EOS Price Analysis – Voice beta coming later this month

Technicals indicate an emerging bull trend for both the EOS/USD and EOS/BTC. A key long term fundamental driver, the Voice beta launch, is scheduled to roll out this month and may be another driver of positive momentum.

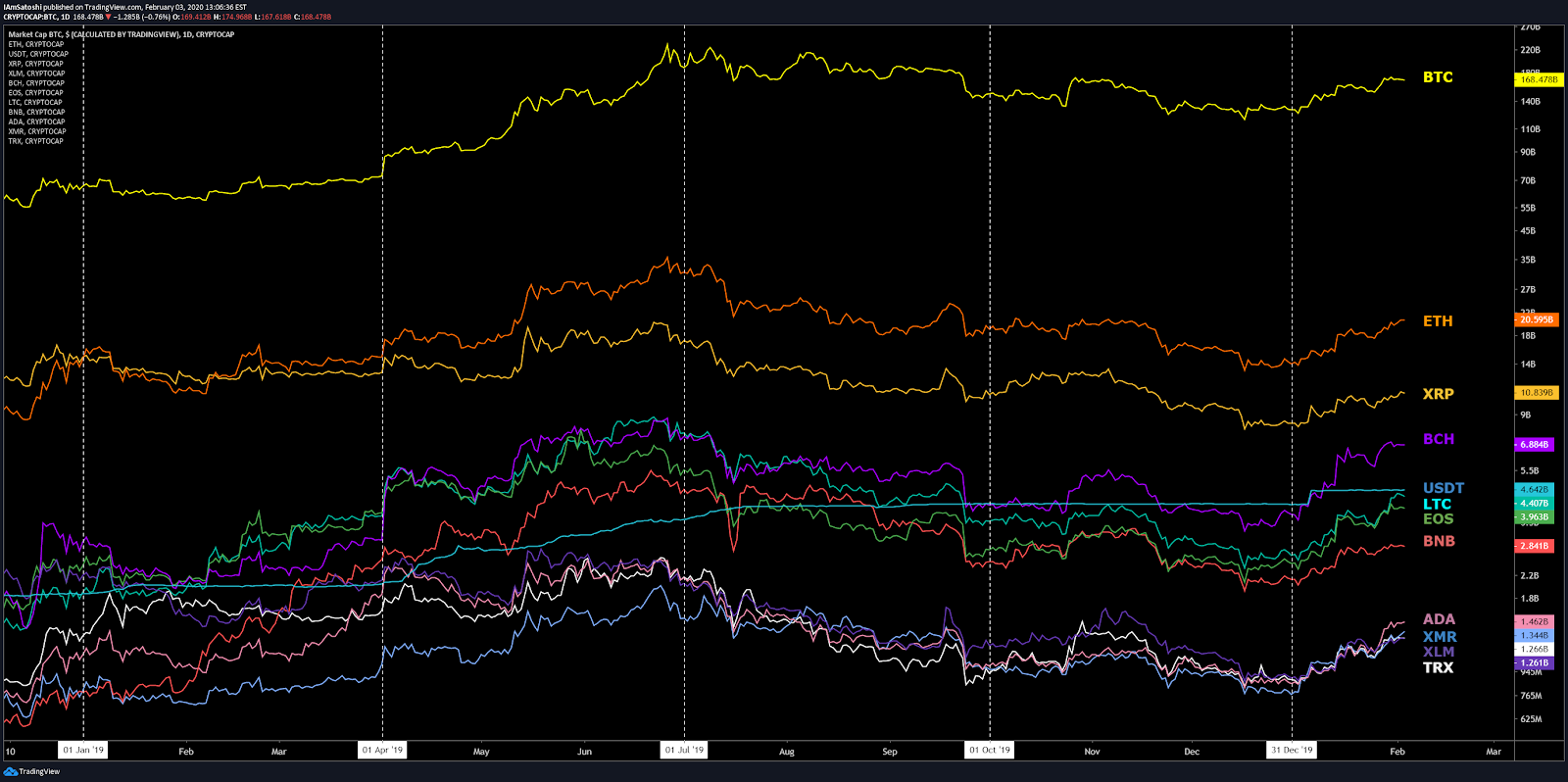

The EOS (EOS) platform, created by Block.One, is a global computing network designed to host decentralized applications (Dapps), and decentralized autonomous corporations (DACs). The asset’s market value in USD is down 82% from the all-time high established in April 2018.

The market cap currently stands at US$3.97 billion with US$1.45 billion in trade volume over the past 24 hours. EOS is ranked 8th on the Brave New Coin market cap table.

The EOS network hosts smart contracts on Virtual Machines and competes with other Dapp or smart contract platform blockchains, including Ethereum (ETH), Tronix (TRX), and NEO (NEO). The ETH and NEO platforms use gas to pay for units of computing power while EOS uses RAM.

