Crypto Market Forecast: The week ahead, 6th May

Crypto markets shook off fresh Tether and Bitfinex concerns to enjoy a primarily positive week of trading. Bitcoin lead markets with near double-digit gains and continues to show signs of medium-term bullishness.

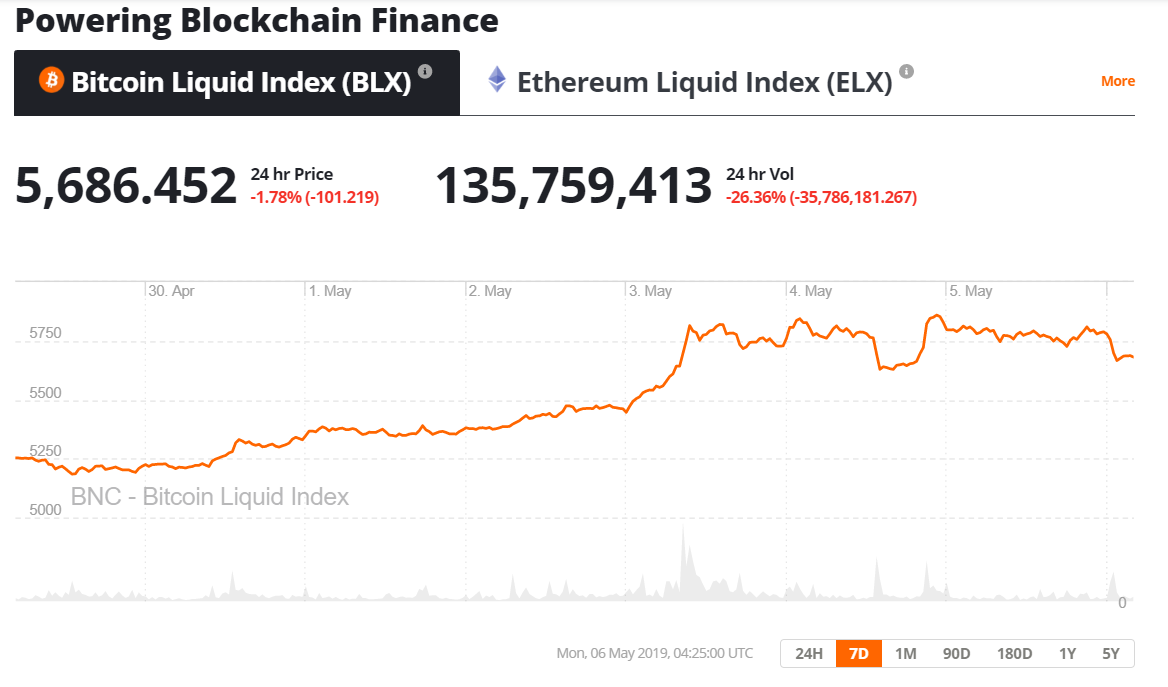

The crypto market had a strong week with gains from market benchmark BTC leading the way for most assets to post gains against the US dollar, before some corrections on Monday. Sustained bullish momentum allowed the BTC/USD pair to move through the $5,500 resistance level in the middle of the week.

