Crypto Market Forecast: The week ahead, 8th April

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

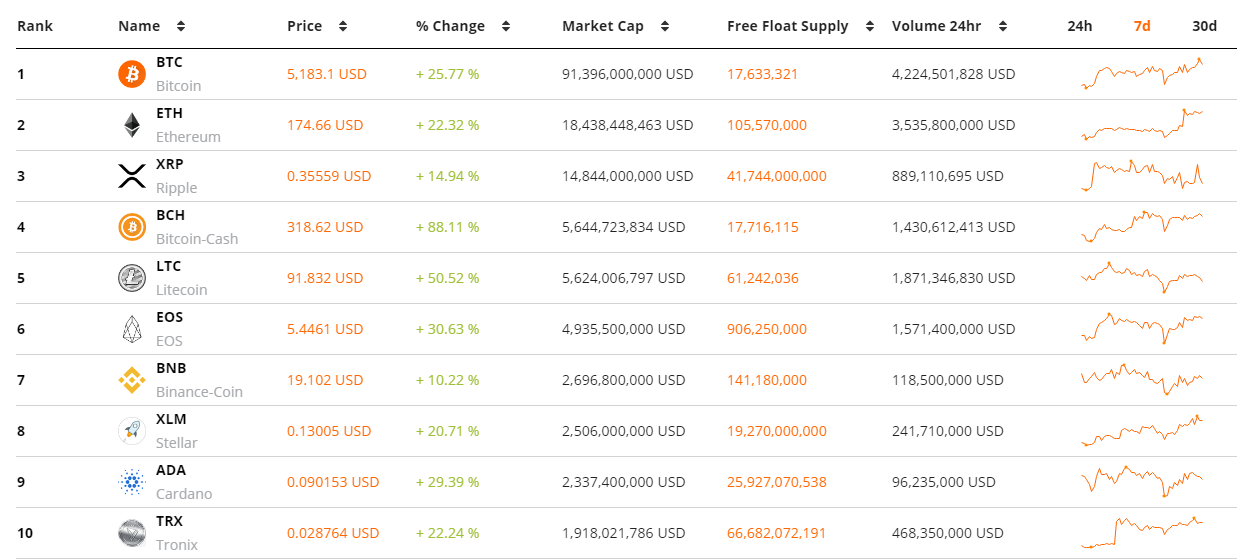

Bitcoin and the entire crypto market hit new highs for 2019 in the last week, potentially signalling a definitive end to the market’s long winter and the beginning of a period of bullishness and accumulation. The price of Bitcoin rose ~25%, easily crossing the US$5000 price threshold over the last 7 days, while large-cap crypto’s Ethereum and Litecoin enjoyed gains of 26% and 64% respectively. The overall crypto market cap grew ~26% over the same period.