The EOS blockchain went live on June 14th, 2018, after raising ~US$4.2 billion in a year-long ICO, with an average token price of US$5.74. Unlike many ICOs, which continue to hold a large quantity of Ethereum, EOS had spent most of their ETH holdings by June 2018 (chart below).

Source: Sanbase

Initial concerns over a competitor chain holding large quantities of ETH, which could possibly be used in a nefarious matter, quickly dissipated. However, the large ETH outflows from the EOS treasury likely contributed to a drop in ETH price throughout May 2018.

In September 2019, Block.One announced a US$10 million investment in Arlington County, Virginia, for new headquarters. Block.One’s CTO, Dan Larimer, has been based in Blacksburg, Virginia, along with an 80-employee team. The new headquarters are set to double the team size and will serve as a base for increased government relations.

Also in September, Block.One announced reaching a one-time civil settlement of US$24 million with the U.S. Securities and Exchange Commission (SEC) in regards to the unregistered EOS ICO on Ethereum. Block.One neither admitted nor denied wrongdoing. The settlement also resolved all ongoing matters between Block.One and the SEC according to the post. Globally, other regulatory agencies may also seek enforcement actions or settlements against EOS if the project is again deemed an unregistered securities offering.

The EOS blockchain uses a Delegated Proof of Stake (DPoS) consensus model, which was pioneered by Larimer. Other iterations of DPoS are currently being used by BitShares (BTS) and Steemit (STEEM), two of Larimer’s previous projects, as well as Lisk (LSK), Ark (ARK), and Tezos (XTZ).

DPoS blockchains have users that vote for delegates, or Block Producers (BPs), who are considered trusted and good actors. The top 21 EOS BPs validate the blockchain, collect a passive income, and are expected to help further protocol development by proposing changes or improvements. Most of the top 21 BPs are located in Asia, with eight located in China.

Source: eospark.com

While the top 100 BPs are paid for their services, the top 21 BPs earn the highest reward. Should any of these BPs go against the community’s wishes, they can immediately be replaced. To encourage voting participation, EOS has implemented a vote decay system with newer votes initially carrying the most weight and eventually having zero impact after two years.

The governance structure is similar to that of a two-layer representative democracy with landowner suffrage. Each stakeholder has an influence proportional to their stake in the system. BPs can also offer reward sharing to encourage votes from stakeholders. However, this can encourage the election of BPs offering the highest reward to stakeholders and does not necessarily encourage what is in the network’s best interest. The current reward for staking on EOS, beyond voting on network proposals, is the use of Virtual Machine (VM) components, including; bandwidth, RAM, and storage.

A now discontinued arm of the EOS governance system was the EOS Core Arbitration Forum (ECAF), a volunteer-led tribunal. While active, the ECAF gave nine public notifications of arbitration and facilitated over 20 orders or rulings. As of April 2019, the ECAF is no longer accepting claims. Instead, 15 of the 21 BPs can now decide on any arbitration matters. The process often involves blacklisting accounts, which only works if the top 21 BPs use the blacklist.

In 2019, a newly rotated top 21 BP, games.eos, failed to apply a blacklist correctly, allowing 2.09 million EOS, or about US$7.25 million, to move out of a blacklisted account. Due to the incident, games.eos is no longer a top 21 BP. Going forward, there are plans to cancel the keys for blacklist account holders entirely, so they can never be used on the EOS blockchain.

