DASH Price Analysis – Technicals suggest a strong bullish trend

Technicals for the DASH/USD pair suggest a strong bullish trend, based on daily Cloud and high timeframe moving averages.

DASH (DASH), or Digital Cash, is a cryptocurrency with optional privacy features and a form of decentralized autonomous organization. The coin is down 91% from the all-time high established in December 2017. The market cap is 14th on the Brave New Coin market cap table and currently stands at US$1.36 billion, with US$316.16 million in trade volume over the past 24 hours.

The project is a Bitcoin fork created by Phoenix, Arizona based programmer Evan Duffield in January 2014, originally known as XCoin. The project was rebranded to DarkCoin and then renamed DASH in 2015. Ryan Taylor is the current DASH Core CEO with Duffield acting as a strategic advisor.

DASH uses a two-tiered PoW (PoW) and Proof of Stake (PoS) consensus model. PoW mining verifies the ledger using a two and a half minute block time. PoS occurs through Masternodes (MNs) and serves higher functioning tasks, including governance and unique sending features. The block rewards are currently split between three entities; 45% goes to PoW miners, 45% to the MNs, and 10% to the DASH treasury.

Around ~18,000,000 DASH will be mined, with block rewards decreasing by 7% per year until no rewards exist. Inflation is currently 7.61% per year. Upon release in 2014, two million coins were mined on the first day, which some have referred to as an ‘instamine.’ However, only 15% of the total circulating supply is currently held by top 100 accounts, a metric that is lower than Bitcoin, where 16% of the total circulating supply is currently held by top 100 accounts.

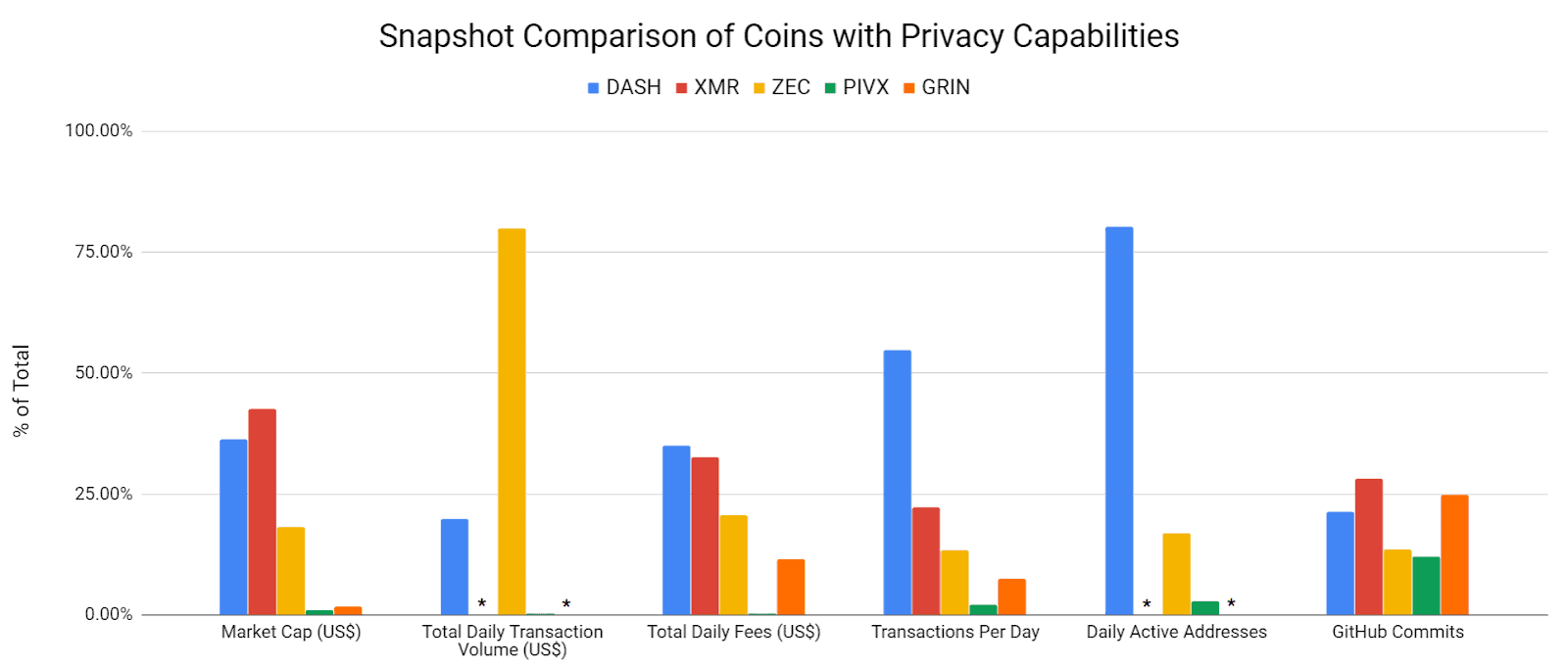

A quick comparison between all coins with privacy capabilities shows DASH leading by most metrics, including; total daily fees collected by the network, transactions per day, and daily active addresses. Other coins with privacy features include Monero (XMR), Zcash (ZEC), Grin (GRIN), and PIVX (PIVX). Both XMR and GRIN obscure the blockchain transaction values and addresses used.

