EOS Price Analysis – Millions of on-chain transactions per day

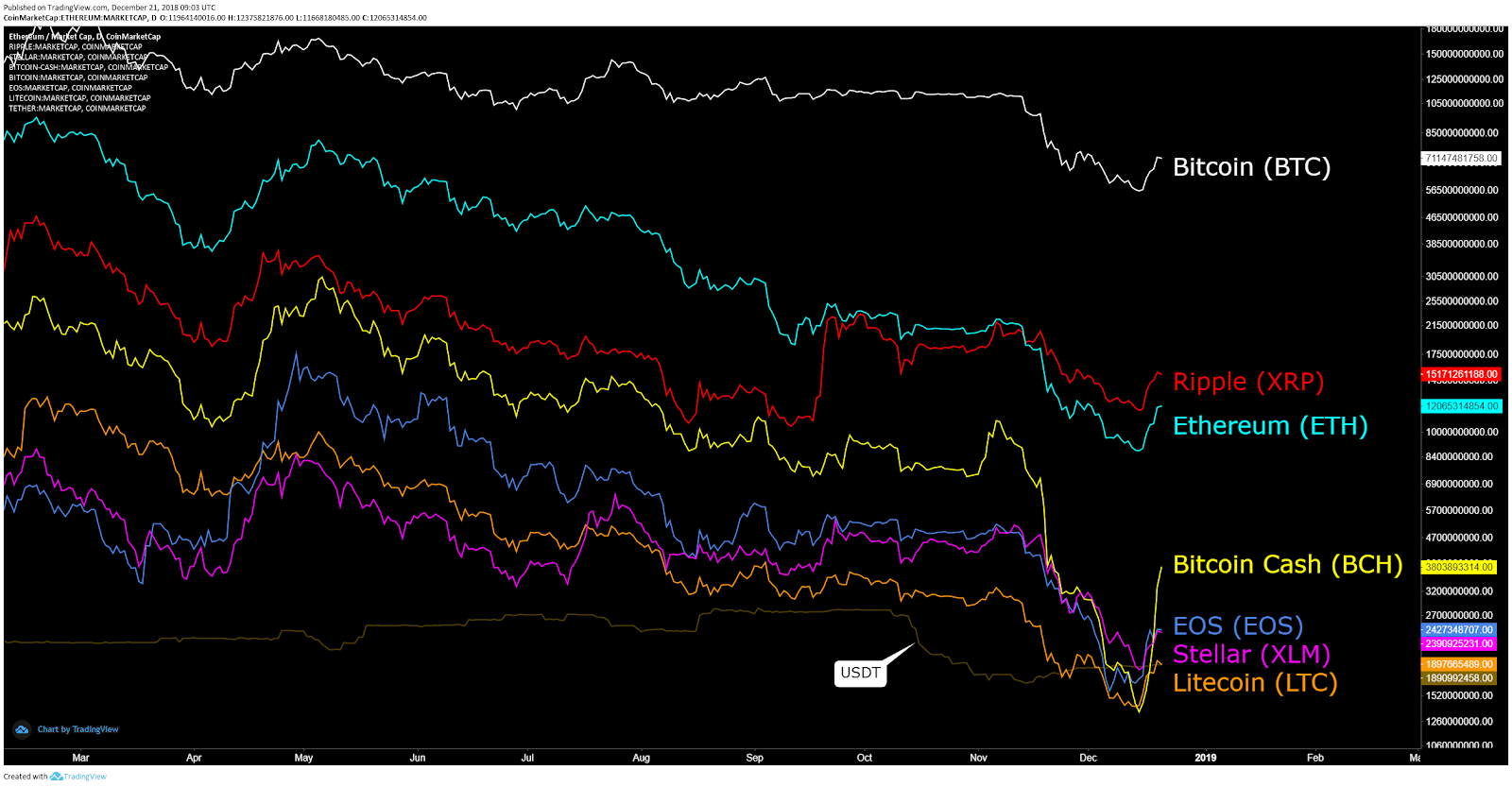

Following a full launch in June, the EOS network has grown in popularity as a gambling Dapp hosting platform, and now daily handles multi-million dollars worth of small, fee-less transactions. Technicals suggest an ongoing multi-month bear trend that has experienced some recent relief likely driven by a mean reversion effect.

EOS is up 85% since hitting yearly lows earlier this month, but remains down 88% from an all-time high established on April 29th. The market cap currently stands at US$2.4 billion with US$1.23 billion in trade volume over the past 24 hours. The crypto asset is ranked 5th on the BraveNewCoin market cap table, after being surpassed by Bitcoin Cash earlier this week.

The EOS platform was created by Block.One to rival other dApp or smart contract enabling blockchains, like Ethereum (ETH) and NEO (NEO), and can be classified as a global computing network running smart contracts on Virtual Machines. The ETH and NEO platforms use gas to pay for units of computing power while EOS uses RAM. EOS went live on June 14th, 2018, after raising ~US$4.2 billion in a year long ICO, where the average token price was US$5.74.