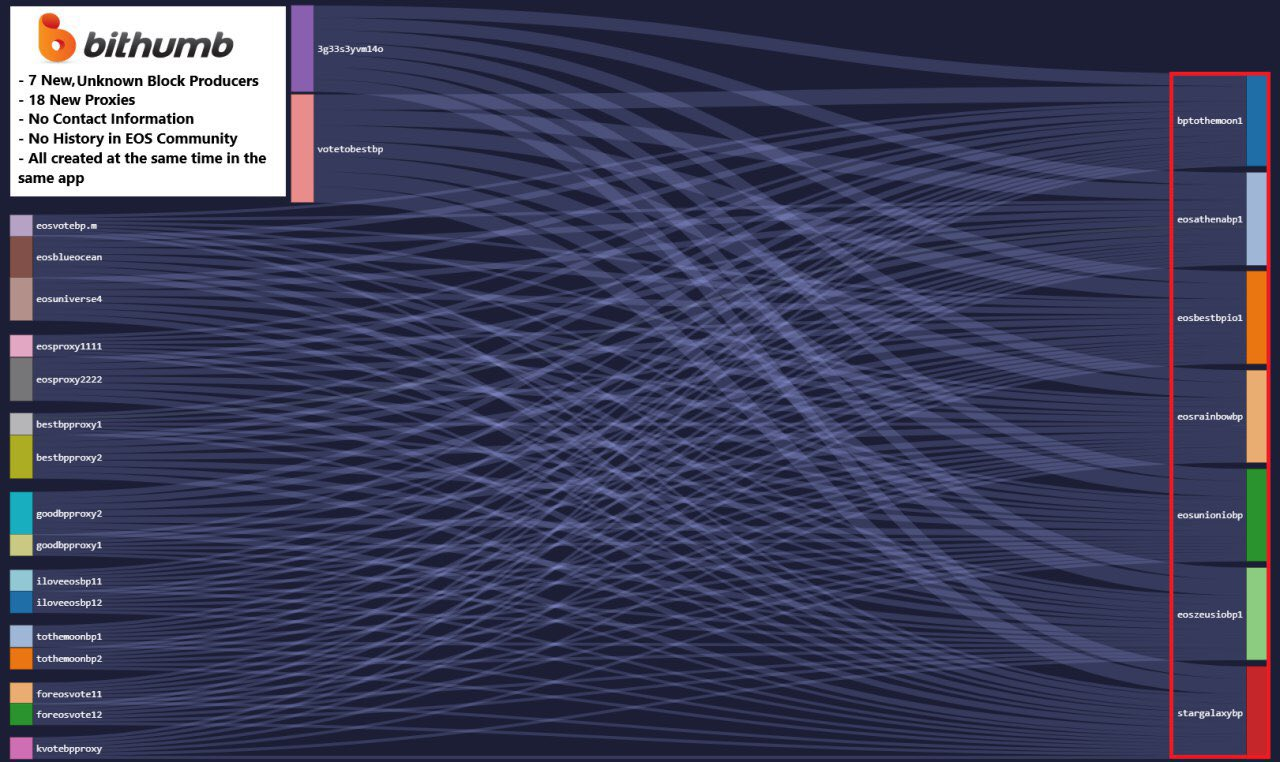

Over the past few months, there has been growing concern in regards to BP ballot stuffing and manipulation. The exchange Bithumb recently added seven new BP accounts with 18 new proxies, which may be an attempt to obscure the trail of its votes. These new BPs have virtually no social media presence and/or working websites. These “sock puppet nodes” could be mirroring larger nodes and siphoning the BP rewards from the top 100 BPs, without providing additional network security.

Source: https://twitter.com/ColinTCrypto/status/1189972205653970949

Developer activity for the EOS project on Github has produced over 1,700 commits in the past year on the main repository (shown below). Most coins use the developer community of Github. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Larimer pushed 15 commits in May 2018, with his commit contribution dropping off precipitously after June 2018. Larimer has also been working on a decentralized identity solution, which has been granted a patent. Despite Larimer’s absence from core dev work, incremental protocol updates continue.

Source: Github

EOS REX (Resource Exchange), first proposed by Larimer in 2018, went live in May 2019 and now has a vibrant lending community. The exchange allows users to lease EOS tokens to Dapps, or other users, for a variable fee. EOS.IO v1.8 was released via a hard fork in September 2019, enabling Voice, a social media platform, which is set for a beta launch on February 14th this year. The hard fork was supported by all BPs and major exchanges.

On the network side, the EOS blockchain has grown to over 4TB in the past year. The nodes are essential for fully-functional Dapp activity as 20% of blockchain lookup requests involve observing the entire blockchain history. A list of these active full nodes was unable to be obtained.

Currently, approximately 46% of all circulating EOS tokens are being staked, and the network is confirming around 35 transactions per second. The record number of transactions on the network at one time stands at 3,996 per second.

