Gnosis Price Analysis: Bearish for now with long term potential

After accumulating a sizable war chest during its ICO and enjoying strong speculation backed gains during the 2017 bull run, the Gnosis project has yet to capture a significant user base - but continues to push forward with updates that spark long term interest.

Gnosis (GNO) is a decentralized, open source prediction market protocol built on the Ethereum blockchain. Along with Augur, another early mover in the decentralized prediction market, Gnosis is one of the most high profile projects building on Ethereum. The alpha version of Gnosis was one of the first major Dapps to launch on Ethereum, releasing in August 2015.

In late April 2019, Ethereum founder Vitalik Buterin singled out decentralized prediction markets as a leading Ethereum use case to Tesla CEO Elon Musk. The founder of Ethhub.io, popular Ethereum community member Eric Conner, recently joined Gnosis to support product development and community engagement. Gnosis was also one of the first Consensys partners.

Gnosis is built with three distinct development layers. The core layer contains smart contracts for events, outcome tokens, settlement, and market mechanisms. There is a small charge to users interacting with this layer when performing operations like purchasing shares on event outcomes from market makers. The service layer hosts user experience tools like chatbots, stablecoins and oracle platforms. This layer assists the delivery of Dapps built around the core Gnosis solution. The application layer hosts front-end Dapp solutions that leverage the core and service layer services. While Gnosis does build some of these, primarily, it drives third parties to build applications.

Gnosis applications include decentralized exchange DutchX and wallet solution Gnosis Safe.

The ecosystem is built with two types of tokens: Gnosis (GNO) and OWL. GNO is an ERC20 token that the team sold during its ICO. A supply of 10 million GNO was created during genesis. The GNO token is tradable on exchanges and acts as a network access token. GNO’s only utility within the Gnosis Ethereum ecosystem is generating OWL tokens.

When users pay fees on Gnosis apps with non-native tokens (other ERC-20s) GNO is burnt by the central Gnosis foundation which buys back GNO from the market. The GNO ICO was run as a Dutch style auction in April 2017. It raised USD 12.5 million in under 10 minutes with the Gnosis team holding onto 95% of the tokens. These tokens are locked. The team has told its community that they will give 3 months notice if and when they decide to sell them.

Because GNO is tradeable on exchanges, it also has value as a vehicle for making speculative trades based on market conditions and sentiment surrounding the Gnosis platform. Gnosis’s connection to key Ethereum influencers has been a factor in the GNO multi million dollar market cap.

Travis Kling, Chief Investment Officer of Ikigai Capital said, “Owning Ethereum today is a call option on what you think the network is going to be in the future.” Similarly, while most GNO buyers are likely looking to realize short term profits, some are buying and holding GNO with expectations of future use cases as the platform grows and matures.

GNO currently trades at ~$14.6. The price of the token has fallen ~9% in the last 7 days and ~11% in the last month. It has a market cap of ~USD 16.2 million and sits on the 206th position on Brave New Coin’s market cap table.

Daily trading volume has fallen over the course of the last month and is presently less than 100,000 USD across exchanges. This reduced amount of trading suggests a break out possibility is limited. GNO is down ~ 51% on its ICO price ($30) and ~96% from an all time high price hit in early January 2018.

Network participants can stake GNO to receive OWL tokens. The GNO, once staked, is locked into a smart contract. The amount of OWL received has been dependant on the amount of GNO locked, time allocated, and the total current supply of OWL in the market. OWL is worth USD 1 in transaction fees on select Gnosis apps, acts as a liquidity provision tool on DutchX, and is integrated into fee payments on smart contract based wallet Gnosis Safe. As per etherscan, there are currently 3,796,356 OWL in circulation held by 77 addresses.

