Omisego price analysis: Price gains coincide with fundamental updates

The OMG token has enjoyed an extended period of positive price activity dovetailing with the delivery of several key development milestones for the Omisego network so far in 2019. Fundamental concerns regarding utility remain, however, with current price action appearing speculative only.

OmiseGO (OMG), is an Ethereum based decentralized banking and exchange solution that utilizes Plasma technology. It gained market notoriety as one of the original ICO unicorns, achieving a $1 billion network valuation (market cap) as an ERC-20 token, without offering a real product or token utility.

It is now almost two years since the token sale ICO (June 25, 2017), when ~USD 25,000,000 was publicly raised to go towards funding, and the token is still yet to provide tangible on-chain utility for holders. However, recent developments of the OmiseGO project show some progress is being made.

OmiseGO aims to use the decentralized, permissionless, scalable, secure nature of the blockchain to provide a public good and solve a real-world problem, financial empowerment in South-East Asia.

There are millions of unbanked individuals in the region, and because of infrastructure issues and the challenges involved in obtaining identification documents, the likelihood of this group being able to participate in the global financial system in the near term is slim. OmiseGO’s accessible, permissionless payment option is attempting to solve this.

Family relationships in the SEA region are complex, interconnected and dispersed throughout multiple countries. An individual in Malaysia might also have family in Singapore, Hong Kong or India. Individuals often face very high exchange/bank fees on transactions such as remittance payments because the coordination between cross-border financial entities is slow and inefficient.

A full alpha release for the network’s Minimum Viable Plasma solution, ARI was released for the Rinkeby testnet in April. The release will allow for all Plasma functions such as deposits, transfers, exits, and in-flight (transaction in progress) exits and based on internal testing is “able to process over 1.2 MM transactions with a peak measured throughput of over 2700 transactions per second so far.” On May 20th, ARI was upgraded to a new version, Samrong, which can be thought of as OmiseGO 2.0.

The new alpha will enable transaction signing using the EIP-712 standard, allowing users to sign transactions through wallets like Metamask. It adds a meta-data field, allowing businesses and decentralized applications to store any preferred arbitrary data into their transactions. The MVP solution is currently in alpha. There are still bugs within the test network with patches to be released continuously over the coming weeks.

Another way to interact with transactions on the OmiseGO alpha is to play the platform’s first integrated Dapp, Plasma Dog. Plasma Dog is a retro, bit based side-scroller. The user plays ‘Officer Dog,’ a blockchain-dwelling canine who captures ‘UTXO’s’ and ‘Atomic swaps’ while avoiding spikes, ‘double spends,’ and ‘invalid blocks’. ‘UTXO’s’ are coins within the game that are sent to a player’s wallet in real-time. Other collected in-game rewards are reflected as blockchain transactions.

Plasma dog gameplay

Plasma Dog was developed in partnership with Hoard, a blockchain development company. There are further ambitions to integrate the OmiseGO network as a solution to transfer in-game collectibles across the Ethereum network. Hoard is working on integrating the blockchain-based collectibles within the indie game My Memory of Us, which is popular on Steam, Xbox 1 and PS4. It will also soon be ported to the Nintendo Switch. When a plasma capable version of the game is launched it is likely to be one of the most sophisticated examples of blockchain integration within a media solution.

In a recent AMA, a community manager from Hoard said factors such as cheap fees and easy fiat on-ramping are reasons why developers are excited to use the OmiseGO network.

There is no clear indication when the OmiseGO Plasma solution will be released for the Ethereum mainnet but the most recent roadmap released in April suggests it will be in 2019.

The roadmap update said that a proof-of-concept for a Decentralized Exchange (DEX) that uses the Samrong/Ari testnet solutions has been completed. Documentation and internal viability testing (trade capacity, settlement times) is ongoing, suggesting that the first version of a publicly testable OmiseGO, with cross-currency transfers, may be imminent.

Progress on building the OmiseGO project has been slow, with no consumer-ready product available almost two years after public funding began. In 2019, however, OmiseGO released a number of testable, interactable ecosystem solutions which have satiated some stakeholder/community members and created some new momentum for the native token and the OmiseGO product. After hitting a bear market low in mid-December the price of the OMG token has risen ~82%.

The OmiseGO model and tools

The OmiseGO business model is set up as an interoperable exchange solution, bringing together digital and fiat currencies, between platforms, using the blockchain. In the future, if successful, it would compete with crypto exchanges such as Kraken and Coinbase, as well as crypto payment services like Bitpay and Wyre.