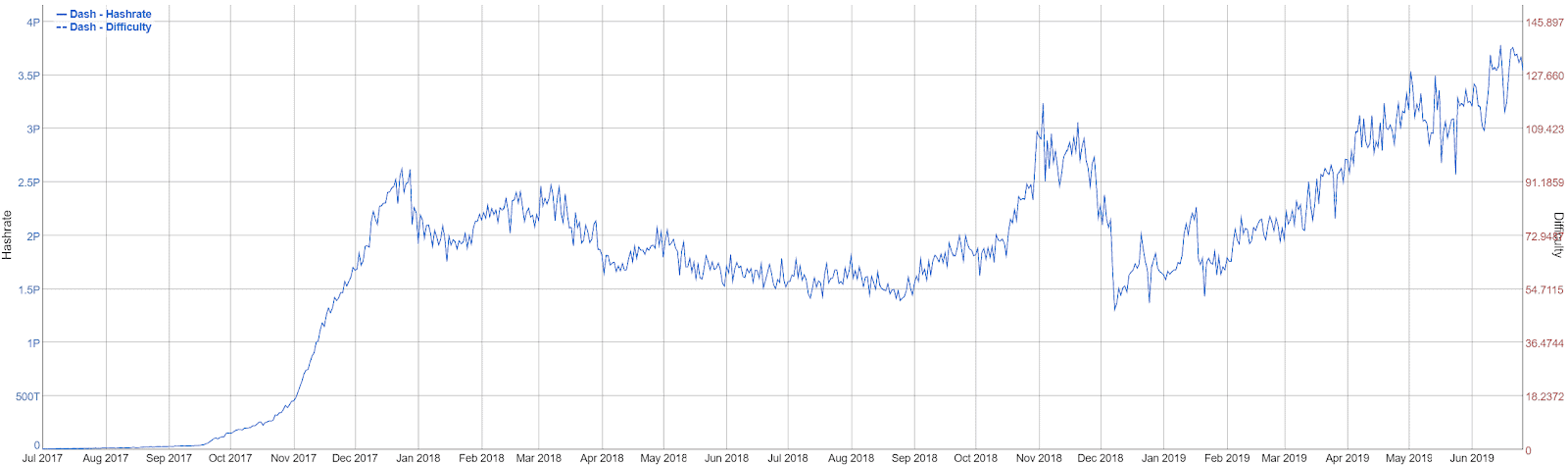

On the network side, hashrate and difficulty have fluctuated wildly over the past three months but continue to push towards record highs. DASH uses the X11 hashing algorithm, which was developed by Duffield, and is comprised of the following hash functions: BLAKE, BLUE MIDNIGHT WISH (BMW), Grøstl, JH, Keccak, Skein, Luffa, CubeHash, SHAvite-3, SIMD, and ECHO. The X11 algorithm cycles through each of the 11 algorithms, in order, during the hashing process.

DASH can be mined by several Application-Specific Integrated Circuits (ASICs) currently on the market, including the Bitmain Antminer D3. Eight X11 ASICs were released over the past two years, three of which are not profitable at US$0.06 per kilowatt-hour (c/kWh). StrongU is slated to release an X11 ASIC this November. Overall, mining profitability is currently sitting near an all-time low.

Source: bitinfocharts.com

Each DASH MN requires 1,000 DASH, currently valued at US$153,470, which acts as collateral during governance functions in order to prevent Sybil attacks or “ballot stuffing.” Despite the price tag and volatility risk, MNs have continued to increase at a steady rate since 2015.

With 4,785 MNs currently, 53% of the DASH circulating supply is currently held as collateral. The MN share of the block reward is split between all the nodes, meaning that as MNs increase, payouts per node decrease. MNs currently earn 6.50% per year. In comparison, PIVX currently has 1,421 active MNs, which require 10,000 PIVX as collateral. These MNs are valued at US$5,900 and provide a return on investment of 10.84% with network inflation at 6.32%.

After months of development, the distributed key generation (DKG) update went live on June 4th, enabling the formation of Long-Living MN Quorms (LLMQs) to enhance the performance and scalability of the network. LLMQ-based ChainLocks provide a protection mechanism against 51% attacks on the network by disallowing miners to secretly mine and then suddenly reveal their chain and attempt to re-org the blockchain.

The protocol change also included a Proof of Service (PoSE) scoring system for each of the MNs. A variety of metrics are involved in the calculation, to mitigate gamification of the system, but MNs which fail to respond to ping requests are banned from the network. The MN must then be repaired before rejoining the network.

Source: http://178.254.23.111/~pub/Dash/Dash_Info.html

MNs can send transactions using InstantSend or PrivateSend. InsantSend enables a type of off-chain 0-confirmation transaction which bypasses miners entirely. This is done through a transaction locking command with a wallet or client showing an intention to lock funds from a specific input to a specific output.

