Decred Price Analysis – Active addresses hit all-time highs as trend metrics flip bullish

Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe's law. A sudden and continuous increase in active addresses paints a bullish picture as this typically indicates a sharp increase in on-chain use or interest.

Decred (DCR) launched in 2016 and was originally a fork of the Bitcoin codebase. The cryptocurrency is down 79% from the record high of US$118, established in early May 2018. The market cap currently stands at US$287 million with US$5.8 million traded over the past 24 hours.

Decred incorporates governance functions using a hybrid Proof of Work (PoW) and Proof of Stake (PoS) consensus system. The hybrid consensus system attempts to shore up the vulnerabilities of both designs.

PoW miners create the blockchain and earn a portion of the block reward. PoS stakeholders purchase tickets that earn a portion of the block reward, participate in on-chain and off-chain network governance, and validate blocks discovered by miners.

A classic PoW model favors entities with access to cheap electricity and the capital to invest in mining infrastructure. This model is subject to mining centralization and 51% attacks, whereby a miner or pool with more than half of the hash rate can temporarily control the blockchain and the transactions.

A classic PoS model favors early adopters who accumulated coins, typically during an initial distribution. The benefits of PoS include decreased infrastructure costs as well as the ability for any user to directly participate in network governance decisions. PoS only blockchains are subject to stake grinding vulnerabilities, which effectively allows a majority PoS miner to control the blockchain.

Similarly, Dash (DASH) also uses a hybrid PoW/PoS consensus mechanism with a governance engine. In contrast, DASH has master nodes to gain increased staking rewards and governance functions, whereas DCR uses the ticket system approach.

For both DASH and DCR, the inflation rates excluding staking rewards, are currently 5.67% and 6.31%, respectively. Annualized staking yields, after inflation, for DASH and DCR are -0.19% and 2.79%, respectively. Total notional value staked for DASH and DCR, respectively, stands at US$517 million and US$173.64 million.

Source: StakingRewards

In a head to head comparison, DASH dominates in on-chain metrics while DCR has had more Github activity over the past year. DASH has a fixed supply of 18 million coins, 54.7% of which are currently circulating, and DCR has a fixed supply of 21 million coins, 58.7% of which are currently circulating.

DCR PoS stakeholders can vote on code updates and budget proposals through a blockchain-anchored public proposal system, dubbed Politeia, which went live in October 2018. If an update or proposal is approved by ticket holders there is a period of time for amendments or reversals, followed by the implementation process.

Source: proposals.decred.org

Stakeholders can purchase tickets using a DCR client. Five tickets are then chosen randomly from the total ticket pool and, if at least three of the tickets vote ‘yes,’ the block is permanently added to the blockchain. Ticket prices, which have stabilized in price over the past year, are based on supply and demand and have no direct correlation to DCR exchange prices. As the amount of DCR being staked increases, so do ticket prices.

Source: DCRstats

The DCR PoW component uses the BLAKE-256 hash function, which is similar to Bitcoin’s SHA-256. There are currently 277 network nodes, most of which reside in the United States.

