US, UK or Asia – Where are all the blockchain startups?

After the launch of the blockchain angels startup tracker and the explosive growth of the tracker from 760 at launch, we now have 967 startups listed in the ecosystem tracker. In 6 weeks, over 200 new startups have been added. We hope to reach the milestone of 1000 blockchain startups by the end of July.

After the launch of the blockchain angels startup tracker and the explosive growth of the tracker, we now have 967 startups listed in the ecosystem tracker. In 6 weeks, over 200 new startups have been added. We hope to reach the milestone of 1000 blockchain startups by the end of July.

After the launch, we asked for feedback from investors, startups, incubators and media to guide the development of the product to make sure we added as much value to the community as possible. What we heard loud and clear was that the most important piece of missing data was location. So we decided to add the country and region for every one of the 967 startups in the tracker!

5 Trends in the Blockchain Ecosystem

1. UK second only to the US as global blockchain hub, will Brexit threaten this?

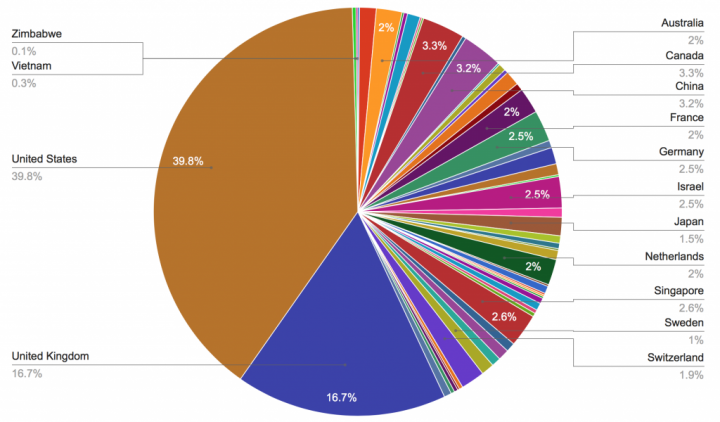

As expected, the blockchain market is dominated by the United States with 38.9% of the startups either registered or with development work taking place in the country. The second most important country is the United Kingdom with 16.7% of all blockchain startups based there. It will be interesting to see how Brexit impacts the blockchain industry; early feedback suggests investors see the weakening pound as an opportunity rather than as a cause to panic. That said, Berlin is already hard at work attempting to attract disillusioned tech talent to the city. Germany actually comes in joint 6th with Israel representing 2.5% of startups led by Canada in third place with 3.3%, China in fourth with 3.2% and Singapore in fifth with 2.6%.

2. The US has a heavy Bitcoin bias

When you dig below the surface, each country has a slightly different makeup of startups. The United States is heavily invested in Bitcoin. This is a function of entrepreneurs and investors being first to market before other alternative blockchains and use cases had been developed. Companies and products have been built around the Bitcoin blockchain, and as culture develops, it is harder for these companies to innovate and use resources to explore alternatives both culturally and practically. This explains why some of the most interesting Ethereum-based startups have based themselves in Europe, specifically the UK and Germany.

3. London is the centre of the Blockchain Fintech scene

The UK is, unsurprisingly, heavily-weighted toward blockchain use cases in FinTech. With 115 companies that we know of there is a lot of diversity but we do see a lot of companies building products around settlement and clearing, insurance and financial trading. The high regulatory barrier of financial services means that domain expertise is very highly valued, which limits the ability for say, a Bulgarian startup to come along with a blockchain solution and disrupt the industry. For that reason, we expect to see the UK to lead on FinTech and Insurance use cases, as talent, resource and funding are shared between startups and incumbents.