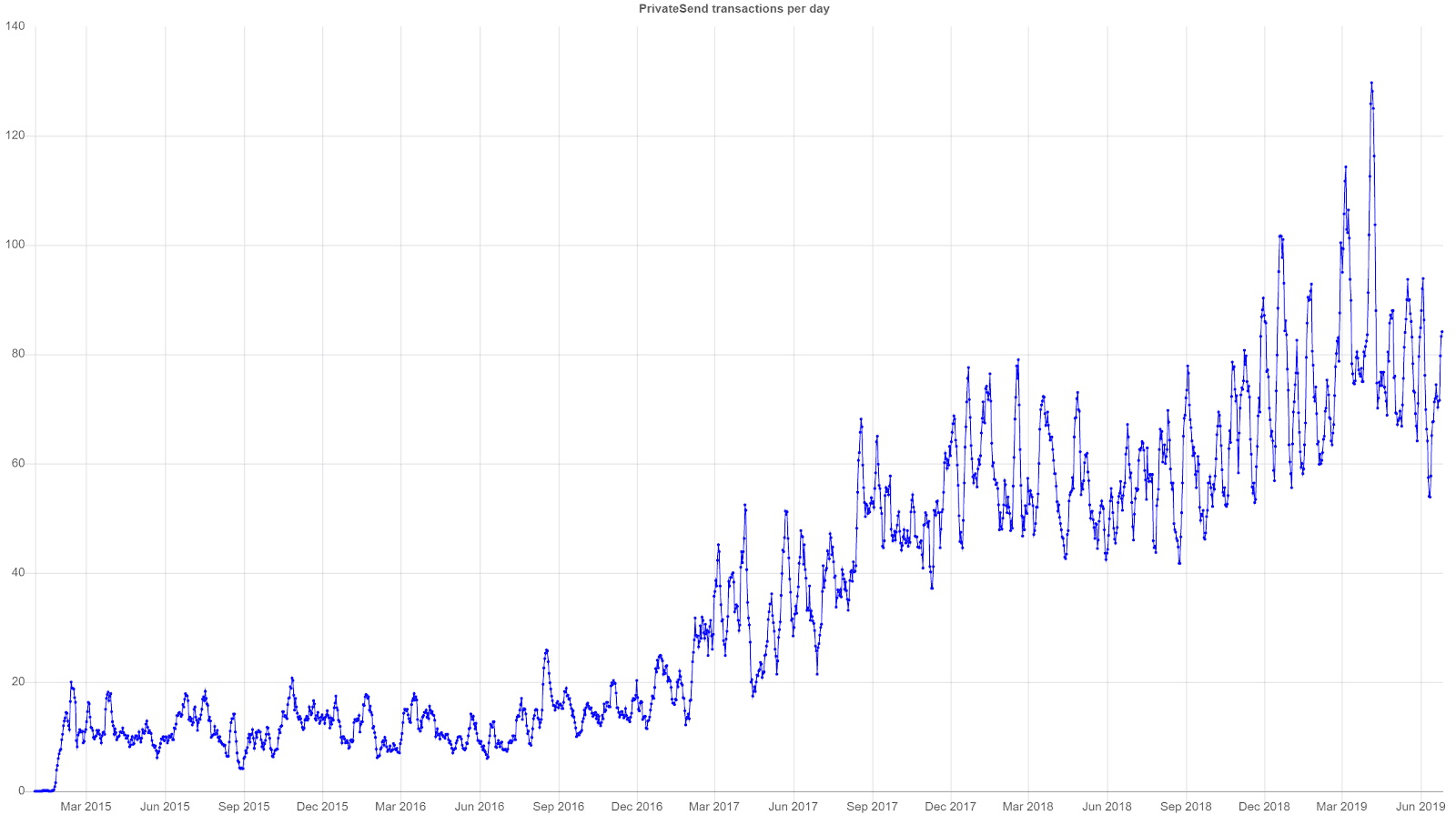

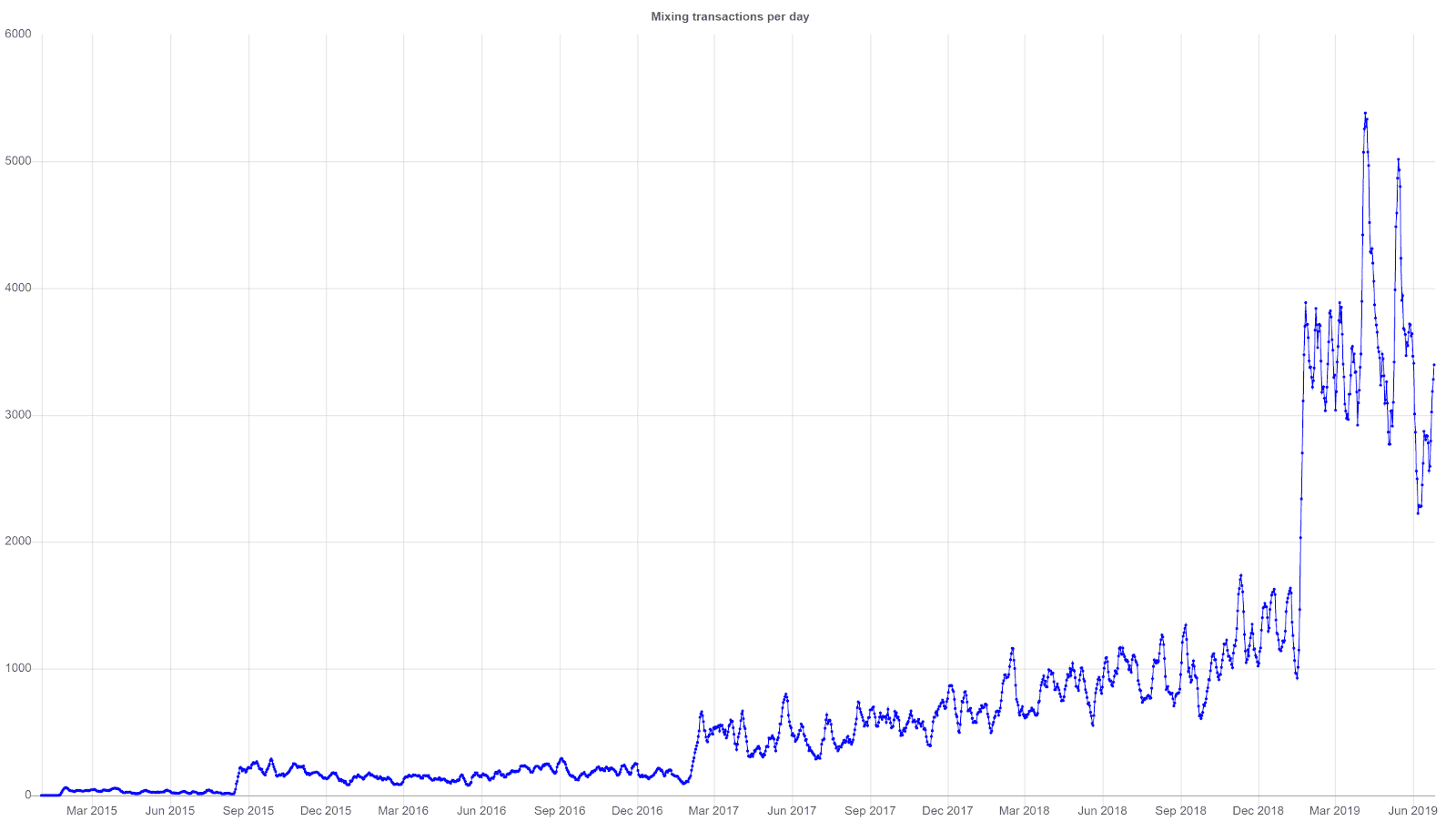

PrivateSend is essentially a coin mixing service, similar to CoinJoin, which combines identical inputs from multiple users into a single transaction with several outputs. For this reason, DASH is often labeled as a ‘privacy coin,’ along with XMR and ZEC. Although PrivateSend and mixed transactions (charts below) represent a low percentage of overall total transactions, these functions have been steadily increasing since 2015. The total number of private transactions on DASH are is far fewer than that of XMR or ZEC.