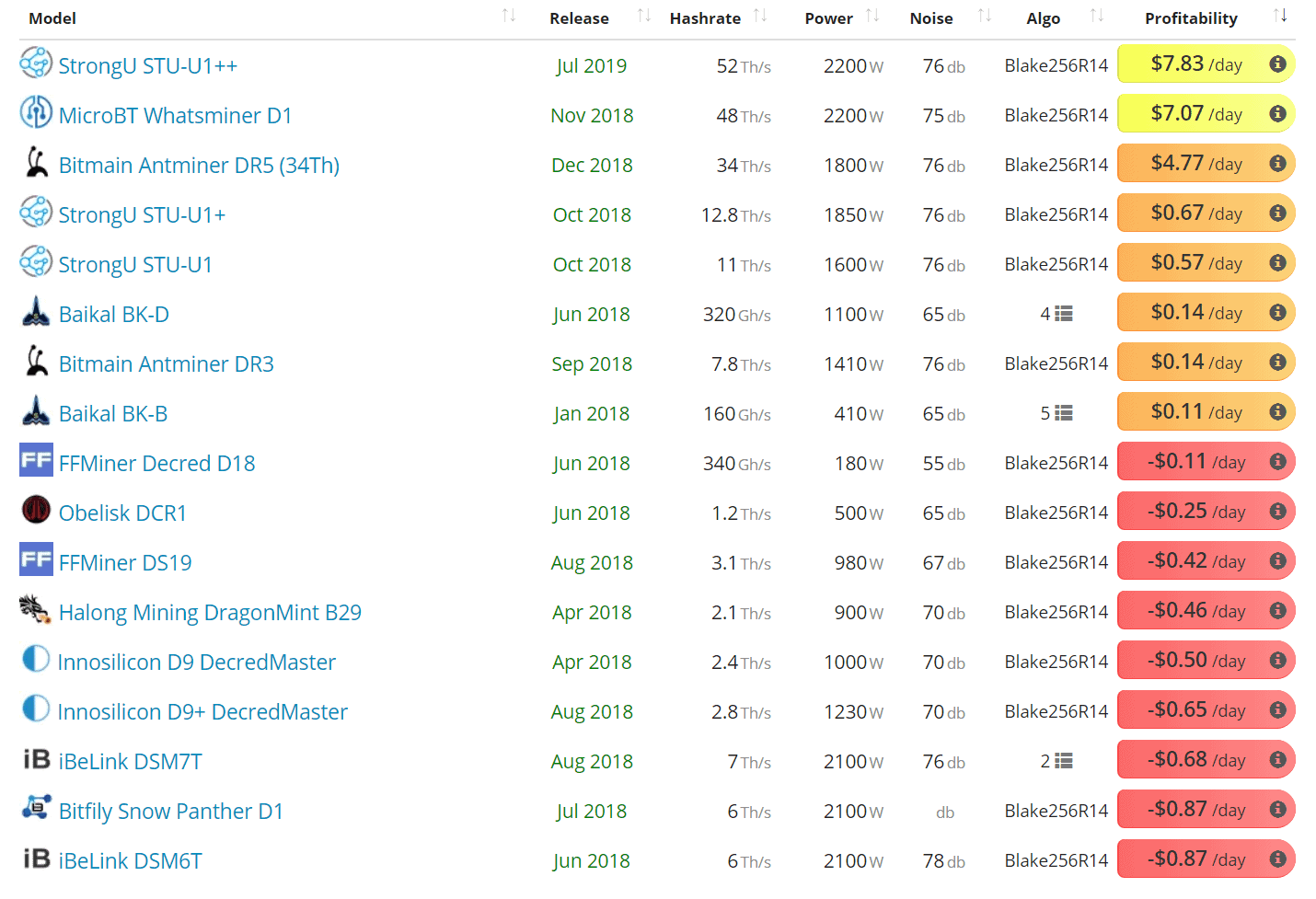

Over the past year, the network hash rate and difficulty have essentially remained flat. Of the 17 currently available DCR BLAKE-256 ASICs, eight are profitable at US$0.04 per kWh. The network has five minute block times and difficulty adjustments every approximately 12 hours.

In a bid to increase PoW decentralization, Decred Senior Developer Donald Adu-Poku released an open-source stratum mining pool for Decred, dcrpool, in September 2019. Solo miners now account for 10% of the total network hash rate. Uupool.cn and Poolin currently account for over 80% of the total hash rate.

Source: DCRstats

Source: ASICminervalue

Block rewards are split, with 60% going to PoW miners, 30% to PoS stakeholders, and 10% to developers. The current block reward breakdown is 8.2774 DCR for miners, 0.8277 DCR per ticket for stakeholders, and 1.3795 DCR for the developer subsidy. Of the total 21 million capped supply, 58.7% has been mined thus far, which includes an 8% pre-mine at launch, or 1.68 million DCR.

According to a December 2015 blog post, all pre-mined coins owned by developers were either purchased at a rate of US$0.49 per coin or earned for work performed. Of the total 10.8 million DCR in circulation, 51% of the coins are being held in the PoS pool. The developer fund address currently holds 611,287 DCR, or US$16.21 million at current prices, and is the largest single account on the network, holding 6.27% of the total circulating supply.

Source: DCRstats

Over the past few months, DCR has unveiled three new features; plans for a Decentralized Exchange (DEX), CoinShuffle++ which adds the ability to send private transactions on the network, and a DCR lightning network which is currently in the testnet phase.

The DCR DEX will be mostly feeless, permissionless, and non-custodial using peer-to-peer Atomic Swaps. Orders will be pseudo-randomly matched within epochs of 10 seconds or greater, negating the advantages of HFTs and front-running. The DEX will also aim to prevent or filter wash trading by using on-chain transactions.

CoinShuffle++ is a non-custodial process for creating CoinJoin transactions. Through the implementation of CoinShuffle++ in the DCR wallet, output addresses are fully anonymized, such that none of the peers or the server can tell which output belongs to which peer. With this addition, DCR joins a myriad of other coins using similar privacy features (shown below). Monero (XMR) also has blockchain pruning capabilities since the v0.14.1 release.

As of October 2019, around 15% of ticket purchases are using private transactions and the total anonymity set is around 7.5% of all DCR in circulation. As of December 2019, CoinShuffle++ made 1.74 million transaction outputs, or 16.1% of all DCR UTXOs, private over a three month period.

On the network side, the current number of transactions per day (red line, chart below) entered a downward trend beginning early in 2018, and have risen to multi-year highs over the past few months. The record high for transactions per day stands at nearly 10,500 in October 2016. The average transaction value per day (green fill, chart below) had largely held above US$1,250 since January 2018 but fell below US$550 earlier this year. Average transactions per day now sit at US$3,300. Transactions fees, all of which are collected by the PoW miners, are currently averaging 0.0001 DCR per transaction, or US$0.016 (not shown).