4. There is limited location clustering around use cases

Beyond London and financial services, however, the data does not show any clear sign of startups clustering in the same countries to solve the same problems. Use cases, such as supply chain and logistics, are being targeted by startups around the world, in Israel, Singapore, Italy and the United States for example. Internet of Things startups using the blockchain are based in Kenya, Germany, the UK and the US. Equally, there is diversity in the use cases being targeted in countries. German startups are exploring everything from data & analytics to financial services, to provenance & notary to social messaging. The reason for the lack of regional clustering could be either; the market is too nascent and clusters will emerge, or that physical clustering is a relic of the old industrial world without the Internet and zero marginal costs of communication and distribution. There is a case to be made for both positions.

Is this the end of clustering?

Clustering occurs when companies in the same industry move close together to benefit from economies of scale. Companies close together can benefit from a shared pool of talent, expertise, suppliers and customers. Modern clustering in the tech industry is usually around universities; Silicon Valley benefits greatly by being located close to Stanford. However, the blockchain, distributed systems, and cryptography courses are not taught widely at universities, at least yet. Blockchain talent to date has come generally speaking from hacker communities online. The industry is one of the first to grow from the Internet and therefore is inherently distributed. Networks are global, expertise is shared globally on GitHub, suppliers are cloud-based and distributed over the Internet, and customers can be anywhere in the World. Clustering no longer provides the economies of scale it once did.

Will clusters emerge in time?

The lack of clustering could be the result of a very nascent market with relatively few startups. Over the next few years, it is possible we will see the emergence of clusters. Berlin for decentralisation technologies, Tel Aviv for security, Singapore for supply-chain and London for insurance. While it is true that The Internet enables global knowledge sharing and distribution to billions of people, one area which isn’t global and borderless is; finance. Despite the potential of blockchain itself, right now finance is highly regulated, and national licenses are required to engage in lending. This means for a blockchain startup that needs to raise funding; they need to be located near VC’s and angel investors. This is why Silicon Valley, New York, London, Berlin and Singapore still attracts blockchain startups. Clustering still makes sense in the digital world, because finance, and specifically venture capital, is not, yet, digital although as we know the DAO and what follows are very much looking to realise this vision.

5. Location might not matter at all anymore

In undertaking this micro-exercise, we have uncovered a more macro trend. Not only is there very little regional clustering, but just as the blockchain itself is distributed so too are the teams working for blockchain startups. With 28%, startups with no HQ constitute the second largest grouping of blockchain startups and projects. Now, it is possible to hunt down the lead developers and figure out where they are physically located, but that is to miss the broader point. Companies building products from decentralised technologies are themselves decentralised and distributed around the world. It is common to see team members based in London, Thailand, Warsaw and Madrid.

This trend is interesting in the context of growing nationalism in the United States, France, the Netherlands and most obviously in the United Kingdom. We are seeing new industries being built without the constraints of national borders. The DAO is a clear extension of the rejection of location altogether, and despite initial setbacks, the experiment shows that future businesses could potentially be built completely in the global cloud. The people involved in blockchain businesses are broadly speaking some of the most globally mobile people on earth. They are the internationalists. They benefit from freedom of capital and movement. The companies are registered where it makes sense for tax purposes, Switzerland and Hong Kong, and teams and customers are based all around the world.

Is the blockchain startup scene stateless?

50 years ago a company would be registered, pay taxes, have workers and undertake all operations in the same country. Globalisation has peeled off each of these layers. Blockchain startups are some of the first post-Internet, post-mobile companies predicated on the assumptions of zero-marginal costs of communication and distribution. The company, staff and customers can all be based in different countries because of the Internet. Many blockchain startups are raising money and paying developers in Bitcoin and Ether, so they don’t bring money into the state environment and can avoid capital gains.

I posit, does it even make sense to ask where a company is based anymore? The answer for many in the blockchain community is ‘the Internet’. It’s interesting to think that while all talk is about Brexit and new trade deals that must be negotiated between countries, for blockchain startups the nation-state is increasingly irrelevant.

Lawrence Lundy is Head of Research and Partnerships at Outlier Ventures, Europe’s first dedicated blockchain venture builder.

Don’t miss out – Find out more today