Crypto Predictions 2019: Alt-Coin Contenders — Augur

In 2019 the cryptocurrency sector will continue its evolution. While its early years have been dominated by almost entirely speculative trading, as the market matures, a digital asset’s ‘fundamentals’ will become increasingly important as value indicators. BNC’s 'Alt-Coin Contenders' series introduces assets with fundamental characteristics that set them apart from their competitors and justify their inclusion in any investor’s ‘ones to watch’ list.

From an investment perspective, valuing businesses is typically done using time honored formulas like price to earnings and price to book ratios, PEG calculations and dividend yields. In the crypto space, none of these methods apply directly — and investors continue to wrestle with how best to assign a value to digital assets in a nascent industry that is sentiment driven and characterized by wild volatility

To that end, the purpose of this ‘Alt-Coin Contenders’ series is to identify specific assets that BNC analysts have identified as having fundamental characteristics that at the very least, justify investors including them in a ‘ones to watch’ list.

The selections are made based on a range of criteria – things like hashrate or an increase in on-chain transactions. Or usage metrics for application tokens and the size and enthusiasm of an asset’s ‘community’. Or apparent liquidity — significant exchange listings and fiat on-ramps. Exposure to potential legislative action is also important, as are the people behind the scenes — inspiring leaders with ‘rock star’ social media status, or alternatively, big-time financial backers with deep pockets and a track record of success.

No single asset will tick every box, and some will tick more than others, but what this series aims to do is move readers beyond simplistic FUD, FOMO and speculation — and introduce the range of fundamental token attributes that should become recognized value indicators as the industry matures.

Augur: Building an n-sided marketplace

Augur (REP) is a decentralized prediction user vs user betting marketplace that is designed to forecast and communicate the outcome of an event based on a majority consensus principle.

Users participating in an Augur betting marketplace find themselves vying against peers on the network to finish on the right side of predicting an event outcome.

The key defining factor of the Augur blockchain is decentralized event/oracle reporting. Oracles, users on the network, report the results of events registered on the network using Augur’s fully automated, incentive aligning protocol, that ensures bad actors are caught and users can dispute unfair outcomes.

Users place bets on questions like ‘Will Donald Trump be impeached by December 25th, 2018?’ (an active market) with either ETH or the platform’s native token, REP. The market creator initially sets odds 50/50, 80/20 etc) and these numbers adjust as bets roll in. The ‘will Donald Trump be impeached’ bet, for example, currently sits at a 5% chance of occurring with ETH 51.4 worth of open interest. The market creator chooses a ‘designated reporter’ who reports on the objective outcome of an event.

The REP token represents ‘reputation’. Users are rewarded REP if they report an event and it matches up to the agreed consensus of other reporters. This is an incentive based system, if an oracle misreports an event—an objective true or false output—then the rest of the market makes note of this bad reporter and punishes them.

For betters, the Augur platform offers a number of advantages over a traditional centralized betting market service offered by large centralized entities like Betfair or PaddyPower.

- There is freedom for users to create any market they want, and as such let other users determine if it is a feasible betting opportunity.

- Blockchain based smart contract settlement has the potential to substantially reduce the cost and time to settle multiple bets across numerous marketplaces,

- The permissionless nature of Augur (funds and transactions secured and confirmed based on the Ethereum global account) lets users in any region participate in previously unavailable secure marketplaces. I.e. An Ethereum holder in Asia can make speculative bets on US stocks cheaply, with minimized friction, in a way not possible before marketplaces like Augur existed.

For oracles, Augur event reporting provides an opportunity to participate in an n-sided marketplace. This means that any user can provide their homogenous service to any other user and the ecosystem can continue to support more workers if demand for their services grows from the other side of the marketplace. Because of these characteristics, Augur has often been referred to as the ‘Uber of crypto’.

The ecosystem also operates more efficiently with more oracles, meaning wider representation and more views on an event result, increasing the likelihood of fair bet outcomes.

Transactions over the Augur Dapp are settled on the Ethereum blockchain through complex smart-contracts. In this sense, functionality and performance of the Augur is dependent on block times and Gas fees of the Ethereum network, which has multiple external factors affecting it.

Augur in 2018: Price struggles but growth across specific metrics

Like many other Ethereum based application tokens, REP’s price performance has been disappointing despite significant strides in product development and maturity. It is currently down ~95% from its all time high achieved in mid-January, trading at ~$6 having previously traded above a $100. Much of this price deterioration occurred in the 2nd half of the year.

The Augur Dapp underwent a significant main network transition on the 9th July. The token was able to maintain some price levity based on speculative assessments from retail traders leading up to, and around the dates of mainnet switch. Augur’s vastly improved protocol and dispute resolution mechanism announced in the lead up to the launch added to this buying pressure.

