Decred Price Analysis – Increasing on-chain metrics and dropping prices

On-chain activity has begun rising over the past few months, which may be due to a combination of DEX, privacy, and staking initiatives. Unlike other coins, DCR has returned to the previous December lows over the past few weeks.

Decred (DCR) launched in 2016, and was originally a Bitcoin codebase fork. The project now incorporates governance functions by using a hybrid Proof of Work (PoW) and Proof of Stake (PoS) consensus system. The cryptocurrency is down 87% from the record high of US$118, established in early May 2018. The market cap currently stands at US$172 million with US$483,000 traded over the past 24 hours. Listen to an episode of The Crypto Conversation podcast with Decred co-founder Jake Yocom-Piatt here.

The hybrid consensus system attempts to shore up the vulnerabilities of both PoW and PoS. PoW miners create the blockchain and earn a portion of the block reward. PoS stakeholders purchase tickets, which earn a portion of the block reward and can also be used to vote on whether a block is permanently added to the blockchain.

A classic PoW model favors entities with access to cheap electricity and the capital to invest in mining infrastructure. This model is subject to mining centralization and 51% attacks, whereby a miner or pool with more than half of the hash rate can temporarily control the blockchain and the transactions.

A classic PoS model favors early adopters who accumulated coins, typically during an initial distribution. The benefits of PoS include decreased infrastructure costs as well as the ability for any user to directly participate in network governance decisions. PoS only blockchains are subject to stake grinding vulnerabilities, which effectively allows a majority PoS miner to control the blockchain.

DCR PoS stakeholders can vote on code updates and budget proposals through a blockchain-anchored public proposal system, dubbed Politeia, which went live in October 2018. If an update or proposal is approved by ticket holders there is a period of time for amendments or reversals, followed by the implementation process.

Source: proposals.decred.org

Stakeholders can purchase tickets using a DCR client. Five tickets are then chosen randomly from the total ticket pool and, if at least three of the tickets vote ‘yes,’ the block is permanently added to the blockchain. Ticket prices, which have continued to increase over the past year, are based on supply and demand and have no direct correlation to DCR exchange prices. As the amount of DCR being staked increases, so do ticket prices.

Source: DCRstats

The PoW component uses the BLAKE-256 hash function, which is similar to Bitcoin’s SHA-256. The network has five minute block times and the difficulty adjusts every 12 hours, approximately. There are currently 213 network nodes, most of which reside in the United States.

Since May, network hash rate and difficulty have essentially plateaued after an explosive early start to the year. This is largely in part due to the 17 BLAKE-256 ASIC mining hardware having been released since January 2018. Five of the 17 applicable ASICs are currently profitable at US$0.04 per KWh.

Source: DCRstats

Source: ASICminervalue

Block rewards are split, with 60% going to PoW miners, 30% to PoS stakeholders, and 10% to developers. The current block reward breakdown is 10.000 DCR for miners, 1.0000 DCR per ticket for stakeholders, and 1.6666 DCR for the developer subsidy. Of the total 21 million capped supply, 50.1% has been mined thus far, which includes an 8% pre-mine at launch, or 1.68 million DCR.

According to a December 2015 blog post, all pre-mined coins owned by developers were either purchased at a rate of US$0.49 per coin or earned for work performed. Of the total 10.116 million DCR in circulation, 50.16% of the coins are being held in the PoS pool. The developer fund address currently holds 611,287 DCR, or US$9.78 million at current prices, and is the largest single account on the network, accounting for 6.27% of the total circulating supply.

Source: DCRstats

Over the past few months, DCR has unveiled two new features; plans for a Decentralized Exchange (DEX) and the ability to send private transactions.

The DCR DEX will be mostly feeless, permissionless, and non-custodial using peer-to-peer Atomic Swaps. Orders will be pseudo-randomly matched within epochs of 10 seconds or greater, negating the advantages of HFTs and front-running. The DEX will also aim to prevent or filter wash trading by using on-chain transactions.

CoinShuffle++ is a non-custodial process for creating CoinJoin transactions. Through an implementation of CoinShuffle++ in the DCR wallet, output addresses are fully anonymized, such that none of the peers or the server can tell which output belongs to which peer. With this addition, DCR joins a myriad of other coins using similar privacy features (shown below). Monero (XMR) now has blockchain pruning capabilities since the v0.14.1 release.

