ChainLink Price Analysis – LINK/USD in price discovery

Technicals for the LINK/USD market have remained in bullish territory since a March drop, with the Chainlink price holding well above both the 100-day exponential moving average and the twelve-hour Ichimoku Cloud.

ChainLink (LINK) is a decentralized oracle network built on Ethereum. The network is designed to connect off-chain data sources, such as APIs, data feeds, or bank payments, to on-chain smart contracts. ChainLink went live on May 30th, 2019.

The LINK market cap currently stands at US$2.14 billion, based on a 381 million circulating token supply, with US$466 million in trade volume over the past 24 hours. Chainlink news attracting market attention is the Chainlink price hitting a new all-time this week, having risen steadily since March. Among the current top 20 coins by market cap, LINK was the best performer in the USD markets during 2019.

The founding LINK team is headed by Sergey Nazarov as CEO, and Steve Ellis as CTO. Advisors for the project include Ari Juels, Professor of Computer Science at Cornell Tech and Director of IC3, Andrew Miller, Associate Professor of Computer Science at the University of Illinois and an advisor to Zcash and Tezos, and Hudson Jameson, of the Ethereum Foundation.

The LINK ICO raised 114,285 ETH, or US$32 million, in September 2017. The tokens could only be bought with ETH. Tokens were sold privately before the ICO for 3,120 LINK/ETH, costing approximately US$0.09 per token, and came with a 20% bonus. Tokens in the public sale were offered at 2,600 LINK/ETH, or approximately US$0.11 per token.