The EOS blockchain uses a Delegated Proof of Stake (DPoS) consensus mechanism, which was pioneered by EOS and Block.One CTO Dan Larimer. DPoS is also currently being used by BitShares, SteemIt, Lisk, Ark, and Tezos. With DPoS, users vote for delegates, or Block Producers (BPs), who are considered trusted and good actors. The top 21 EOS BPs validate the blockchain, collect a passive income, and are expected to help further protocol development by proposing changes or improvements.

Source: http://eosnetworkmonitor.io/

While the top 100 BPs are paid for their services, the top 21 BPs earn the highest reward. Should any of these BPs go against the community’s wishes, they can be fired and replaced. To encourage voting participation, EOS has implemented a vote decay system with newer votes carrying the most weight. Older votes decay and have a minimal impact after two years.

The governance structure is similar to that of a two-layer representative democracy with landowner suffrage. Each stakeholder has influence proportional to their stake in the system. BPs can also offer reward sharing to encourage votes from stakeholders. However, this encourages BPs offering the highest reward to stakeholders to become elected and does not necessarily encourage what is in the network’s best interest. The current reward for staking on EOS, beyond voting on network proposals, is use of the Virtual Machine (VM) components, including; bandwidth, RAM, and storage.

Another arm of the EOS governance system is the EOS Core Arbitration Forum (ECAF), a volunteer-led tribunal. Thus far, the ECAF has given nine public notifications of arbitration and has facilitated 19 orders or rulings.