Source: blog.decred.org/2019/08/28/Iterating-Privacy

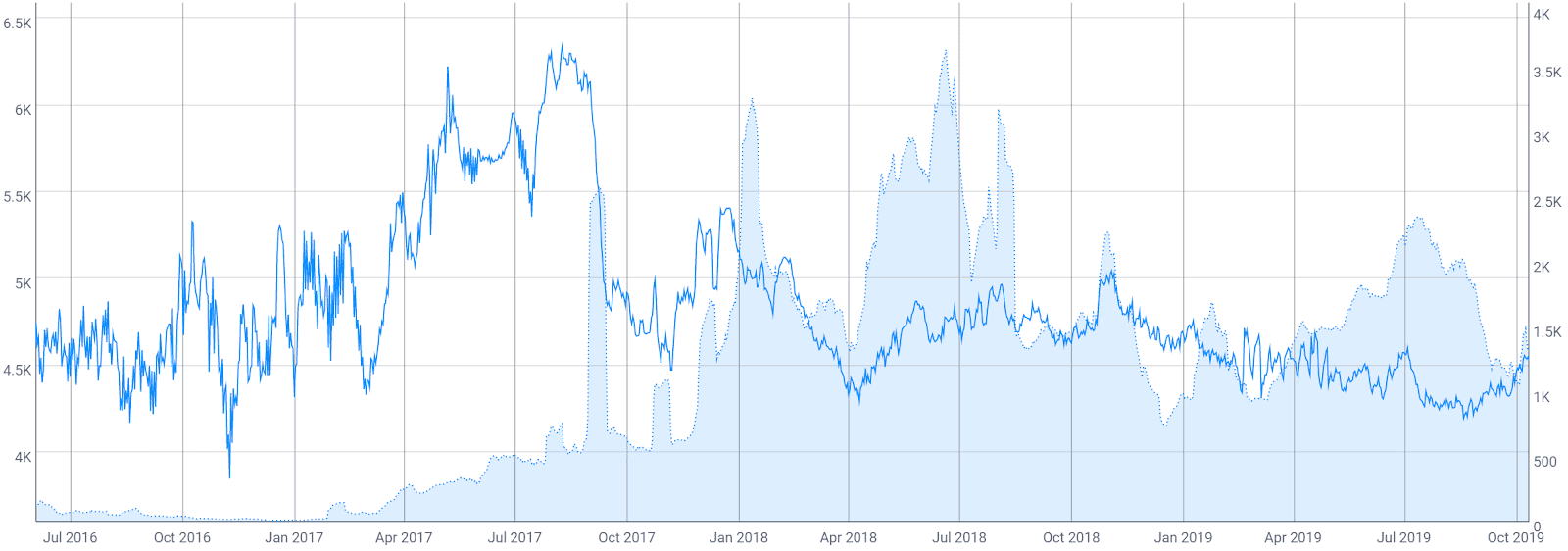

On the network, the current number of transactions per day (line, chart below) entered a downward trend in the beginning of 2018. The record high for transactions per day stands at 6,290 in August 2017. The average transaction value per day largely held above US$1,250 since January 2018. Transactions fees, all of which are collected by the PoW miners, are currently averaging 0.0003 DCR per transaction, or US$0.004 (not shown).

Source: CoinMetrics

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has dropped from 185 to 112 since June. Inflection points in NVT can be leading indicators of a reversal in an asset’s value. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Monthly active addresses (fill, chart below) declined from January 2018 to August 2019, but have recently spiked to a 21-month high. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe’s law. A sudden and continuous increase in active addresses paints a bullish picture as this typically indicates a sharp increase in on-chain use or interest.