Source: dashradar.com/charts

Source: dashradar.com/charts

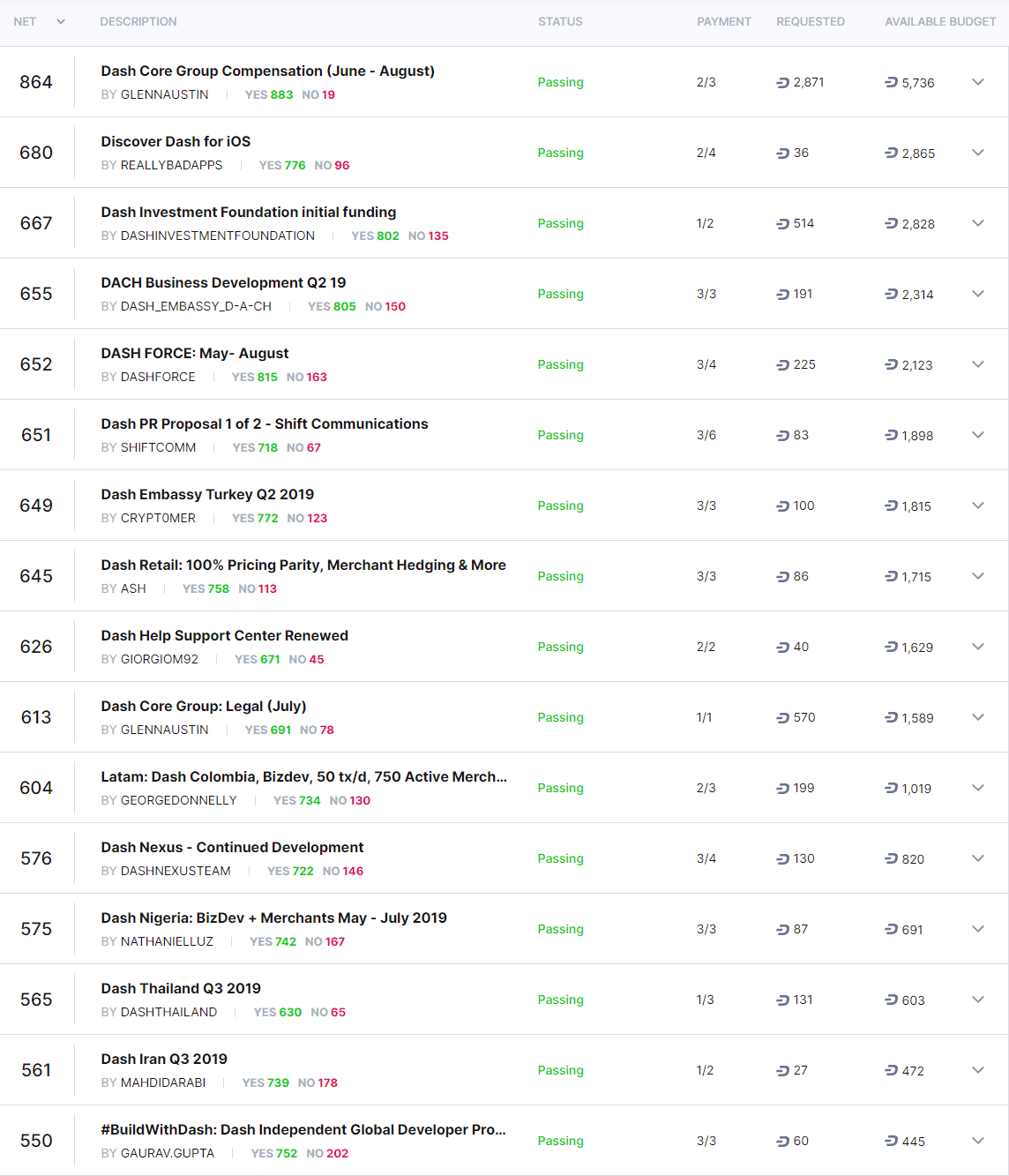

The MN governance model also enables a decentralized voting mechanism for DASH related projects, paid for through the treasury block reward. These DASH related projects, and their related budgets, are voted on by MNs. Each project, if it passes a vote, is added to the total budget and the person or entity doing the work is paid. While the mechanism has resulted in various projects being funded by the network, a substantial amount of proposals over the past few months focused on marketing and promotion in developing countries.

Largely in part due to Duffield’s Arizona connection, DASH has also funded or partnered with many Arizona based initiatives. In August 2017, the treasury set aside US$50,000 for Blockchain Research Laboratory (BRL), and in November 2017, DASH and Arizona State University (ASU) opened a BRL at the university. In January 2018, DASH unveiled a US$300,000 initiative with ASU to accelerate research, development, and education in the blockchain field.

