Crypto Market Forecast: Week of March 22nd 2021

A curated weekly summary of forward-focused crypto news that matters. This week, the Bitcoin price recovers after a difficult start to the week, The Fed commits to an aggressive money printing policy and XRP finally gets some positive legal news.

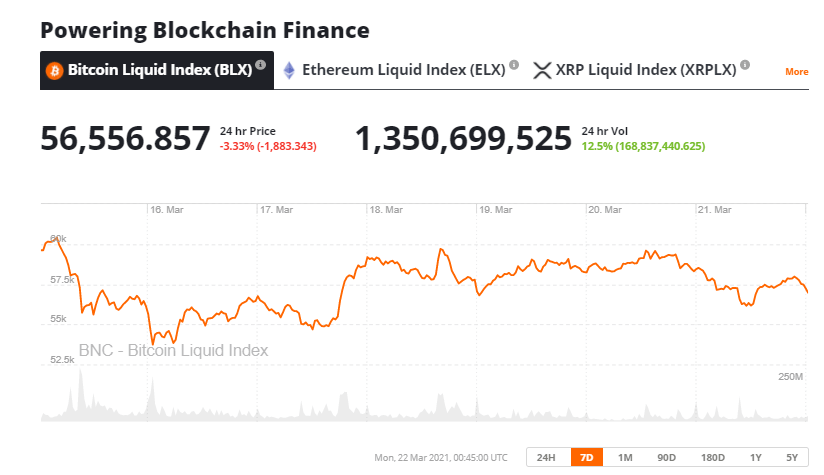

It was a volatile week in digital asset markets as the Bitcoin price ranged between $60,401.61 and $53,376.36. It ends the week trading at ~$57,186 and down ~6%. In terms of the number 2 & 3 assets the Ethereum price moved down ~7% during the week, and the Binance Coin price also dropped ~1%.

After touching lows of around USD53,000 on Tuesday, a factor in Bitcoin’s price recovery in the second half of the week was long-term US bond yields hitting 14-month highs on Friday. The 10-year Treasury note hit 1.732% and the 30-year note reached 2.451%. A higher yield on long-term bonds implies that investors have confidence in a country’s economic outlook but also signals that they expect inflation to rise.

Bitcoin was in part created to be an easily accessible digital safe haven and hard asset with an independent monetary policy. It has been used by investors to protect themselves when increased fiscal stimulus and bail-out packages, funded by government debt, threaten to devalue fiat currencies globally. Bitcoin was inversely correlated with a dipping US dollar for much of 2020.

Federal Reserve chairman Jerome Powell, writing a commentary piece for the Wall Street Journal, reiterated that the central bank was committing to an “all-in” approach to keep the economic recovery moving forward. In response to economic shutdowns caused by the Covid-19 pandemic, the Fed has supported the government with its largest economic recovery package of the postwar era. The US economy is set to grow by 10% in the first quarter of 2021 but a high unemployment rate remains a sore point for the government.

Heavy stimulus operation is not over in the US with Powell saying the recovery is far from complete and the Fed will “continue to provide the economy with the support that it needs for as long as it takes.” Financial markets appear to be reacting to this stance by backing inflation hedge assets like Bitcoin.

Crypto news for the week ahead

March 24th – Sakeswap launches on the Binance Smart Chain

Sakeswap is a popular AMM-based DEX on Ethereum that is a fork of Uniswap and targets fixing issues around impermanent loss and market maker earnings. This Wednesday it launches on the Binance Smart Chain (BSC), an alternative platform blockchain operated by the Binance exchange. There has been an ongoing trend of Ethereum decentralized applications like Sushiswap, Fantom, and Polygon ditching the higher fees of the Ethereum network to operate on the BSC.

__March 25th – Mainnet launch of the CRO token on the Crypto.org chain __

Crypto.com, a platform that is focused on providing onramp services for connecting fiat and cryptocurrencies, is set to launch a new blockchain platform this Thursday. The new Crypto.org chain, which also arrives with the Crypto.org URL, will use Tendermint based delegated proof-of-stake and will target offering high speed and low fees to power Dapps.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

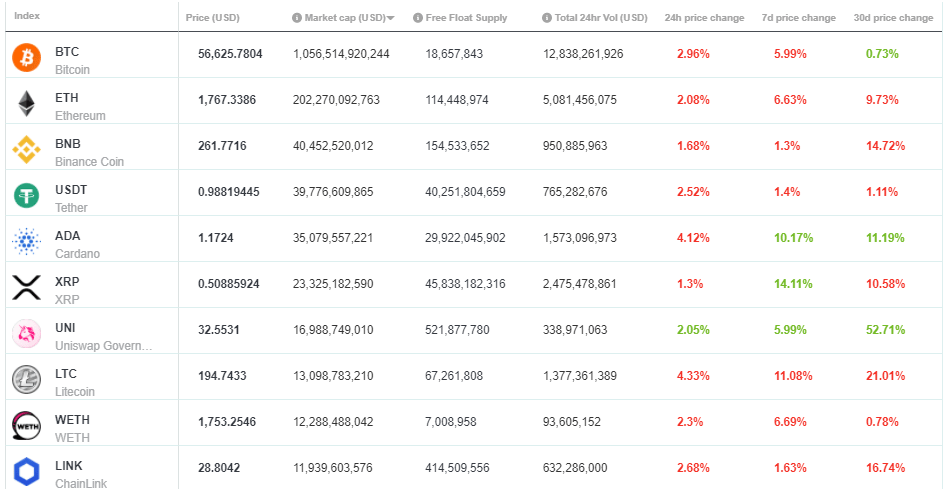

Top 10 Crypto Summary

It was a mixed week of trading for large-cap assets on the BNC market cap table. XRP is the best performer on the table, rising an impressive 13% in the last week. In his analysis of discovery hearings in the SEC v RIpple Inc case, attorney Jeremy Hogan says SEC lawyers have stated that US exchanges which have facilitated the sale of XRP tokens have not breached any securities laws – and he expects US exchanges like Coinbase and Kraken may list XRP again.

Bitcoin Price Chart

The Bitcoin price ends the week down ~6%. Three times last week BTC challenged the $60,000 price and on every occasion, the ascent was flatly rejected. This suggests 60k is a key psychological resistance level in the near term. Meanwhile, Bitcoin’s long-term outlook remains bullish with Glassnode reporting unprecedented growth in new entrants to the Bitcoin network last week.

Don’t miss out – Find out more today