Bitcoin options boomed in 2020 – more growth expected in 2021

Following a surge in bitcoin futures trading in 2020, cryptocurrency exchanges and traders are expecting an even bigger year for options in 2021

Bitcoin options contracts give traders the right to buy or sell an agreed amount of bitcoin on a set date for a certain price, allowing traders to hedge their risk against spot and futures positions. For example, for a fee a trader might buy a "call" option contract to purchase bitcoin at the price of $42,000, which lasts for one month. If the price of bitcoin rises to $44,000 within the month, the trader can exercise the option and buy Bitcoin at $42,000 and then sell it at $44,000 – making a $2000 profit – less any fee they had to pay to buy the call option in the first place.

With a "put" option, traders can take the opposite side of the bet and buy the right to sell bitcoin at a predefined price. The strike price of an option is a fixed price at which the owner of the option can buy, or sell, the underlying security or commodity. Options can either be in-the-money, out-of-the-money, or at-the-money.

| Put | Call | |

| In-the-money (ITM) option | The price of the underlying is less than the strike price of the option. | The price of the underlying is greater than the strike price of the option. |

| Out-of-the-money (OTM) option | The price of the underlying is greater than the strike price of the option. | The price of the underlying is less than the strike price of the option. |

| At-the-money (ATM) option | The price of the underlying is equal to the strike price of the option. | The price of the underlying is equal to the strike price of the option. |

Bitcoin miners are uniquely positioned to benefit by using options to secure a price for selling mined bitcoin to lock in future revenue — just like owners of olive presses in ancient Greece used the first options contracts to ensure they didn’t lose out on earnings in the event of a bad harvest.

Plenty of upside remains

In legacy markets, derivatives typically account for more than four times the trade volumes of the underlying asset. But in the bitcoin markets, spot trading still accounts for a much larger proportion. This is changing, however, driven by the entry of a number of players.

The space is also experimenting with new and unique individual contract offerings. Panama based options exchange Deribit has recently released a new options contract that allows traders to bet on the price of Bitcoin potentially rising to USD100,000. The contract which expires on 24th September 2021. As the price of Bitcoin surged above USD30,000 in early January, the exchange introduced an options contract with a USD200,000 strike price that expires in December 2021.

The fact that only call options have been registered on the contract at the time of writing is an indication of the present underlying bullishness of Bitcoin options traders. The USD100,000 call option is deeply out of the money (The price of the underlying is much less than the strike price) and is therefore relatively cheap compared to other options tradeable on Deribit. The option currently trades for BTC0.1365 (~USD5628), whereas other out of the money contracts like the USD48000 call contract expiring on the same day (24th September 2021) trades for BTC 0.2890 (USD11908).

Traders like to buy deep OTM options during bull runs because of their low price and because they can accrue significant value during spot market rallies and periods of volatility. Deribit’s 100k contract is another strategic bet traders can take to potentially capture profits during the ongoing crypto bull run. Options infrastructure has grown dramatically over the last two years and has been accompanied by a growth in trading volume and demand.

At the beginning of 2020, Luuk Strijers, Deribit’s Chief Commercial Officer, said the cryptocurrency derivative infrastructure could be expected to grow by five to ten times in 2020 and ultimately occupy an even greater proportion than legacy markets due to the higher leverage used in cryptocurrency trading.

Strijers pointed to the Amazon example to indicate how much higher relative spot vs options activity was in traditional markets than in crypto. At the time the daily volume of Amazon’s common stock was USD11 billion, while the Amazon options market traded USD 9 billion a day. Conversely, the Bitcoin spot market was trading at just under USD1 billion a day and its options market was trading at ~USD40 million.

Since Strijers made his prediction the ratio between Bitcoin options and spot trading volume has indeed moved closer together. The current daily trading volume of the Bitcoin options market sits at USD866 million.This constitutes an increase of 2065% since January. On the spot market, in the last 24 hours ~USD72 billion worth of Bitcoin was traded. The gap between options trading on the Bitcoin and traditional stock market has certainly closed since since Strijers’ initial prediction – with the Bitcoin derivatives market exploding in popularity in the second half of 2020.

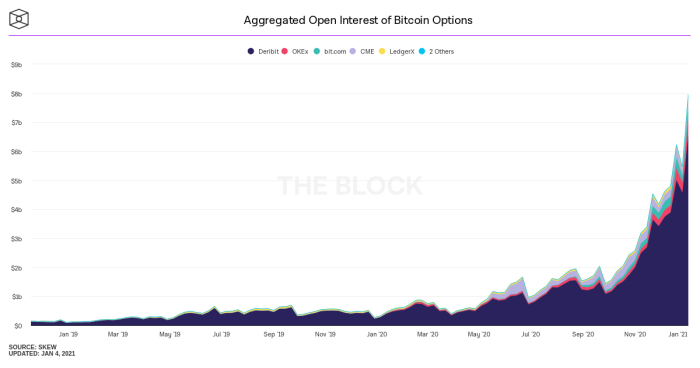

Open interest, the total number of outstanding Bitcoin options that have not yet been settled, has also ballooned this year. On January 1st 2020 Open interest for Bitcoin options touched USD305.36 million. On January 3rd OI hit USD7.6 billion, this constitutes a more than 2200% increase in a year.