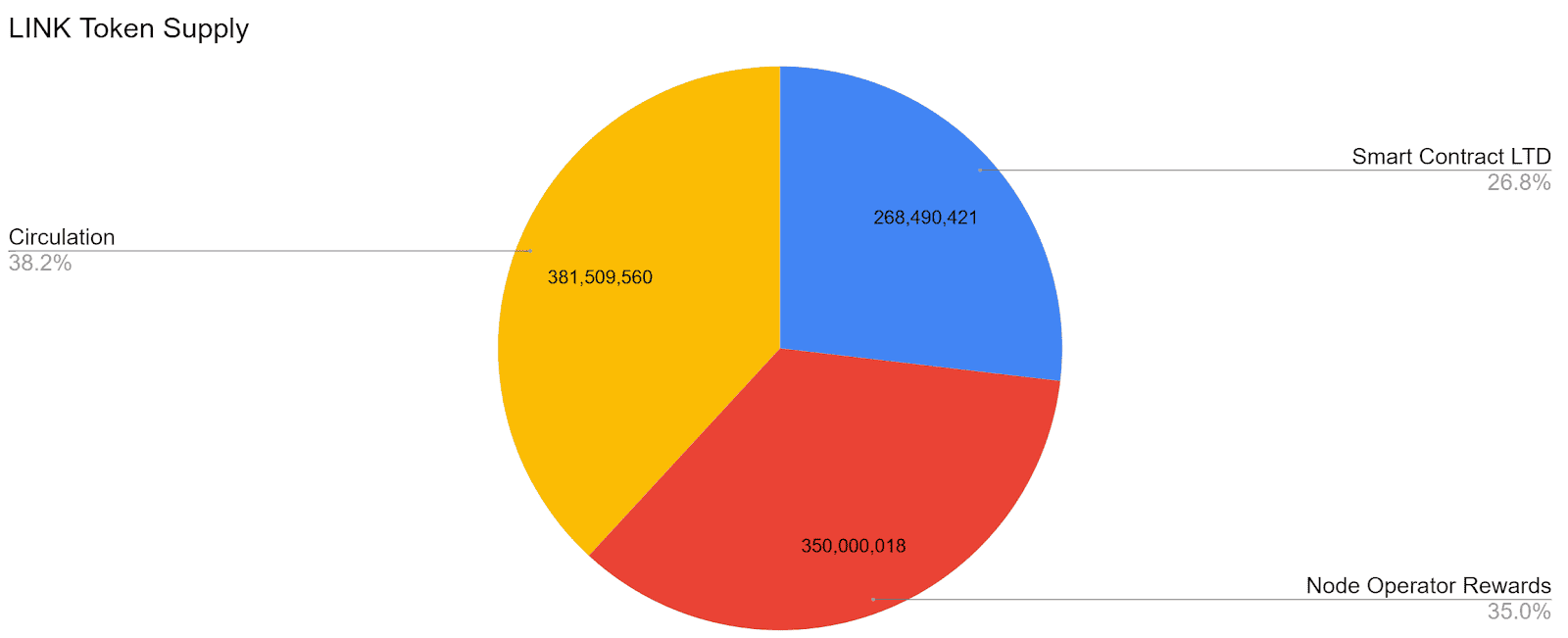

Both sales bring the combined circulating supply to 350 million LINK tokens. A further 650 million LINK tokens were issued, 55% of which will be used for node operators and ecosystem rewards, while 45% were allocated to the LINK parent company, Smart Contract Limited.

Smart Contract Limited was founded in September 2014 and was selected as a "2017 Blockchain Applications Cool Vendor” by Gartner. Smart Contract Limited partnered with the interbank messaging platform, SWIFT, after completing a phase-one proof-of-concept in June 2017.

Since the ICO, Smart Contract Limited appears to have sold 30.5 million tokens, based on available wallet data. The remaining tokens also appear to have no lock-up or vesting schedule. The two most recent token movements occurred on June 12th and June 29th, both for 500,000 tokens.

LINK is an ERC-20 token, with the additional ERC-223 “transfer and call” functionality of transfer, allowing tokens to be received and processed by contracts within a single transaction. The LINK token is used to pay ChainLink Node operators for the retrieval of data from off-chain data feeds, the formatting of data into blockchain readable formats, and off-chain computation. The number of node operators has continued to grow steadily since launch.

Source: https://public.tableau.com/profile/cryptospong3#!/vizhome/ChainlinkContractTransactionCounts/Sheet1

LINK has 21 price oracles for Ethereum, which can be used as an aggregated trusted price source for DeFi applications. LINK also offers decentralized price reference data for several other USD and ETH pairs, all of which can be used by various types of applications, crypto-native or otherwise.

Source: feeds.chain.link/eth-usd

The decentralized network has three approaches for preventing faulty data and reducing single oracle vulnerabilities. Data sent through the network is curated and verified through majority voting, which prevents a single point of failure in the oracle system.

The network also cycles through oracles and introduces a reputation and certification system for oracle performance. Hardware components also protect the integrity and confidentiality of data to ensure tamper-proof and private data transfers between oracles and smart contracts.

When a smart contract requests data from ChainLink, every node in the network submits their data and the nodes put their LINK tokens at stake. If the node is found to have submitted bad data, their LINK tokens are distributed to nodes that submitted good data.

This punishment system incentivizes a continuous stream of honest data from decentralized sources. The network currently supports Ethereum, Bitcoin, and Hyperledger with partnerships including Google, Intel, and Oracle.

Source: @linkmarine1

On the network side, the number of on-chain transactions per day (line, chart below) and average transaction value in USD (fill, chart below) have been inversely related since mid-May 2019. Average transactions per day over a weekly period hit an all-time high of 7,600 earlier this year. Average transaction values have ranged from US$1,500 to US$4,500 since February. Average transaction values reached US$86,000 on November 29th, 2018.

Source: CoinMetrics

The 30-day Kalichkin network value to on-chain transactions ratio (NVT) has ranged wildly over LINK’s short history and hit an all-time low in late September 2019. NVT currently sits near a historic low. A falling NVT suggests the coin is undervalued based on economic activity and utility, which should be seen as a bullish price indicator.

The number of monthly active addresses (fill, chart below) has moved in line with the LINK/USD price. From May to July 2019, monthly active addresses (MAAs) increased 13x, reaching an all-time high of nearly 2,400, while the USD market price increased nearly 6x. MAAs currently sit near a new all-time high. On June 29th, 2019, daily active addresses surpassed 10,000. A sustained increase in MAAs should be seen as a bullish indicator for price.