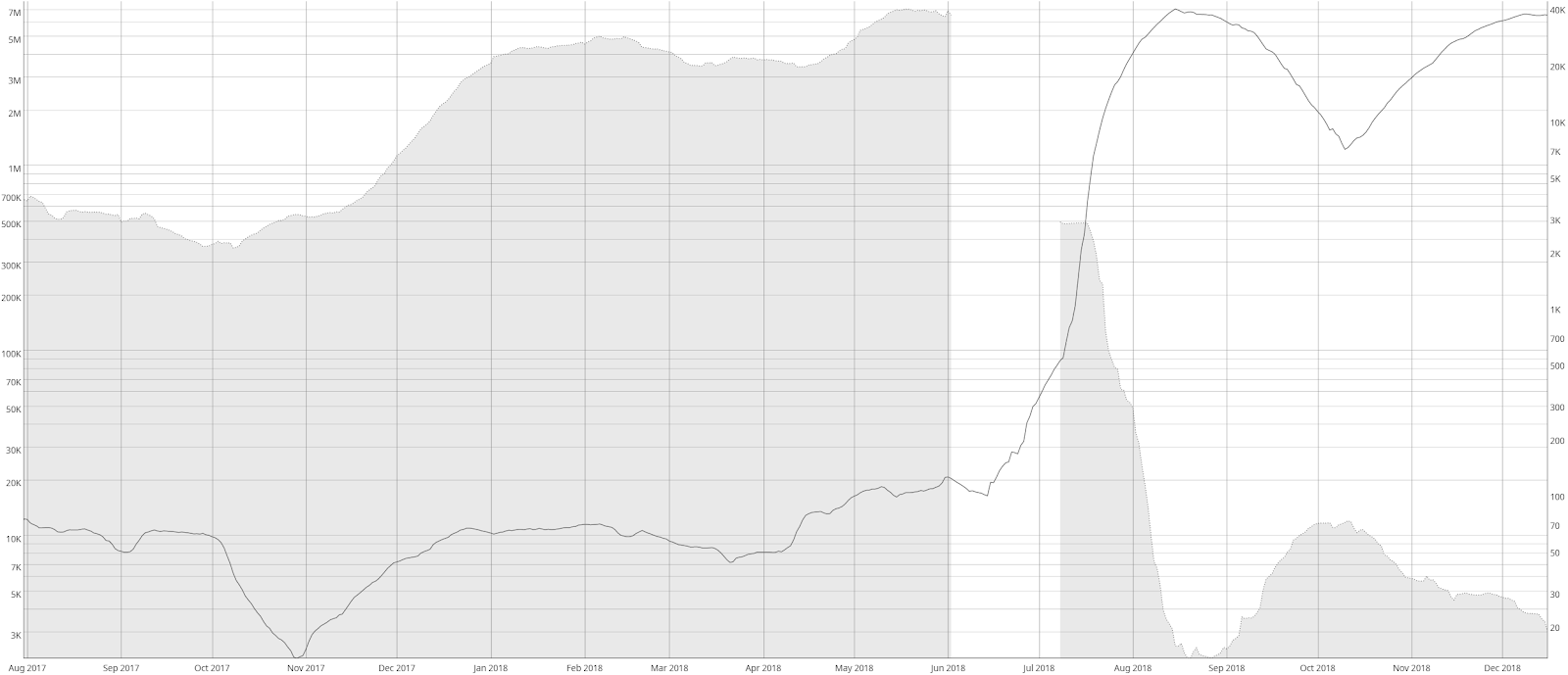

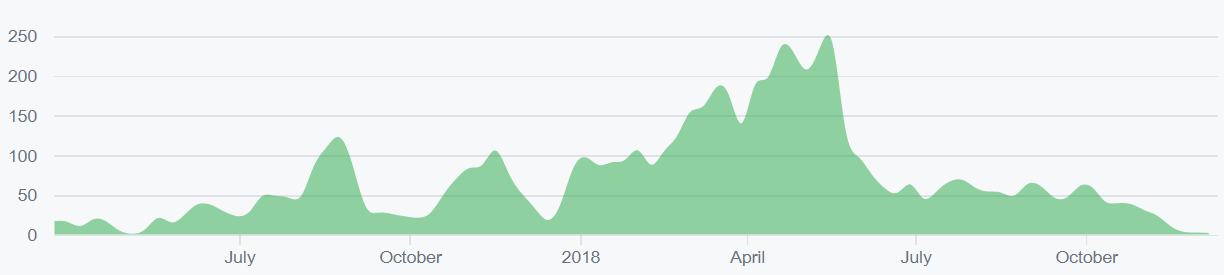

On the network side, 57.7% of all tokens are currently being staked, and the network is confirming around 90 transactions per second. The record number of transactions on the network stands at 3,996 per second. The current number of total transactions per day on the network (line, chart below) stands at ~6.5 million, which has increased substantially since June, and is likely related to dApp activity. The average transaction value (fill, chart below) is currently US$18.27, which is down from a May high of US$38,000 and is also likely related to dApp activity.

Source: coinmetrics.io

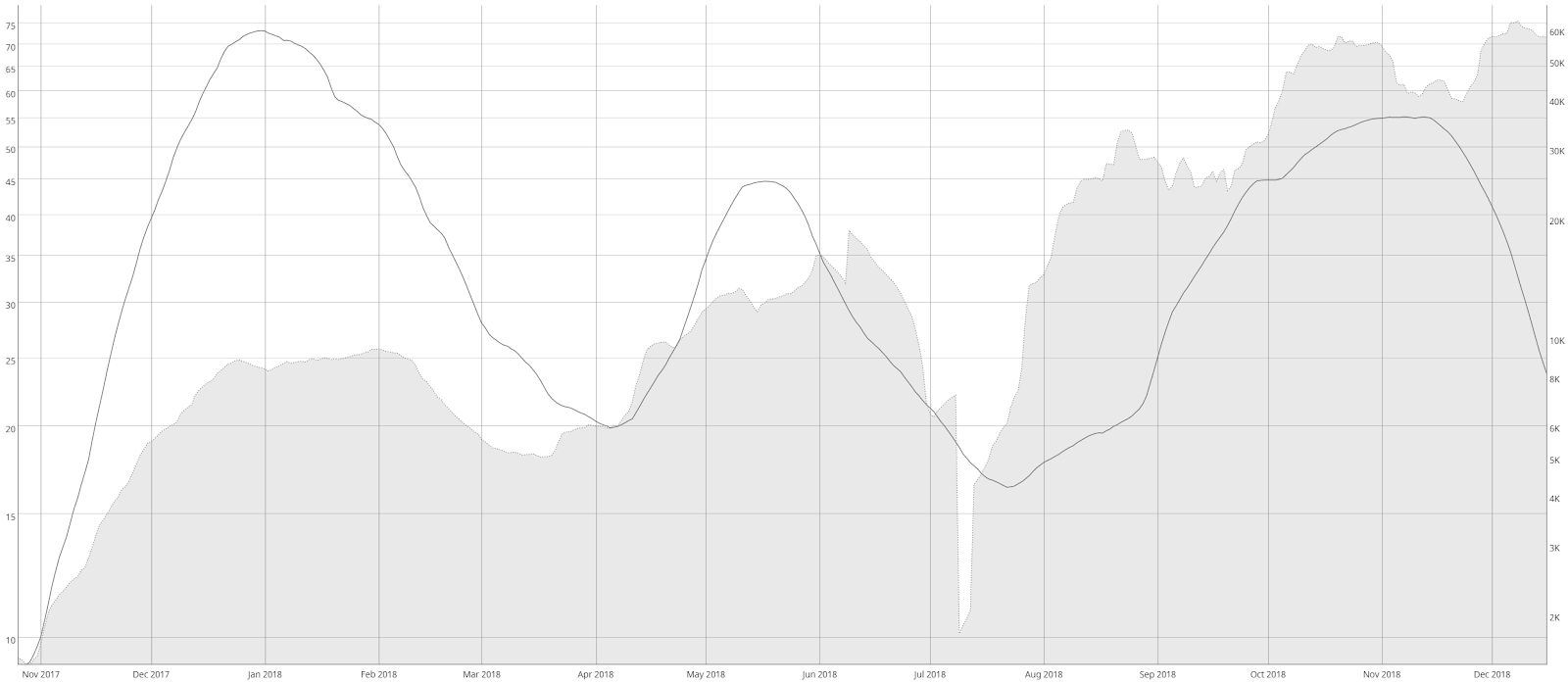

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is falling rapidly from historic highs. Inflection points in NVT can also be leading indicators of a reversal in asset value. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Daily active addresses (fill, chart below) have continued to increase since July and are sitting near all-time highs. EOS currently has fewer daily active addresses than ETH, but significantly more daily active addresses than NEO. Active addresses are important to consider when determining the fundamental value of the network based on Metcalfe’s law.

