BlackRock and Coinbase combine for a blockbuster Bitcoin ETF application

Bitcoin has reached new highs for 2023, breaking above $30,000 with strong momentum coming from news of BlackRock’s Bitcoin ETF application. The BlackRock ETF is given good odds of being approved, this article looks at why.

A rocket has been tied to the Bitcoin price in the last week. Bitcoin bulls have ridden this wave to price levels above US$30,000. Since news of financial management behemoth BlackRock’s Bitcoin ETF application became public, the price of BTC has risen by ~20.7%, from around US$25,000 to above US$30,500. Bitcoin has recently touched new highs for 2023, breaking the US$30,000 price level with conviction. This has been a key resistance level all year.

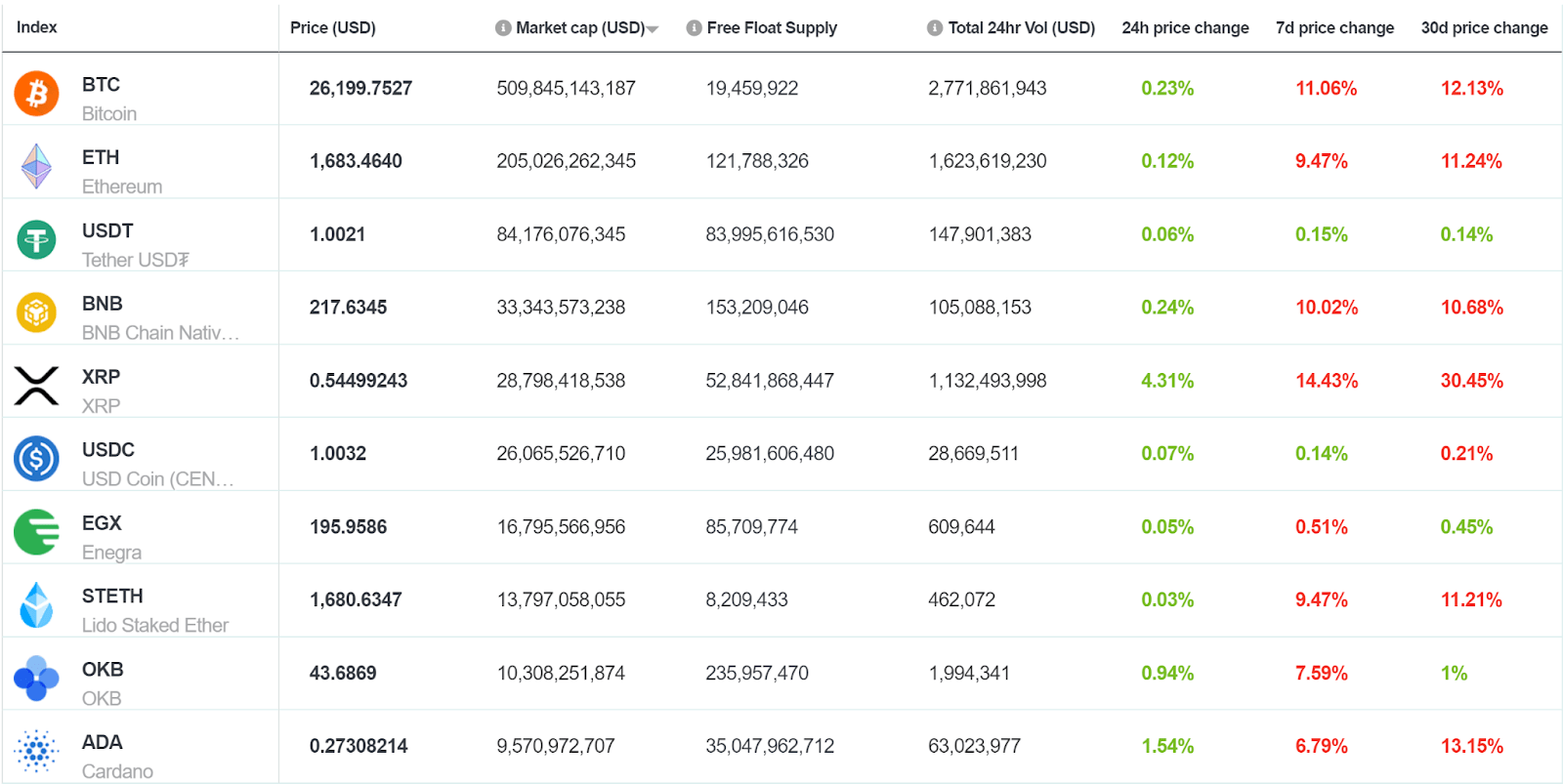

Source: Brave New Coin

What Is A Bitcoin ETF?