The first OWL generation event occurred from June to July 2018. The Gnosis team is seeking to expand the number of OWL circulating in the ecosystem in the near term. There is currently an OWL generation event ongoing. It began on the 16th of April and ends on the 22nd of May. 2 OWL will be allocated for every 1 GNO staked during the event, independent of when the GNO is staked. OWL will be immediately credited once staked and the GNO is locked until the 22nd of May at which point it becomes unfrozen.

The advantage of a two-token system for Gnosis users, with one token as a platform’s native stablecoin, is stable and deterministic fees. Gnosis Dapp users can set OWL aside for transaction fees on Gnosis Dapps knowing that the price of these tokens (US dollar) are likely to be unaffected by volatile crypto markets. The staking model and knowledge of upcoming OWL generation events may also help cull some selling pressure of GNO by encouraging hodling.

Core Gnosis solution

The Gnosis prediction model works with a smart contract that lets parties purchase shares or tokens that represent event outcomes. The price of these event outcome tokens changes depending on the likelihood of the connected event occurring.

For example, a user registers an event like ‘Will the UK vote yes on the Brexit referendum?’ This market may be built with three outcomes: ‘Yes’, ‘No’, or ‘result delayed’ (markets need to be built to ensure all possible outcomes are covered). When the vote market first opens, the ‘No’ outcome may be the most popular because of the perceived negative economic implications tied for the UK to a ‘Yes’ vote to the Brexit referendum. ‘No’ tokens rise in value initially and observers will likely rush in to buy them, however, if because of strong PR campaigns and social polls, it appears more likely that a ‘Yes’ or ‘result delayed’ outcome is possible prices of tokens across the outcome are likely to even out.

For buyers of event outcomes, there are two ways to realize profits from participation. Either by correctly earning a pay out once an oracle reports the event outcome after it has been determined, or by trading before the event is completed based on sentiment shifts. Rewards on Apollo, one of Gnosis’s decentralized betting platforms can be set to a number of different ERC-20 tokens like GNO or OMG.

The Apollo platform built on top of Gnosis acts as one of the core decentralized prediction trading markets, and works based on the token outcome trading model. A version 2 of the Apollo platform is set to be released in the near future and will add Conditional token trading, which lets users double up and hedge on predictions by packaging related conditions, other event outcomes, into their trades.

Gnosis, Augur, and other decentralized prediction protocols are closely monitored by the crypto space. They have created value because they have built infrastructure that seeks to utilize the ‘wisdom of the crowd’ effect. This is the phenomenon in which the collective of a group of people is more accurate than that of one expert. A prediction market is simply a group of traders who make trades with a pay-out dependent on a future event outcome. Taken to its logical conclusion, decentralized prediction markets have the potential to produce a tool for absorbing the world’s information. This would lead to better decisions and greater efficiencies in many different areas of society.

Gnosis, more than other decentralized prediction projects, may be building more infrastructure, via peripheral apps, to utilize the wisdom of its user community (crowd).

Gnosis differentiates its core model from rival platform Augur in several ways. Augur uses its native REP (Reputation) token as a staking tool for public oracles to ensure they maintain integrity. Gnosis uses a combination of on-chain oracles, centralized off-chain oracles, and decentralized off-chain oracles to resolve its prediction markets. During an interview in 2016 Gosis co-founder, Martin Köppelmann, described the thinking behind this design choice.

“While Augur uses many oracles to determine the outcome of an event, Gnosis uses a mechanism whereby only one or a few oracles provide the outcome, a feature they say will lead to faster validation.”

The Gnosis team has also stated that it will use state channels to achieve higher levels of scalability than would be possible with fully on-chain settlement.

Another major point of difference is Gnosis focuses on being a Dapp development platform to build applications (products and services) that utilize the decentralized ‘wisdom of the crowd’ phenomenon, like the DutchX DEX and the Gnosis Safe free Ethereum multi-signature wallet. Augur does not have plans to build any extended products and services.