Source: CoinMetrics

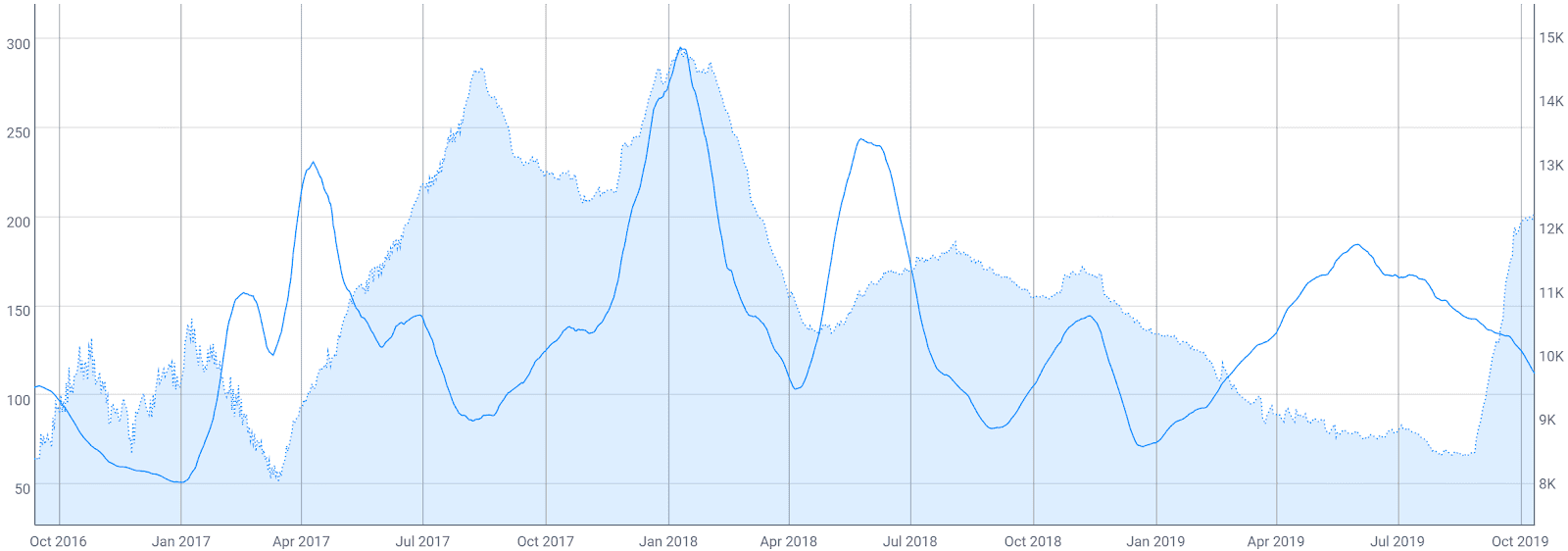

Turning to developer activity, DCR has 75 Github repos with 595 commits on the main repo (chart below) over the past year. Most crypto projects use the developer community of GitHub, where files are saved in folders called "repositories," or "repos." Changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Dave Collins, the lead DCR developer, optimized the master branch earlier this year, introducing a significant spike in commits. Decred v1.4.0 was released in early February and included; a new consensus vote agenda, Trezor support, and advanced Politeia integration.

Source: Github

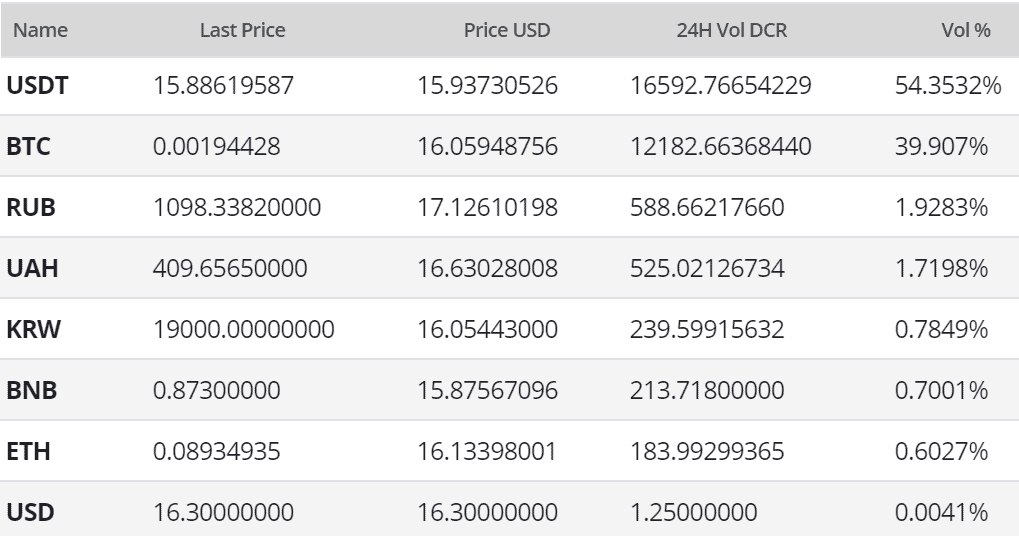

In the markets, DCR exchange traded volume in the past 24 hours has predominantly been led by Tether (USDT) and Bitcoin (BTC) pairs on Binance, Huobi, and Bittrex. In March, OkCoin listed DCR/USD, DRC/BTC, and DCR/ETH pairs. In May, Poloniex disabled DCR pairs for US citizens, along with eight other coins, suggesting that they believe DCR may represent an unregistered security in the eyes of US law. DCR is not currently available for trading on Coinbase or Bitfinex, although in August, DCR was on a short list of potential additions to Coinbase.