The hype and positive speculation lasted until the 6th of July when Augur traded at a peak of ~$42, post this date Augur has been on a deep slide towards low single digits that has lasted over 5 months.

Figure 1: REP- 1 year price chart, Source Bravenewcoin.com

Post-mainnet launch the Augur platform is a far more complex, fundamentally strong and consumer-ready application than it was in January, but price/value has moved in the opposite direction. This is characteristic of immature and volatile crypto markets, dominated by retail buyers who tend to trade on sentiment, as opposed to letting fundamental factors play out.

As such, price was likely too high at the height of the bull run and currently sits too low as we approach new bottoms in the ongoing bear market.

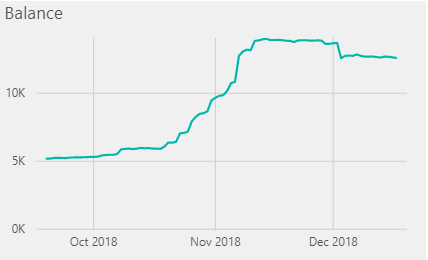

Figure 2: Growth in the total balance of ETH in the Augur platform. Source: www.curiousgiraffe.io/augur/

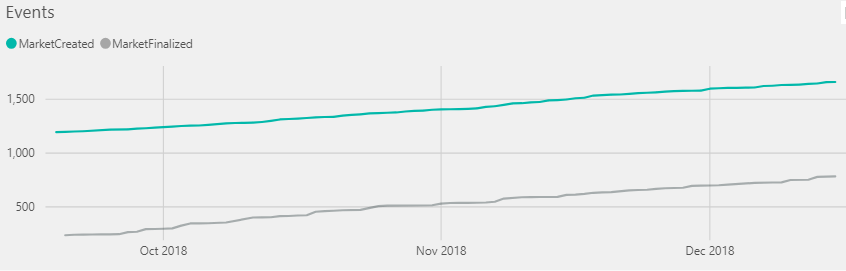

Figure 3: Growth in the total number of markets created and finalized on the Augur platform. Source: www.curiousgiraffe.io/augur/

As at December 17th, there was over 12,600 ETH locked into Augur betting markets with over 1600 markets created and 700 finalized (figures 2&3). These important metrics have shown steady upward momentum over the last 3 months, indicating a growing enthusiasm for the platform. This fundamental has not been reflected in the REP price, however.

This considered, very few of these markets are active or liquid, with most action occuring on very specific events surrounding the year end price of digital assets. The vision of Augur becoming a fully peer-to-peer betting marketplace, where any user can bet on any global event, with automatic settlement through objective reporting confirmed by consensus, has yet to achieve scale or mainstream relevance in a way that Dapps like Cryptokitties have achieved in the past.

A case study in the efficacy of the Augur platform in 2018

The Augur decentralized consensus was recently put under significant stress when trying to settle a market for ‘Which party will control the House after the 2018 U.S. mid-term elections – Democrat or Republican?

The Democratic party won the election, but the market expiration date was December 10th. Because the date was not specified in the market & the default expiration date for the betting market was 12/10/18, many argue that Republican is the correct outcome as the Democrats do not officially take control of the House until January 3rd 2019.

There is over $1 million tied into this market, with large volumes on either side of the bet. The question is clearly ambiguous and a ‘code is law’ argument may favour the Republican side of the bet, however, most believed they were voting on the results of the election or would not have voted for any party other than Republican.

90% of the bets in the market backed a Democratic win. Nonetheless, it appears that the designated reporter for the event (the oracle selected for reporting duties by the market creator) will be taking the perspective that code is law, and Republicans were in the control of the House on the expiration date despite losing the election.

This means that all Democrat backers will lose their stakes, and the minority favouring Republican will win the bet on a technicality. The event has been a useful case study on both the value and clunkiness of building a decentralized betting market. In the watertight multi-billion betting houses that dominate the sports betting world, ambiguous markets like this would never have seen the light of day. Even if they did ever face a similar unclear outcome, ‘centralized’ customer service protocols would resolve any issues.

What has been commendable is the transparency and discussion around this issue and the commitment of developers and users to prevent similar situations in the future.