Source: CoinMetrics

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has dropped to an all-time low over the past year, and now resides at 113. Inflection points in NVT can be leading indicators of a reversal in an asset’s value. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Monthly active addresses (MAAs) increased dramatically in August 2019 (fill, chart below), likely related to the newly released CoinShuffle++ privacy feature. MAAs now sit at or near all-time highs. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe’s law. A sudden and continuous increase in active addresses paints a bullish picture as this typically indicates a sharp increase in on-chain use or interest.

Source: CoinMetrics

Turning to developer activity, DCR has 81 Github repos with over 550 commits on the main repo (top chart, below), dcrd, over the past year. The Politeia repo has also been active, with nearly 200 commits over the past year (bottom chart, below).

Dave Collins, the lead DCR developer, optimized the master branch in 2019, introducing a significant spike in commits. Decred v1.4.0 was released in February 2019 and included; a new consensus vote agenda, Trezor support, and advanced Politeia integration. Decred v1.5.0 was released in November 2019 and included; mining infrastructure improvements, quality assurance changes, a new consensus vote agenda, automatic external IP address discovery, and various other minor improvements.

Decred v1.5.1 was released in late January, and included minor bug fixes and improvements. In August, the v1.5.2 update was released to mitigate against potential Denial of Service attacks on Proof-of-Work miners. Release candidates for v1.6.0 are currently available for testing. The initial release of the DCR DEX MVP on mainnet accompanied the first v1.6.0 release candidate.

Most crypto projects use the developer community of GitHub, where files are saved in folders called "repositories," or "repos." Changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: Github – dcrd

Source: Github – politeia

Worldwide Google Trends data for the term "Decred" has dropped substantially since the start of 2018, and is currently sitting near lows. A slow rise in searches for "Decred" preceded the bull runs in 2016 and 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between google trends data and BTC price whereas a 2017 study concluded that when U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

DCR recovered 126% from March to late August, but still underperformed most of the crypto market. Over the past month, DCR again rose over 130%. Exponential moving averages, pivots, the Volume Profile of the Visible Range, divergences, and the Ichimoku Cloud can help highlight a future price roadmap. Further background information on the technical analysis discussed below can be found here.

On the daily price chart for the DCR/USD pair, the 50-day Exponential Moving Average (EMA) and the 200-day EMA crossed bullish on November 19th. The 200-day EMA at US$16.50 should now act as support. Since August 2018, the spot price has mainly held below the 200-day EMA with an active Death Cross.

The Volume Profile of the Visible Range (VPVR, horizontal bars chart below) now shows resistance in the US$30 zone, with strong support at US$16.50. Yearly pivots also show support and resistance at US$22.75 and US$32.87, respectively. Additionally, there are no active bullish or bearish divergences on volume or RSI.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Three-day Cloud metrics, with doubled settings (20/60/120/30) for more accurate signals, are bullish; the spot price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and above the current spot price. The trend will now remain bullish until the spot price is below the Cloud. This is the first bullish Kumo breakout on the three-day chart since 2018.

On the daily chart for the DCR/BTC pair, trend indicators have leaned bearish since early 2018. However, over the past month, the spot price has popped above the 200-day EMA and daily Cloud. The spot price is also below the VPVR point of control (red horizontal line) at 0.0026 BTC, the highest volume zone historically, which should now act as resistance. The next VPVR resistance zone sits at 0.0040 BTC. If the current low does not hold, a move towards the VPVR support of 0.00085 BTC is likely. Additionally, there are no active bullish or bearish divergences on volume or RSI.

Conclusion

Network fundamentals show a plateau in Proof of Work hash rate over the past year as Proof of Stake ticket prices have also stabilized. Hash rate has likely stopped increasing due to decreasing mining profitability over the same period, as well as a decrease in new, more powerful ASIC miners being manufactured.

On-chain metrics, aside from transactions per day, have risen substantially since August, which may be due to a combination of DEX, privacy, and staking initiatives. The treasury system for blockchain proposals and developer funding will likely sustain the coin for many years to come. DCR is very similar to DASH in this regard, although DASH currently maintains higher on-chain metrics.

Technicals for both the DCR/USD and DCR/BTC pairs show a long term bullish trend reversal. Over the past month, spot prices for both pairs have risen above both the 200-day EMA and Cloud. Upside resistance for the DCR/USD pair sits at US$25-US$30, as well as the psychological resistance of US$50, and upside resistance for the DCR/BTC pair sits at 0.0026 BTC. A Coinbase listing, if it should occur, may bump both pairs higher, although the addition of new privacy futures may hamper listing potential unless those features can be disabled on the exchange wallet.

Don’t miss out – Find out more today