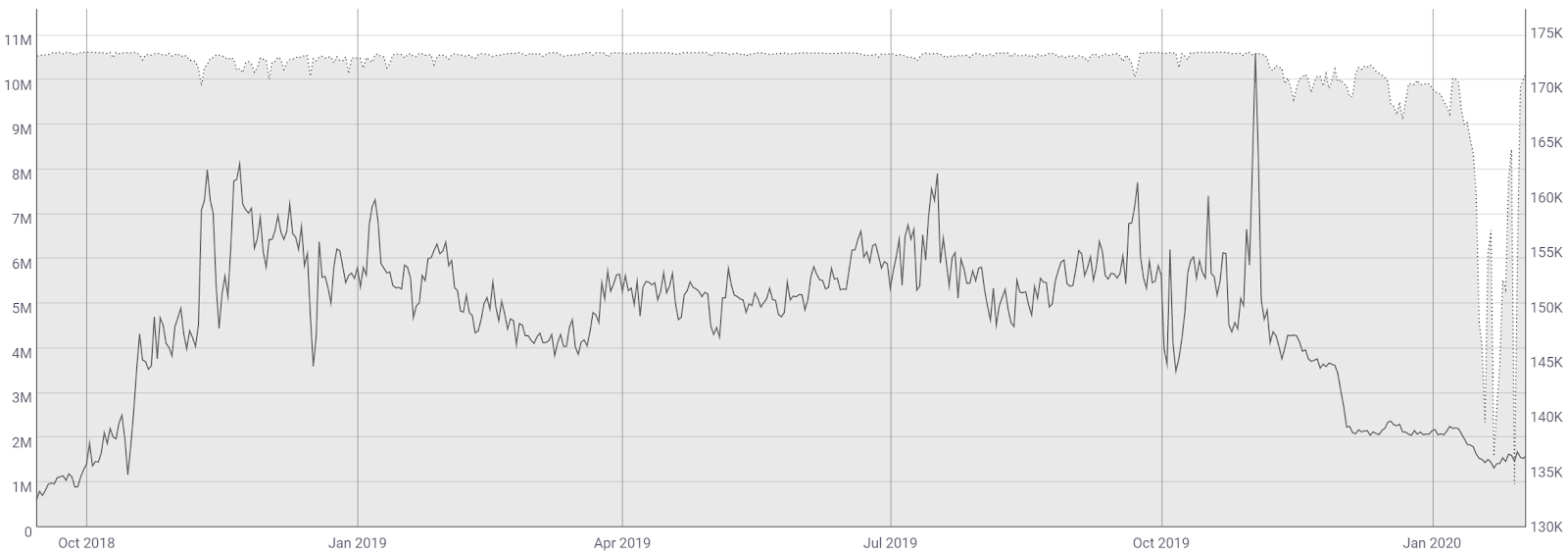

The number of total transactions per day on the network (line, chart below) hit a new all-time high of over 10 million in November 2019 and has fallen to 1.6 million. The spike in transactions was related to the EIDOS airdrop, which encouraged transactions of any size. Blocks produced per day (fill, chart below) have also fallen substantially since November.

Transaction costs on EOS are essentially free, enabling Dapp transactions to flourish. Grassroots interest on meetup.com shows nearly 60,000 people in 135 EOS-related groups worldwide and nearly 70,000 subscribers on the EOS Reddit sub.

Source: CoinMetrics

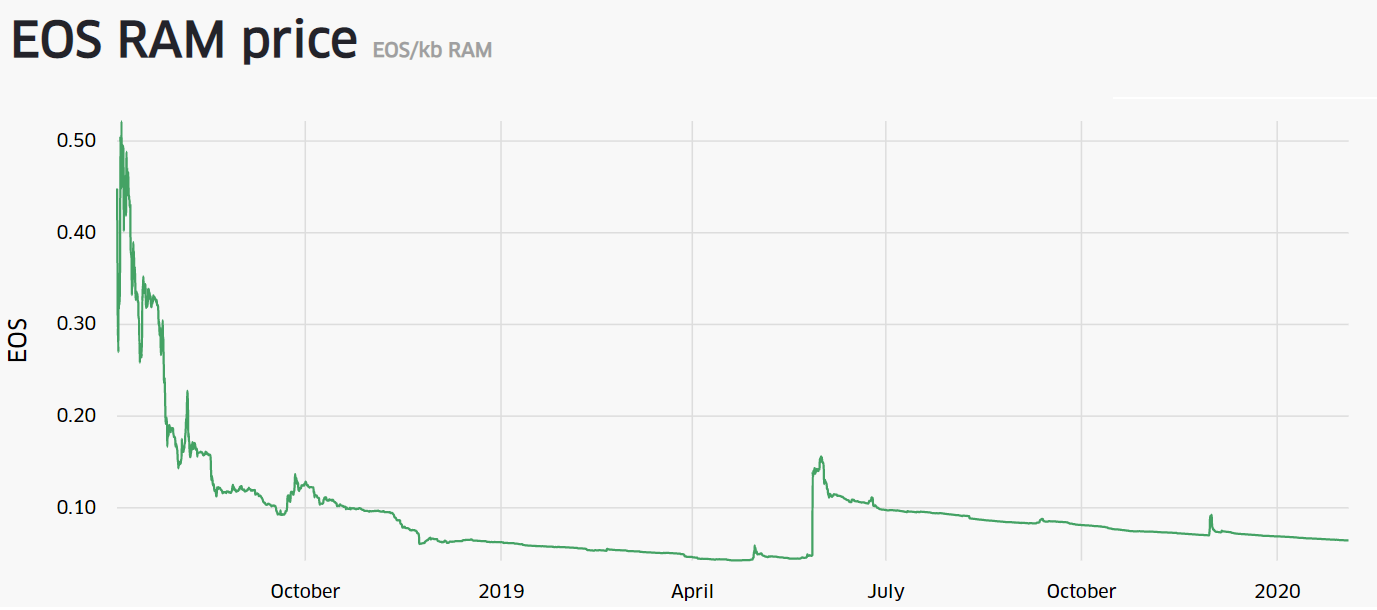

RAM on the EOS virtual machine is subject to supply and demand, as well as speculation. New EOS account creation uses 4kb of RAM and, after an account is created, there are minimal transaction fees. In July 2018, a few users attempted to corner the RAM market, causing RAM costs to skyrocket to more than 900EOS/MB. In response, 15 of the 21 EOS BPs approved a measure to double the supply of RAM, flooding the market and decreasing RAM costs.