Source: CoinMetrics

The chainlink project has 100 Repos on Github with the most active repo accruing over 4,000 commits over the past year from 33 developers. Most coins use the developer community of Github where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: Github – smartcontractkit/chainlink

LINK exchange-traded volume over the past 24 hours has been dominated by the Tether (USDT) and Bitcoin (BTC) trading pairs on Binance and Coinbase. The U.S. Dollar (USD) and Ethereum (ETH) pairs make up a substantial portion of the reported volumes.

LINK has benefited from several pair additions on several exchanges over the past two years, unlocking high levels of global liquidity. LINK pairs were first added to Binance in September 2017, Huobi in January 2018, Coinbase in June 2019, Hitbtc in July 2019, Kraken in September 2019, Bittrex in December 2019, Poloniex in March 2020, and Gemini in April. Binance.com also added a LINK/USDT perpetual futures contract with a 75x margin availability earlier this year and delisted a LINK/PAX pair. LINK is not currently listed on Bitfinex.

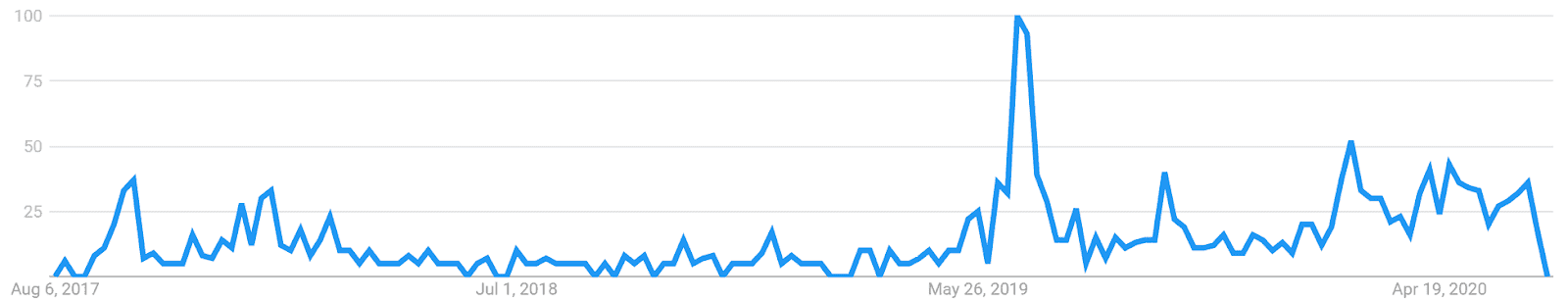

Worldwide Google Trends data for the term “chainlink crypto” increased dramatically from April to June 2019, corresponding with an increase in LINK spot prices. Interest appears to have dropped since peaking in June, with fleeting and smaller peaks in interest. The peak far exceeded initial interest during the ICO.

A slow rise in searches for "bitcoin" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. However, a 2015 study found a strong correlation between google trends data and BTC price whereas a 2017 study concluded that when U.S. Google "bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

A roadmap for trend confirmation and strength can be deduced using Exponential Moving Averages, Volume Profile of the Visible Range, pivot points, the Ichimoku Cloud, Pitchforks, and chart patterns. Further background information on the technical indicators discussed below can be found here.

On the twelve-hour chart for the LINK/USD market, the spot price relative to the 50-period Exponential Moving Average (EMA) and 200-period EMA can be used as a litmus test for the trend. These key EMAs crossed bullish on April 16th, after the previous 70% drop in price. Both EMAs currently sit above US$4.00 and will likely act as support.

The Volume Profile of the Visible Range (VPVR, horizontal bars) also shows support in the US$3.80 zone with little volume resistance overhead. Although RSI and volume show no signs of bearish or bullish divergences, RSI hit a low of 17 on March 12th. As the pair now enters price discovery, yearly pivots and the 1.618 fib extension from the March high and low suggest a resistance zone between US$6.50 and US$7.00.

