Crypto Market Forecast: The week ahead, 13th May

A defining week of trading in Bitcoin markets ended with price above $7000 and BTC seven day gains over 20%. Price appears to have been driven by the 'smart money' - a bullish flag that a retail pump may be incoming.

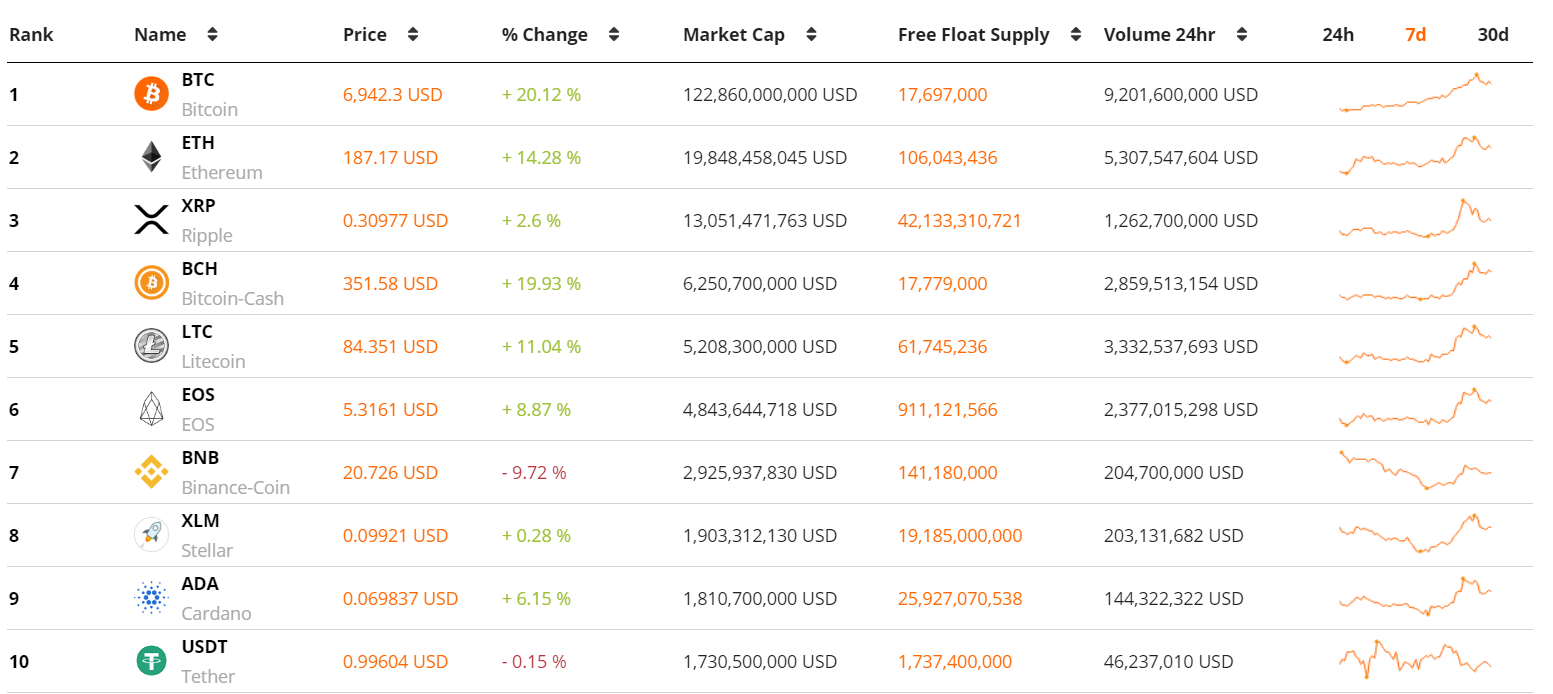

In what may have been a defining week in the transition from a long crypto winter to a new spring, Bitcoin briefly went parabolic, surging $1,500 in four days to a local high of $7,570, before correcting. Bitcoin ended the week with an impressive gain of ~21% – trading at $7,115 at the time of writing. The altcoin market also posted strong gains, the second and third largest crypto assets on Brave New Coin’s market cap table, ETH and XRP, gained ~14% and ~3% over the last seven days. The total crypto market cap rose ~16%.

The week was dominated by the strong performance of market leader Bitcoin. Brave New Coin measures its current market dominance at ~59%, up from 50% at the start of April. As yet, there is no single factor behind the price surge. Contributing factors may include the front-running of bitcoin flows from institutional brokers E-Trade and TD Ameritrade, which plan to launch BTC trading operations in the near future, and co-ordinated buying from large crypto bulls. Another possibility is the ongoing breakdown of trade talks between the US and China. This has pushed American equity markets down and may create bitcoin buy pressure due to its characterization as a global macroeconomic hedge.

Bitcoin’s price surge was accelerated by a short squeeze as bears were forced to close their short positions, further adding to the upward price pressure. A number of market participants remained short through the run, viewing the spike as unsustainable. Arthur Hayes, CEO of the Bitmex trading platform, said the final surge to $7,500 resulted in a new 24-hour trading volume record of 10.03B. The market bullishness may have caught many traders off-guard due to a theft on major crypto exchange Binance, just two days before the price began to accelerate. Hackers used a variety of techniques, including phishing, viruses and other attacks to steal 7,000 BTC from Binance. In the past, following a security breach at a major exchange, similar events have led to a dip in the market. The Binance hack may have led to more traders entering short positions, before being caught out by the price run.

One element of the price increase that is clear, is that it was not driven by new mainstream buyers. Google trend data indicates a small increase in Bitcoin related searches during the run (worldwide). Reporting from mainstream finance media was muted. This suggests the buying was led by those ‘in the know’, with retail traders following the price surge.

The fact that the pump wasn’t lead by mainstream buyers may be considered a strong bullish flag. If a wave of new mainstream buyers does emerge, price appreciation may be swift. In the short term, with NYC blockchain week conference Consensus 2019 underway, (May 12th-15th), the market may see further bullish momentum based on new announcements from the conference.

Upcoming crypto events

May 12th-15th – Consensus 2019

The blockchain industry’s most high profile event returns to New York this week. The speaker list includes high profile thought leaders from the Bitcoin and blockchain space, and US 2020 presidential candidate and Bitcoin supporter, Andrew Yang. In the bear market of 2018, the conference failed to have much of an effect on the crypto markets. However, with Bitcoin’s recent price volatility, and an apparent return to bullish sentiment, this year’s Consensus may have more of an effect.

May 20th- 23rd – Collision 2019

The Collision 2019 tech conference, now in its 5th year, takes place in Toronto next week. The intriguing speaker list includes Canadian Prime minister Justin Trudeau, actor Seth Rogan, DJ Steve Aoki, senior leaders from Y Combinator and Oculus VR, and tech investor and crypto-bull Tim Draper.

Also this week, Bitcoin Cash received vocal support from Ethereum’s Vitalik Buterin. Buterin congratulated the team for scheduling the implementation of Schnorr signatures ahead of Bitcoin. Buterin suggested the Bitcoin Cash community has benefited from the departure of Bitcoin SV supporters. BCH rose ~20% last week.

BTC markets exploded at the end of last week, pushing through any potential resistance at the $7,000 price level, crushing shorts along the way, before eventually topping out just above $7500. The price is now sitting just under the $7000 price level.

In another bullish sign, Bitcoin’s hash rate continues to rise, building on 2019’s continued uptrend. The next difficulty adjustment, due in ~10 days, is expected to be positive (~3%).

Don’t miss out – Find out more today