Source: dashnexus.org/leaderboard

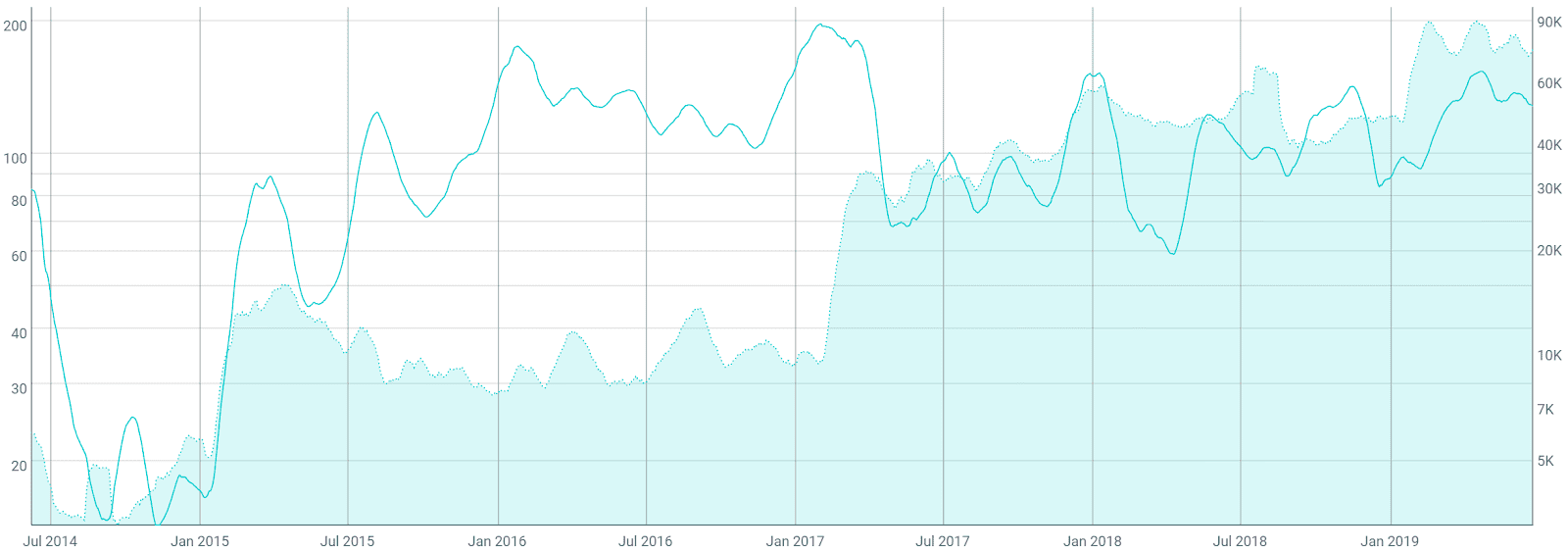

The total number of transactions per day on the network (line, chart below) has steadily increased since the August 2018 low of 4,800, and is currently 21,000. The transaction spikes represent stress testing periods in July, October, and November, when more than 3.5 million transactions were sent.

The average transaction value per day (fill, chart below) peaked late in 2017 and declined to less than US$100 in January this year. Since then, the average transaction value has risen slightly, and has ranged from US$500 to US$1,000 over the past few months. The average transaction fee (not shown) has held below US$0.025 since the beginning of the year, and is currently US$0.014. Average transaction fees for XMR, ZEC, GRIN, and PIVX are currently US$0.043, US$0.036, US$0.044, and US$0.0013 respectively.

Source: coinmetrics.io

The 30-day network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has oscillated between 20 and 70 throughout 2018 and early 2019. Inflection points in NVT can be leading indicators of a reversal in asset value. An NVT held below 20 should signify bullish market conditions. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe’s law. Monthly active addresses (fill, chart below) made a new all-time high of 87,700 in mid-April this year. Active addresses have continued to steadily increase year over year, suggesting sustained and increasing interest in the network.

Source: coinmetrics.io

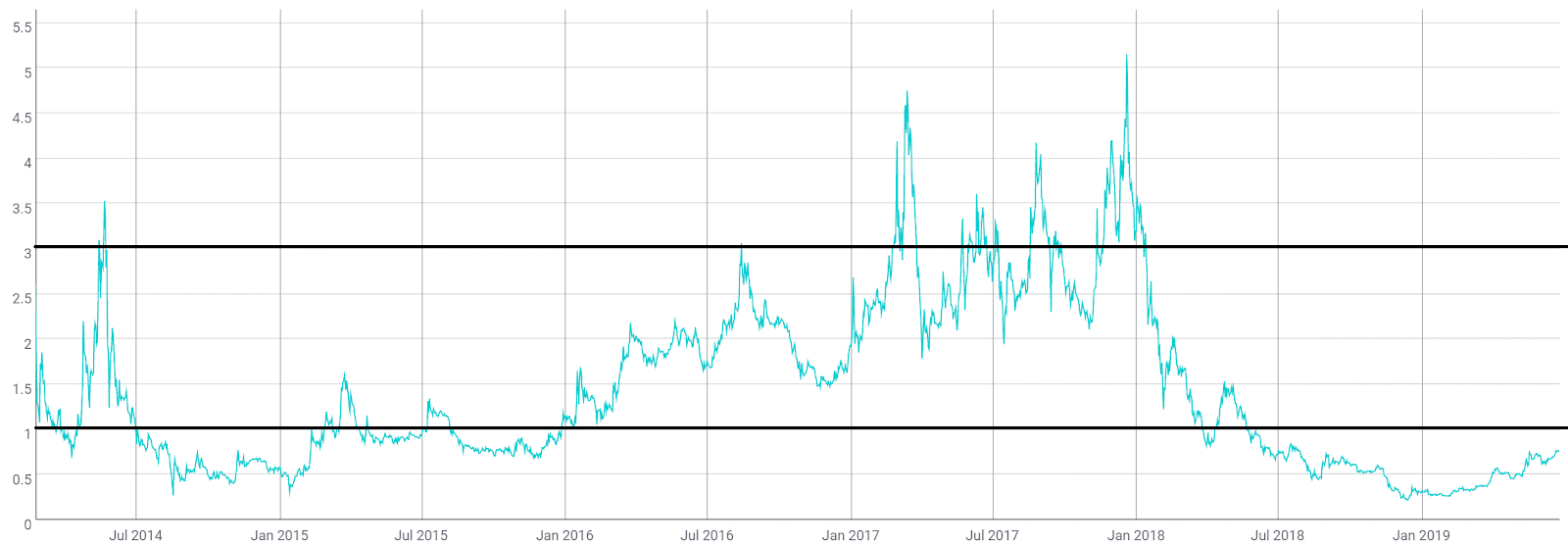

The market cap divided by the realized cap (MVRV) is another crypto-native fundamental metric used to asses overbought or oversold conditions. Realized cap approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain. The metric was created through a combination of efforts by Murad Mahmudov, David Puell, Nic Carter, and Antoine Le Calvez.