Source: coinmetrics.io

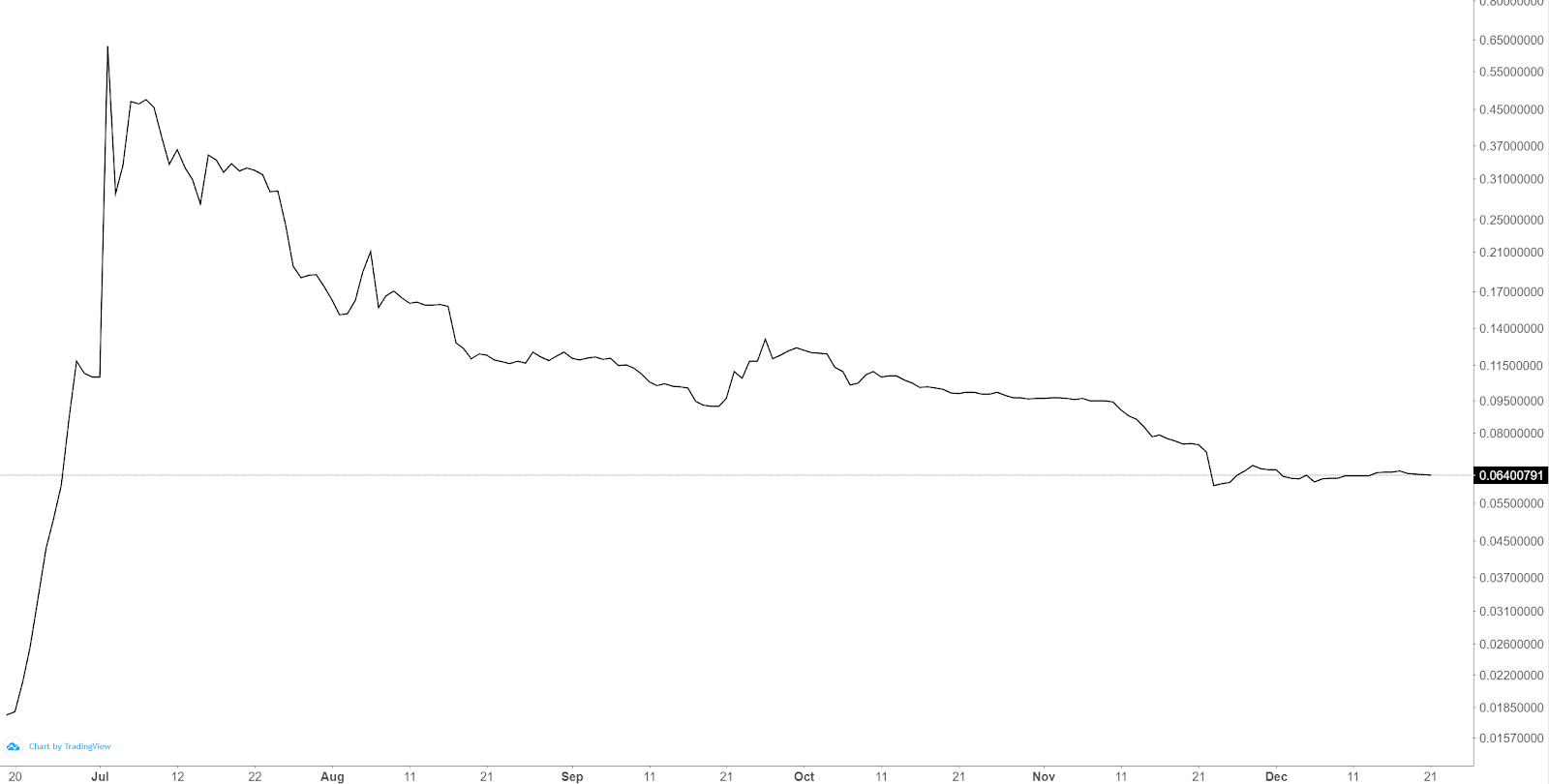

The cost of RAM on the EOS virtual machine is currently ~0.0640EOS/kb and continues to decrease. RAM on EOS is subject to supply and demand, as well as speculation, and is required to create new accounts or interact with dApps. New account creation uses 4kb of RAM. A few users attempted to corner the RAM market in July when RAM costs skyrocketed to ~900EOS/MB, which meant a new account cost ~US$32 at that time. In response, 15 of the 21 EOS BPs approved a measure to double the supply of RAM, flooding the market and decreasing the cost.