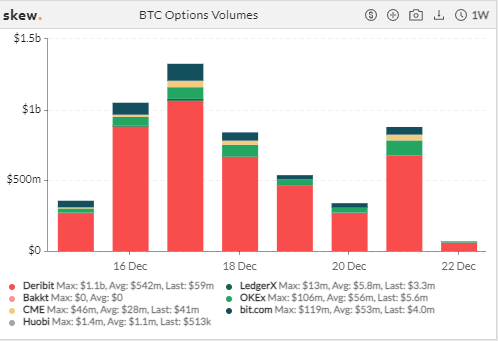

Bitcoin options trading volumes crossed the USD1 billion mark for the first time ever on December 16th as the price of BTC crossed USD20,000 and USD21,000 for the first time. On December 17th, volume increased further as the price of Bitcoin briefly crossed USD24,000. Volume was led by Deribit, followed by bit.com and OKEx.

The decision of regulated players Bakkt and CME to move into bitcoin options was a big step for the bitcoin market and marked a key milestone for the maturity of cryptocurrency derivatives. CME options opened on January 15th 2020 with around USD3.1 million 24 hour trading volume. By December 12th this number had grown to touch USD357 million.

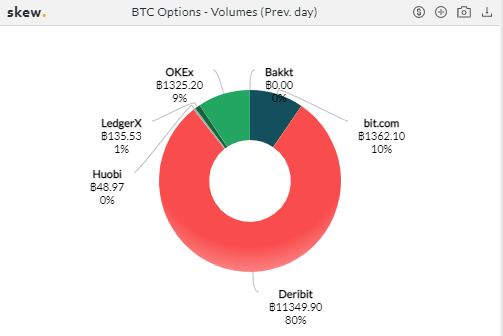

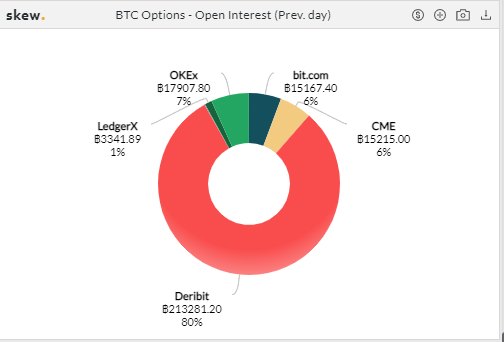

Nonetheless, Deribit remains the biggest player in the Bitcoin options market and has a nearly 80% market share of Bitcoin options open interest and trading volume.

Regulatory oversight of Bitcoin options

Although options exchanges have attempted to dodge KYC and AML oversight, it’s a strategy whose time is running out. In February 2020, the Deribit platform moved from the Netherlands to Panama. A blog post explained that the move was made because of new EU regulations that would have to be strictly implemented, requiring the exchange to “demand an extensive amount of information from our current and future customers.”

Despite this, Deribit has since extended its KYC program and required all users to become verified before the end of the 2020. This means that all traders had to provide proof of identity with government ID as well as proof of residence. The move comes after rival derivatives exchange Bitmex implemented similar KYC mandates for users requiring them to be fully verified by November 5th 2020. The Bitmex move came after its founders were targeted for arrest by US regulators for breaches of US KYC and AML regulations.

On November 6th Deribit announced that by November 9th 2020 it would require all new clients to become verified in order to complete an account opening. This will involve providing an ID document and proof of residence. Existing clients had until 9th December 2020 to become verified and upload both verified forms of both documents.

There has been no update from Deribit’s official channels about the success of its new KYC mandates. Bitmex released a blog post on January 7th stating that the exchange will begin the new year with a fully verified user and volume base, confirming that the exchange’s user verification program had been successfully implemented.

Despite the increase in KYC requirements for customers, Deribit remains the most popular Bitcoin options platform in the space by some distance.

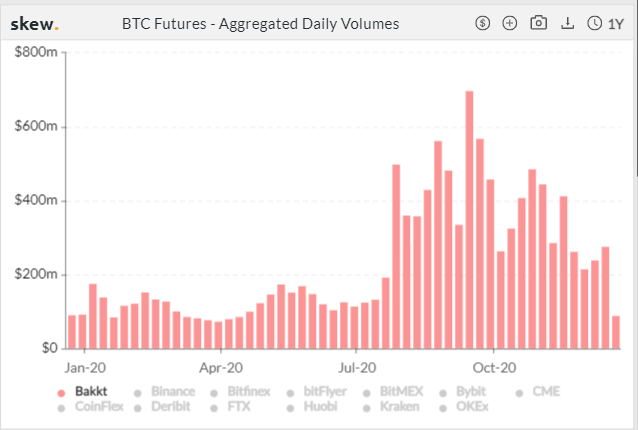

Meanwhile, Futures trading volume has been growing steadily on regulated platforms since they were launched. Bakkt has gone from zero to trading USD697 million in a week in mid-September.