Source: Stateofthedapps.com

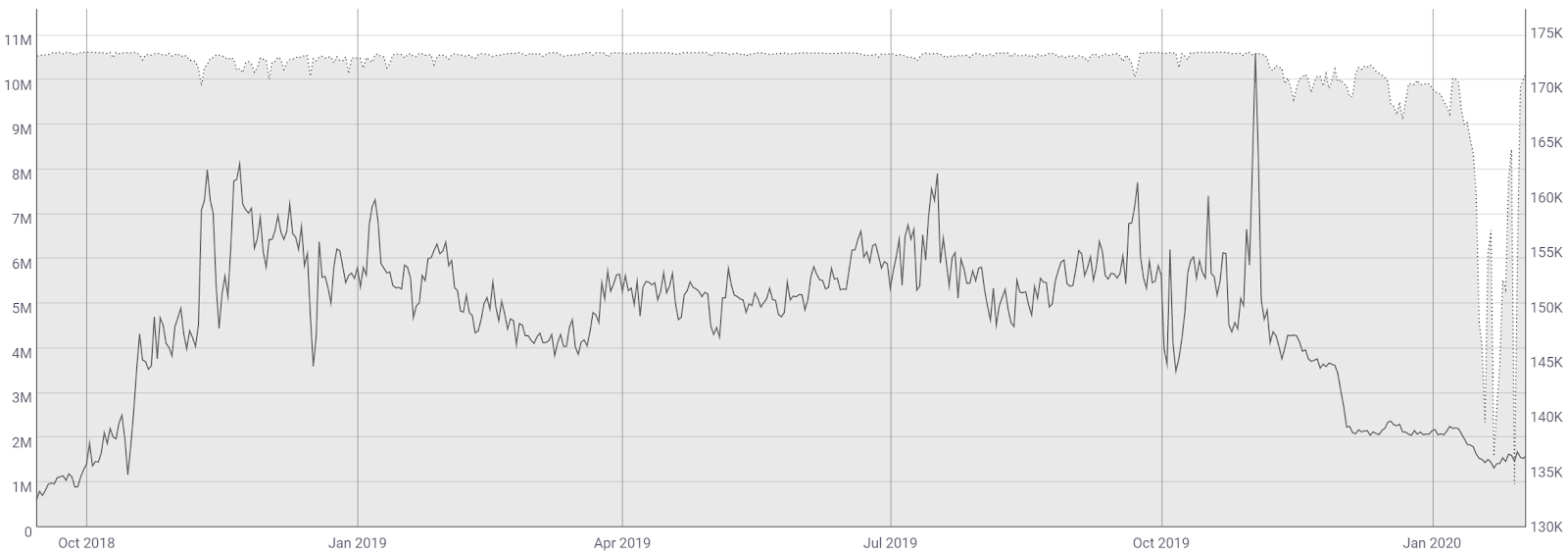

StateoftheDapps.com tracks the primary Gnosis smart contracts as an Ethereum Dapp and it indicates a slight downward trend in both the number of active users and transactions over the course of the last month.

Gnosis is currently listed as the 132nd most popular Dapp in the ecosystem and has averaged ~12 active users a day over the last month and ~34 transactions.

Gnosis applications

Beyond the core prediction trading market platforms, Gnosis has been used to build applications like Decentralized exchange DutchX. DutchX is an Ethereum ERC-20 exchange that runs based on a dutch auction model.

Initially a user submits a pair like ETH/GNO. Traders then have a choice to act as askers or bidders. It needs to be determined upfront that enough askers are willing to participate (sell) to run a functioning market, in this example enough willing to sell ETH for GNO.

Once a threshold of askers is met, a dutch auction starts with an initial price two times the most recently listed market price of the pair (Oracle reported). Price then continuously falls, hitting the recently listed price after six hours, and 0 after 24 hours. At any time during this period a bidder can commit to buy ETH for GNO at the current auction price or higher, once enough bid volume is hit to match all of the ask volume, the market closes with the price at the time. Everyone receives tokens at this same set price.

