Binance Under The Microscope As Market FUD Dominates

In the wake of the FTX failure, centralized crypto exchanges are now firmly in the sights of law enforcement, politicians, and of course, their user bases. As the largest of them all, Binance is feeling the heat as it attempts to introduce more transparency to its global operations.

Following the collapse of FTX, it appears as though the tide has turned against an entire sector of crypto. Centralized exchanges are struggling — many firms are scaling back, struggling to fulfill withdrawal requests, and finding it difficult to answer questions from regulators and users.

Following FTX’s downfall, Dubai-based exchange Binance has cemented its position as the largest international exchange in the world. With great power comes great responsibility, however, and Binance is being put under an intense microscope. Since the collapse of FTX, Binance’s mistakes are being magnified, and rightly so, because it is such a major custodian of assets within the crypto space.

Global exchange Binance deals with FUD

Reuters has reported that the US Department of Justice (DOJ) is considering filing criminal charges against Binance. It has been reported that prosecutors are determining whether they want to pursue Binance aggressively, quickly, or take more time to review the evidence they have.

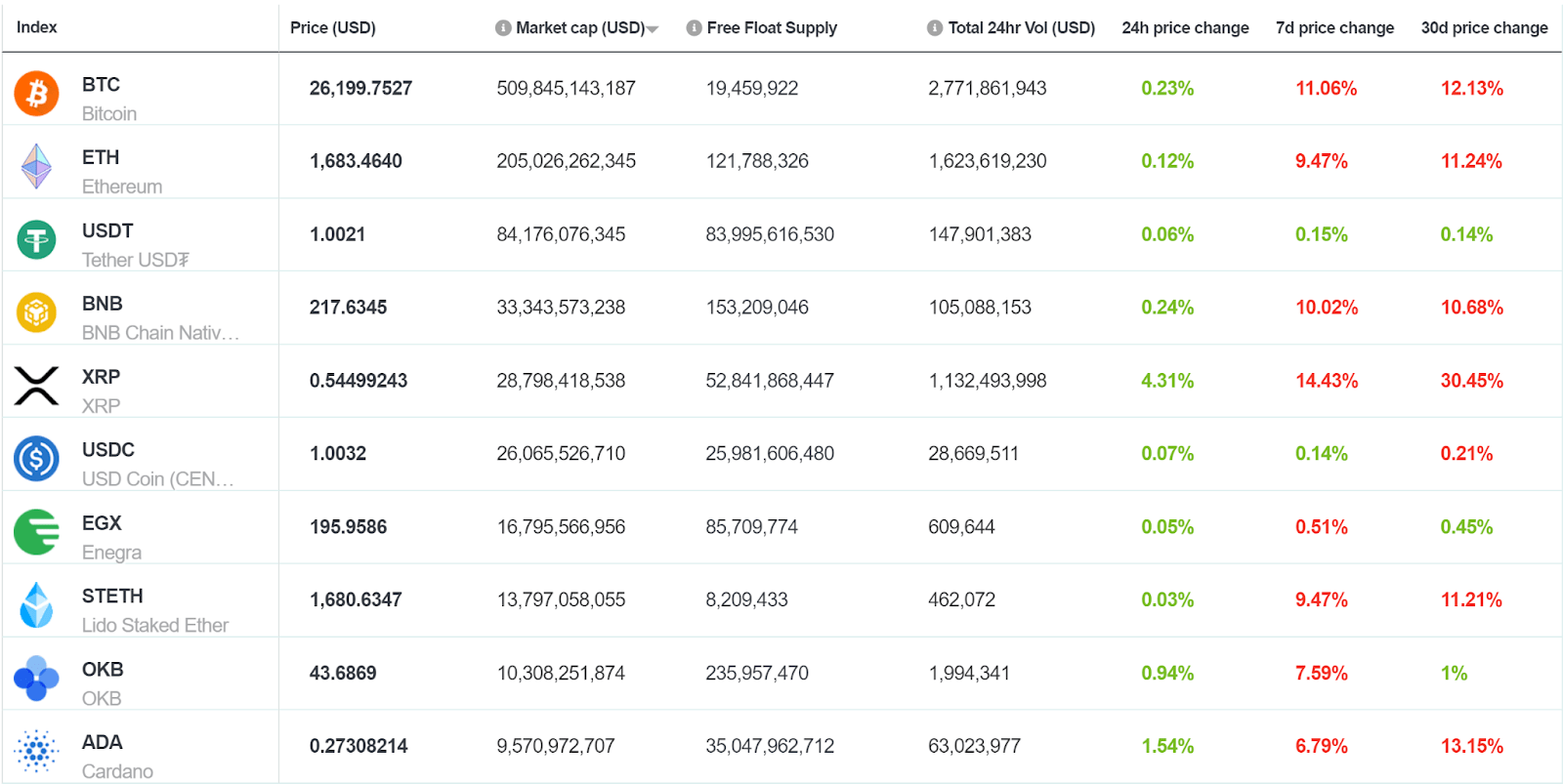

As the world’s biggest crypto exchange, Binance handles billions of dollars of trading volume every day and according to Similarweb is one of the top 500 most visited website in the world. In finance terms it’s much higher, with Similarweb ranking it as the 4th most visited ‘investing’ website in the world.

The DOJ’s current investigation is reported to have begun in 2018 when prosecutors at the US attorney’s office in Seattle began looking into whether criminals were using Binance to transfer illicit funds.

Binance has responded to the money laundering investigations, with Tigran Gambaryan, Binance’s Global Head of Intelligence and Investigations saying that since November 2021 the company has responded to over 47,000 law enforcement requests with a response time of three days. According to Gambaryan, this is faster than any traditional financial institution.