In 2019, OmiseGO released the new version of an integral e-wallet solution. The OmiseGO eWallet suite is a white-label, open-source, fully customizable eWallet to digitize and store all types of assets. The e-wallet will be essential for the OmiseGO ecosystem. Potential OmiseGO merchants can now trial their own digital wallet services through a local ledger. Eventually, they’ll be able to connect to a decentralized blockchain exchange service to form a federated network on the OMG network. This will allow providers to facilitate the exchange of currencies (digital or fiat) into any other currency, leveraging the Ethereum network and Plasma.

The OmiseGO e-wallet application isn’t just a regular e-wallet. The device it is attached to will act as a node, verifying transactions occurring on the OmiseGO blockchain (a plasma child chain attached to the Ethereum root chain). However, it is not enough just to have a wallet open and installed, there needs to be value held in the wallet, and this is where OMG tokens and the PoS mining model comes in.

Because the e-wallet is white-label, providers can manage and integrate OmiseGO operations according to their own requirements. It is open-sourced and fully customizable, and can be changed and developed to suit multiple provider requirements. It can also be used to store company loyalty points, employee benefit points, game tokens, cryptocurrency, or even fiat.

Part of this solution is the recently launched e-wallet open source SdK (Software Developer Kit) which at this stage will allow for simple integration into the OmiseGO platform. Being open-source as well, the progress the OmiseGO team is making on its e-wallet solutions are available to be viewed and commented on.

Issues within the e-wallet UI and UX are continually being fixed and there are consistent updates to the community on this progress. The most recent update said that major fixes include “Improved the way reset password works for users” and “Wallet permission balance check”.

OmiseGO: Scalability within Ethereum.

Managing and facilitating cross currency transfers via is a complex multi-operational solution. OmiseGO says it will be able to facilitate multiple fiat-to-fiat, fiat-to-crypto exchanges instantly, cheaply and between providers/electronic payment providers (EPPs or across border financial entities). However, any blockchain is likely to struggle with verifying these transaction loads.

OmiseGO integrates with Ethereum based off-chain scaling solution Plasma. Through Plasma, every EPP on OmiseGO will enter a smart-contract with ETH, which will funnel a supply of liquidity onto its own, off-chain centralized network, allowing it to operate smoothly, without flooding or compromising the decentralized OmiseGO network.

In the above diagram, the OmiseGO network DEX and individual federated merchant networks are Plasma blockchains or ‘child chains’ which function on top of the root chain, Ethereum. Source: Plasma in 10 minutes.

There are two solutions to this problem. Firstly, liquidity pools for small transfers, where EPPs will hold a pool of liquidity for small amount transfers between their most popular destinations. Secondly, for larger transfers, an amount of ETH will be bonded via a smart contract to the OmiseGO blockchain and this will allow for a large Yen-Baht transaction to happen via a Yen-to-Ether, Ether-to-Baht route, facilitated on the OmiseGO network. There is no reason that Ethereum needs to be used, but the network’s size and robustness make it a natural choice.

The OmiseGO proof-of-stake (POS) block reward model works by giving greater rewards to nodes/validators who have larger investments in the blockchain. So, having more OMG tokens means access to more fees which positively correlates with an increase in the usage and activity on the network. OmiseGO proof-of-stakers earn rewards for confirming operations that occur on the Plasma child chains.

The greater reward stems from miners with more OMG taking more risk. If the network turns out poorly, and the tokens start losing value, the miners with higher stakes are worse off.

In the present market, the price of the OMG token is propped up by the market’s conviction in the future success of the OmiseGO blockchain (because the network is not yet live, and OMG does not yet have utility). Once the OmiseGO mainnet launches, even if an investor is not interested in being a node on the blockchain, having OMG gives them a chance to sell their stake in it, to someone who is.

There will initially just be 200 transaction validators on the OmiseGO child chain, however, token holders can stake their tokens to pools who validate on their behalf and allow any holder to earn confirmation rewards passively.

While the progress the network has made over the last few months will be encouraging to some community members and OMG token holders, the fact that there is no set date for the release of a publicly usable, real-world payment capable version of the OmiseGO blockchain remains a frustration.

Historically, OmiseGO has had challenges managing the expectations of its token holding community. A number of posts on blogs and on the official OmiseGO subreddit express frustration at the project being overhyped by project heads in the lead up to the bull run – which drove the token’s price towards $20, and subsequent efforts to try to ensure the token was not sold off heavily in the bear market.