The DutchX model essentially utilizes the ‘wisdom of the crowd’ phenomenon to determine a fair price for a crypto trading pair. This may differ significantly above or below the price of the pair on traditional orderbook based exchanges.

DutchX is clearly built using idiosyncratic trading infrastructure and its tagline of being the world’s first truly decentralized exchange may be true to an extent. Market reaction has been muted and public trialing of the platform has been minimal.

Source:Dappradar.com

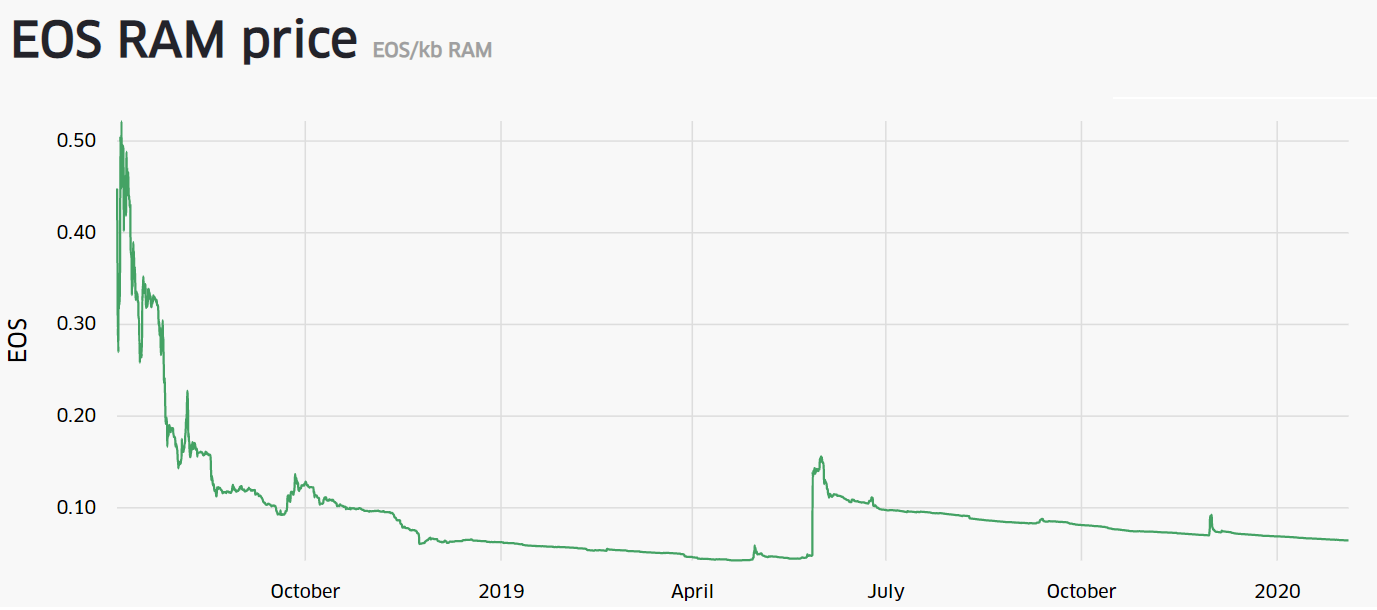

The number of users on the DutchX platform maxed out at 34 in early March, an objectively low number for an exchange. On most days this year the number of traders on DutchX has ranged between 4-12, and there have been 22 total active users on the platform in the last week. DutchX is listed 271st most popular Dapp in the crypto ecosystem and the 25th most popular within the ‘decentralized exchange’ category.

Both DutchX and Apollo likely suffer from the chicken and egg problem which occurs whenever the value proposition of two separate groups is dependent on penetration in the other. With DutchX the number of askers drives the number of bidders (market makers) and without bidders available, traders are not willing to create orders. This means that DutchX’s two sided marketplace solution has likely faced challenges achieving scale. The trading app cannot benefit from the ‘wisdom of the crowd’ if there is no crowd.

