DASH Price Analysis: Emerging from the crypto winter

After a challenging 2018, DASH has ended Q1 and begun Q2 2019 strongly – emerging from the crypto winter on the back of well-received functionality upgrades and an increase in network activity.

DASH (DASH), or Digital Cash, is a cryptocurrency payment network with optional privacy features and a masternode solution designed to offer a tiered governance and blockchain ‘work’ structure. DASH is a bitcoin fork founded in 2014 by Arizona based programmer Evan Duffield. It was initially founded as Xcoin, before rebranding to Darkcoin and finally settling on DASH in 2015.

DASH had a challenging price year in 2018, facing negative market sentiment and specific FUD surrounding its relevance as a payment token in a crowded market place with strong direct competitors like Bitcoin and XMR. The Price of DASH is currently ~$122 down ~90% from an all time high achieved in December 2017. Formally a top 10 crypto it now occupies 14th position on Brave New Coin’s market cap table. Challenges faced in the crypto winter, saw the DASH Core Group announcing layoffs in February 2019 in order to "ensure business continuity."

However, since hitting its 2018 price low of ~$60 in December, the price of DASH has risen over ~100% suggesting that a bear market bottom may have been found. DASH has benefited from favourable market conditions, with large chunks of crypto sector performing well over the same period. Some gains can also be credited to improving fundamentals – with the DASH project releasing a number of major updates to its core protocol that appear to have been received well by crypto markets.

DASH uses a dual Proof-of-work/Proof-of-stake consensus model, where Proof-of-work miners verify the DASH ledger using two and a half minute block times. Proof-of-stake occurs through the network’s Masternodes which serve higher tiered tasks to the network including voting on governance and funding proposals and performing tasks within DASH’s PrivateSend and InstantSend features.

InsantSend enables a faster off-chain confirmation-free transaction which minimizes onchain work. This is done through a transaction locking command within a wallet or client that displays an intention to lock funds from a specific input to a specific output.

DASH has historically been identified by its optional PrivateSend features, which has linked it to other privacy focused coins like Monero (XMR) and Zcash (ZEC). PrivateSend is analogous to coin mixing and involves combining identical inputs from multiple users into a single output. DASH appears to be barely used for its PrivateSend option despite a historical distinction as falling under the ‘privacy coin’ categorization.

Both InstantSend and PrivateSend transactions have higher fees than featureless DASH transactions.

While DASH has generally ranged between having 9,000-20,000 transactions per day in the last year, the maximum number of PrivateSend transactions in a day has been 186. This is in sharp contrast to privacy coin networks like Monero where every transaction obfuscates user data. Monero daily transactions have generally ranged between 3,000-5,000 in the last year.

Source: DASHradar.com

Source: DASHradar.com

There will eventually be a total of ~18,000,000 DASH once all tokens have been mined. Two million tokens of this total supply were mined when the network launched in 2014. ~70% of current DASH is held by 5429 addresses with balances between 1,000 and 10,000 DASH, while ~10% is held by 33 addresses with balances holding over 10,000 DASH.

The hashrate for the DASH network has picked up significantly in the last three months. This may be thanks to the recent price pickup which has improved short term mining profits. DASH uses the X-11 hashing algorithm which consolidates BLAKE, BLUE MIDNIGHT WISH (BMW), Grøstl, JH, Keccak, Skein, Luffa, CubeHash, SHAvite-3, SIMD, and ECHO.

A higher hashrate for a PoW means greater security from 51% attacks, and greater censorship resistance because of a more competitive blockchain. A rising hashrate is generally viewed as a bullish fundamental flag.

DASH is minable using Application-Specific Integrated Circuits (ASICs) and there are a few different hardware options miners can choose from. A new option released in March, the FusionSilicon X7+ Miner – Dash Miner 330 GH/S built by French company Bitech, currently offers an attractive annual return percentage of 181% or $4,332, while retailing at 2,385 USD. More efficient ASICs may be another factor in the recent Hashrate pickup for DASH.

Source: cryptocompare.com

To become a DASH masternode and access a larger share of block rewards and increase in network activity, users are required to accumulate 1,000 DASH as collateral to prevent a potential sybil attack or ‘ballot stuffing’. The current USD collateral cost for running a DASH masternode is ~USD 123,000 and as of EOD April 3rd, 2019 there are 4304 active masternodes on DASH.