Specific strategies that have been perceived by the community as being empty marketing tactics include; OmiseGO CEO Jun Hasegawa’s overly bullish tweeting, vague pictures from official OmiseGO social accounts inside Google Headquarters (hinting at a possible partnership that did not come) and consistent announcements about minor events such as the creation of Github repos. It appears as though the OmiseGO project has pulled back its overly bullish/highly speculative social media posting strategy. OmiseGO hired a new CEO in April 2019, which may suggest a move towards more robust business practices and operations.

Objective on-chain indicators

NVT Signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

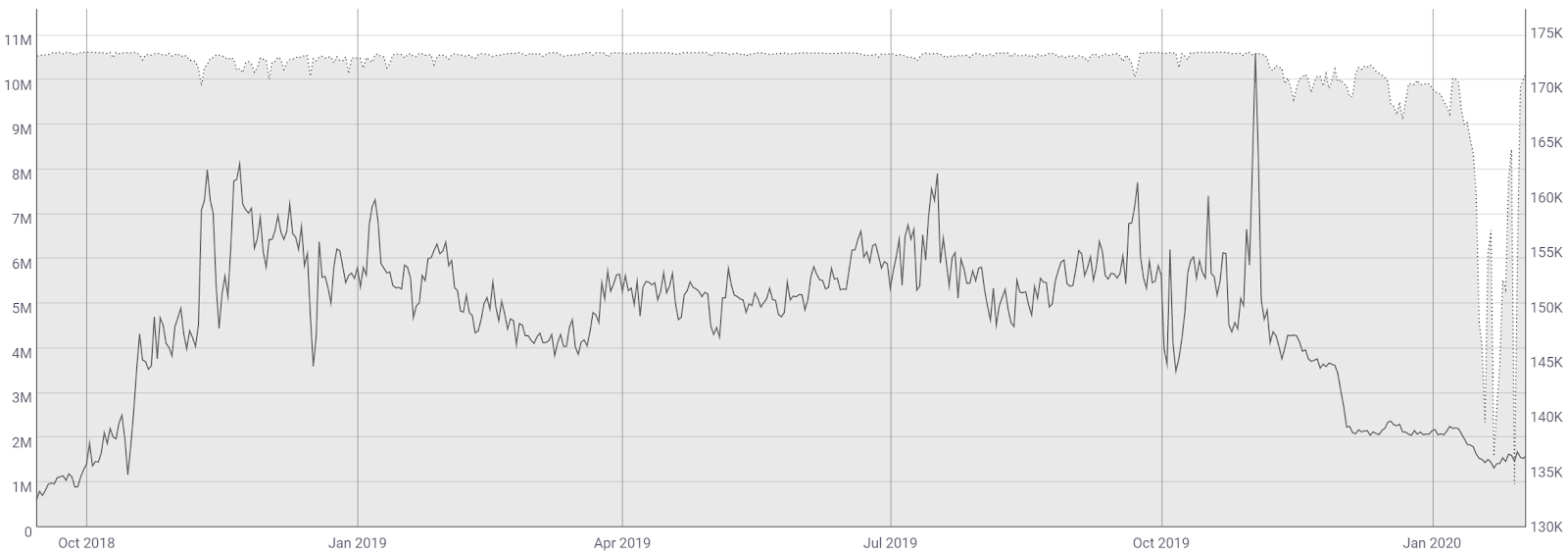

The OMG tokens on-chain volume indicators lean bearish. The recent medium-term uptick in the price of the token has coincided with a rising NVT signal that appears to be approaching an ‘overbought’ level. Recently OMG’s NVT signal hit 150 points, a high number for a digital asset, this may have been a cycle inflection point as the NVT signal has quickly dropped off since. If it begins to fall quickly and reaches levels as low as 40-60 this would put significant downward pressure on price.

This means that price discovery, and the relationship between price and on-chain volume, is murky for the OMG token. While there is currently no on-chain utility for the OMG token, on-chain volume may be an indication of demand to accumulate the token for future use, such as on-chain wallet transfers or DEX trading. This demand is likely to increase with bullish fundamental development announcements and positive market conditions.

However, a decision to accumulate OMG is made based on primarily speculative considerations. At this stage, it is not clear how profitable OmiseGO proof-of-stake mining will be when launched, or how its earnings will compare to other proof-of-stake alternatives like Tezos or DASH. Other potential reasons for OMG holders to interact with the token beyond speculative trading and investment reasons may be airdrops allocated to holders, or interacting with Ethereum Dapps which accept payments across a range of ERC-20 tokens.

