Whaleclub: A look below the surface

Whaleclub Director of Operations, Petar Zivkovski, and Director of Partnership, Jessica Lee, took over operations of Whaleclub in October 2015, a year after TradingView members founded the club as only a real-time feed of bitcoin trade ideas, primarily from TradingView and the Teamspeak community. “Back then it was a much different product,” Lee explained in an interview, adding that it was merely “a simple bitcoin trade idea browser and social sentiment indicator with some basic demo trading features which catered well to the thriving bitcoin trader community.”

Whaleclub Director of Operations, Petar Zivkovski, and Director of Partnership, Jessica Lee, took over operations of Whaleclub in October 2015, a year after TradingView members founded the club as only a real-time feed of bitcoin trade ideas, primarily from TradingView and the Teamspeak community.

“Back then it was a much different product,” Lee explained in an interview, adding that it was merely “a simple bitcoin trade idea browser and social sentiment indicator with some basic demo trading features which catered well to the thriving bitcoin trader community.”

Prior to Zivkovski and Lee assuming control, Whaleclub already had a few tools for traders; Whaleclub Signals launched in February 2015, allowing traders to open demo long and short positions based on a real-time price feed; Whaleclub Fantasy Trading was released in September 2015, where traders could paper trade in a fully realistic trading simulator. The Club held their first trading contest in July 2015, attracting 500 traders. The top five were paid over US$1,000 in bitcoin.

“We were impressed by the growth and community that developed around Whaleclub and we thought we can bring in the expertise to build a secure and reliable trading platform, powered by bitcoin, to serve the bitcoin trader community […] Our first project was a full-featured bitcoin trading simulator (demo trading).”

— – Zivkovski and Lee

With Zivkovski and Lee on board, Whaleclub is now wholly owned by Whaleclub Limited, a Seychelles company with headquarters in Hong Kong.

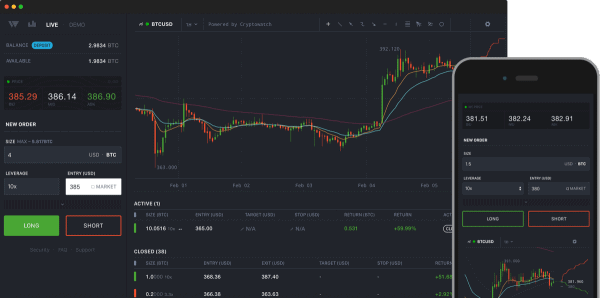

“Our goal is to make trading extremely easy and painless for our customers, and that’s achievable thanks to bitcoin,” Zivkovski said. “We believe the most unique aspect of Whaleclub is the trading experience.”

The duo got straight to work testing a new bitcoin only margin trading platform. Zivkovski revealed, “We try to focus on long-term performing currencies,” explaining the focus on Bitcoin. The team has plans to offer forex and equities trading using bitcoin in the future.

In January, the Club launched the service to over 7,000 traders in the club’s database, from over 160 countries. In February, the platform executed over 100,000 trades, with a total volume exceeding US$10 million.

Opening a Whaleclub trading account does not require any personal identification information, such as bank account or credit card, since everything is done in bitcoin and not linked to fiat currencies. “It’s strict company policy to never touch political currencies, so we don’t touch banks,” Zivkovski explained.

Once the account is verified by email, users can start using the demo trading platform straight away. Live trading can be done following a bitcoin deposit.

As with any third party bitcoin service, relinquishing control of your private keys introduces risk. Private keys to bitcoins held by Whaleclub are stored offline in cold wallets. According to the Whaleclub website, Funds are distributed over a global network of storage vaults, so that a single security breach cannot lead to a catastrophic loss: "Our keys have been GPG and AES-256 encrypted and replicated at max-security locations.”

There is no deposit or withdrawal limit imposed by the service provider. The only restriction is a 20 bitcoin maximum for an active position, which they hope to increase in the near future. Withdrawals are processed manually “through a standardized, checklist-based procedure,” usually once a day.

Limit, market, stop, and take-profit order types are all supported. Zivkovski explains that traders have used Whaleclub to hedge, scalp, and swing trade. “Virtually every type of strategy can be implemented,” he added. The only exception is automated strategies that require an API, which they do not currently provide.

“We offer advanced order types for advanced traders; a simple, intuitive user experience for new traders; spreads and volatility that cater to scalpers, swing traders, mid-term and long-term traders; and the option to go long and short at the same time with different position sizes which caters to hedgers.”

— – Zivkovski

All Whaleclub trades are matched and settled internally in bitcoin, so Whaleclub’s exposure is either nonexistent or very small. Long and short trades generally cancel themselves out, Lee explained. However, excessive exposure is hedged with liquidity providers, which are currently Bitfinex and OKCoin. “Most of the liquidity is actually internal to Whaleclub,” she added, emphasizing little need for outside liquidity.

One particular strength of the Whaleclub platform is that orders are executed fully within 500 milliseconds, and there is no slippage or partial execution, Zivkovski states. Market orders are executed at the best price available, while limit, take-profit, and stop orders are settled at the price specified by the trader.

Zivkovski describes how market orders executed at multiple prices, due to low liquidity, and partially executed limit orders account for “some of the largest sources of losses for traders.” Partial execution can take the investor by surprise and can be even more costly if there are fees per trade.

Trading platforms, such as Kraken or Bitfinex, have partial execution clauses in their Terms of Service. As the largest Bitcoin exchange in euro volume and liquidity, Kraken states that "an order may be partially filled or may be filled by multiple matching orders."

“On your trading dashboard, what you see is exactly what you get. If you see your active position’s return at +5% and you click ‘Close’ to take profit, you’ll receive exactly +5% return – unlike other platforms where you click close on a +5% position and you receive a smaller return due to fees, slippage, and poor execution.”