He says the security team at Binance has grown by 500% in the last year and that many of his team come from some of the world’s top investigative organizations and law enforcement agencies. He also endorses Binance’s Global Law Enforcement Training Program, which is a program that helps law enforcement and prosecutors across the world detect financial and cyber crimes.

The DOJ has not yet responded to the Reuters article and requests for responses. So the claims made by the news agency are unconfirmed by the department as yet.

Nonetheless, the reports that the DOJ is investigating Binance has triggered a sharp response from the exchange and the crypto community on social media. The term ‘Binance’ was trending in multiple regions on Twitter yesterday. Changpeng Zhao (CZ) the CEO of Binance said on the platform “ignore FUD. Keep building!”

Binance’s ‘Proof Of Reserves’ raises questions

There are other questions beyond a potential money laundering investigation faced by Binance.As its recently published Proof-of-Reserves has been criticized as too narrow. A Proof-of-Reserves is an independent audit of a company’s balance sheet conducted by a 3rd party. Very few crypto businesses have done them (or done them well), but this one from Nexo is a good example of a best practice example.

In the last month, Binance has publicized details about its ‘held crypto’ wallets. Binance is not publishing details about the entire company’s financials. It is simply publishing details about user fund storage and assets held onchain.

“When we say proof of reserves, we are specifically referring to those assets that we hold in custody for users,” Binance says on its website. “This means that we are showing evidence and proof that Binance has funds that cover all of our users’ assets 1:1, as well as some reserves.”

There has been criticism that the Binance Proof-of-Reserves does not provide users and investors sufficient information about the collateralization or the financial stability of Binance. The document was attested by the South African arm of financial services firm Mazar’s and contains very few numbers. Mazars said in the report it conducted the work based on “agreed-upon procedures” but “we make no representation regarding the appropriateness” of the PoR process.

In an interview, Binance’s chief strategy officer, Patrick Hillmann, admitted that this Proof-of-Reserve was just the beginning. He assures that more information about Binance’s wider financial position will be revealed over the months and years.