A Gnosis App that has been appreciated by the Ethereum community is its free, multi-purpose wallet solution, Gnosis Safe. Gnosis Safe runs entirely on smart contract and doesn’t use the more common Externally Owned Account (EOA) model that other Ethereum solutions use. This means users of the wallet have access to a number of logic functions that extend the wallet’s functionality.

Gnosis Safe features a multi-factor authorization solution (web browser extensions and mobile authorization) and advanced password recovery solutions. Because Gnosis Safe is a smart contract based solution, users do incur gas fees for transactions, and as mentioned earlier Gnosis Safe transaction fee payments are integrated into the OWL payment model.

Gnosis vs other free Ethereum wallet solutions

Network activity

Derived from the NVT ratio (Network Value to Transactions), the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. It is akin to the price/earnings ratio signals used in traditional equity markets. Crypto markets are prone to bubbles of speculative purchasing that are not reflective of underlying network performance and activity. The NVT signal is a tool to assess drivers of these patterns.

The NVT signal provides some insight into what stage of a price cycle a token is at. A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, as market speculation runs out of steam.

Source: Coinmetrics.io community data

The NVTS (NVT signal) of Gnosis is historically high, ranging between 200-800 points for most of the token’s existence. A triple digit NVTS is often a sign of a digital asset that has derived much of its value through speculative trading, as opposed to tangible onchain usage of its product/application. This may be natural for a token like GNO because of the radical nature of the decentralized prediction market model.

In recent times, the NVTS of GNO has ranged between 200-350 points. This is in between a historically oversold inflection point of around 100 points and an overbought inflection point that has in the past been between 500-800 points. This suggests that unless day-to-day Onchain volume levels increase or decrease sharply, on-chain volume as a fundamental factor is unlikely to be a significant driver of price activity in the near term.

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Source: Coinmetrics.io community data

Similar to on-chain volume indications, based on PMR signals, GNO has derived most of its external value through speculation as opposed to active address/user growth and organic network effects. On most days in 2019, there have been fewer than 50 active GNO addresses. It can be noted that GNO has limited on-chain utility however the lagging levels of address activity may imply low interest to buy into the Gnosis ecosystem.

Historically, GNO hitting an oversold floor of ~6 points preceded a period of strong price performance. Therefore, if PMR drops to these levels this can be considered a bullish fundamental flag, it currently sits at ~9 points.

