Crypto Market Forecast: The week ahead, 26th November

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

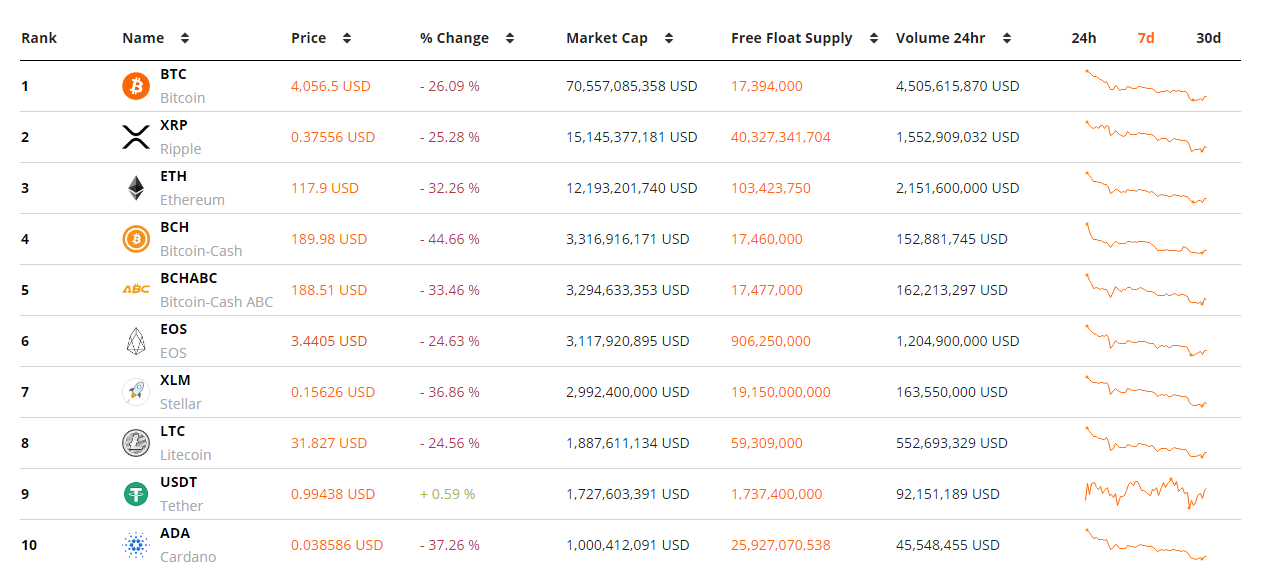

2018’s bear market hit a new low in the last week as the overall market cap of digital assets slid ~34%. Bitcoin fell ~26% over the week and is now down ~82% from its all time high. Other large caps like XRP and Ethereum are down ~91% and 92% from ATH’s respectively.

Over the last few weeks stories of increased regulatory scrutiny, delays to anticipated mainstream crypto purchasing solutions, and power struggles within major crypto projects, have intensified.

These factors coupled with lukewarm network fundamentals and reports of falling adoption of crypto as a tool for services such as payments, have led to strong selling pressure against a lack of buying resistance — to a point of apparent capitulation.

The current, bruised digital asset marketplace may represent an opportunity to purchase into a number of exciting crypto projects at cut-price valuations. Traders, however, should be wary of trying to catch a falling knife, as there are arguments on both sides as to whether crypto markets have bottomed out — with neither camp fighting with any real certainty.

Upcoming events in crypto

November 27th– Consensus Invest: NY

Likely the biggest event on the Q4 crypto calendar, Consensus Invest features one of the deepest and most influential crypto speakers lists ever. Jay Clayton, chairman of the SEC, John Tornatore, director of CBOE global markets, Mark Yusko, CEO of Morgan Creek Capital and many others within the finance & digital asset sector will be speaking at the event. With a major focus on the evolution of crypto in 2019, crypto markets may receive a strong boost in positive sentiment post the event.

November 28th– Ark Mainnet Launch V2

Ark was one of crypto’s strongest performing tokens in 2017, rising ~3,147% in under 6 months. It launches a significant upgrade to its network this Wednesday which will allow for dynamic fee scheduling, a plug-in system that will be at the core of the project’s ambition to become the ‘word press of blockchain’, and an improved API system with new endpoints & stability.

November 30th– CME last trading day Bi-Monthly November contract

The current round of CME monthly Bitcoin Futures trading, has its last trading day on Friday. This will be the last chance for futures contracts to be traded or closed out, and post this date outstanding contracts need to settled by cash as per original specifications. In November there were over 5000 XBT contracts traded, each worth 5 BTC. This equals close to $100 million. The days surrounding futures expiration are always prone to unusual price activity with scenarios like long squeezing, tending to exaggerate movements. The high volumes on CME markets this month will add to any potential price volatility.

December 1st– Stellar Livenet Lightning Network launch

Top 10 crypto asset, XLM and its underlying blockchain Stellar, continue to build on a position as a market leading cryptographic platform blockchain, with the launch of Lightning Network (LN) support this Saturday. LN implementation allows a blockchain to circumvent certain on-chain operations (without sacrificing security & anonymity) through the use of trusted off-chain channels. Implementation has a significant impact on scalability, transaction ease, and fees. The price of XLM fell 35% over the last week, but positive speculation around the LN deployment may assist with a price reversal.

Top 10 Crypto Summary

It was a challenging week for all large cap alts across the crypto marketplace. As ETH approaches double digits, LTC falls under $35 and ADA dips under $0.05, there appears to have been a purge of a number of less tightly held crypto participants. A large amount of trading into fiat pairings indicates a full exit for a number of crypto traders and investors.

It was a challenging week for Bitcoin, as price dropped below $3600 at one point on Saturday — and overall losses exceeding 25% in most markets.

At a fundamental level there have been concerns as hashrate has begun to dip alongside mining profitability. Further sell-offs of BTC and equipment from major mining operations (some Chinese mining operations are selling older GPU machines because of their inability to generate profits at current BTC prices) could have major effects on price in the short run and network participants will hope that any new price lows will signal the re-entry of miners who have been passive over the last few weeks.

Don’t miss out – Find out more today