Historically, periods of an MVRV less than one have represented oversold conditions, whereas periods of an MVRV greater than three have represented overbought conditions. Currently, MVRV is at 0.75, suggesting the potential for additional upside. Unlike Bitcoin, the record price for DASH does not correlate with highs in MVRV. However, the extreme lows for price have corresponded with MVRV being lower than 0.5.

Source: coinmetrics.io

Turning to developer activity, over 150 developers have contributed over 1,000 commits to the 34 DASH repos in the past year. The DASH protocol repo (shown below) has had 871 commits in the past year with Dash Core v0.14 released last month. DASH Electrum, Android, and iOS wallets were also updated earlier this month. There are also 10 Dash Improvement Proposals, four of which have been finalized.

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: https://github.com/dashpay/dash/graphs/contributors

Custodial solutions for DASH include both Trezor and Ledger hardware wallets, as well as Abra, Electrum, and Jaxx mobile wallets. On the UpHold wallet service, DASH was the most popular cryptocurrency from January 2018 & January 2019. In April, the spend.com app also announced support for Dash on the Spend Visa card.

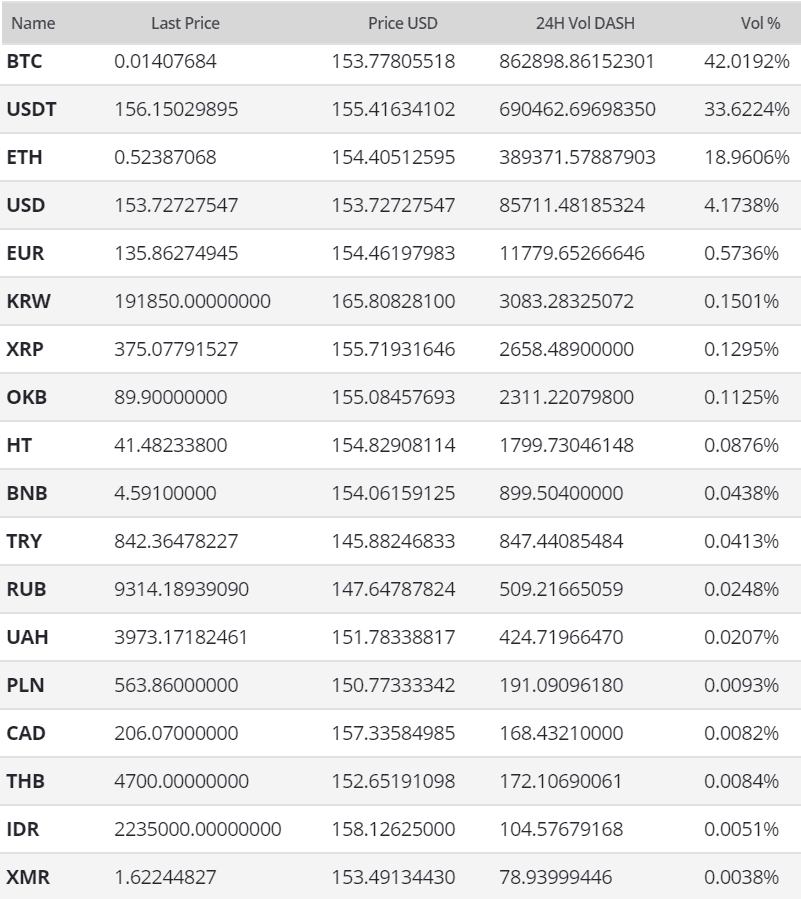

At the institutional level, BitGo has DASH support, with Coinbase potentially adding DASH for custody purposes in the near future. This week, the Brave Browser, which enables seamless micropayments for publishers and content creators, also added DASH as a payment option. Exchange traded volume is dominated by Bitcoin (BTC), with substantial volumes also coming from Tether (USDT), and Ethereum (ETH).