Turning to the Ichimoku Cloud, there are four key metrics; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

On the twelve-hour chart, Cloud metrics are bullish; the spot price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price. The trend will remain bullish so long as the spot price remains above the Cloud. Kijun support currently sits at US$4.77. Since the Kumo breakout in April, the Cloud has had two bullish TK recrosses (yellow) above the Cloud, highly suggestive of bullish continuation.

Historic price averages can also provide a band of most likely price targets around a high and low zone. Using backtesting, various iterations of any high timeframe price average can be used, so long as previous highs can be accurately predicted.

Prices below the moving average can be treated as areas that will likely find support and should be considered oversold conditions. Prices above some multiple of the moving average can be treated as zones more likely to find resistance and should be considered overbought conditions.

The half-year moving average currently provides a lower limit of US$3.55. The half-year 5x multiplier currently provides an upper limit of US$10.69.

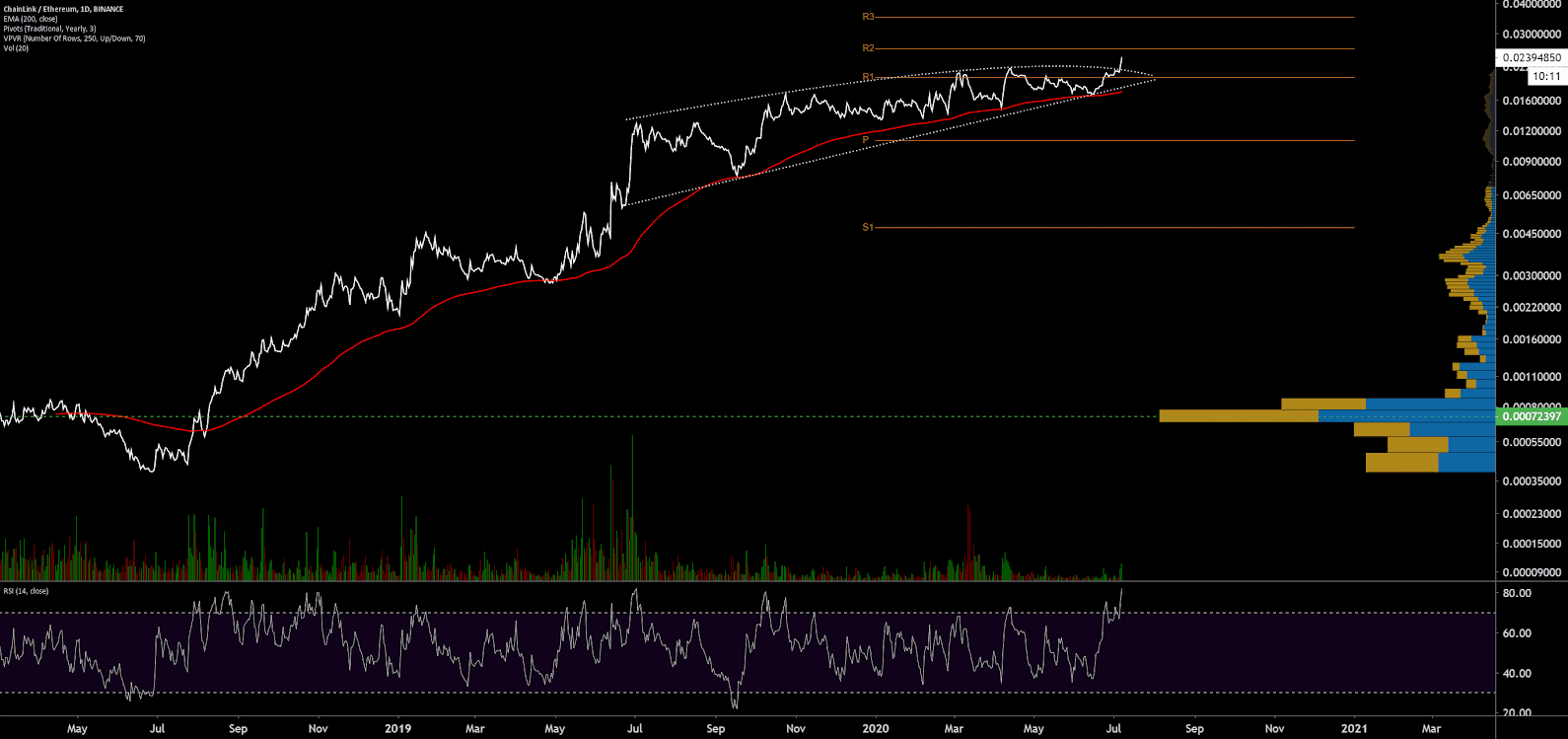

On the daily LINK/BTC chart, trend metrics remain bullish. Price has largely remained above the 200-day EMA since August 2018. Additionally, since 2018, all drops below the Cloud have been temporary, leading to bullish continuation (not shown). The trend will remain bullish while the spot price is above these two critical levels. High volume VPVR support sits around the 12,000 sat zone should price fall below the 200-day EMA.

A high timeframe bullish Pitchfork (PF) with anchor points in July 2018, and January and May 2019 encapsulates the current price action. Throughout any given trend, the spot price returns to the median line several times, currently at 56,750 sats (yellow). Based on the median line and yearly pivot resistance, a price of 72,000 sats is expected around September this year, should the trend continue. A price close below 32,000 sats would likely invalidate the current trend.

On the daily LINK/ETH chart, trend metrics are similar to the LINK/BTC chart; price has held above both the 200-day EMA and the Cloud since July 2018. Again, the trend will remain bullish while the spot price is above these two critical levels. Upside yearly pivot resistance sits at 0.026 ETH. If and when this trend does reverse, very little downside VPVR support exists until the 0.0036 ETH level.