In June 2019, RAM spiked to nearly 0.20 EOS/KB after Block.One bought US$25 million worth of RAM for the launch of the Voice social network. Since July, RAM costs have continued to drop below 0.1 EOS/KB.

Source: eosweb.net/ram

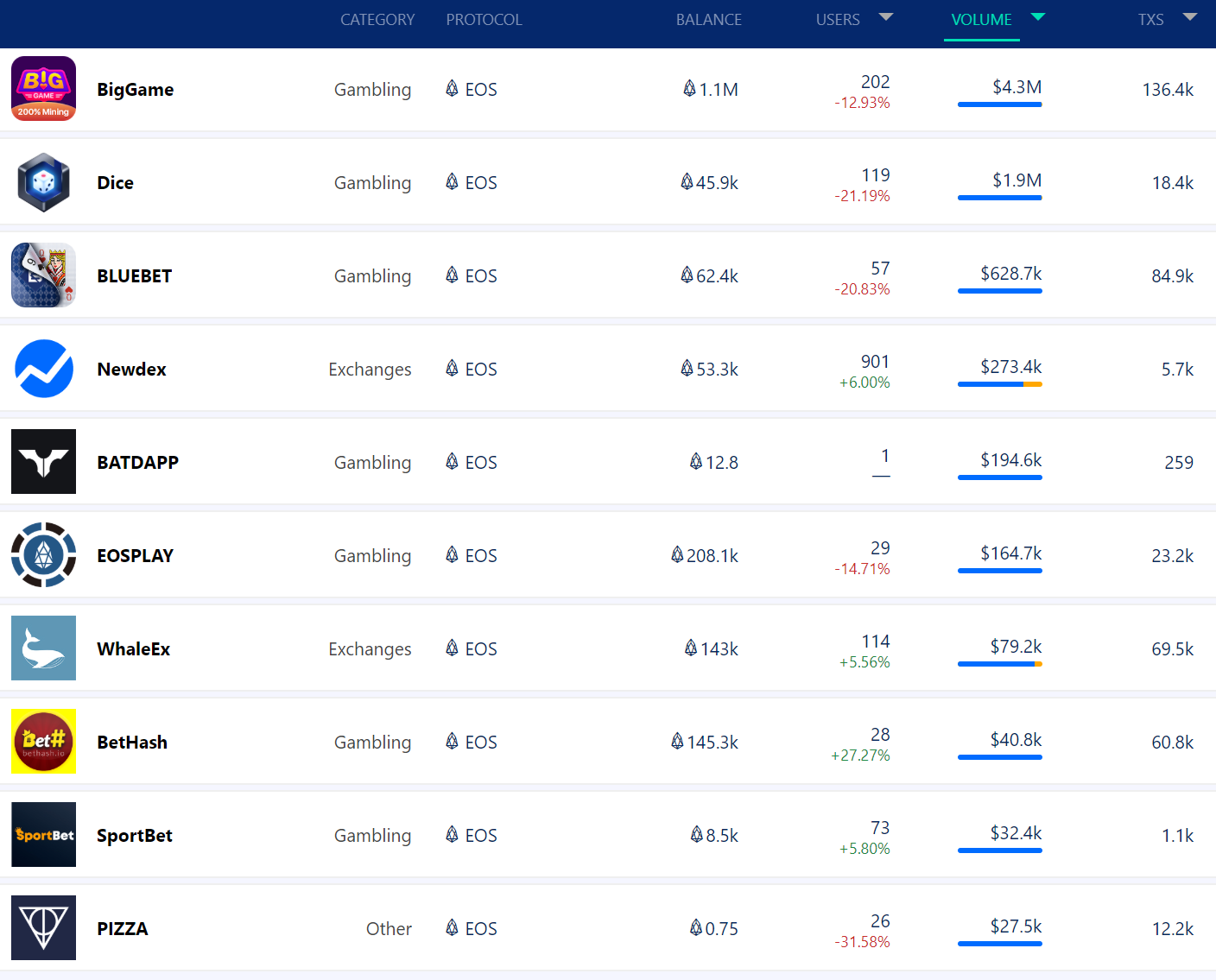

Gambling and exchange Dapps continue to be the most used application on EOS, which is likely due to gambling activity being highly regulated in most countries. These Dapps are currently outside of legal purview, at least for the moment. EOS Knights and EOS Dynasty, both role-playing games, have also seen sustained user growth since launching in August 2018 and April 2019, respectively.

