Banks could save billions in mortgage loan costs by adopting blockchain-based smart contracts, says Capgemini

At the end of the second quarter this year, there was $13.97 trillion mortgage debt outstanding in the U.S., according to the latest statistics from the Boards of Governors of the Federal Reserve System. Residential properties account for over 90 percent or approximately $12.6 trillion. 35 percent of outstanding mortgages were held by major financial institutions and over 36 percent by Federal and related agencies, including Fannie Mae and Freddie Mac.

At the end of the second quarter this year, there was $13.97 trillion mortgage debt outstanding in the U.S., according to the latest statistics from the Boards of Governors of the Federal Reserve System. Residential properties account for over 90 percent or approximately $12.6 trillion. 35 percent of outstanding mortgages were held by major financial institutions and over 36 percent by Federal and related agencies, including Fannie Mae and Freddie Mac.

The Consumer Financial Protection Bureau (CFPB), a government agency built to protect U.S. consumers, explains that there are several different kinds of costs borrowers pay when taking out a mortgage. While some costs are paid upfront, including origination fees, points and third party closing costs, other are paid over time, such as principal, interest, and mortgage insurance.

“The mortgage loan process relies on a complex ecosystem for the origination, funding, and servicing of the mortgages, adding costs and delays.[…] Smart contracts could reduce the cost and time involved in this process.”

— – Capgemini Consulting

The Global Strategy Consulting are of Capgemini Group, Capgemini Consulting, recently published a report explaining how smart contracts can create major savings for the mortgage industry. The code-based, self-executing agreements than work in conjunction with blockchains, can help with automation, process redesign, shared access to electronic versions of physical legal documents between trusted parties, and provide access to external sources of information such as land records.

“The loans are one of the main drivers of growth, but at the same time also of operational complexity in the retail banking industry,” writes the MD and Global Head Disruptive Technologies and Solutions at Deutsche Bank AG, Roberto Mancone. “This creates an enormous need to enhance the efficiency of internal services and processes.”

Mortgage customers could expect an 11% to 22% drop in the total cost of mortgage processing fees charged if smart contracts are adopted, according to the firm’s estimates. This translates to a savings of $480 to $960 on the average processing fees of $4,350 on every mortgage loan. Loan providers in the US could see a minimum of $1.5 billion in savings through automation, the report claims.

“Savings of $6 billion could be achieved once external partners such as credit scoring companies, land registry offices, and tax authorities become accessible over a blockchain to facilitate faster processing and reducing costs.”

— – Capgemini Consulting

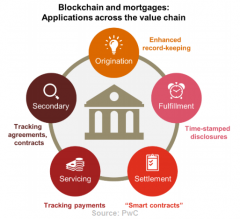

Capgemini Consulting is not the first company to publish an in-depth report on how blockchain and smart contracts can disrupt the mortgage industry. PricewaterhouseCoopers (PwC) published a report in June, based on an interview with two of the firm’s principals, Pamela Johnston and Tim Davis. Citing handoffs, exchanges of value, third-party certifications, and built-in delays they said, “Two of blockchain’s features—smart contracts and distributed ledgers—could help.”

They also claim that borrowers might prefer lenders who have streamlined the mortgage process, while another persistent challenge in the industry concerns false documentation. “By making it harder to tamper with ownership records, blockchain could reduce the odds of mortgage fraud,” the reports states.

Blockchains can also help with mortgage servicing process by tracking payments, and provide transparency about the underlying assets when sold on the secondary market, where mortgages are packaged into mortgage-backed securities (MBS). “We think blockchain could be relevant at every stage,” they said.

“In the secondary market, smart contracts could help the securitization process […] When mortgage-backed securities are created more efficiently, or when MSRs are traded more quickly, this adds liquidity back into the market. That’s good for everyone.”

— – Pamela Johnston and Tim Davis, PwC Principals

Capgemini Consulting estimates that mainstream adoption of smart contracts should occur in 2020. They came to this conclusion based on discussions with industry experts from major banks, startups and academia.

The Director of Innovation at Banco Santander, John Whelan, said, “We’re a couple of years away from in-production systems in a bank or a group of banks.” Whelan notes that there may be some small pilot-scale implementations in the next 12 months.

Deutsche Bank’s Mancone is more optimistic, however. “I think any product that a smart contract can manage, can be developed without waiting for readiness on a distributed ledger technology (DLT), and it could be viable by the end of 2017,” Capgemini Consulting reported.

“While mainstream adoption may well be at least 3 years away, financial services companies should not stand still. They ought to begin by identifying the changes that will be required, including to IT systems, processes and change management policies.”

— – Capgemini Consulting

The Institute of International Finance (IIF) is already discussing how smart contracts can be used for various real estate applications. Nina Kilbride, a developer at Monax, (formerly Eris Industries) told the IIF that users can use the platform for deed and lien registries, mortgage originations, collateral agreements and derivative assets.

Monax offers an open-source blockchain platform that “allows anyone to build their own secure, low-cost, run-anywhere data infrastructure using blockchain and smart contract technology,” according to their website. Mortgage loans are just one of the many smart contracts listed as an example.

Customizations can be as simple as putting two components together to make them do a simple agreement automatically, and as complex as complete form-fitting business logic that can be tailored throughout to your case-specific needs.

BNC launched our own finance data Oracles in September, giving smart contracts everywhere the ability to make decisions using reliable pricing data from the cryptocurrency markets. According to Rory Manchee, BNC head of Business Development, Smart Contract Oracles could each represent a single loan in a mortgage portfolio, while connecting to repayment data. The creditor could see the performance of the underlying loans without knowing specific details of the mortgages. "Smart Contract Oracles could also manage the distribution of cashflow […] and provide better market valuation on the mortgage backed security itself," Manchee states.

Mphasis is also developing solutions for the Mortgage, Insurance and Payment industries. The leading Indian IT services and solutions provider unveiled an industry first Centre of Excellence (CoE) for Blockchain-based solutions in Bangalore last July.

A global financial services consulting and technology services provider, Synechron, has since launched a Blockchain Accelerator Program. “Blockchain Accelerator for Mortgage Lending” is one of the accelerators six cloud based blockchain applications. The service allows loan documents to be moved onto a centralized ledger, increasing transparency, expediting loan settlement and reducing overall risk, the company explained.

Don’t miss out – Find out more today