The current reward rate for a DASH masternode stake is ~7.76% yearly or 0.65% monthly, or, setting up a masternode with collateral requirement of ~$122,200 yields ~$9480 yearly and $790 monthly.Stakingrewards.com, a masternode and staking network yield aggregator rates the DASH masternode setup complexity as comparatively ‘hard’ (maintenance, running cost etc), the reward rate as comparatively ‘good’ and the risk rate as ‘very stable’.

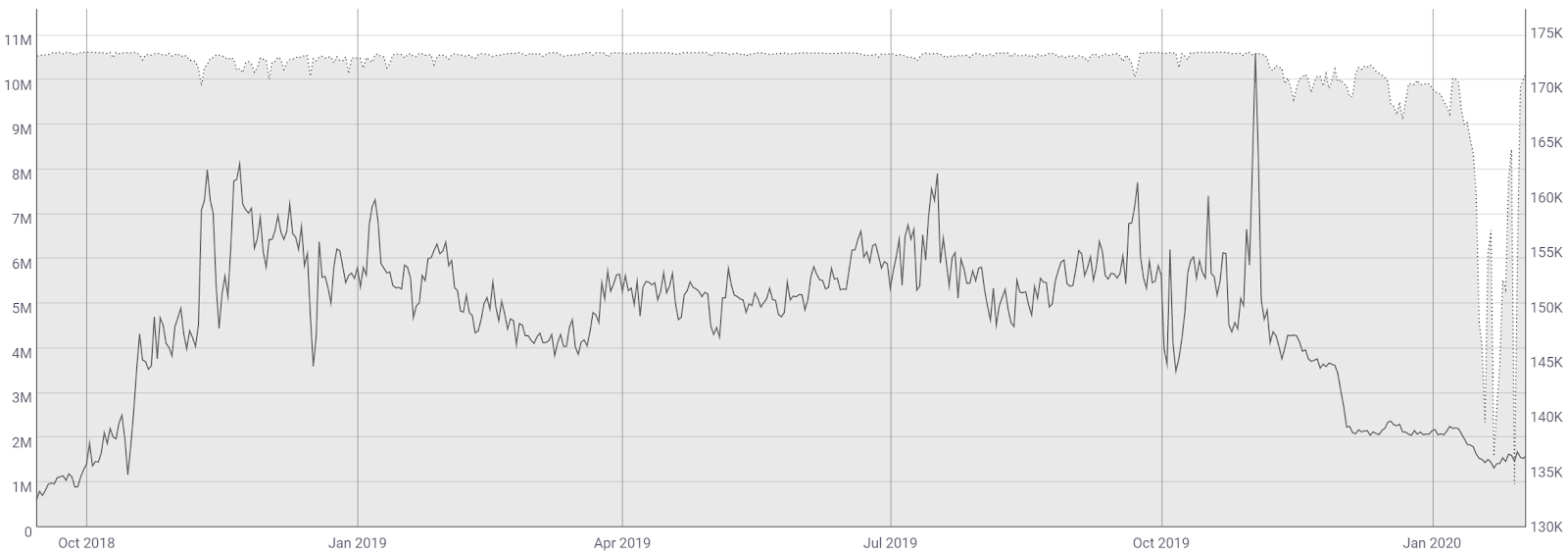

Since February 2019 there has been a reduction in the number of DASH masternodes. This has coincided with the period of strong price performance, which suggests some profit-taking from existing DASH masternodes and a decision to sell off some of their collateral locked to the network.

Some of the switch-offs may also be explained by nodes going offline to implement recent upgrades, meaning the fall in masternode numbers should only be temporary. However, following the late February drop-offs, while some masternodes appear to have returned to the network, overall masternode number remains well down from pre-drop levels. With the April 2nd drop, some of the switch-off’s may be explained by upgrading procedures, and it will be worth observing how many Masternodes switch back online over the coming days and weeks.

In January DASH launched a significant upgrade to its network – DASH v0.13. This upgrade added improved InstantSend and PrivateSend functionality, a deterministic masternode list to provide a single source of truth for clients validating transactions, special facilities to allow for non-financial transactions to occur on the blockchain and a masternode key separation system for ownership, operation and voting. An improved version, DASH v0.13.2 was released on March 15th to patch some of the flaws in the January update.