An ETF or exchange-traded fund is an investment vehicle that tracks the performance of a particular asset or group of assets. A Bitcoin ETF will track the price of BTC, the largest crypto asset by market capitalization. The advantage of a Bitcoin ETF is that it will allow investors to buy into the ETF, and therefore gain exposure to Bitcoin price action, without having to buy and custody the asset itself.

Speculation around whether a Bitcoin ETF would be approved has been a key driver of price action since the first applications began in 2013. Since then, asset managers including Van Eck, Ark Invest, Bitwise, and Grayscale have all had their applications rejected. In total, over 30 previous applications for Bitcoin spot ETFs have been denied.

Immediately before the filing of the financial product, the price of Bitcoin was hovering around US$25,000 before receiving a leg-up to push it to higher heights over the weekend. Optimism around the filing of a spot Bitcoin ‘ETF’ by asset management giant BlackRock is not unfounded. There are signs that the BlackRRock ETF is different and has the potential to finally open the door for BTC to become investable to as wide an audience as possible.

According to the U.S. Securities and Exchange Commission (SEC), BlackRock has $8.6 trillion of “assets under management” (AUM), as of December 2022. BlackRock is sometimes known as the ‘company that owns the world’. It is considered to be one of the Big Three index fund managers alongside Vanguard and State Street.

BlackRock’s portfolio is extensive and touches nearly every major industrial sector in the world, it has enormous equity positions in Apple, Microsoft, and Nvidia to name a few. Its advanced trading algorithm called Aladdin, has shaped the world of trading over the past three decades. Vanguard and BlackRock are the top two owners of Time Warner, Comcast, Disney, and News Corp, together they own ~90% of the US media landscape. There is a feeling that what BlackRock wants, BlackRock gets.

The new BlackRock product is technically a trust, however, many experts suggest it will have the same functionality as an investor would expect a Bitcoin Exchange Traded Fund (ETF) to have. Senior ETF analyst at Bloomberg Eric Balchunas described the BlackRock Bitcoin trust as the ‘real deal’.

The BlackRock ETF, for example, is different from products available today such as the Grayscale Bitcoin trust. While the Grayscale Bitcoin product is only available to institutional investors and has to be purchased Over-The-Counter (OTC), the BlackRock product will be available to retail investors and will be listed on major ETF exchanges.

While some observers on Twitter have said that the BlackRock product is a trust and the market excitement is overwrought, Balchunas says the BlackRock product, while technically a trust will be considered an ETF by most investors. He said many structures fall under the ETF definition umbrella. He compares it favorably to SPDR’s Gold Trust, which in most investment circles is considered an ETF and at various points was described as the largest ETF in the world.

In further tweets he backed the BlackRock BTC trust for approval, pointing to BlackRock’s impressive 575 to 1, approval vs decline ratio when making filings with the SEC.

Why a BlackRock Bitcoin ETF might be approved

Balchunas says the BlackRock filing has breathed new life and optimism into the BTC ETF race.

In a Twitter thread from 2019 following the rejection of a Bitwise ETF, Balchunas explained the SEC’s thinking at the time. The agency’s primary concerns have been market manipulation and oversight. There are signs that progress has been made in these areas.

It is thought that BlackRock’s Bitcoin Trust application has a better chance of approval by the SEC than all other applications to date. That’s because of a “surveillance-sharing agreement” between exchanges.

On page 36 of the 19b-4 filing, it says that to avoid market manipulation, BlackRock and the Nasdaq will enter into a surveillance-sharing agreement with an operator of a spot trading platform for Bitcoin. This is said to be Coinbase.

This could finally satisfy the SEC, that the ETF can function without market manipulation, a charge it has used to deny previous Bitcoin Spot ETF proposals.

Is BlackRock going to succeed where all others have failed? The current regulatory environment remains uncertain but the Wall Street giant has the best shot yet. We’ll know early next year, about one month before the halving. If they succeed, expect Bitcoin fireworks.