Technical analysis

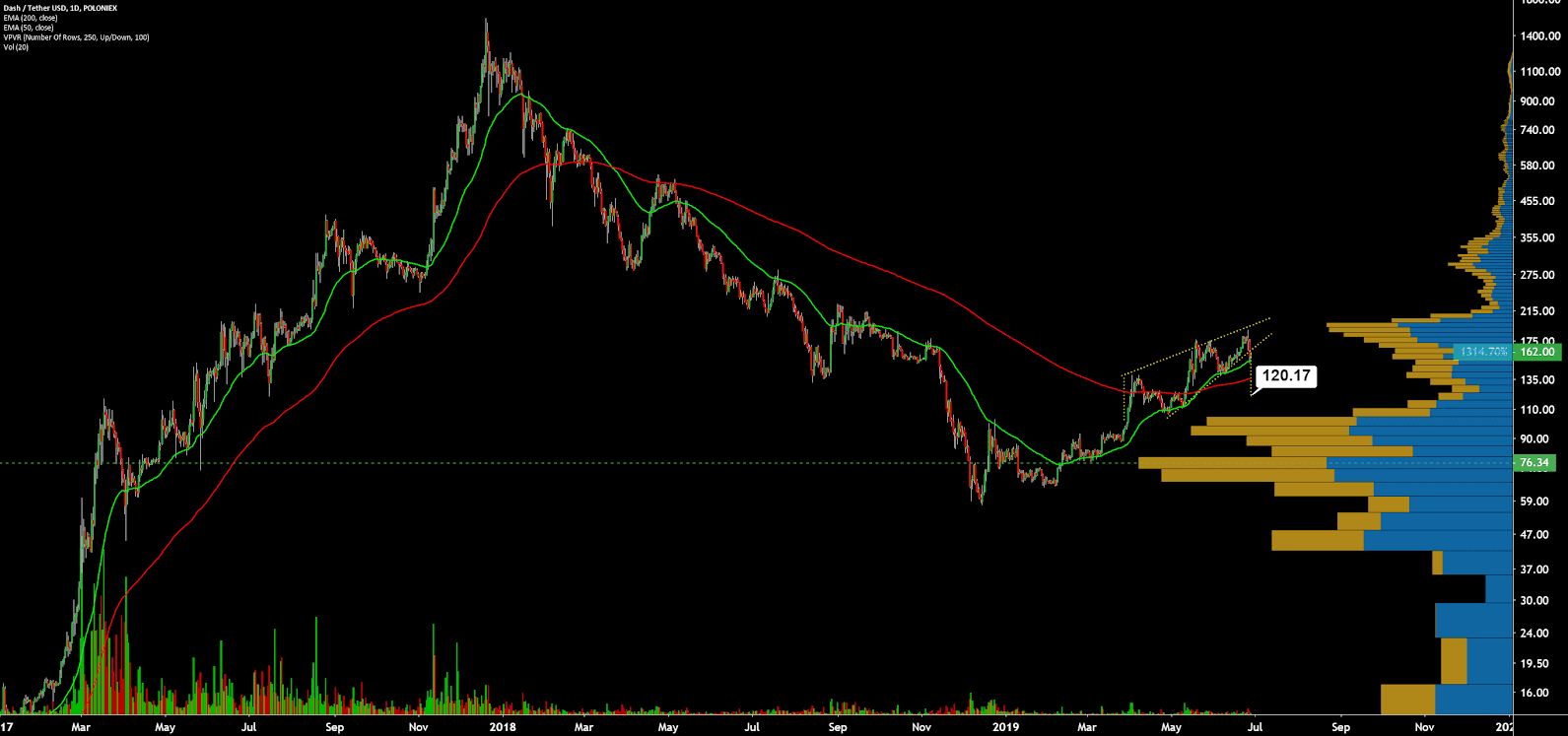

Since the December lows, DASH has moved in line with the broader crypto market. Potential roadmaps for upcoming price movements can be found on high timeframes using Exponential Moving Averages, volume profiles, Pitchforks, chart patterns, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day and 200-day exponential moving averages (EMAs) have been bullishly crossed since late May, ending the 427-day bear market. The 200-day EMA, currently at US$135, should now act as support. Significant volume resistance (horizontal bars) sits at the psychological level of US$200 with significant support between the US$70 to US$100 zone. There are currently no active RSI or volume divergences although RSI has consolidated since April.

Additionally, a potential bearish reversal pattern has formed, the rising wedge. The hallmarks of this pattern include a series of higher highs and higher lows in a tighter and tighter range. Measured move targets bring price to US$120. Over the past few months, rising wedges have represented bullish continuation for several other coins.

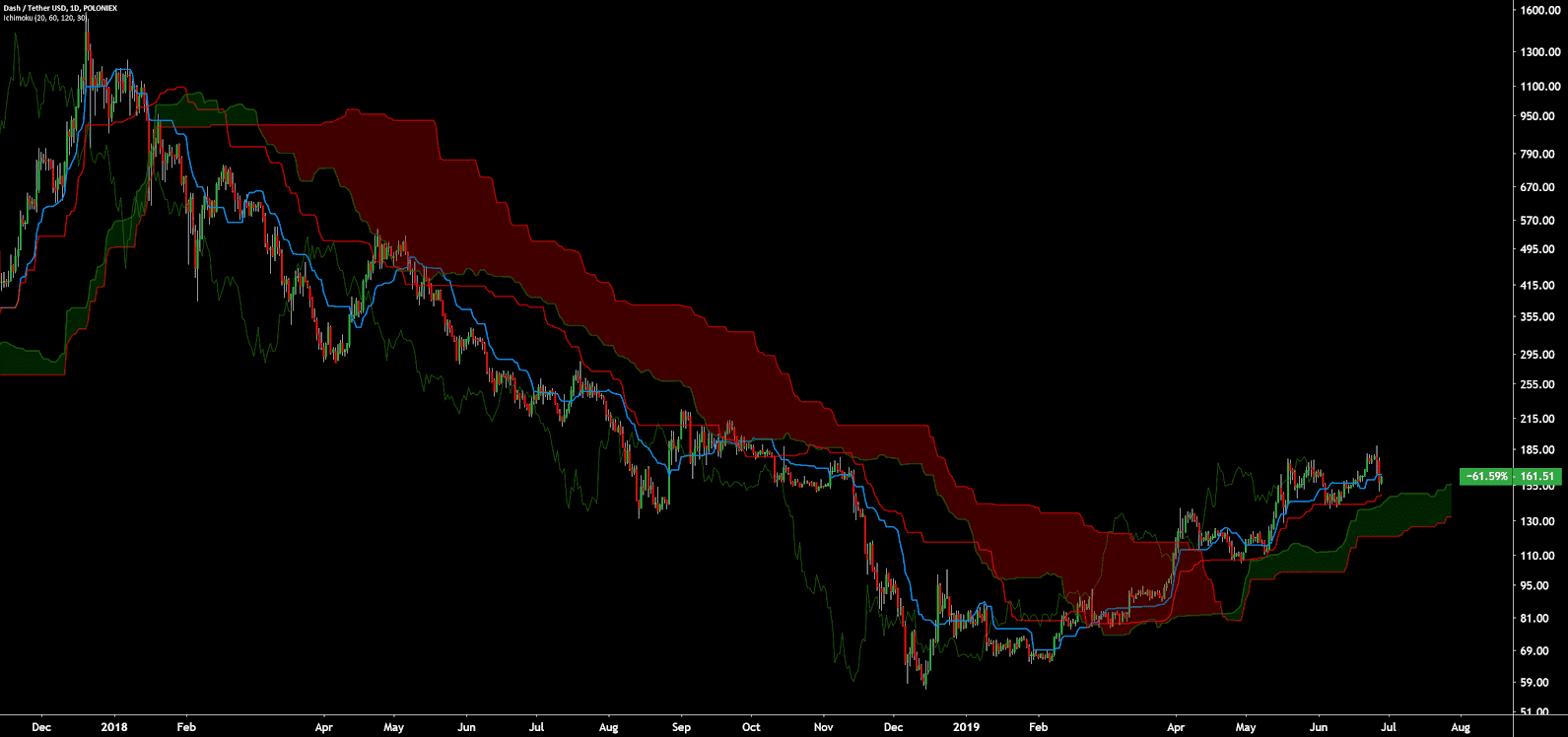

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, have remained bullish since May; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and above price. The Kijun support currently sits at US$148. The trend will remain bullish so long as the price remains above Cloud.