PMR signal

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

The PMR signal of OMG has historically been high, generally ranging between 4-7 points for most of its existence. The PMR value also has a tendency of dropping and rising quickly. This suggests that most of its value is speculative and not driven by tangible user activity and network effects, with market cap (network value) dominating against Metcalfe’s law. PMR at this stage is likely not a useful indicator for future price movements.

When the production-ready versions of the OmiseGO Plasma and DEX are released, Metcalfe’s law and network effects will likely become important considerations.

A token transfer network like OmiseGO requires counterparties to create liquidity and expand the utility of the network to new users through externalities like a wider range of base currencies to trade with. This suggests that OmiseGO will need to organically drive unique user activity once its full solution launches to scale and expand the network’s value.

Turning to developer activity, OmiseGO has 44 repos on GitHub with active repos including ‘ewallet’,’plasma-contracts’ and ‘omg-js’. Most coins use Github as their open development platform, where files are saved in folders called ‘repositories,’ or ‘repos,’ and changes to these files are recorded with ‘commits,’ which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Activity on the ‘ewallet’ repo has been relatively consistent over the last year and through the bear market, with at least a few commits every week.

Trading and Exchange pairs

The most popular trading option for OMG is USDT with the pair handling close to 40% of daily trading volumes. The second most popular market is the OMG/BTC pair. Together the top two pairs make up ~75% of daily trading volume. The ETH pair is the next most popular. Fiat transactions with US dollar are also available, alongside other fiat options like Korean Won and Turkish Lira. The USD value of daily volume of the entire OMG trading market is ~USD 60,000,000.

A mix of exchanges contributes to the OMG trading ecosystem, with the top 5 pairs spread across 4 exchanges. The OMG/BTC market on Digifinex is the most active market in the ecosystem. OMG is also tradeable on high profile exchanges such as Binance, Bittrex, and Poloniex.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, OMG has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.88 (not shown), which has allowed a death cross to persist since June 2018. Despite the continued death cross, price has increased by ~116% since early February (currently at $2.20). However, despite the surge, a golden cross has yet to occur with price failing to break above the 200 day EMA twice (arrows). Positively, OMG still remains above the 50 day EMA, which keeps a positive picture somewhat intact.

On the 1D chart, OMG has semi-strongly followed the Fibonacci retracement levels during this uptrend. The most recent resistance failure was against the 0.5 level of $2.26, which resulted in price bouncing off the 0.382 level of $1.97. Continued price acceptance above 0.382 and $2.00 psychological level, aid the bullish view, currently.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0 and trending upward. The maintenance of VFI’s uptrend may enable another attempt above key resistance in the near future.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is above the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price initially completed a Kumo breakout in mid-March 2019, but it faltered in late-April. However, since mid-May, price has successfully completed a new Kumo breakout. Since then, price has already retested Cloud support of $1.83 with it holding, to-date. However, two points of concern exist with an RSI of 63 approaching overbought and price making lower highs.

However, there are a few positive factors for OMG, including:

- VFI still in the bulls’ favor

- Key support levels holding and generally confined within the same region

If support holds or buying volume resumes, price targets are $2.40 and $2.59. If key support fails, additional support levels are $1.83 and $1.60.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield similar results; including current Kumo breakout, and price targets and support levels.

Conclusion

While the OMG token is historically popular and heavily traded on altcoin marketplaces, in the almost two years since its launch, the token is yet to have any tangible on-chain utility. The network’s plasma solution is still only in an alpha stage, while the network’s DEX is still in the hands of developers. This means OMG is only bought for speculative reasons and expectations of future value. This suggests there is very little reason (beyond hope) for holders to resist against selling pressure, and a reversal of the current bullish market conditions may lead to quick retracements back to lower price levels.

However, the promise of a future OmiseGO decentralized exchange solution with the ability to seamlessly connect with electronic payment vendors and fiat only merchants – remains one of the most exciting and sticky ICO concepts in the crypto investment space. Recent development updates have been exciting, with signs that 2019 will be the year that a public, Ethereum mainnet solution of OmiseGO is finally released. If this coincides with impressive partnership announcements, the token will perform well.

The current technicals for OMG are moderately bullish, while flashing warning signs that bears might be looking to take over. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) may view the existing Kumo breakout as sufficient for entering a long position. However, a more conservative trader may wait not just for the current support levels to hold, but also a break above the 200 day EMA of $2.30 before entering a long position. Success for the bulls will yield price targets of $2.40 and $2.59. Success for the bears will highlight support levels of $1.83 and $1.60.

Don’t miss out – Find out more today