Despite impressive user numbers, a report earlier this year from AnChain.AI found that blockchain bots account for 51% of all EOS Dapp users and 75% of all EOS Dapp transactions. These bogus transactions accounted for US$6 million of the daily transaction volume at the time. The report concluded that without sophisticated prediction models, Dapp leaderboard websites, or rating agencies; investors, developers, and enthusiasts will be fooled by inauthentic numbers.

Transaction costs are also very minimal, or non-existent when interacting with EOS Dapps. Several Dapps have launched on EOS, or migrated from competitors in recent months, citing concerns over scalability or transaction costs on other platforms. These Dapps include; Effect.AI, Tixico, Unico, Medipedia, Sense Chat, Billionaire Token, EOSBet, HOQU, Everipedia, and Insights Network. Additionally, Tapatalk, a forum app with 300 million registered users, is building a reward system using the EOS blockchain.

Source: DappRadar

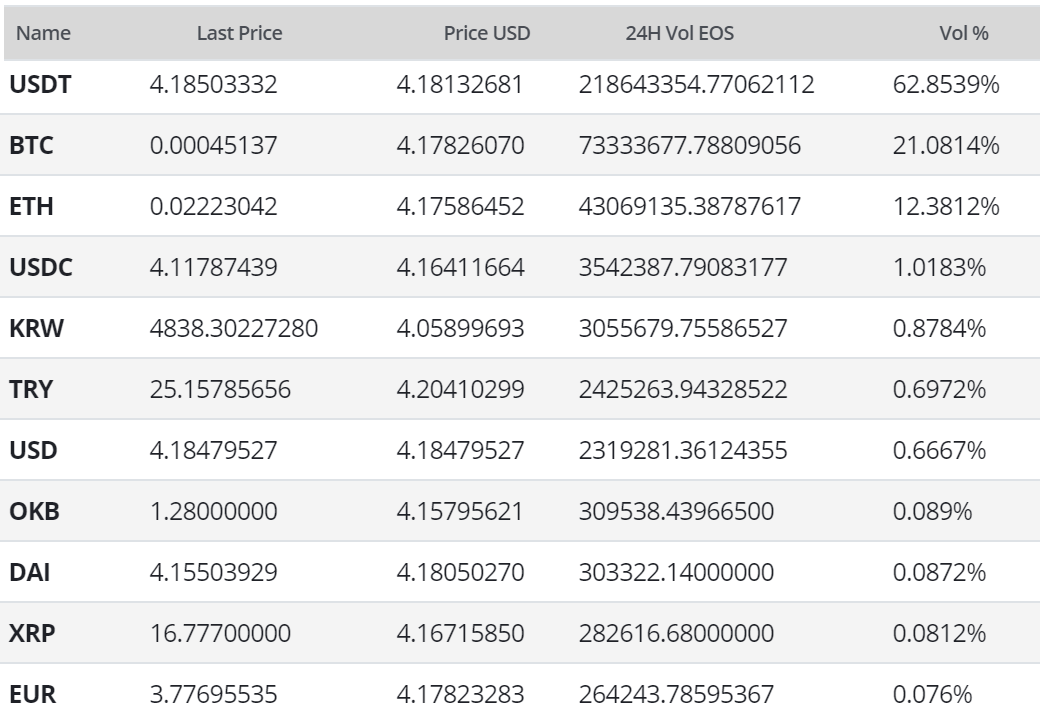

Exchange-traded volume in the past 24 hours has predominantly been led by the Tether (USDT) and Bitcoin (BTC) pairs, with Ethereum (ETH) accounting for a smaller but substantial percentage of the volume. Tether was launched on the EOS chain in June 2019, where there are currently US$5.25 million USDT issued. Bitfinex and Huobi, which are both EOS BPs, also launched exchanges on the EOS chain last year.

In April, the EOS/USD, EOS/EUR, and EOS/BTC pairs were added to Coinbase Pro and a EOS/USDT pair was added to Bitfinex. Bittrex International added EOS/USDT, EOS/BTC, and EOS/ETH pairs in July and EOS was made available for purchase on Coinbase.com in June. Margin pairs for EOS/USDT and EOS/BTC were also added to Binance in August. In the custody realm, Trezor added EOS support in late July. EOS holders can also earn a yield on funds held within Celsius.