— – Lee

According to Lee, having zero fees on order executions, positions, balances, inactivity, and deposits sets Whaleclub apart from other trading platforms.

Many bitcoin trading platforms use the maker-taker fee model where market makers receive reduced fees for providing liquidity to the market takers. This payment model originated in the late 1990s. Island Electronic Communication Network (ECN) became one of the first markets to adopt the model, in 1997, and it’s now used by many large exchanges.

One of the largest cryptocurrency trading platforms, Bitfinex, for example, charges 0.100% maker fees and 0.200% taker fees for all trades less than $500,000.

“Maker fees are paid when you add liquidity to our orderbook, by placing a limit order under the ticker price for buy and above the ticker price for sell. Taker fees are paid when you remove liquidity from our orderbook, by placing any order that is executed against an order of the orderbook.”

— – Bitfinex

The largest Bitcoin exchange by Euro volume and liquidity, Kraken, charges more for smaller-size trades, starting at 0.16% maker fees and 0.26% taker fees for trades less than $50,000 but charges the same as Bitfinex for trades between $250,000 and $500,000 in volume.

WhaleClub also offers leverage. 10x, 5x, and 3.3x are available, or traders can simply trade without. There is a pro-rata 0.2% daily interest is charged on your active positions. Kraken currently offers up to 5x leverage while Bitfinex allows up to 3.3x leverage.

“Leverage allows you to open a larger position with a smaller amount of funds. For example, if you open a $5,000 position in XBT/USD with 5:1 leverage, only one-fifth of this amount, or $1000, will be tied to the position from your balance. Your remaining balance will be available for opening more positions. If you open this same position with 2:1 leverage, $2,500 of your balance will be tied to the position. If you open with 1:1 leverage, $5,000 of your balance will be tied to the position.”

— – Kraken

There are exchanges that offer very high leverage. BitMex, for example, offers up to 100x leverage for a maker fee. However, fees are usually hefty for high leverage. For bitcoin margin trading for 25-100x leverage, BitMex charges a maker fee of 0.025% and taker fee of 0.075% with settlement fee of 0.05%.

Explaining the math without naming any particular exchanges, Lee said that a 0.05% fee for access to 100x leverage is equivalent to 5% fee per trade which “sets customers up for long-term loss.” The club makes its commission from the spread. “Our goal is to keep lowering spreads and interest as we scale,” states the website.

Trading performance on the WhaleClub platform can be tracked in real-time Reports that include more than 80 metrics, including Sharpe ratio, performance graph, win-loss ratio, are automatically generated, Lee explained. Users are also ranked, based on their trading performance. The top ~100 are shown on the website.

Whaleclub trading is available globally, except in the State of New York. “This stance is stricter than most global bitcoin exchanges and similar to the one adopted by Bitfinex,” Lee admits.

New York is home to the infamous BitLicense. When the BitLicense came into effect, in June 2015, Bitfinex stopped offering certain services to New York residents, margin trading among them. "New York Residents cannot use cryptocurrencies as collateral on margin positions," BitFinex announced at the time.

While over 7,000 traders have found Whaleclub trading platform useful, margin trading of any kind can be very risky.

“Margin increases investors’ purchasing power, but also exposes investors to the potential for larger losses.[…] Margin accounts can be very risky and they are not appropriate for everyone.”

— – U.S. Securities and Exchange Commission (SEC)

Disclaimer: While Brave New Coin is a Whaleclub partner, providing technical analysis on a weekly basis, the author has no vested interest.

Don’t miss out – Find out more today

“We were impressed by the growth and community that developed around Whaleclub and we thought we can bring in the expertise to build a secure and reliable trading platform, powered by bitcoin, to serve the bitcoin trader community […] Our first project was a full-featured bitcoin trading simulator (demo trading).”

“We were impressed by the growth and community that developed around Whaleclub and we thought we can bring in the expertise to build a secure and reliable trading platform, powered by bitcoin, to serve the bitcoin trader community […] Our first project was a full-featured bitcoin trading simulator (demo trading).”

“Maker fees are paid when you add liquidity to our orderbook, by placing a limit order under the ticker price for buy and above the ticker price for sell. Taker fees are paid when you remove liquidity from our orderbook, by placing any order that is executed against an order of the orderbook.”

“Maker fees are paid when you add liquidity to our orderbook, by placing a limit order under the ticker price for buy and above the ticker price for sell. Taker fees are paid when you remove liquidity from our orderbook, by placing any order that is executed against an order of the orderbook.” “Leverage allows you to open a larger position with a smaller amount of funds. For example, if you open a $5,000 position in XBT/USD with 5:1 leverage, only one-fifth of this amount, or $1000, will be tied to the position from your balance. Your remaining balance will be available for opening more positions. If you open this same position with 2:1 leverage, $2,500 of your balance will be tied to the position. If you open with 1:1 leverage, $5,000 of your balance will be tied to the position.”

“Leverage allows you to open a larger position with a smaller amount of funds. For example, if you open a $5,000 position in XBT/USD with 5:1 leverage, only one-fifth of this amount, or $1000, will be tied to the position from your balance. Your remaining balance will be available for opening more positions. If you open this same position with 2:1 leverage, $2,500 of your balance will be tied to the position. If you open with 1:1 leverage, $5,000 of your balance will be tied to the position.” “Margin increases investors’ purchasing power, but also exposes investors to the potential for larger losses.[…] Margin accounts can be very risky and they are not appropriate for everyone.”

“Margin increases investors’ purchasing power, but also exposes investors to the potential for larger losses.[…] Margin accounts can be very risky and they are not appropriate for everyone.”