On March 28th DASH devs released DASH v0.14 update to the DASH testnet. The upgrade will add some significant features to the network. Chief amongst them is the implementation of Long living masternode quorums (LLMQs). DASH already uses selected masternode quorum groups for InstantSend which works by choosing a new quorum of 10 masternodes per transaction input and letting every member sign and propagate a vote for it.

LLMQs operate as a quorum for an extended time period on multiple transactions and possibly are very large (10-400), increasing the security, for example, of InstantSend transactions that would have previously run with just a 10 masternode quorum. LLMQS only increase the required resources (CPU, RAM, network) on the members of LLMQ quorums – instead of increasing the load on the whole network.

The LLMQ model increases the number of operations within quorums, reducing the amount of work required by the wider network on InstantSend transactions, and looks set to make the current DASH model more scalable. LLMQ’s are initially designed just to function on top of featured DASH transactions like PrivateSend, but it is eventually expected to be used for basic DASH transaction also.

Given the price jumps in DASH since early January, the crypto trading market seems to have responded well to the network updates. However, the drop off in masternode numbers may be a concern and suggest that commitment to the network may not be sticky for some high tiered operators within the DASH ecosystem.

A continued pattern of sharp drop offs in masternode numbers followed by only partial switching back on is worth observing. It may be an indication of masternode community response to the new direction of DASH network which now has a focus on building small quorums of masternodes designed to minimize the work required by the wider node network.

On the horizon, the DASH blockchain is still working towards an eventual goal of version 1.0 of Evolution. Evolution is the DASH core update goal of building a viable merchant and consumer ready blockchain that addresses some of the UI/UX barriers within networks like Bitcoin. It can be thought of in a similar way to Ethereum’s Serenity target. The DASH roadmap states Evolution will be released at an unspecified date in 2019 with a primary goal of improving the blockchain UX.

Evolution will have a number of ambitious features which will revolve around a core set of solutions including

- DAPI, or Decentralized API, a new more robust API implementable by merchants that will also feature an address mixing mechanism similar to TOR to make transactions more difficult to track

- Blockchain users, which simplifies the peer-to-peer payment process by letting users set up channels to other trusted users within the network expediting a number of network operations and minimizing transaction fees (Layer 2 solution)

- A decentralized data storage system, designed to permit the storage of compromisable data on the network such as user profile data without having to use centralized third party solution.

DASH is integrated into gift cards like Betrefill, eGifter and Coins Cards and debit card style solutions like Equicex. DASH is billed as a merchant/point-of-sale ready blockchain payment solution and news of new deals and merchant adoption may be creating buying pressure and feeding into the recent price pick up.

In Q1 2019 DASH also released a significant update to its internal wallet that added fingerprint unlocking, Mobile (iOS) InstantSend transaction receiving and iOS library integration.

Network activity

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

The NVT signal of DASH has ranged between 20 and 150 points since early 2017. Generally the hitting of lower bound inflection points has preceded short-to-medium periods of strong price performance. Lower bound inflection points have also tested higher lows as time has progressed.

An NVT signal of ~20 points was an inflection point in March 2017, while the lower bound inflection point was as high ~60 points (and preceding a period of strong price performance) in January 2019. This suggests that over time speculation has played a bigger factor in driving periods of positive price activity in DASH markets.

Currently, DASH NVT signal sits at ~ 75, having trended slightly upwards over the last two months. A move down towards 65-60 points would be a bullish flag for a continued period of upward price activity. NVT signal also appears far from an overbought upper bound flag, suggesting positive speculation from retail buyers may have more room to push price upwards.

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume.

Active address growth appears to have an effect on the network value of DASH. A negative PMR value means Metcalfe’s law is higher than market and suggests that a network may be undervalued based its network effects and is a bullish flag that true fundamental value may not be reflected by external price. DASH has had a negative PMR since Q2 2018.

PMR has trended slightly upwards since mid-January 2019, coinciding with the rise in DASH and market cap. A possible upper bound inflection point may be ~-1 PMR points, which if hit will signal an end of short term speculative price boost.