The Korean exchange Bithumb has been hit hard by hackers over the past two years, including a loss of US$18 million in various coins during a theft in August 2018, and a loss of US$15 million of EOS in March 2019. The second hack came on the heels of the exchange cutting 50% of its staff, or 150 people, due to declining trade volumes. ChangeNOW, a non-custodial exchange service, reportedly intercepted and returned US$500,000 worth of the stolen EOS tokens to the exchange. Some reports have concluded that the exchange has been repeatedly targeted by North Korea, while others suggest the possibility of disgruntled staff playing a role in the theft.

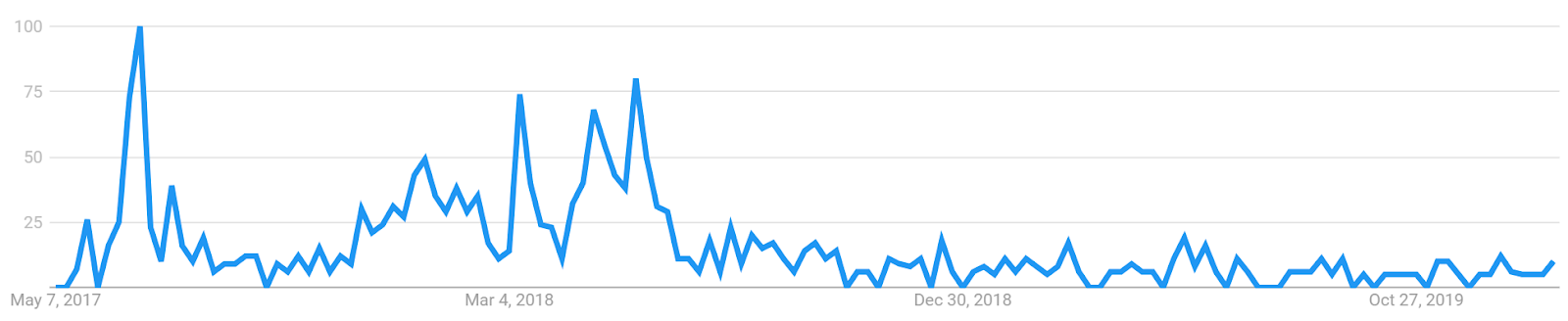

Aside from a brief period between July 2017 and March 2018, Google Trends data for the term "EOS.IO" has mostly been pinned to the floor. The increase in 2018 likely signaled a large swath of new market participants at that time. A 2015 study found a strong correlation between the google trends data and bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, bitcoin price drops.