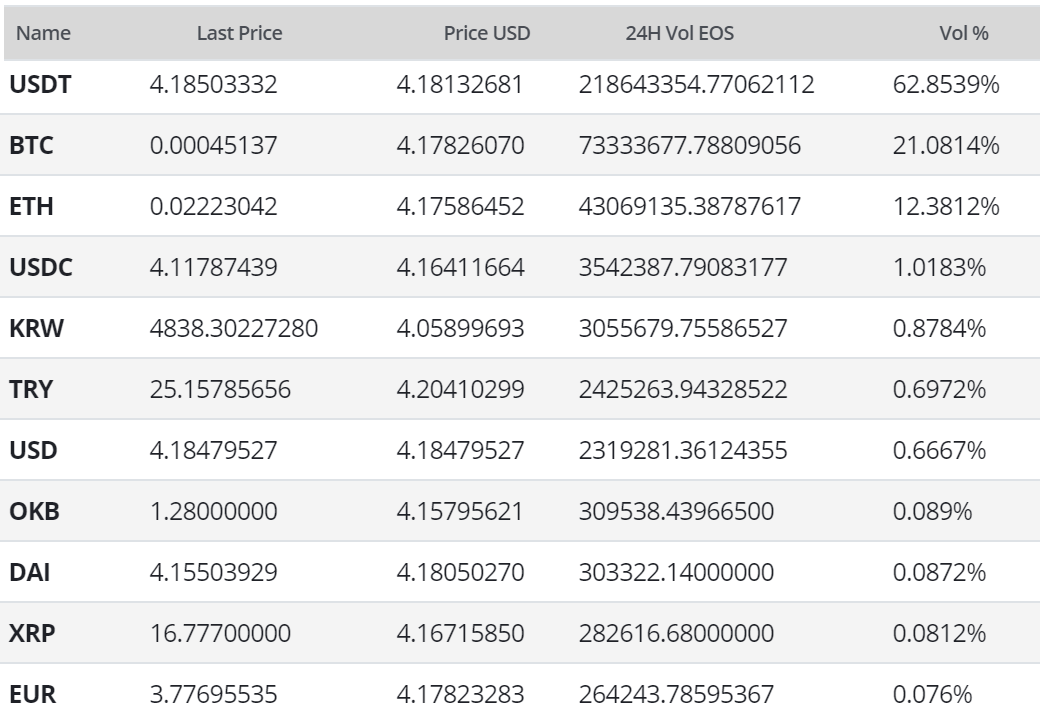

Exchanges and trading pairs

The most popular trading option for GNO is BTC with the pair handling close to 39% of daily trading volumes. The second most popular market is the GNO/USD pair. Together the top two pairs make up over 60% of daily trading volume. The GNO pair is the next most popular. Fiat transactions with GNO are also available in Euro and Korean Won fiat options. The USD value of daily volume of the entire GNO trading market is just ~USD 67,000.

Markets on the US based Kraken exchange dominate the GNO trading ecosystem, with four pairs in the top 5 exchange. The GNO/BTC, GNO/USD, GNO/EUR and GNO/ETH markets on Kraken currently handle over 76% of daily trading volume. GNO is also tradeable on visible and trusted exchanges such as Bittrex and IDEX.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, GNO has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.85 (not shown), which has allowed a death cross to persist since 2018. Currently, price is beneath both the 50 and 200 day EMAs, and the 50 day EMA is currently acting as resistance near $14.40.

Additionally, on the 1D chart, price bounced off the 1.0 Fibonacci retracement level of $18.87 twice. Since then, price has steadily declined with the 0.382 Fibonacci level of $13.39, currently holding as support.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0 with a positive trend still intact, which is positive for price. The maintenance of buying volume may enable GNO to bounce off the 0.382 level support before once again climbing higher.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is in the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below price and above the Cloud.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price originally completed a Kumo breakout in late-February 2019. Since then, price has struggled to maintain it, despite still technically being intact. Price has bounced off Cloud support twice since the original breakout (arrows), and is currently sitting at Cloud support.

There are a combination of potentially positive factors for GNO:

- Cloud support coincides with Fibonacci support

- VFI is still in the bulls’ favor

- RSI is currently at an acceptable level of 41.

If history repeats itself and the breakout holds, price is expected to retest prior resistance of $17, with possible future targets of $18 and $20. If the breakout does not hold, support levels are $13.20, 11.82, and 10.81.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is mixed: price is touching the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span above the Cloud and touching price.

The slower settings yield similar results with price currently sitting at Cloud support, with similar price targets and support levels.

Conclusion

The Gnosis platform has achieved momentum and won over some influential fans within the Ethereum community while building its infrastructure and diverse product suite. Its solutions, however, appear to have gained little traction with users and consumers. On-chain user and transaction activity is very low. It also appears to have fallen out of favour with traders, current trading volume suggests few buyers in the near term.

Long term signals, however, may lean positive. New products like the Olympus trading market platform are set to be released soon, while existing products like Gnosis Safe continue to be updated. Gnosis is a two-sided marketplace, and both sides may grow quickly if the right solution captures user attention.

The recent technical indicators for GNO favor the bears, but bulls should not be counted out until key support levels falter, i.e. 0.382 Fibonacci and Cloud support. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will await price to maintain its current Kumo breakout above $14.40 before entering a long position. Success will yield price targets of $17, $18, and $20. Failure will highlight support levels of $13.20, 11.82, and 10.81.

Don’t miss out – Find out more today