A popular pseudonymous crypto trader Coinmamba has also launched a volley of criticism at the exchange. The user claims Binance has closed their account after they posted on Twitter that the exchange and its CEO had done little to help them get money back stolen from their account. Coinmamba says the money was stolen from their account following an API key leak tied to crypto trading firm 3commas. Coinmamba unable to find support from Binance, went to Twitter to call Binance greedy and say that centralized exchanges were ‘shady’.

While disgruntled customers are to be expected, what was unexpected was the CZ himself would get involved in the dispute. In a now-deleted Tweet, the Binance founder appeared to threaten Coinmamba with reduced account access if he continued the attacks. “On top of 3Commas, I am actually thinking of putting @coinmamba’s account in off boarding (withdrawal only) mode,” CZ tweeted. “We don’t want to service people who are unreasonable. Just more problems down the road. It’s a 2-way street. Might get a lot of flak, but…” Binance eventually did put Coinmamba into withdrawal-only mode.

While all the details have not been made clear, this was viewed by some as censoring a user for speaking out. This goes against the free, non-interventionist ethos of crypto.

According to analytics firm, Nansen, the net outflows of Binance on December 14th — The difference between the value of assets leaving the exchange and the amount coming in, was over US$3 billion in 24 hours. A number that surpassed nearly every other major centralized exchange combined on the same day.

There have been rumors circulating around crypto circles that major crypto trading firms like Wintermute and Jump are withdrawing large amounts from Binance. Nansen is tracking the transactions and is identifying which are being made in and out of known wallets of large crypto players, what Nansen defines as ‘smart money’. Nansen does find that firms like Genesis have made withdrawals but other smart money institutions like Wintermute and Tether are also depositing as well, suggesting they still have confidence in the exchange.

Another onchain data provider Cryptoquant stated recently, based on on-chain volume data, says that since FTX collapsed Binance’s Bitcoin reserves are up 4%, and reserves for Ethereum (ETH) and stablecoins are down, 6% and 15% respectively.

Like Mazar’s Proof-of-Reserve report, the issue with simply reporting onchain is that it does not offer much insight on the wider financial health of the exchange and if the large spike in outflows is affecting other parts of the Binance business.

Binance Dominates In Market Share

Market data provider CryptoCompare analysed the crypto exchange space in November 2022 and found that following the collapse of FTX, Binance increased its market share to 52.9%. This is the largest-ever market dominance Binance has held to date. Binance has also reached a new height in its dominance of the crypto derivatives space. CryptoCompare reports that Binance’s market share of the crypto derivatives space now sits at 67.2%.

While Binance has grown relative to other platforms in the exchange space, it appears that the space overall is struggling. CryptoCompare finds that total spot exchange trading volume has risen only marginally between October 2022 and November 2022.

In November, total spot trading volumes increased 13.7% to US$1.06 trillion but overall volumes are down significantly year to date. There has been a sharp drop off in the trading volumes of lower-tier exchanges, CryptoCompare states that this is the lowest volume trading level observed on low-tier centralized exchanges since June 2018.

Likely triggered by the collapse of FTX, in November, BTC Netflows recorded the largest negative flow from the CEXs in its history with a netflow of -91,363 BTC. The difficult November for centralized exchanges was followed by the ‘Fear, Uncertainty, and Doubt’ that engulfed Binance in December.

Conclusion

While the crypto industry has had a quiet last couple of weeks from a hacks and failures perspective, the pace of user withdrawals makes it clear that retail confidence in centralized exchanges has taken a beating. Add to that the remarkable spectacle of the Senate hearings into the FTX collapse and the arrest of its founder Sam Bankman-Fried on criminal securities fraud charges, and it’s likely the centralized exchanges that remain will continue to sit under the dual microscopes of both their customers and law enforcement for the foreseeable future. Clearly, the era of opaque exchange operations is now over for all.

Don’t miss out – Find out more today