Source: https://eos.feexplorer.io/

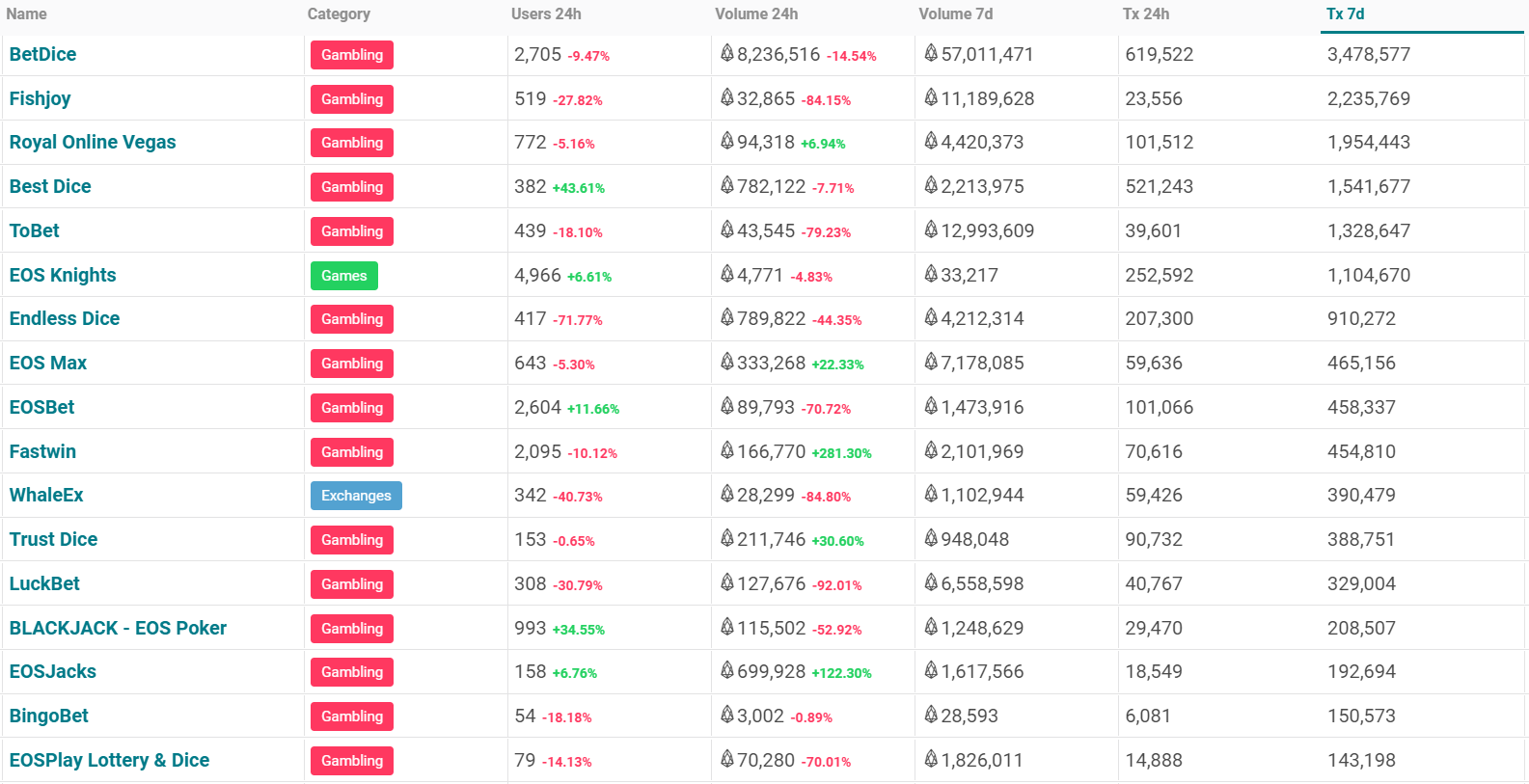

The top dApps over the past week, ranked by transactions, were dominated by gambling dApps. Volume across most EOS dApps has increased dramatically over the past few months. Gambling dApps are popular because they are normally highly regulated in most countries but are currently outside of legal purview, at least for the moment. Transaction costs are also very minimal.

Source: https://dappradar.com/eos-dapps

Turning to developer activity, over 160 developers have contributed to the EOS project on GitHub. There have been a cumulative 6,653 commits over the past year, mostly in the main repo (shown below). Most coins use the developer community of GitHub, which was acquired by Microsoft for US$7.5 billion. Files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: https://github.com/EOSIO/eos/graphs/contributors

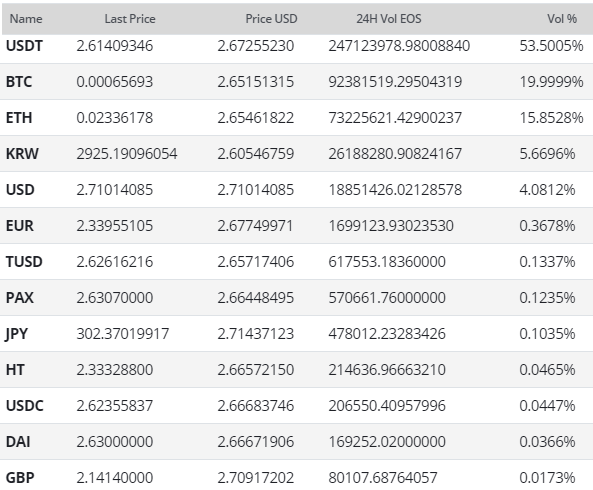

EOS exchange traded volume in the past 24 hours has predominantly been led by Tether (USDT), with Bitcoin (BTC) and Ethereum (ETH) pairs also accounting for a smaller but substantial percentage of the volume. The majority of trading has occurred on OKEx, Digifinex, and Huobi. EOSfinex, an EOS-based DEX in the works the Bitfinex platform, is still listed as "coming soon" on the website. EOS is not currently listed on Bittrex or Coinbase.