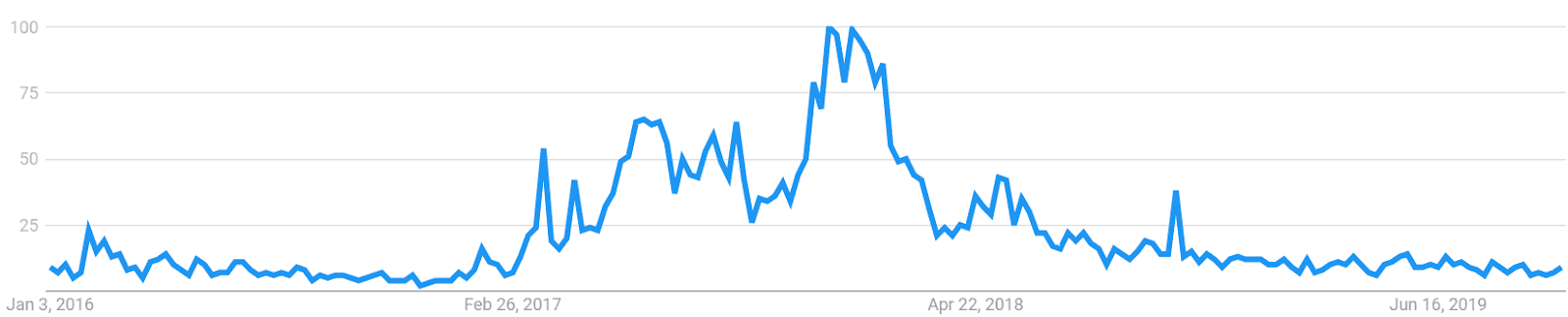

Worldwide Google Trends data for the term "Decred" has dropped substantially since the start of 2018, and is currently sitting near multi-year lows. A slow rise in searches for "Decred" preceded the bull runs in 2016 and 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between google trends data and BTC price whereas a 2017 study concluded that when U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Technical Analysis

Unlike other coins, DCR has returned to the previous December lows over the past few weeks. A price roadmap for this key horizontal level can be determined using Exponential Moving Averages, Volume Profile of the Visible Range, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day Exponential Moving Average (EMA) and 200-day EMA have been bearishly crossed since late August, resuming the previous 309-day bear market. Both EMAs should now act as resistance. The Volume Profile of the Visible Range (VPVR, horizontal bars chart below) shows some resistance above the current price, with strong support at US$16. If the December low of US$13.80 does not hold, there is negligible historic support until US$3.50. Although there are no active RSI or volume divergences, the multi-month bearish RSI concavity will likely come to an end over the next few weeks.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame with doubled settings (20/60/120/30) for more accurate signals are bearish; price is below the Cloud, the TK cross is bearish, and the Lagging Span is below Cloud and below price. The trend will remain bearish as long as the price remains below the Cloud. A long re-entry signal will not trigger until price returns above the Cloud.

On the daily DCR/BTC pair, trend indicators are leaning heavily bearish. The 50-day and 200-day EMAs have been bearishly crossed since August 2018 and the current spot price has been below the Cloud since April 2018. The previous VPVR support at 0.0026 BTC was breached with the next VPVR support zone around 0.0017. The most prudent long entries will be placed after a bullish 50/200 EMA cross and bullish kumo breakout. There are no active RSI or volume divergences, although a bullish divergence has attempted to form over the past several months with no bullish momentum.

Conclusion

Network fundamentals show a plateau of PoW hash rate over the past six months and a significant uptick in PoS ticket holders. Hash rate has likely stopped increasing due to decreasing mining profitability over the same period. On-chain activity has begun rising over the past few months, which may be due to a combination of DEX, privacy, and staking initiatives coming to DCR. DCR’s treasury system for blockchain proposals and dev funding will likely sustain the coin for many years to come. DCR is very similar to DASH in this regard.

Technicals for the DCR/USD pair are bearish based on trend metrics, with the current spot price once again below both the 200-day EMA and daily Cloud. If the December low of US$13.80 does not hold, there is negligible historic support until US$3.50. Otherwise, upside resistance sits near the US$25-US$30 zone based on histoic volume and the 200EMA. Technicals for the DCR/BTC pair are currently heavily bearish, with trend metrics again showing price below both the 200-day EMA and daily Cloud. If the current low does not hold, the next historic support zone is around 0.0017. A Coinbase listing, if it should occur, may bump both pairs higher.

Don’t miss out – Find out more today