Following BlackRock’s application, filings for a spot-style Bitcoin ETF have been made by WisdomTree, Invesco, and Bitwise. These filings were also accompanied by rumors of a planned filing by traditional finance giant Fidelity. There is an extra layer of intrigue to the Fidelity rumors because it is said the ETF application plan will include a purchase of major digital asset manager Grayscale.

Another eye-catching element of the BlackRock ETF application is the firm’s historic disinterest in the asset and asset class. BlackRock CEO and founder Larry Fink, in 2018, stated that his clients had "zero interest" in trading cryptocurrency. In 2020, his tone towards BTC somewhat softened, he said, describing Bitcoin markets — “Still untested, pretty small market relative to other markets,” he said. You see “these big giant moves every day (in bitcoin)… it’s a thin market. Can it evolve into a global market? Possibly,” he added.

If the BlackRock application is approved, Coinbase Custody will serve as the custodian for the Bitcoin that will be held to secure the ETF. Coinbase Custody is a service offered by mega exchange Coinbase. The Coinbase Custody Trust Company is a fiduciary under New York state banking law and a Qualified Custodian. It is designed to offer institutions a safe offline (cold) storage solution. Coinbase explains that its custody solution combines physical security, consensus computation, and strict process controls.

Why the (spot) Bitcoin ETF is considered the holy grail

While a spot BTC ETF has never been approved, a Bitcoin Futures ETF, however, has already been approved.

The launch was viewed as a significant step in the legitimization of the crypto asset industry. It has opened the door to an eventual pathway for the wider American investment community to invest in Bitcoin.

Eventually, the SEC reached a concession with asset managers in 2021 when ProShares launched the ProShares Bitcoin Strategy Exchange Traded Fund (ETF) for trading on the NYSE Arca. This was the first Bitcoin ETF to be approved for trading in the United States. The ETF trades under the ticker BITO. The ProShares ETF is a futures-based product that tracks the price of Bitcoin CME Futures. The regulated CME BTC futures were considered a more digestible instrument to base security on than spot bitcoin.

Upon opening for trading, it broke the record for the largest day-1 ETF launch ever by natural volume. BITO assets under management (AUM) hit US$1.1 billion after its 2nd day of trading, making it the fastest ETF to get to $1b, breaking an 18-year-old record previously set by gold by one day. The fund’s price rose to $41.94 at the close of trading, up 4.9% from the initial $40 net asset value. Demand in the United States to gain exposure to BTC is clear.

Any futures Bitcoin ETF product, however, is imperfect because of factors like Contango, which is why the market has waited patiently for a spot Bitcoin ETF. An ETF based on futures can create problems when markets are in a state of Contango, a situation where the futures price of an asset is higher than the spot price of an asset.

Issues may arise for Bitcoin Futures ETFs because the funds will need to renew or “roll” their futures contracts that back the ETF shares regularly. If the price of the longer future contract that is being rolled into is higher than the price of the expiring contract, the ETF issuer needs to pay the difference between the two contracts. Meaning they have to bear a loss known as the Contango bleed. There is often a price difference between the BTC spot price and BITO.

Source : TradingView, the BLX, CBOE

The Candlestick chart represents the spot for Bitcoin (the BLX) while the orange line represents the BITO futures prices. As evidenced by the chart, the BITO ETF has been trading at a significant discount to the spot price of BTC.

The spot BTC ETF is far more likely to move close to the market price as opposed to the futures ETF because it does not need to deal with a roll. Given the vociferous response to the futures Bitcoin ETF, the positive expectations for the spot bitcoin ETF are unsurprising.

Conclusion

The possible approval of BlackRock and Coinbase’s Bitcoin ETF application is being anticipated as a paradigm shift that will mark a significant milestone in the cryptocurrency industry.

If approved, it will introduce a trusted, secure, and accessible way for retail investors to gain exposure to Bitcoin’s price action, potentially driving a broader adoption of cryptocurrency. Despite historic skepticism towards crypto, this BlackRock application illustrates a growing recognition of Bitcoin’s value and legitimacy within mainstream finance. A firm of BlackRock’s influence has never made such a strong play in the realm of Bitcoin ETF applications, this one feels different.

As Bitcoin continues to deepen its relationship with traditional financial structures, its net of participants becomes wider, likely to lead to future price gains.

The BlackRock application can be read here.

Don’t miss out – Find out more today