Technical Analysis

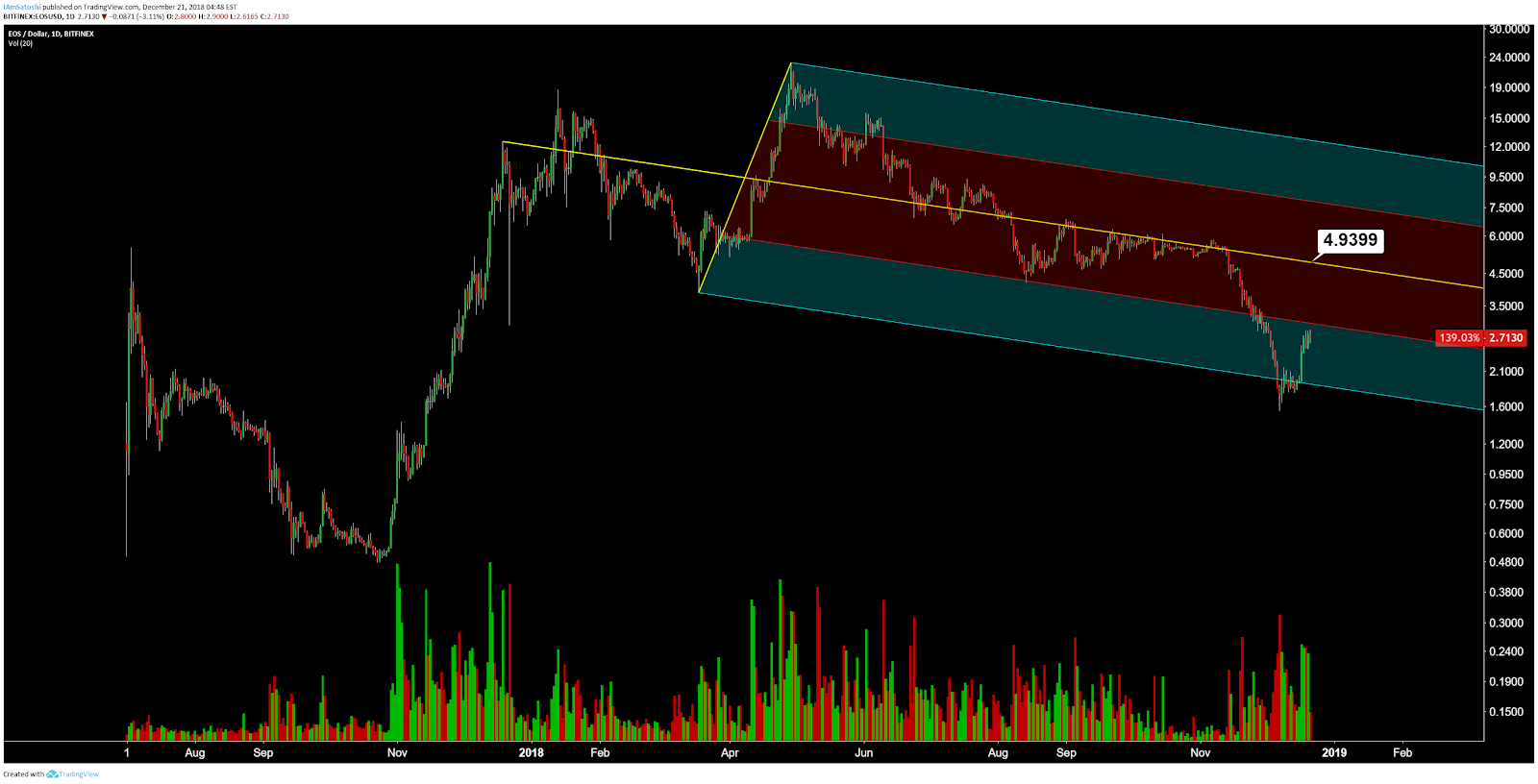

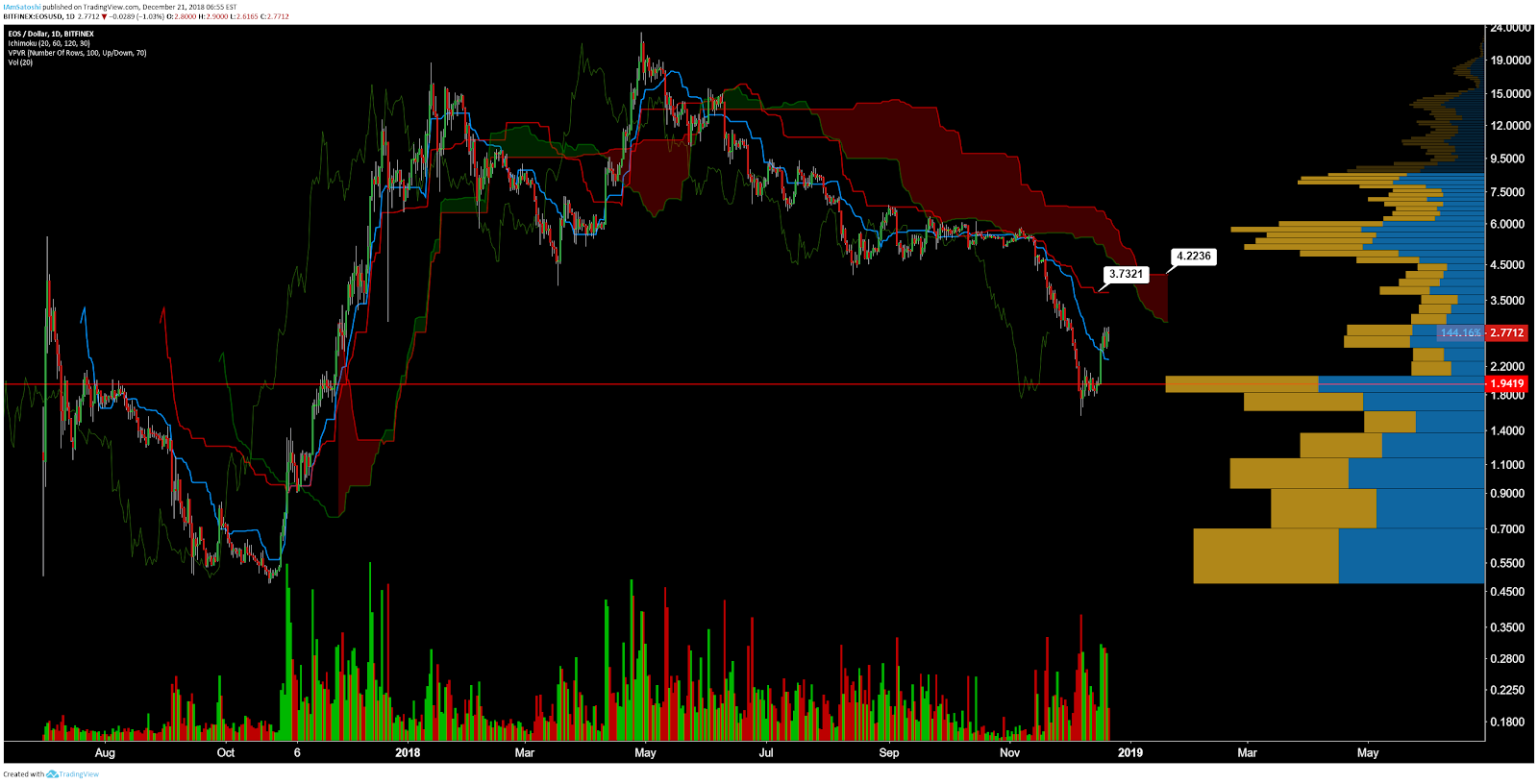

EOS has retraced 38% of the drop and looking for the nearest resistance around 50%, as is typical with most reversals. As a potential trend shift occurs, exponential moving averages (EMAs), Pitchforks, Ichimoku Cloud, and volume can be used to find optimal entry and exits. Further background information on the technical analysis discussed below can be found here.

Bitfinex open interest remains mostly net long, with longs sitting near record highs (top panel, chart below). A significant price movement downwards will result in an exaggerated move as the long positions begin to unwind. There are no active RSI or volume divergences.

Price dropped a total of 82% after the bearish 50/200 EMA cross in late July. Although a bullish entry would not be warranted until a bullish 50/200EMA golden cross occurs, a price move towards the 200EMA continues to be possible simply due to mean reversion. The 50EMA will also act as resistance for price.

Price continues to reside with the boundaries of a bearish Pitchfork (PF) with anchor points in December, March, and April. In the recent drop, price found support near the bottom of the PF, confirming the validity of the trendlines. Price should now attempt to return to the median line (yellow), currently at US$4.94, after consolidating near the local diagonal resistance. A breach of the ML to the upside could bring prices of US$8-US$10 based on the PFs upper resistance zone.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bearish; price is below Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span below Cloud and below price.

Price did form a TK C-clamp before the price reversal. A move towards the Kijun at US$3.73 is likely before the next zone of resistance. The trend continues to be bearish, so asks, or short entries, in this price range are prudent. Furthermore, volume history (horizontal bars) suggests significant resistance above US$4.50.