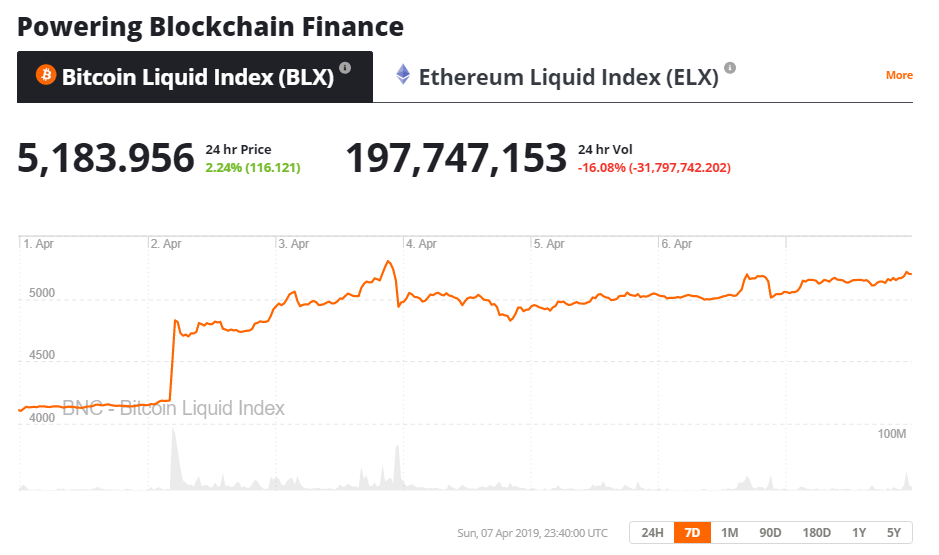

There was no apparent news story driving the market gains that began early in the week, although potential factors such as an April fool’s day trading signal have been suggested. The apparent trigger for the initial price jump was an interconnected, algorithmically executed ~20,000 BTC order spread across the Coinbase, Kraken and Bitstamp crypto exchanges by a mystery buyer.

The surge in Bitcoin demand was accentuated by the squeezing of shorts across a number of crypto future markets including Bitmex and OKEx. As is often the case, large orders in Bitcoin markets often triggers buying activity in altcoin markets, and initial BTC gains began to permeate across to other cryptos. It is unclear what triggered the mystery buyer’s order but it opened the door for other bulls to purchase altcoins in large volumes, push the price of BTC well past ~US$5000, and demolish bears in the short term.

Many, however, may have seen a potential price jump coming – with technicals showing signs of accumulation and price bottoms being hit in a number of crypto markets. BTC has had two consecutive green months and other cryptos like BNB and LTC have performed strongly since December. As noted by Jehan Chu, managing partner at blockchain investment advisory firm Kinetic Capital, blockchain markets remain emotional and small compared to traditional finance, prone to short term waves of enthusiasm. In this regard, the $5000 psychological support level remains precarious in the eyes of many analysts.

In wider ecosystem news, the SEC published a clear, detailed framework in the last week to help issuers and buyers clearly understand whether the purchase of a digital asset or ICO constitutes an investment or security. While in the landmark QuadrigaX user fund loss case, audit firm EY advised last week that the Canadian exchange should be put under bankruptcy and not be restructured, as bankruptcy would allow for "the potential sale of assets, including but not limited to Quadriga’s operating platform."

Upcoming events in Crypto

April 10th – BAT/Brave team "Ask Me Anything" (AMA)

Popular ERC20 and ICO project Basic Attention Token (native token of the Brave web browser), has a community AMA (‘ask me anything’) this week. Questions may cover ongoing Brave strategy decisions and efforts to push the browser mainstream.

April 15th – Mainframe OS launch

Mainframe (MFT) launches its operating system for discovering, using and creating decentralized applications (Dapps). Clunky UX and intimidating development procedures have been historic challenges for the blockchain Dapp ecosystem and according to developers, the Mainframe OS is designed with these challenges in mind. The price of MFT has risen ~19% in the last week and ~44% in the last month.

April 15th – Paris Blockchain Week summit

A major event for the European crypto community, Paris Blockchain week will feature 100 speakers and have ~1500 attendees. Notable speakers include Tezos co-founder Arthur Breitman and Morgan Creek Capital CEO Mark Yusko. Featured discussions on the agenda include a panel on European solutions to digital asset regulation and institutional investment in crypto.

It was a tremendous week of trading for assets in BraveNewCoin’s top 10 market cap table, with significant double digit gains and tokens like LTC, EOS and BNB continuing month long periods of bullish activity. Bitcoin Cash outperformed the rest of the large cap market on the back of news that the blockchain may have greater merchant adoption in Japan vs Bitcoin and apparent positive speculation from Asian markets.

Bitcoin crashed through the $5000 ceiling early last Tuesday and has continued to build upon this initial surge in momentum as the week has progressed. BTC bulls have defended the $5000 price level strongly, with buying pressure ticking upwards whenever BTC price has approached the ~$4900 level.

Bitcoin’s hashrate rose in the last week, continuing a multiple month uptrend that indicates a strong short/medium run in demand to mine the network.

Don’t miss out – Find out more today