed to be high risk by regulators. Nearly one in every three dollars remitted in 2013 was sent to a country currently listed as a high risk or non-cooperative jurisdiction by FATF. 13% went to countries in the top 25% riskiest countries as measured by the Basel Institute’s index of money laundering risk, and 6% went to countries actively covered by an OFAC sanctions program."