Price has also formed a potential bearish reversal pattern, the rising wedge. Hallmarks for this pattern include a series of higher highs and higher lows confined in a tightening zone. According to chart pattern specialist, Thomas Bulkowski, “rising wedges are some of the worst performing chart patterns which can breakout in any direction, but break downward 60% of the time.”

Conclusion

As more and more non-compatible blockchains, APIs, and datasets begin to emerge, so has the need to bring interoperability to the on-chain and off-chain worlds. LINK aims to solve this problem through a decentralized oracle network of node operators, incentivized to propagate accurate data by staking LINK. Thus far, LINK has established impressive proofs-of-concept or partnerships with SWIFT, Google, Oracle, and Intel, all of which are leaders in banking or cloud computing industries.

On-chain metrics for the LINK token, Github dev activity, and Google Trends all show a strong or continuous uptick in activity over the past several months, which supports the recent bullish rallies and continuous bullish price trend. LINK run oracles have quickly become a mainstay of the DeFi universe. However, this flurry of on-chain activity is likely related to speculative demand and not necessarily organic use of the network. Additionally, the remaining 268 million tokens currently held by Smart Contract Limited can be sold at any time. Based on wallet activity recently, 500,000 have been moved every two weeks.

Technicals for the LINK/USD have remained in bullish territory since the March drop, with price holding well above both the 100-day EMA and the twelve-hour Cloud. Any further price discovery will likely find resistance at the yearly pivot and 1.618 fib extension near US$6.55 to US$7.00. Pullbacks in the near term are likely to find support at US$3.80 to US$4.00.

Technicals for the LINK/BTC and LINK/ETH pairs suggest a bullish outlook with a continued multi-year bull trend. Both pairs are holding above the 200-day EMA and daily Cloud. If prices move higher throughout 2020, LINK tokens held by Smart Contract Limited may again be sold, as was the case in July through August 2019. Additionally, as ETH enables staking later this year, the LINK/ETH pair may enter a short-term bear market fueled by ETH speculators.

Don’t miss out – Find out more today