Onchain fundamental indicators

NVT signal

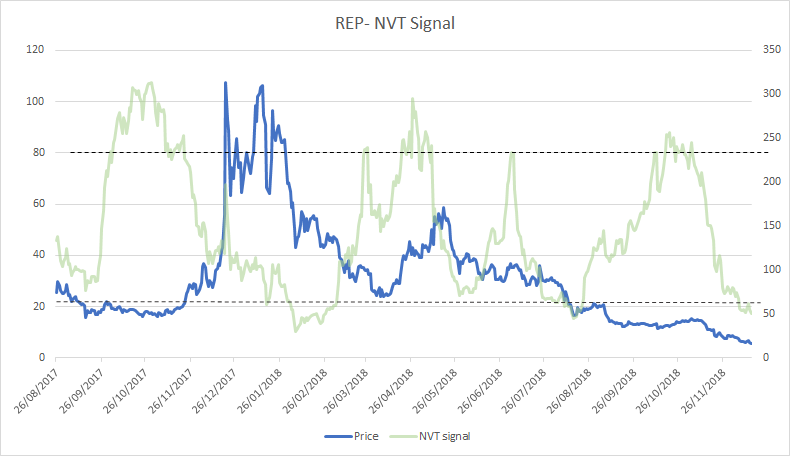

Figure 5: REP NVT signal and price. NVT signal calculated with data from Coinmetrics.io. Adjusted onchain transaction volume used for NVT signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity. The NVT signal provides some insight into what stage of this price cycle a token may be in.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

The rise in usage of the Augur betting platform over the last 3 months has coincided with a sharp fall in the NVT signal (Figure 5). This has lead to a position where REP is likely close to an oversold inflection point, and assessments of being short-term undervalued.

The token, when it finds a bottom, may be able to build on its recent network activity to push off strongly.

As mentioned, it appears that Augur platform’s recent strong fundamental value has not yet been priced into REP, once it does it is likely that some positive short term price performance will come with it.

External factors such as a reversal in the wider bearish sentiment surrounding crypto and other speculative factors specific to REP, will deflate or inflate any price movements driven by a bounce from the bottoming NVT signal.

It is Important to note that while much of the activity in the Augur platform is of ETH tokens, a more active Augur platform with more bets made with ETH increases the utility of the REP token and will likely feedback into more onchain movement of REP, as oracles observe additional opportunities to generate revenue.

PMR signal

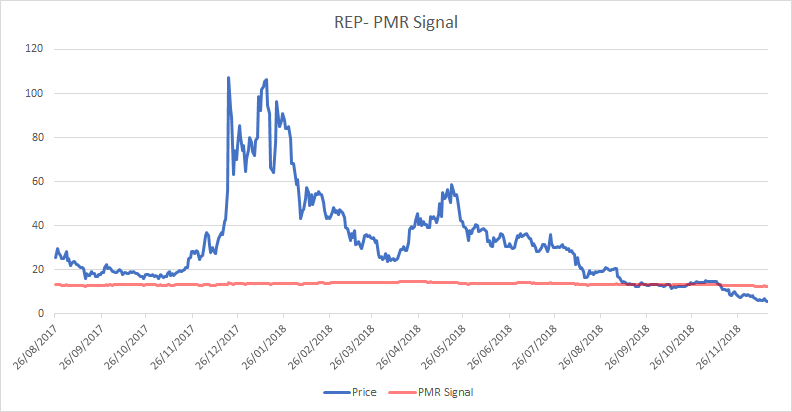

Figure 6: REP PMR signal and price. NVT signal calculated with data from Coinmetrics.io. Active addresses^2 used to reflect Metcalfe value. PMR values in natural log form.

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Historically, active address growth has generally been low for REP tokens. Active addresses on the network have never exceeded 3252 unique users on a day and averaged ~401 users a day over the period from the 26th of August to the 17th of December. This is a surprisingly small number for a network worth ~$70 million and illustrates that the REP token is still an immature asset and much of its valuation is speculative and based on venture style investment decisions made by retail buyers.

At this stage, there appears to be very little association or contribution from the PMR signal towards price (Figure 6). This may be red flag for some long term investors and a sign of weak fundamentals, however, as the network builds up momentum and activity through more bets being made on the event and more value being allocated to betting markets, the number of active addresses on the Augur network is likely to increase.

Conclusions

The Augur Dapp underwent significant changes and progression in the second half of 2018. It is now a fully functioning decentralized betting marketplace where new markets are consistently being created and settled, while onchain REP token movement continues to build momentum.

The REP token has found new utility but very little scale and coverage. This may change in 2019.

A reversal in sentiment surrounding the utility and performance of Dapps that is likely to coincide with the next bull market will be defining for REP. Augur as a much discussed, idiosyncratic, n-sided marketplace, that provides an admirable solution to traditional centralized legacy prediction markets, could re-emerge as market leading Dapp and build momentum and utility for its attached token.

Don’t miss out – Find out more today