Coinbase IPO prospects boosted by crypto bull market

As it prepares for its IPO, Coinbase is experiencing phenomenal trading volumes driven by Bitcoin’s eye-opening bull run.

On January 11th Coinbase recorded a staggering USD9.7 billion in trading volume according to The Block’s Larry Cermak. To put this number into perspective this is more volume than the platform recorded in the whole month of January 2020 and first quarter of 2019.

Cermak says this huge trading volume couldn’t come at a better time with regards to the upcoming Coinbase IPO. Vijay Boyapati, author of the legendary “The Bullish case for Bitcoin” blog post agrees – saying the IPO is going to be a major catalyst for the market when it happens. Boyapati predicts a lot of capital from the stock market will flow into the Bitcoin market as a result. “It is a perfect time for an IPO. Wall Street and retail will be dazzled by the bull market profits.”

Coinbase announced on December 18th that it had submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (SEC). Form S-1 is the initial registration form for new securities required by the SEC for US companies that want to be traded on national exchanges like the New York Stock Exchange (NYSE).

In October 2018, Coinbase achieved a USD 8 billion valuation based on a Series E equity raise. With its S-1 filed, this number is no doubt higher thanks to Coinbase solidifying its position as a blue chip crypto service provider and Bitcoin’s price rising 260% since then.

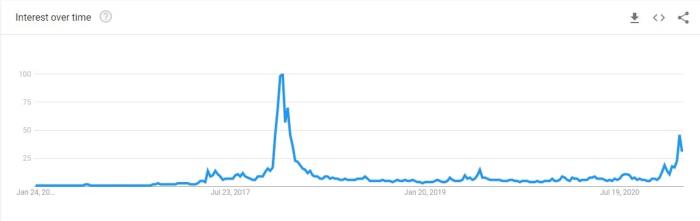

The Coinbase news came just a day after the Bitcoin price crossed the USD20,000 barrier for the first time and joined a chorus of other major crypto announcements. Now, as the Bitcoin price enters previously unexplored territory above thirty thousand dollars, Google Trends shows public interest in Coinbase and Bitcoin has surged to levels not seen since late 2017 – with a very strong correlation between search interest in Bitcoin and in Coinbase.

Coinbase is also popular amongst mobile users in the US and is the 5th most popular finance app on the Apple App store and 3rd most popular finance App on the Google Play Store. Perhaps an indication of the growing popularity of digital assets in the US is that four of the top five apps in the App store; The Cash App, Robinhood, Paypal and Coinbase, all let users buy crypto.

Other factors pushing the Coinbase IPO towards success are;

-

The Bitcoin price bullrun. Since a March 2020 crash that saw it hit USD4,994 on March 15th, the price of bitcoin has risen ~561% to currently trade at USD33,025. Zoomed out even further, Bitcoin is the best performing asset of the last decade rising a staggering 9,710,233% between the end of 2010 and the beginning of 2021.

-

The success of other startup Unicorn listings like AirBNB and Doordash. Like them, Coinbase is another first-of-its-kind company that may enjoy a speculative value boost. The IPOs for both these companies opened in December 2020. The AirBNB stock closed on its first day of trading at USD144 a share after opening at USD68, while Doordash’s IPO surged from an opening price of USD108 to close at USD 188.

-

The recent institutional endorsement of Bitcoin from people like MicroStrategy CEO Michael Saylor and legendary hedge fund investor Bill Miller has legitimized the digital asset industry and adjacent companies like Coinbase.

-

The global impact of COVID-19 has also been a major macro driver of Bitcoin’s new popularity as government’s worldwide will attempt to kick start their economies in 2021 with massive fiscal stimulus. In such an environment Bitcoin’s economic characteristics of finite supply and fixed encoded inflation has seen it firmly establish its appeal as a store of value.

Potential challenges that may turn investor away from investing in the milestone Coinbase IPO include:

-

Regulatory resistance: While Coinbase has filed its S-1, it may take some before the SEC approves the listing for a variety of reasons. In 2018, for example, Mashable uncovered more than 115 complaints to the SEC filed by Coinbase customers for issues including outages to missing funds. Many of these issues persist to this day.The platform has also recently been sued for listing the Ripple token XRP. The SEC announced in late December that it had filed an action against Ripple Labs Inc and its possible Coinbase may delay its IPO until that issue is resolved.

-

Investor misinformation and challenges with valuation: Although Bitcoin is over 10 years old it is still true to say that the digital asset sector remains nascent – and the wider public is generally oblivious to how cryptocurrencies work. Cryptocurrency transfers have also been closely associated with illicit activities like money laundering and ransomware. As a result, Investors may be skeptical to back the flagship company for an industry that has had its name dragged through the mud following the collapse of the ICO market in 2017 and the numerous failures of blockchain technology. The trend of Bitcoin being written off as a failed technology persists to this day with an article titled ‘The Bitcoin dream is dead’ going viral as recently as January 14th.

Investor’s perspective: What is Coinbase?

Cryptocurrency services giant Coinbase is now positioned to become mainstream finance’s most reliable and accessible cryptocurrency industry proxy bet. But with the wider public’s understanding of cryptocurrency not high, some have suggested that Coinbase could or should position itself as a banking/financial services company – as opposed to a blockchain adjacent company. A similar tact was taken when Snap, the company behind the popular application Snapchat, described itself as a camera company in its original S-1 filing.

Indeed, Coinbase’s own ‘Mission’ page does not mention Bitcoin or cryptocurrencies at all – instead focusing on its desire to create “an open financial system for the world.” While this is indeed a noble goal, Coinbase’s footprint outside of buying and trading cryptocurrencies isn’t large. Coinbase began its life as a digital asset wallet consumers could use to buy, store and transfer digital currencies.

It now also offers Coinbase Pro as an exchange for more advanced cryptocurrency trading and operates USD-Coin (USDC) a popular stablecoin that is pegged to the US dollar. For businesses it offers Coinbase Commerce to merchants as a solution for accepting digital asset payments, Coinbase Custody for institutional digital asset custody and Coinbase Prime as a prime brokerage solution. The company claims 35 million verified users, operates in 100 countries and has around 1000 employees.

Don’t miss out – Find out more today