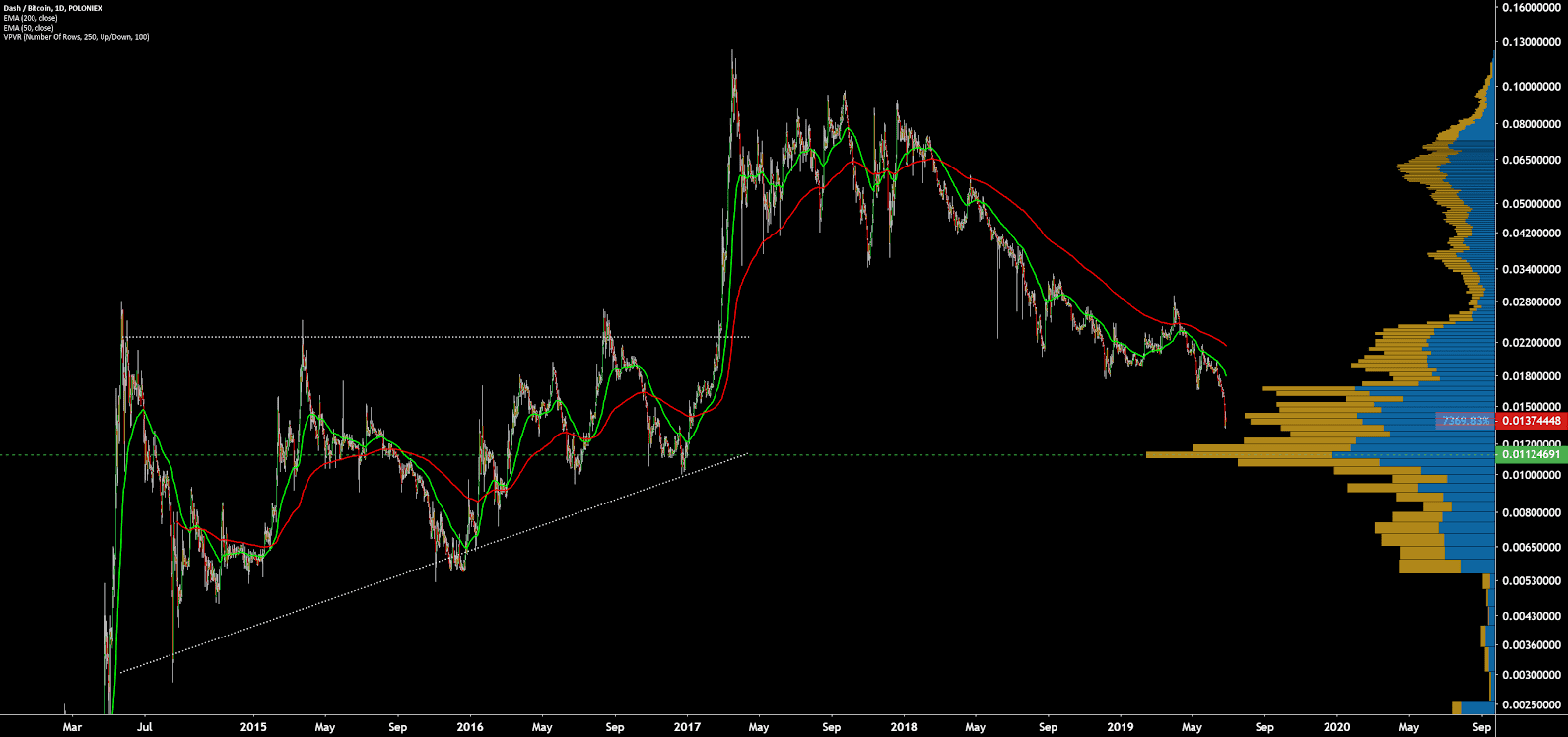

For the DASH/BTC pair, trend indicators suggest a bearish trend, with oversold metrics, and price at a 30-month low. The 50-day and 200-day EMAs have been bearishly crossed for 482 days. There are no bullish divergences to indicate waning bearish momentum, but RSI is currently at the lowest level ever recorded for the pair. A high volume support node (horizontal bars) sits at the 0.01125 zone with a mean reversion target of 0.0216 based on the 200-EMA.

Conclusion

Fundamentals suggest increasing and sustained on-chain activity since the beginning of the year. Although optional privacy features are used minimally on the network, these types of transactions have increased year over year since inception. Protocol development also continues with several changes to Master Nodes over the past six months.

Unlike other coins from the class of 2014, which have largely fallen by the wayside, DASH has likely survived due to both the Master Node and treasury component. Master Nodes also discourage a vast majority of the circulating supply to ever see the open market, and the treasury has continued to fund DASH related development and marketing to sustain the coin over the past four plus years.

Technicals for the DASH/USD pair suggest a strong bullish trend, based on daily Cloud and high timeframe moving averages. Prices above the psychological resistance of US$200 should see significant bullish momentum. The DASH/BTC pair has reached for fresh 30-month lows with the lowest daily RSI ever recorded. High volume support sits at the 0.01125 zone, which is likely where buyers will return in force.

Don’t miss out – Find out more today