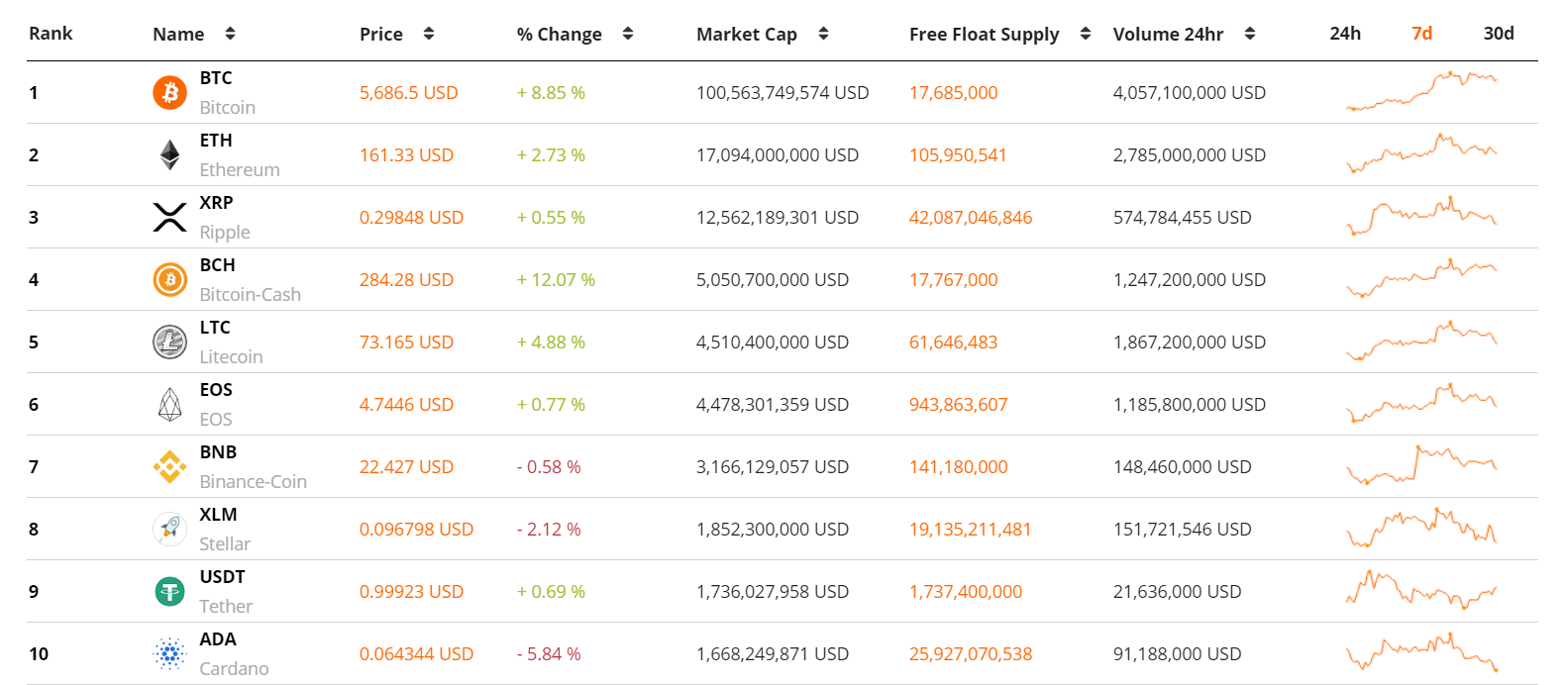

Market benchmark BTC rose ~9% in the last 7 days, while number two and three crypto assets, ETH and XRP, rose ~3% and ~0.5% respectively. XRP markets were buoyed by the launch of Brave New Coin’s XRP-LX on the Nasdaq Global Index Data Service on Monday. The overall crypto market cap rose ~7% last week.

The market shook off another round of Tether/Bitfinex FUD following the revelation that USDT only has enough cash to back 74% of its increasing supply. This number is contrary to previous statements from Tether, as recently as December 2018, stating that USDT holdings were backed 100%, 1-for-1 with USD cash equivalents.

For now, the markets have signalled an intention to continue to use USDT as a trading tool, likely because of its excellent liquidity and ease of use. Volumes remain consistent and the $1 price peg has continued to hold.

Based on the above, the market appears willing to grant Bitfinex/Tether time to put their books in order. To achieve this, Bitfinex has announced it will conduct a $1 billion Initial Exchange Offering (IEO). An IEO is a new fund-raising mechanism that allows crypto businesses to sell previously unlisted tokens on an exchange to raise capital. Bitfinex’s plan to sell its IEO tokens was met with mixed reaction. The token will launch as the first IEO on Bitfinex and seeks to raise $1 billion during its sale with USDT acting as the on-ramp medium.

Meanwhile, Bakkt, the Intercontinental Exchange backed institutional crypto trading platform, acquired crypto custodian service Digital Asset Custody Company (DACC) and entered a partnership with Bank of New York Mellon to offer geographically-distributed storage of private keys. When Bakkt launches, the demand for its products is increasingly seen as the “acid test” to determine institutional demand for crypto. Significant demand for Bakkt’s bitcoin futures product would be a clear sign that Wall Street is warming up to the crypto space.

Upcoming crypto events

8th May 2019 – Loopring (LRC) Token smart contract upgrade

The Loopring network, a decentralized exchange solution, will release a significant update that redefines the fee model and utility of the native LRC token. The upgrade is automatic for any LRC tokens held on an Ethereum wallet. The new model adds a protocol that incentivizes LRC staking and more regular burning of treasury supply. The price of LRC fell 4% in the last week.

10th-18th May – Multiple New York Blockchain week events

In the lead up to Consensus 2019, a number of exciting crypto events are set to take place in NYC this week. On May 13th, policy think tank Coin Center hosts its 2019 annual dinner, with SEC Commissioner Hester M. Peirce and CFTC Commissioner Brian Quintenz as speakers. The Magical Crypto Conference will run between the 11-12th of May. It features a number of high-quality panels including speakers such as Brave New Coin’s own Josh Olszewicz, Blockstream CEO Adam Back, and Litecoin founder Charlie Lee.

It was a steady green trading week for most large cap assets with BTC and BCH leading the way before Sunday’s corrections. Outside the top 10, as reported by Cryptocurrency Newsfeed, news that Jaguar Landrover will enable car drivers to earn IOTA by sharing data, created some mid-week buying momentum before these gains were cancelled out by Sunday sell-offs.

BTC continues to perform well in the medium term, with bulls taking the opportunity to continue to accumulate the asset. Strong buying volumes helped the price push through the $5500 and the $5650 levels.

In another bullish sign, Bitcoin’s hash rate continues to rise, building on the recent uptrend in mining activity after the fall in December 2018. The next difficulty adjustment, due in ~10 days, is expected to be positive.

Don’t miss out – Find out more today