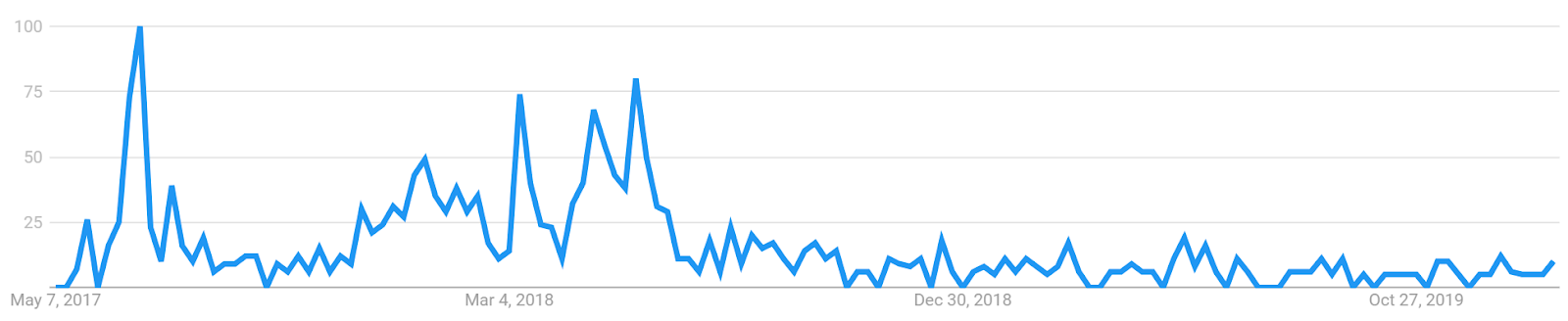

Turning to social indicators, the primary DASH twitter account @DASHPAY Twitter account currently has ~321,000 followers and is ranked as the 24,054th largest account on Twitter and averages 31 retweets and 83 likes per post.

Source: Socialblade.com

Follower growth has stagnated in recent months following sharp pickups during the most recent major price bull in late 2017, early 2018. In recent months the account tends to pick up a few hundred followers a month but had a negative month between February and March 2019

There has been an increase in tweets per month for the DASH accounts, though, likely associated with the recent increase in key network updates.

Turning to developer activity, DASH has 34 repos on GitHub with core backend activity on a repo titled ‘DASH’, other active repos include the DASH documentation repo.

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source:https://github.com/dashpay/

Commit activity within the core DASH repo was consistent throughout 2018 with a significant pick-up in early October. The pattern suggests that in development terms, DASH was somewhat unaffected by 2018’s long term bear market.