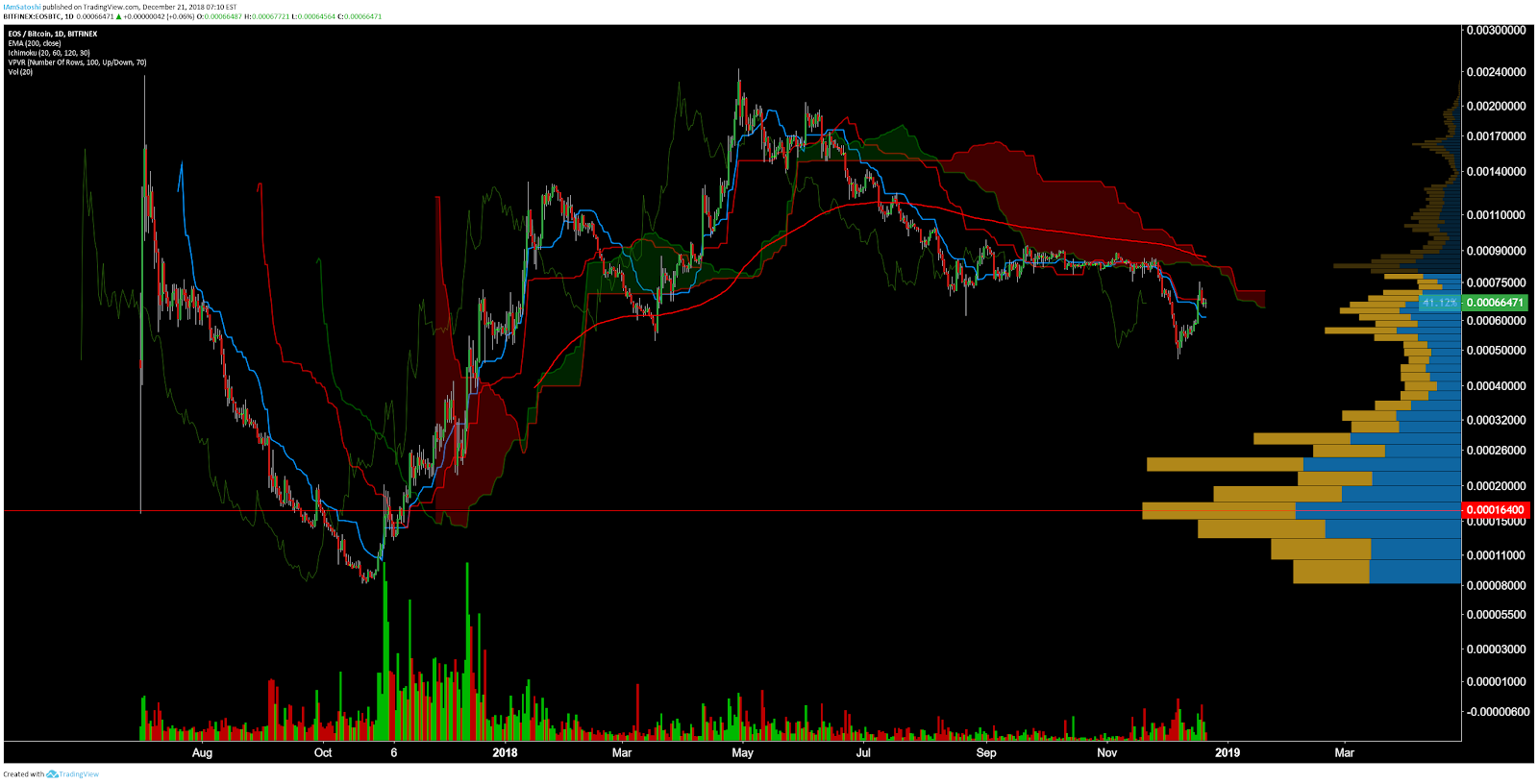

Lastly, on the EOS/BTC pair, the daily chart shows similar bearish trend indications; Cloud is bearish and price is below the 200EMA. The next high probability opportunity for a long trade will likely come with a bullish Kumo breakout with a bullish TK cross. Based on the shrinking Cloud resistance, this may occur in February. A breach of the 200EMA would add to the possibility of continued bullish momentum. The volume profile also shows very little resistance above the 82,000 sat zone.

Conclusion

Network fundamentals show that gambling dApps have driven the number of on-chain transactions per day into the multi-millions while sinking average transaction value to below US$20. EOS does not have transaction fees per say, so it is hard to judge the importance or relevance of this data when compared to other blockchains which do have transaction fees. Active addresses have also risen substantially, likely due to dApp activity. The governance system of BPs and the ECAF shows a centralization of power which is not apparent in many other blockchains and is antithetical to crypto ideology in general.

Technicals suggest an intact multi-month bear trend which recently experienced a significant relief rally reminiscent of mean reversion. Substantial trading volume and the substantial distance from the mean of the range are indicative of bearish exhaustion for the time being. The next strong resistance lies at US$3.73, which will likely be a decision point and consolidation level before bearish continuation.

Don’t miss out – Find out more today