Technical Analysis

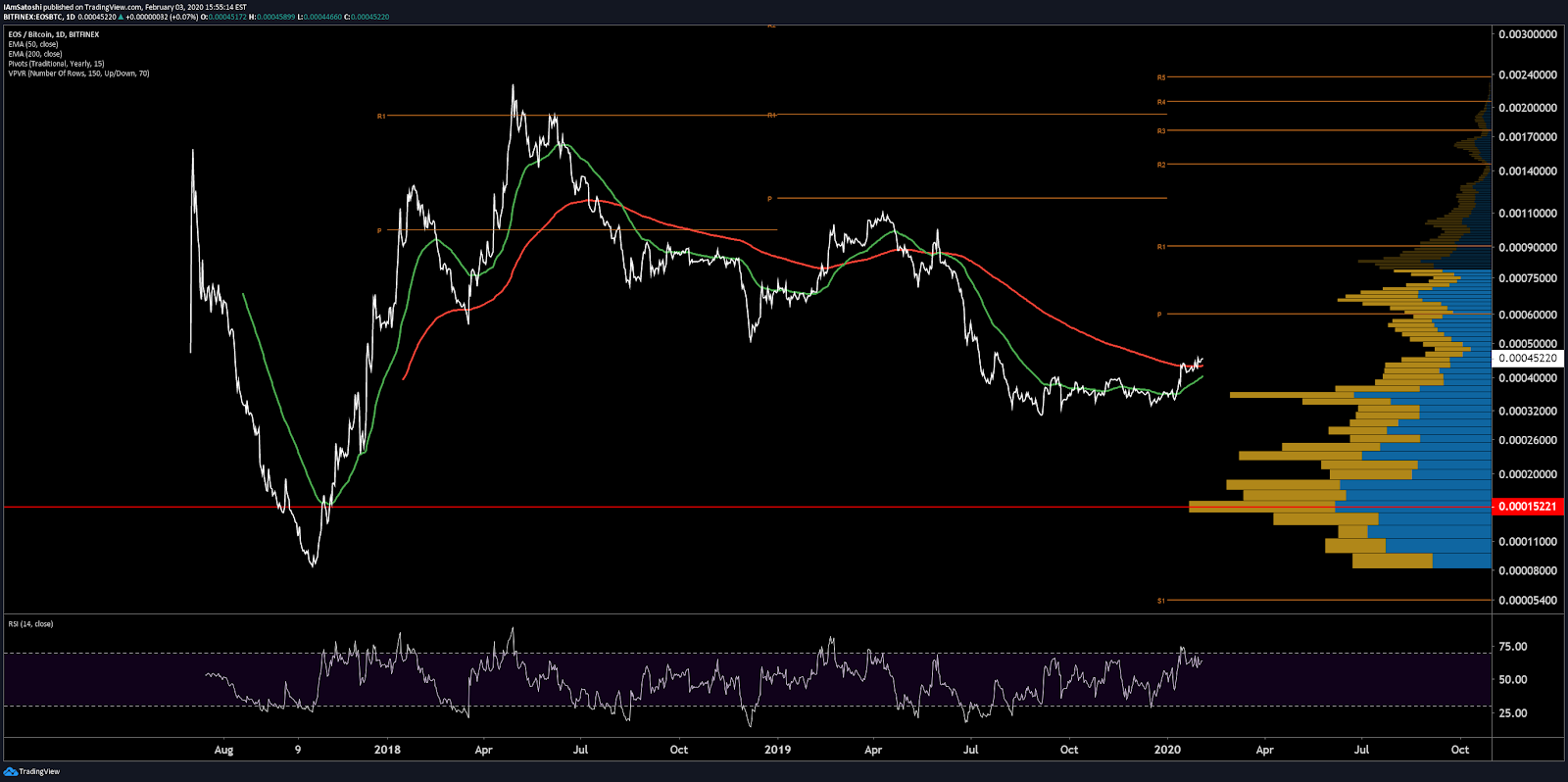

EOS has followed most of the cryptocurrency market with an upward thrust of price action in January 2020. As the trend flips, the strength and duration of any trend can be measured using Exponential Moving Averages, Yearly Pivots, Volume Profile of the Visible Range, Pitchforks, and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart for EOS/USD, the 50-day and 200-day Exponential Moving Average (EMA) have been bearishly crossed since July 28th. Over the past month, price has breached both EMAs, now with a bullish Golden Cross likely over the next week.

The Volume Profile of the Visible Range (VPVR, horizontal bars chart below) shows a strong zone of resistance at US$4.80-US$5.90 and strong support at US$3.71. Yearly pivots also show resistance at US$4.48 and US$6.87. Additionally, there are bearish volume and RSI divergences, suggesting waning bullish momentum.

Bitfinex long/short positions are currently 96% long, with long interest ranging near record highs and shorts decreasing slightly over the past month (top panel, chart below). The late June reduction in short interest mirrors a reduction in short interest on Bitfinex for BTC on the same day. A significant price movement downwards will result in an exaggerated move as the long positions begin to unwind.

The current spot price continues to reside within the boundaries of a bearish Pitchfork (PF) with anchor points in December 2017, and March and April 2018. Price has resided in the upper half of the PF since March. The spot price will need to exceed the current local high invalidate the nearly 700 day downtrending PF. If price fails to break the current diagonal resistance, a move toward the median line (yellow) is likely.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bullish; price is above the Cloud, the Cloud is newly bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and above the price. A traditional long entry signal will be triggered on the bullish Kumo twist.

Lastly, trend metrics for the EOS/BTC pair echo the EOS/USD pair. Price has breached both the 50-day and 200-day EMAs, and price is now above the Cloud (not shown). A bullish Golden Cross is likely over the next week. Upside resistance sits at the yearly pivot of 60,000 sats and a VPVR node at 65,000 sats. Bitfinex EOS/BTC long/short open interest is currently 61% net short (not shown). Additionally, similar to EOS/USD, there are bearish volume and RSI divergences, suggesting waning bullish momentum.

Conclusion

Due to the feeless nature of the chain, Dapp activity on EOS has flourished. However, further investigation has shown that up to 75% of these transactions recently are likely to be bot activity or transaction mining related to the EIDOS airdrop.

There is also some concern regarding the concentration of EOS BPs in Asia, which may lead to the centralization of governance. Additionally, the current EOS full node size could not be determined, but the chain has very likely developed further blockchain bloat beyond the 4TB discussed in 2019. Many functional full nodes are important for a network to maintain decentralization and to continue running smoothly. Sooner rather than later, EOS will need to deal with the growing burden of both blockchain size and bandwidth requirements.

Technicals for both the EOS/USD and EOS/BTC pairs show a nascent bullish trend. Both pairs will likely have a Golden EMA Cross within the next week. Both pairs are also showing waning signs of bullish momentum with bearish volume and RSI divergences. The nearly 700-day bearish Pitchfork on the EOS/USD pair will also likely be invalidated this within the next two weeks. Fundamental drivers leading into the Voice beta launch, slated for February, may create bullish momentum for both market pairs, similar to the initial announcement in June of last year.

Don’t miss out – Find out more today