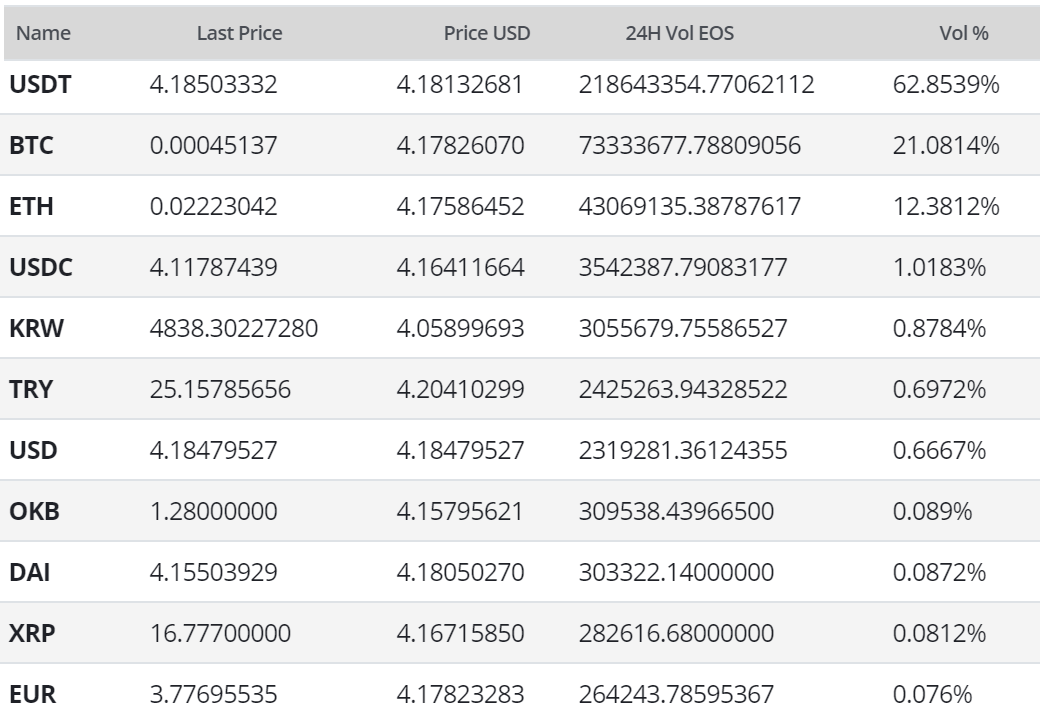

Exchanges and trading pairs

Source: Bravenewcoin.com

The most popular trading option for DASH is BTC, handling close to 48% of daily trading volume. The second most popular market is the DASH/USDT pair and together the top two pairs make up over 70% of daily trading volume. Multiple fiat options for DASH with USD, EURO and Turkish Lira markets all actively traded. The USD value of daily volume of the entire DASH market is ~ USD 341 million.

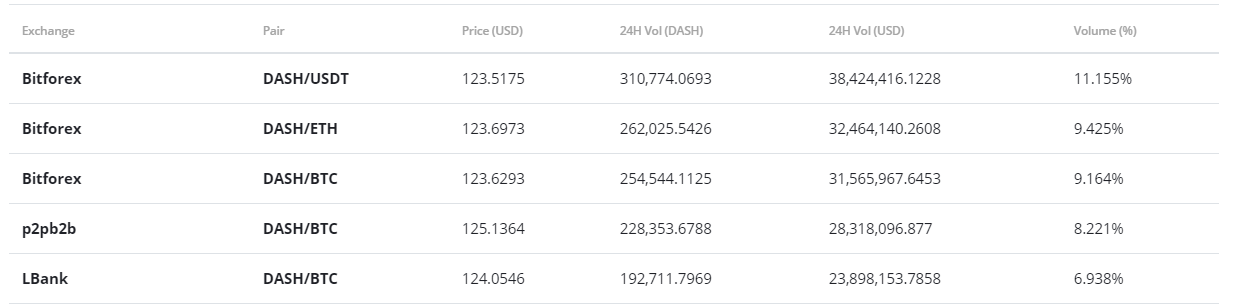

Source: Bravenewcoin.com

The leading exchange for DASH trading is Seychelles registered but Singapore based Bitforex, which operates the three most popular DASH markets. DASH is also tradable on historically visible exchanges Binance, Kraken and Bitifinex.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, DASH has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.86, which has resulted in a death cross since late-March 2018. However, since late-March 2019, DASH has since come to life in combination with the entire crypto market, which has resulted in price settling above the 200 day EMA, while nearing the top range of its linear trend.

Also, on the 4H chart, DASH’s recent momentum has produced a golden cross with price currently sitting above the 50 period EMA, at ~$122.22.

Additionally, on the 1D chart, the 30 day TRIX and volume flow indicator (VFI) are both above 0 and trending higher, respectively, which confirms the recent price momentum and potentially sets the stage for further upward movement.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bullish price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above price and Cloud.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price originally completed a Kumo breakout back in early-March, and has continued the upward momentum with strong volume since then; touching Senkou B resistance of $133. Given this strong breakout, it appears price is likely to continue higher, for now. However, in the near term, price is likely to compress given the RSI is in heavily overbought territory. Price is likely to fall back to $116 during this compression phase before beginning to move higher once again. If the aforementioned occurs, future price targets are $133 and $150. However, in the event Senkou B support failing, additional support levels are $111, $100, and $93.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bullish; price above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The analysis using slower settings is very similar to the faster settings with a likely retest of Senkou B support of $116 in the near term until DASH resumes its prior momentum or begins to falter.

Conclusion

DASH has had a strong start to 2019, with steady gains through January and February complimented by a booming late March and early April. Fundamentally the network has implemented a number of key updates over the same period, while stories of continued global merchant adoption have added speculative fuel to entice retail buyers. DASH price may have found a bear market bottom and is enjoying a period of accumulation.

Buying DASH now though remains a call option on future value with some major promised network upgrades yet to be implemented (with no clear dates on delivery either) and recent masternode activity inconsistent. Future value will dependant on network features like InstantSend gaining greater adoption and the DASH blockchain being used more widely as a payment and transfer solution.

The technical indicators for DASH show bullish momentum since late-March, but near term weakness due to overbought conditions. Both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30), on the 1D chart, will await price to maintain its current Kumo breakout via defending the $116 Senkou B support level before entering a long position. In the event of failure, both trader’s support levels are $111, $100, and $93. In the event of success, both trader’s price targets are $133, $140, and $150.

Don’t miss out – Find out more today