ShapeShift volumes surge as demand for Ethereum explodes

Erik Voorhees launched [ShapeShift](https://shapeshift.io/) in March of 2015, and secured over [US$2 million in venture capital funding](https://shapeshift.io/site/blog/2015/12/31/shapeshift-year-review-looking-back-2015) from prominent digital currency firms and investors including Roger Ver, Digital Currency Group and leading bitcoin exchange BitFinex.

Erik Voorhees launched ShapeShift in March of 2015, and secured over US$2 million in venture capital funding from prominent digital currency firms and investors including Roger Ver, Digital Currency Group and leading bitcoin exchange BitFinex.

BitFinex Director of Community and Product Development, Zane Tackett, explained that the secret to their rapid growth is a revolutionary design and model, which enables fast and secure trading of cryptocurrencies. Supported by a simple user interface and efficient cryptocurrency processing technology, the platform has become one of the most popular and largest cryptocurrency trading platforms by volume.

“ShapeShift demonstrated an entirely new way to think about asset exchange. It’s like Google Translate for digital currencies. We’ve known Erik for a while now and he’s knocked it out of the park with this one. We’re very excited about the partnership.”

— – Zane Tackett

Following last year’s growth in monthly volume and newly registered users, the ShapeShift team and its CEO, Erik Voorhees, have focused on adding support for new and popular cryptocurrencies such as Factom, Emercoin, and Ethereum.

Since January, the market cap of Ethereum has risen from US$70 million to US$777 million, recording a staggering 10x increase in the past two months. The explosive demand for Ethereum resulted in surging daily volumes for ShapeShift, which allowed the ShapeShift team to continue the platforms growth.

“ShapeShift grew 1,000% in 2015. It has already grown another 1,000% in the first 2 months of 2016.”

— – Erik Voorhees

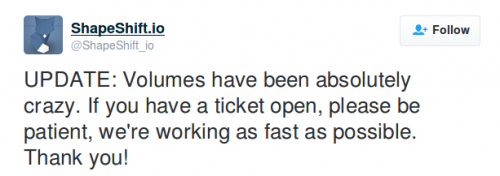

Daily volumes on ShapeShift have risen to a point where the platform couldn’t handle the spiking trade requests for trending cryptocurrencies such as Ethereum and Factom. The ShapeShift team announced on March 5 that the platform was struggling to support all of the surging requests from its users.

The price of Ether, the underlying cryptocurrency the Ethereum network runs on, has increased 10 fold since the start of the year, from just under $1 to around $10. Due to the sudden surge in demand and volumes, members of the cryptocurrency community have begun to suspect a pump and dump by financial institutions or cryptocurrency enthusiasts. However, some argue that the volume of Ethereum is simply too large for a single individual or a group to manipulate.

Many still believe that the involvement of multi-billion dollar banks and financial institutions from the R3 consortium, a collaborative Ethereum blockchain-based financial project including some of the world’s largest financial establishments and corporations, triggered the spike in volumes and price of Ethereum.

On March 2, the R3 consortium announced that Bank of America Corp., Deutsche Bank, Morgan Stanley, Royal Bank of Scotland Group PLC and 36 other banks completed a trial of five blockchain solutions developed using the Ethereum network. The 40 banks utilized blockchain solutions and infrastructure developed and structured by Chain, IBM, Eris Industries, Ethereum and Intel Corp. to settle transactions and process traditional financial settlements using the Ethereum blockchain network.

“With the completion of this trial we have raised the bar significantly with the sheer number of global financial institutions, distributed ledger technologies and cloud providers working together in parallel to demonstrate how this nascent technology can be applied to real-world financial markets processes by deploying smart contracts on an actively traded asset class.”

— – Tim Grant, Managing Director and Global Head of R3’s Collaborative Lab

Although it is still unknown if the R3 consortium will continue the development of Ethereum products, the demand for Ether and value of the Ethereum network will continue to rise as long as banks and developers persistently create decentralized applications on the Ethereum network, which rely on Ether for financial settlement.

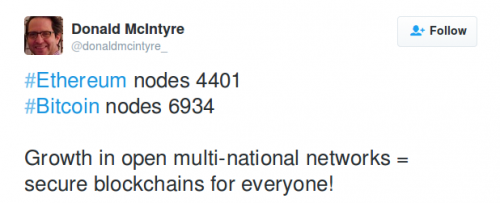

Due to the increase in the number of Ethereum developers and members of the Ethereum community, the node count of the Ethereum network has reached over 4,400, approximately 65% of the Bitcoin network’s node count.

Considering the explosive growth of the Ethereum network, Voorhees hinted that an Ethereum-focused customer service may be in the works, that will target BTC-Ether traders on the platform. The ShapeShift Ethereum service is most likely going to be introduced in the new ShapeShift user interface, that is currently on beta.

“We’ll continue working to make it as easy as possible for all blockchain assets to be convertible with Ethereum, via web or API. We’re working on improving contract support, and look forward to some more advanced Ethereum functionality.”

Don’t miss out – Find out more today

“ShapeShift demonstrated an entirely new way to think about asset exchange. It’s like Google Translate for digital currencies. We’ve known Erik for a while now and he’s knocked it out of the park with this one. We’re very excited about the partnership.”

“ShapeShift demonstrated an entirely new way to think about asset exchange. It’s like Google Translate for digital currencies. We’ve known Erik for a while now and he’s knocked it out of the park with this one. We’re very excited about the partnership.” “ShapeShift grew 1,000% in 2015. It has already grown another 1,000% in the first 2 months of 2016.”

“ShapeShift grew 1,000% in 2015. It has already grown another 1,000% in the first 2 months of 2016.”

“With the completion of this trial we have raised the bar significantly with the sheer number of global financial institutions, distributed ledger technologies and cloud providers working together in parallel to demonstrate how this nascent technology can be applied to real-world financial markets processes by deploying smart contracts on an actively traded asset class.”

“With the completion of this trial we have raised the bar significantly with the sheer number of global financial institutions, distributed ledger technologies and cloud providers working together in parallel to demonstrate how this nascent technology can be applied to real-world financial markets processes by deploying smart contracts on an actively traded asset class.”