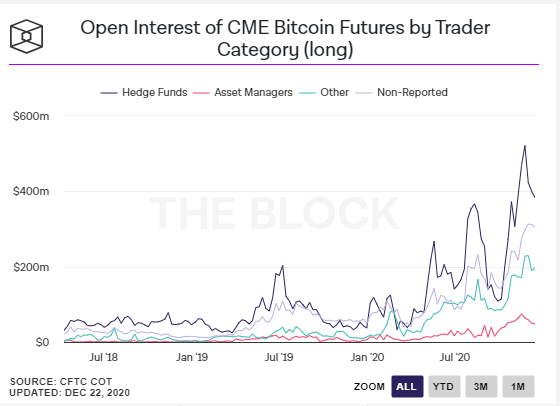

The CME continues to report growing interest from institutions (like hedge funds). This suggests the trading venues might have been waiting to acquire enough market participants and liquidity to add another layer of complexity in the form of options.

Other crypto exchanges including Malta-based OKEx and Singapore-based Huobi have also recently introduced their own options contracts in an attempt to claim a slice of the growing market.

A new data source

One of the advantages that options give is the ability to tap into the collective wisdom of the market. This can be achieved by measuring Implied Volatility (IV)—a metric derived from options that reflects the market’s expectations about a certain asset. Implied volatility is more difficult to calculate than historical volatility and requires a number of parameters, unlike historical which just uses historical price data.

Source: theoptionsguide.com

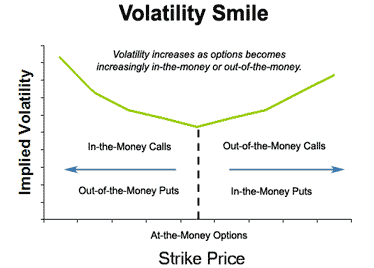

Research conducted by BNC analysts suggests that implied volatility for options across Bitcoin markets have a U-shaped pattern or “volatility smile” skew. This means that the volatility of options increases as an option becomes increasingly in the money or out of the money. The volatility smile shows that OTM and ITM options tend to be more in demand than ATM Bitcoin options.

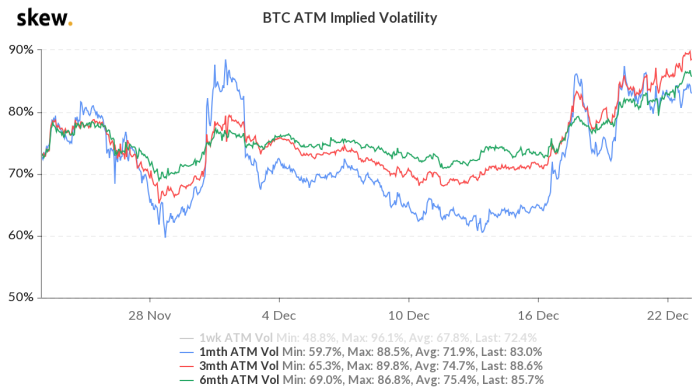

The implied volatility of Bitcoin options has spiked recently following the recent move past USD20,000 price level on December 16th. Over the same period historical volatility has also risen. The closeness between implied and historical volatility implies traders are looking towards the recent past to indicate future price movements.

IV is a metric used by investors to estimate future fluctuations of an asset price based on market sentiment and is often used as a proxy for risk. The rising IV suggests the market expects the price of BTC to be volatile and a potentially risky investment. IV does not indicate the direction of price movement.

The continuation of the Crypto options trend in 2021

The expansion of Bitcoin options in 2020 was evidenced by Deribit’s latest institutional newsletter. The exchange reports that total notional turnover in 2020 reached USD 211 billion across all contracts and coins, constituting an 82% increase from 2019. In Q4 2020 the exchange recorded record trading volumes. The exchange’s Q4 2020 number demonstrated a 134% increase versus Q3 2020 and a 216% increase versus Q4 in 2019. The derivatives exchanges reports that Option “finally got the long-awaited recognition from crypto traders, breaking new volume and open interest records every month.”

The newsletter continues to state that it is expected that the options market will continue to grow with ETH continuing its rapid expansion as more traditional exchanges are adding it to its offering and attracting institutional traders’ attention. With the price of Bitcoin booming, and a new all time high price above USD36,500 hit on January 6th, the popularity of Bitcoin options is set to continue to grow. Options contracts can be a useful instrument traders can use to diversify and take advantage of bullish market conditions.

As referenced earlier during a period of bullish sentiment, buying deeply out of the money call options is a **cheap **way to bet on the price of Bitcoin continuing to rise in the near term. Other strategies involving options contracts to make the most of a bull market include the bull call spread, the bull put spread and the bull ratio spread.

The expansion of the wider ecosystem of crypto options and derivatives is also set to continue into the new year. The CME have announced that they will be launching Ether futures in February 2021. The institutional approval is a sign of the maturity the asset has garnered since its launch in 2015. Ether Options may not be far behind.

Don’t miss out – Find out more today